OPEC Agrees To 1.5MM Barrel Output Cut, But Fails To Obtain Critical Russian Backing

Today’s OPEC meeting has been more of a stunt by members to persuade Russia to agree to deep cuts amid a demand shock triggered by the Covid-19.

Ministers from OPEC agreed on a large cut of 1.5 million barrels per day in the second quarter to support prices but made it conditional on Russia joining in, said two OPEC sources, who were cited by Reuters.

Brent crude futures have soared between 6-10% in the last four sessions on OPEC+ JMMC technical committee recommendation, which stated cuts between 750,000 to 1 million barrels per day are needed to stabilize prices. Demand destruction from China and aboard has been one of the most significant shocks to hit global oil markets since the financial crisis a decade ago.

Reuters notes that Saudi Arabia, the largest producer in OPEC, has yet to win the support of Russia agreeing on the cuts.

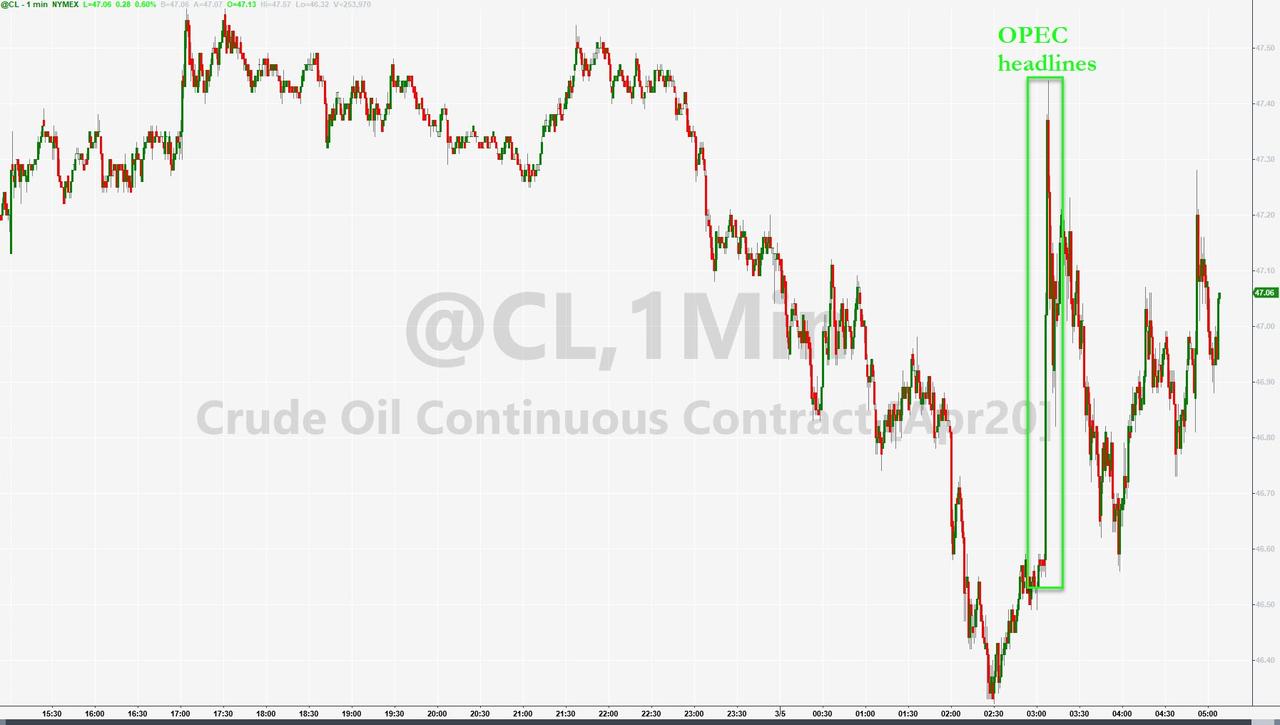

But that didn’t stop the algos bidding oil higher…

Moscow, which has worked with OPEC+ since 2016 to balance supply, has so far withheld its support for a reduction in output.

Russia’s energy minister left OPEC meetings in Vienna on Wednesday, expected to return on Friday for more in-depth talks.

“Our expectation is that OPEC+ will deliver a credible and coherent strategy that will take more barrels than what’s priced into the market off the table,” Mitsubishi UFG’s Ehsan Khoman told Reuters.

Russia could capitulate on Friday, as it has done everything so far to drag out production cut talks. Still, as we noted yesterday, “Russia will decide on production cuts at the very last minute.”

“We think OPEC+ really needs to cut about 1 million to 1.5 million barrels a day just to put a floor under prices right now,” Allyson Cutright, a director at Rapidan Energy Advisers, said in a Bloomberg TV interview. Cutright said Moscow would likely accept a reduction in output, but the Saudis “will have to take the majority” of cuts.

Goldman Sachs’ Jeff Currie is not bullish on OPEC achieving their goals, warning any OPEC cut is “too little, too late,” and forecasts Brent Crude tumbling to the low-40s. That may make sense after we just heard from Russia’s FinMin Siluanov, who said “Russia is prepared for a possible drop in oil prices.”

Doesn’t sound like they are about to acquiesce to the Saudis anytime soon.

Tyler Durden

Thu, 03/05/2020 – 08:09

via ZeroHedge News https://ift.tt/2VLWxcX Tyler Durden