“Super Puke” – US Stocks Crash As Credit Markets & Yields Collapse

So much for the ‘Biden Bounce’. Watching the markets today – as The Dow plunged 1000 points, Treasury yields collapsed to record lows, credit markets imploded, and demands for more Fed intervention exploded – has one veteran trader remarking, “this is becoming a super-puke.”

It seems the stock market is ‘stuffed’ with Fed intervention and ‘just one waffer-thin mint’ more may spark the total destruction of markets.

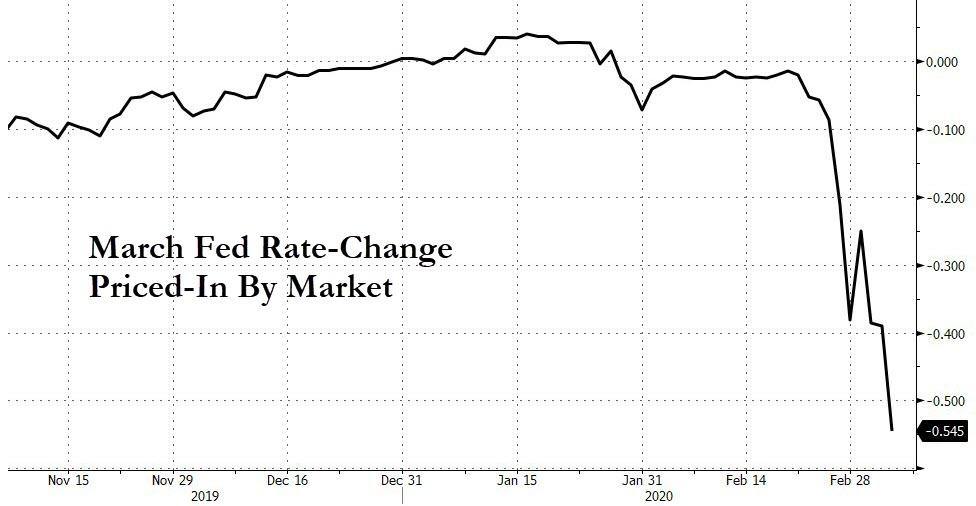

The market is in panic mode – demanding over 50bps more rate-cuts in March as stocks collapse…

Source: Bloomberg

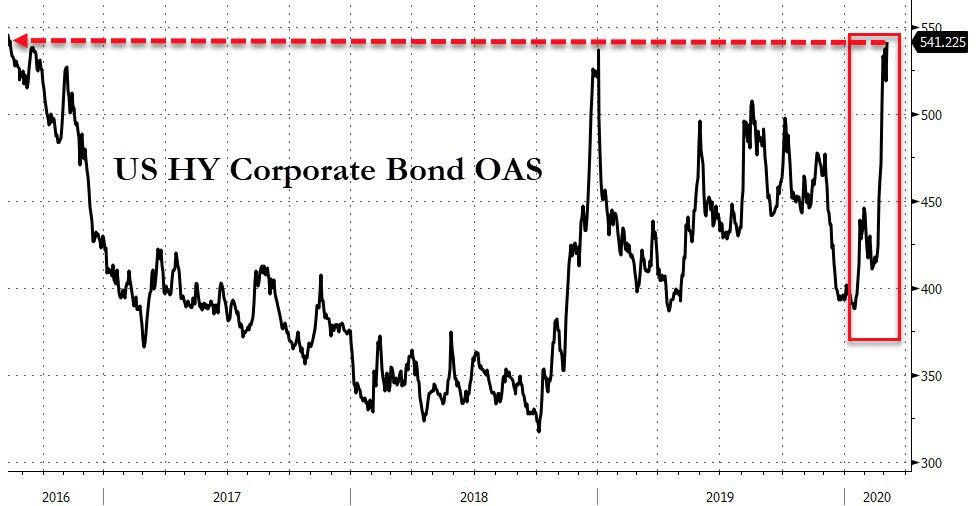

Credit spreads are exploding wider (decompressing 9 of the last 11 days – the biggest blowout since June 2013) – now at their widest since 2016…

Source: Bloomberg

Sending an ugly message to stocks…

Source: Bloomberg

10Y Treasury yields plunged to new record lows…

Source: Bloomberg

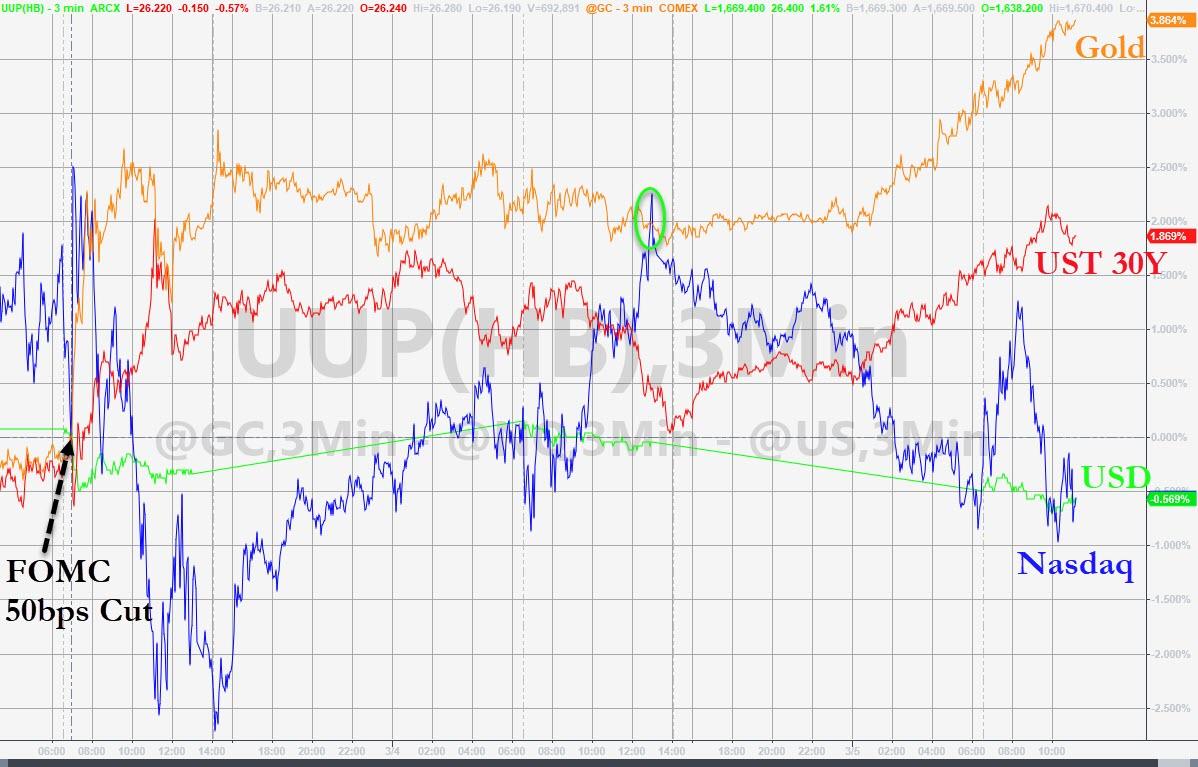

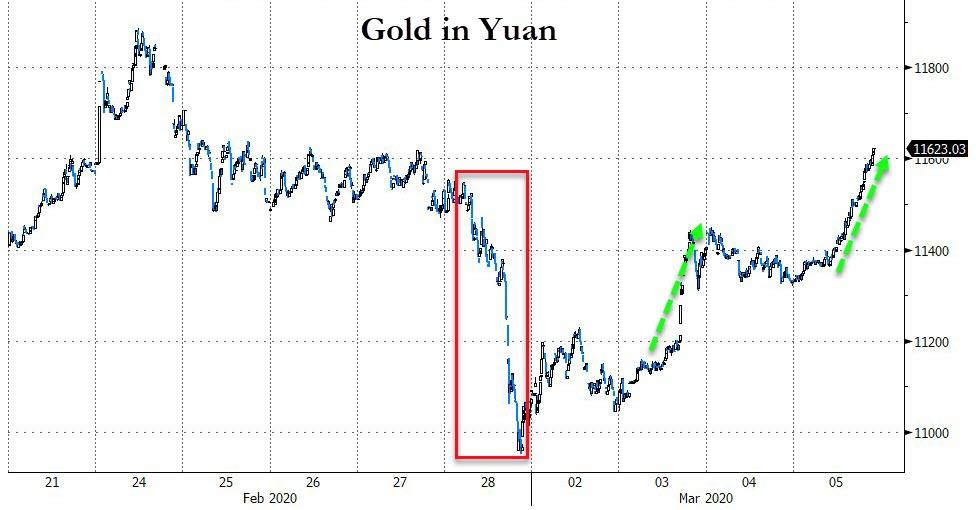

And gold (safe-haven) was aggressively bid…

In fact, since The Fed enacted an emergency 50bps rate-cut, Gold is soaring as the dollar and stocks faded…

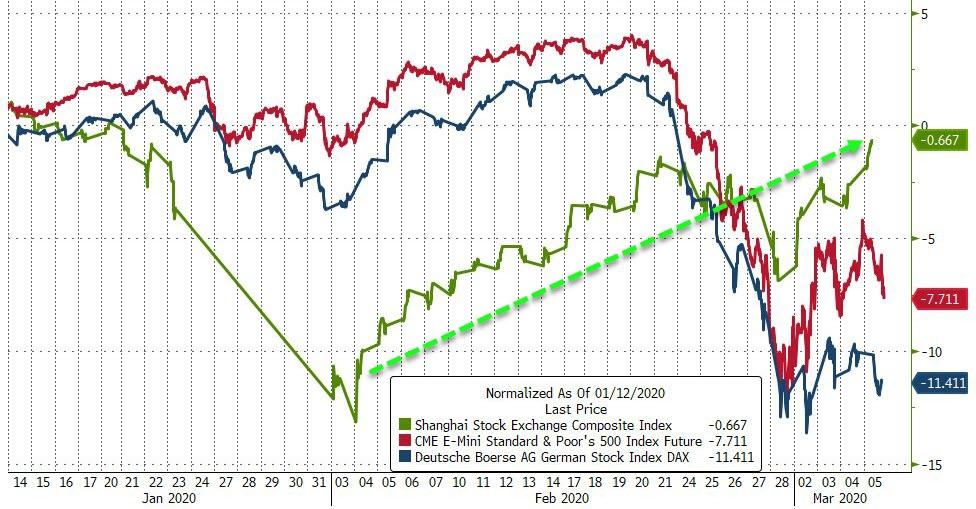

And before we dive into some of the details, this made us laugh – China – the epicenter of the collapse in global supply chains – has seen its stock market MIRACULOUSLY soar back to pre-Covid-19 levels… as Europe and US crash…

Source: Bloomberg

Amid all this chaos, Dow, Nasdaq, and S&P are still up 2-3% on the week, Small Caps and Trannies are red though…

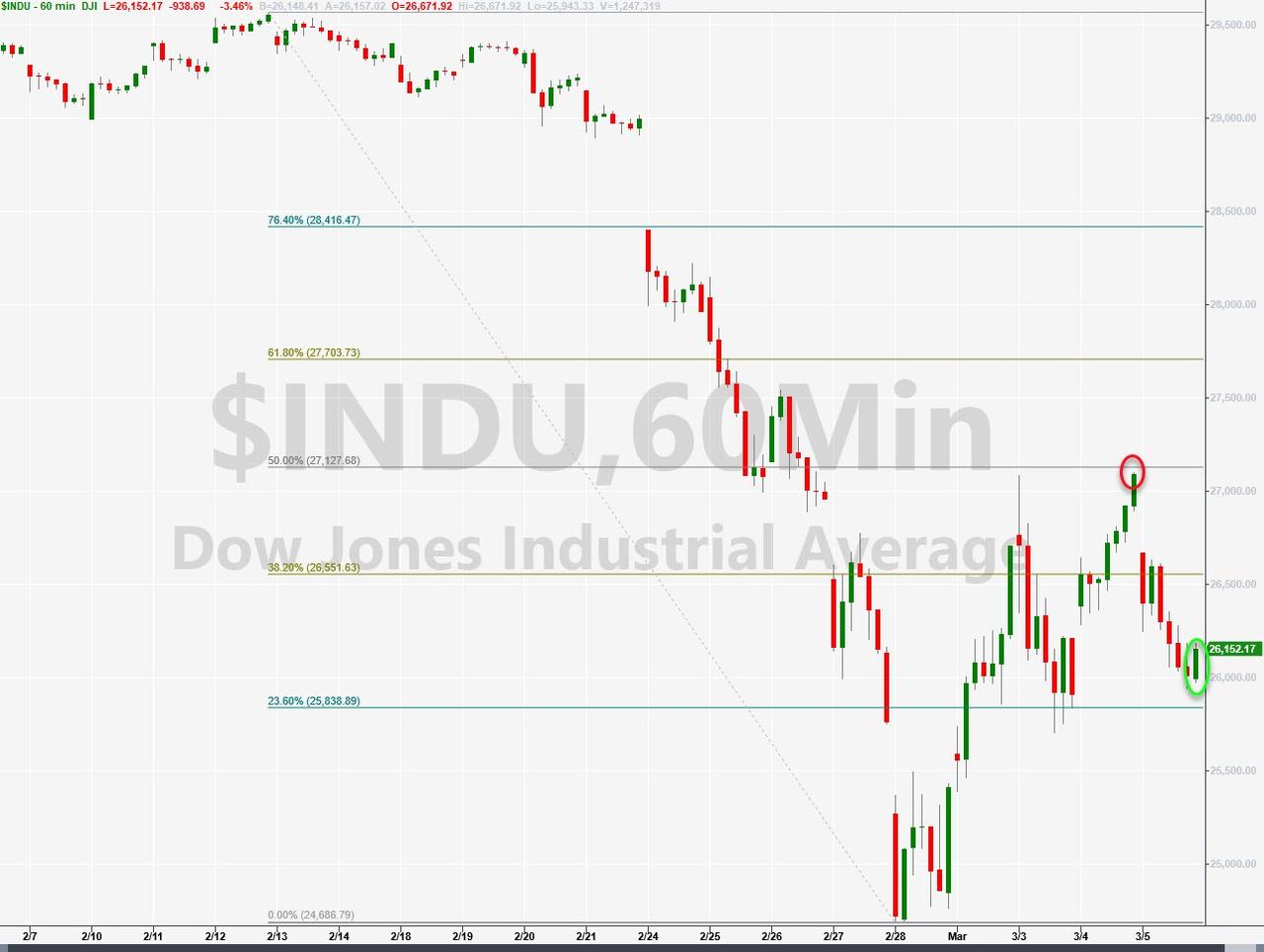

Dow tumbled back below 26k and then the battle began for the algos…

Yesterday’s top was at an almost perfect 50% retrace of the initial crash…

Another 1000-point day for the Dow – just how crazy is this vol? It’s the most extreme since the very peak of Europe’s debt crisis…

Source: Bloomberg

On the week, Defensives have dominated with Cyclicals unchanged (although today saw both hit just as hard)…

Source: Bloomberg

Bank stocks entered a bear market today, tumbling to their weakest since Jan 2019…

Source: Bloomberg

Global Systemically Important Banks are collapsing…

Source: Bloomberg

The Big US Banks were clubbed like baby seals…

Source: Bloomberg

VIX smashed higher, back above 42 intraday…

The VIX term structure is its most inverted since Lehman…

Source: Bloomberg

While stocks feel like they have plunged, they have a long way to go to catch up to bonds’ reality…

Source: Bloomberg

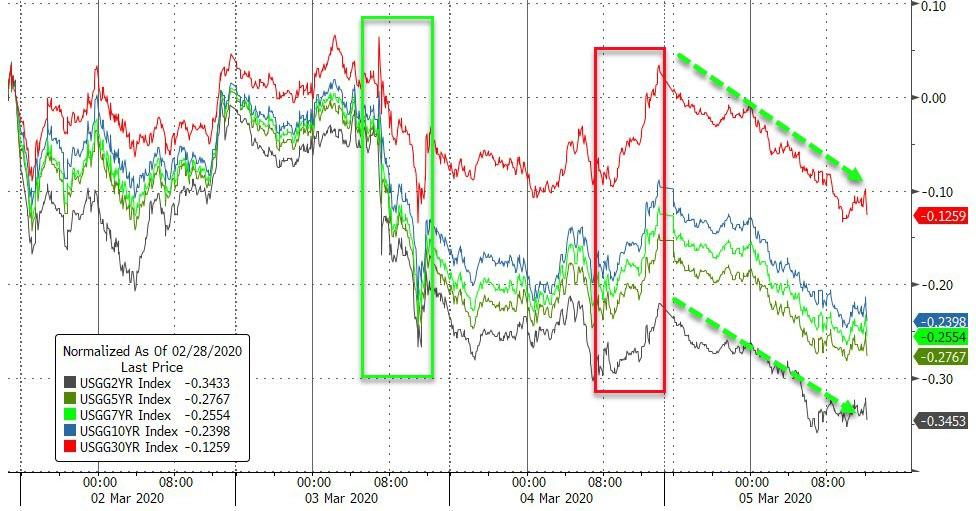

Treasury yields crashed today down 10-15bps across the curve with the long-end outperforming…

Source: Bloomberg

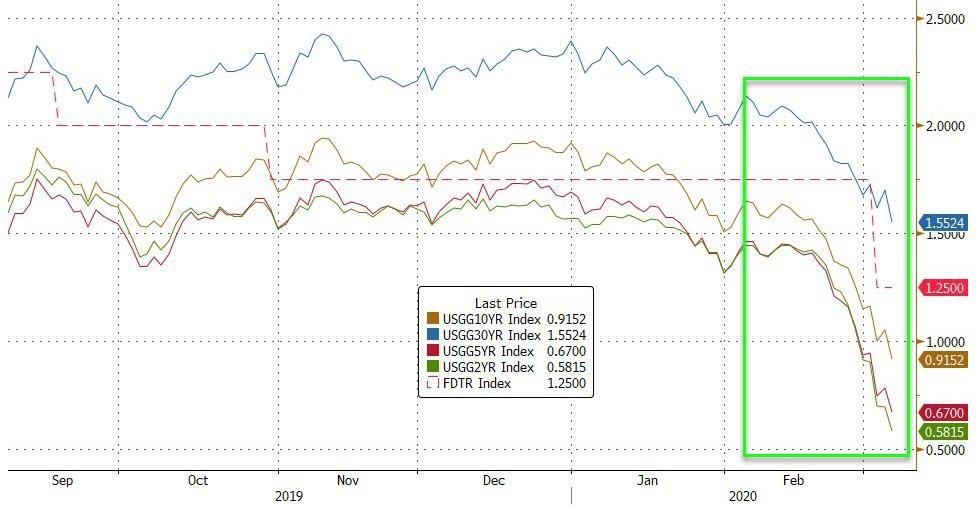

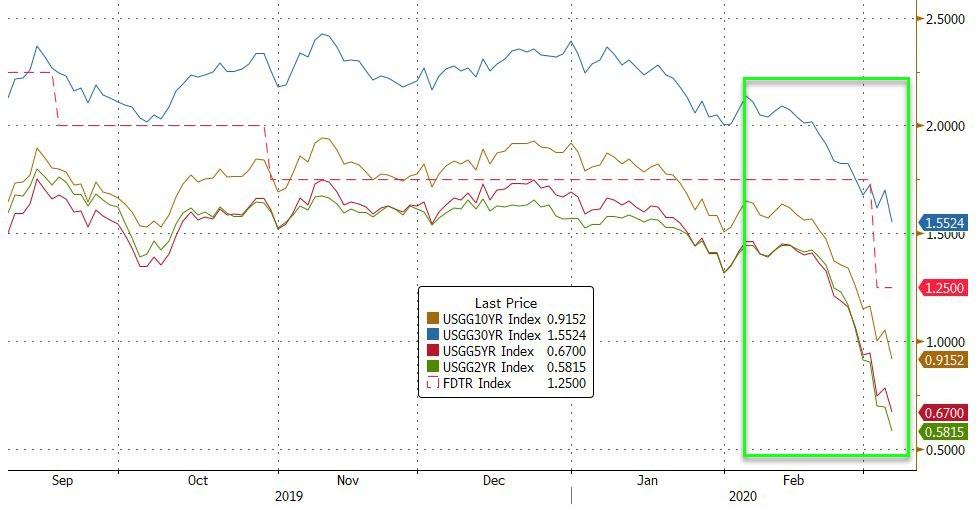

Yields are hitting record or cycle lows across the entire curve…

Source: Bloomberg

The Dollar slipped back to post-Powell-cut lows – this is the lowest for the dollar since January…

Source: Bloomberg

Cryptos were bid today, lifting all the major coins into the green for the week…

Source: Bloomberg

Commodities were clearly divided today with gold and silver soaring and copper and crude crushed…

Source: Bloomberg

WTI plunged back to a $45 handle after OPEC+ talks did not seem to go well (damn you Putin!)…

Gold soared higher all day – to its highest close since Jan 2013

And also surged again Yuan…

Source: Bloomberg

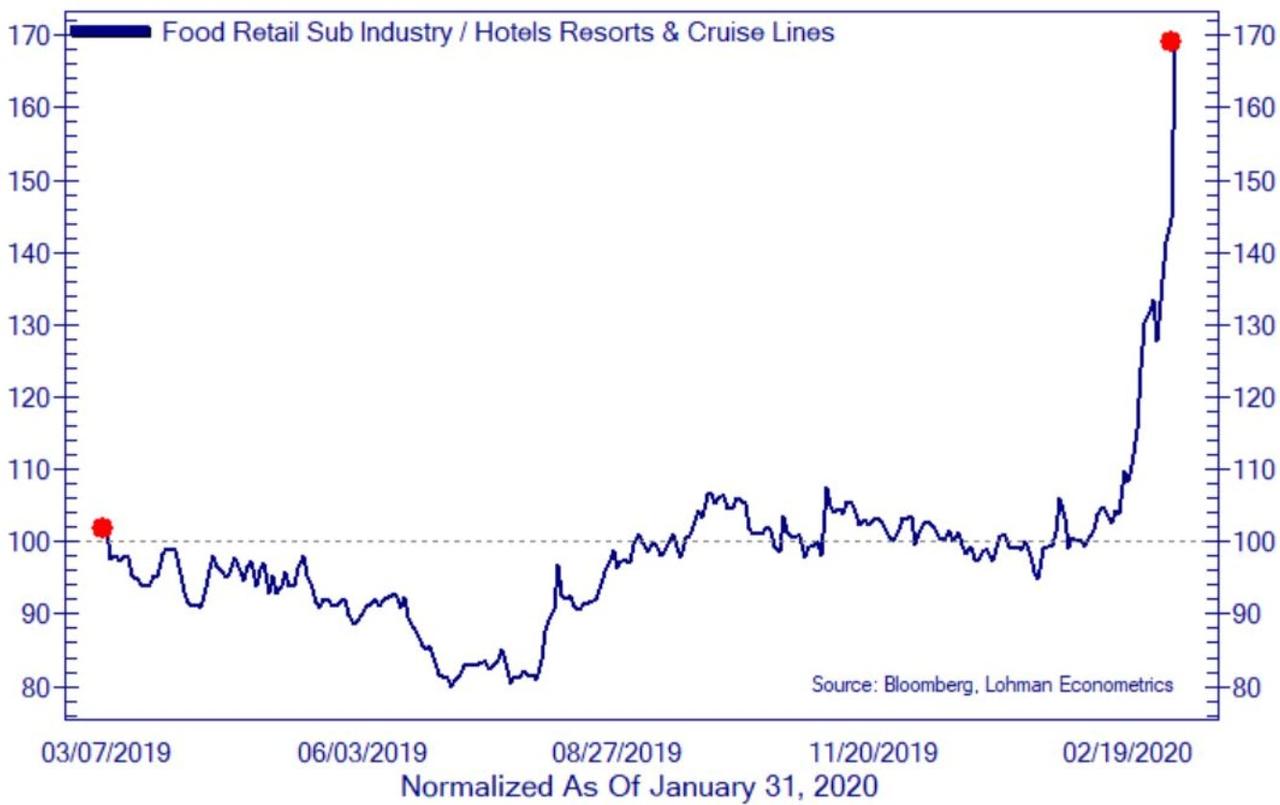

Finally, with a h/t to John Lohman, the Coronavirus Fear Index is exploding… “Long panic-buying food, short travel and entertainment”

“Probably nothing!”

Tyler Durden

Thu, 03/05/2020 – 16:01

via ZeroHedge News https://ift.tt/32VSJqV Tyler Durden