Term Repo Record Oversubscribed As Market Liquidity Craters

Yesterday, when discussing the most oversubscribed overnight term repo operation yet, in which dealers scrambled to obtain $111.5BN in liquidity from the Fed’s $100BN overnight repo operation, we said that it was “the second day in a row the overnight funding repo operation was oversubscribed (and it is virtually certain that tomorrow’s downsized term-repo will be oversubscribed as well).“

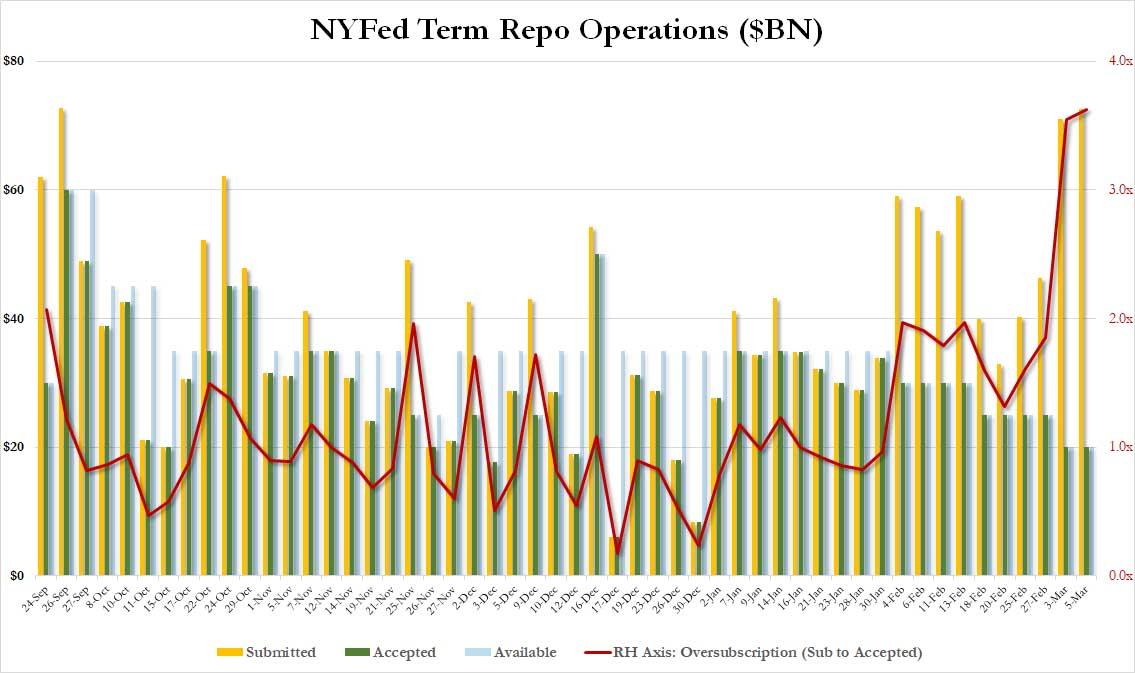

We were right, because moments ago not only did the Fed announce that the latest 14-day term repo was indeed oversubscribed, but it was in fact the most oversubscribed term-repo on record, surpassing even the funding needs indicated at the start of the repo crisis last September.

While the Fed tapered the size of the term-repo operation from $25BN to $20BN as we entered March, the demand for the liquidity it unlocks has not only refused to go down, but has in fact soared, and rose to an all time high of $72.6BN consisting of $45.25BN in Treasurys, $2.5BN in Agency and $24.8BN in MBS tendered to the Fed.

As a result, with the full amount of eligible liquidity, or $20BN, released, this meant that today’s term repo operation was 3.6x oversubscribed – the most on record.

This continuing liquidity crunch is bizarre, as it means that not only did the rate cut not unlock additional funding, it actually made the problem worse, and now banks and dealers are telegraphing that they need not only more repo buffer but likely an expansion of QE… which will come soon enough, once the Fed hits 0% rates in 2 months and restart bond buying.

Will that be enough to stabilize the market? We don’t know, but in light of the imminent corona-recession, on Tuesday Credit Suisse’s Zoltan Pozsar repo guru published a lengthy piece whose conclusion – at least on the liquidity front – is that the Fed should “combine rate cuts with open liquidity lines that include a pledge to use the swap lines, an uncapped repo facility and QE if necessary.“

In short, a liquidity avalanche is coming to prevent a market crash. It’s only a matter of time.

Tyler Durden

Thu, 03/05/2020 – 08:47

via ZeroHedge News https://ift.tt/2wstK2D Tyler Durden