As “Big Short 2” Explodes, Citi, Deutsche Bank Stuck With Billions In Unsellable CMBS Debt

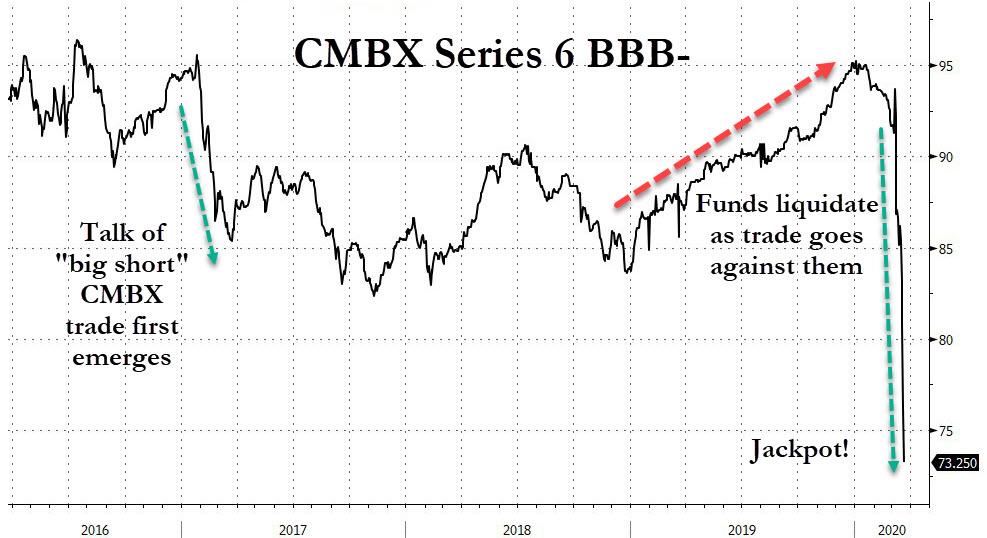

Earlier today we reported that amid a growing investor panic that the Wu Flu will be the final nail in the malls’ coffin, resulting in countless retail outlet closures and a collapse in rental payments crushing the commercial real estate space, the “Big Short 2.0” trade, shorting the CMBX 6 series which has an outlier exposure to malls, finally crashed vindicating long-term bears such as Carl Icahn and a handful of other hedge funds who were not stopped out over the past three years.

This collapse in broader CMBX indexes as “the big short 2.0” gradually comes to fruition, has led to spillover effects across the entire Commercial Mortgage-Backed space, resulting in the first hung deal.

Bloomberg reports that Citigroup and Deutsche Bank – both of which somehow tend to always be involved any time bad debt emerges – are among the bank lenders stuck with billions of dollars of debt backed by MGM Grand and Mandalay Bay properties in Las Vegas, as the coronavirus pandemic shutters casinos across the nation, hampering the banks’ ability to syndicate the loan amid a plunge in investor demand.

To help stem the spread of the coronavirus, MGM Resorts International, which continues to operate the MGM Grand and Mandalay Bay, has shuttered operations in Nevada and New Jersey.

A JV of MGM Growth Properties and Blackstone REIT used $3 billion of financing to purchase the casinos last month, and Citigroup, Deutsche Bank, Barclays Plc and Societe Generale had planned to syndicate $1.9 billion of the total as commercial mortgage-backed securities, or CMBS, according to Bloomberg. However, as gambling along with any other activity that involves social interactions has ground to a halt and it is unclear just when it will restart, the efforts to sell the CMBS were met with “tepid demand” and the sale was put on hold, leaving the banks stuck holding on to the billions in debt, although it was not clear now much of the loan each bank holds.

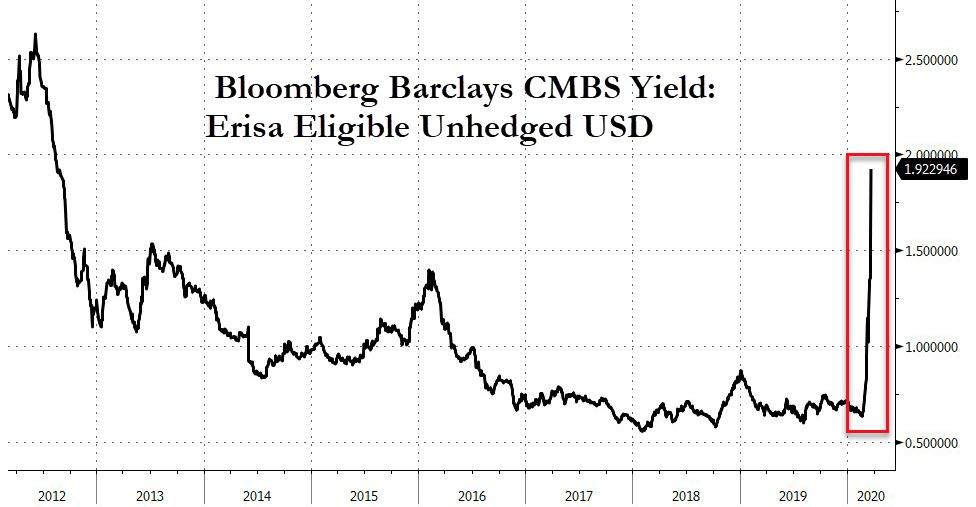

The CMBS facility has a 12 year maturity, with an anticipated repayment date in March 2030, and came to market with an interest rate of 3.308% per year. In light of the recent surge in CMBS yields and spread, that number will have to go sharply higher to spark investor interest unless somehow Jamie Dimon convinces the NY Fed to buy the whole piece.

Pricing of the CMBS was expected during the week of March 9, but obvious those plans collapsed.

When syndication deals are unsuccessful, banks typically retain loans on their balance sheets until market conditions improve and the deal can be brought back. During the financial crisis, banks ended up stuck with hudnreds of billions in LBO and M&A bridge loans which they were unable to offload for years. It remains to be seen just how bad the hit will be during the Global Coronavirus/Crude Crusus.

Tyler Durden

Mon, 03/23/2020 – 17:40

via ZeroHedge News https://ift.tt/33HHIKr Tyler Durden