The Fed Is Now Buying Investment Grade Bond ETFs Like LQD

Over the weekend, we reported that virtually all of Wall Street was praying for nothing short of divine intervention from the Fed, but would be content with the announcement of corporate bond buying, with banks such as BofA…

… and Deutsche Bank…

… pushing hard for the Fed to launch corporate bond purchases.

On Monday morning, that’s precisely what they got when the Fed announced that it would indeed start purchasing corporate bonds. And in a way, the Fed exceeded expectations, because unlike the ECB which only buys bonds in the primary market, the Fed announced that in addition to a Primary Market Corporate Credit Facility, it would also buy Investment Grade bonds in the secondary market.

Here are some details: as was widely expected, the Fed created a SPV that will purchase in the secondary market corporate debt issued by eligible issuers. What is more interesting is that the SPV will purchase eligible individual corporate bonds as well as eligible corporate bond portfolios in the form of exchange traded funds (“ETFs”) in the secondary market. In other words, the Fed is now active in the equity market via ETFs, even if focusing only on securities collateralized by IG bonds (for now).

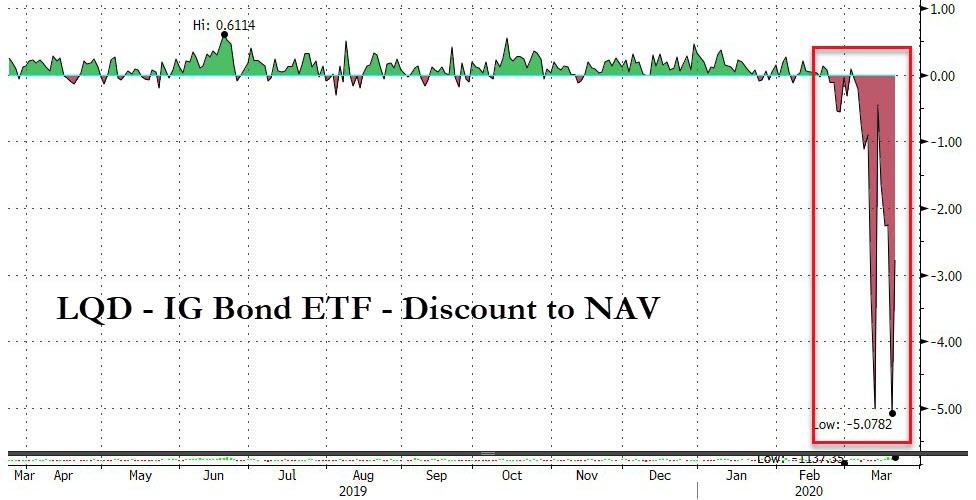

Which also was to be expected: after all one of the biggest laments about the breakdown in the market has been the blow out in the basis between ETF prices and NAV values, which in the case of the investment grade ETF, the LQD, has soared to a record high 5% as a result of crippling illiquidity in the underlying bond market. It is this gap that the Fed is hoping to close.

Completing the SPV details, the NY Fed announced that will be secured by all the assets of the SPV, in order not to be susceptible to a capital loss (unlike the BOJ which has suffered trillions in paper losses on its equity ETFs). The Department of the Treasury, using the Exchange Stabilization Fund, will make an initial $10 billion equity investment in the SPV in connection with the Facility.

But going back to the key point, here was the highlight of the term sheet:

Eligible ETFs. The Facility also may purchase U.S.-listed ETFs whose investment objective is to provide broad exposure to the market for U.S. investment grade corporate bonds.

In other words, as of this moment the NY Fed will be actively buying the LQD ETF (and various other IG version) to stabilize the corporate bond market.

Some more details from the term sheet:

Eligible Issuers for Individual Corporate Bonds: Eligible issuers for direct purchases of individual corporate bonds on the secondary market are U.S. businesses with material operations in the United States. Eligible issuers do not include companies that are expected to receive direct financial assistance under pending federal legislation.

The cap is interesting, as it amounts to 10% of maximum bonds outstanding of any specific issuer, and the Fed is also limited to 20% of any ETF:

Limits per Issuer/ETF: The maximum amount of bonds that the Facility will purchase from any eligible issuer will be capped at 10 percent of the issuer’s maximum bonds outstanding on any day between March 22, 2019 and March 22, 2020. The facility will not purchase more than 20 percent of the assets of any particular ETF as of March 22, 2020.

Finally, the Fed disclosed the term of the facility:

The Facility will cease purchasing eligible corporate bonds and eligible ETFs no later than September 30, 2020, unless the Facility is extended by the Board of Governors of the Federal Reserve System. The Reserve Bank will continue to fund the Facility after such date until the Facility’s holdings either mature or are sold.

The full term sheet is here:

And notably, while LQD soared in early trading, it has since given up much of its gains…

… as the overall market slides lower amid renewed fears that the Fed, by firing yet another bazooka, has crushed the odds of a Fiscal stimulus deal getting struck in the Senate.

And yes, if this fails to stimulate the market, now that the Fed is effectively all in, it will buy stocks and junk bonds next.

Tyler Durden

Mon, 03/23/2020 – 09:52

via ZeroHedge News https://ift.tt/2UvGHRp Tyler Durden