“Stop The Revolver Run”: Cash-Strapped Banks Quietly “Discourage” Companies From Drawing Down Their Loans

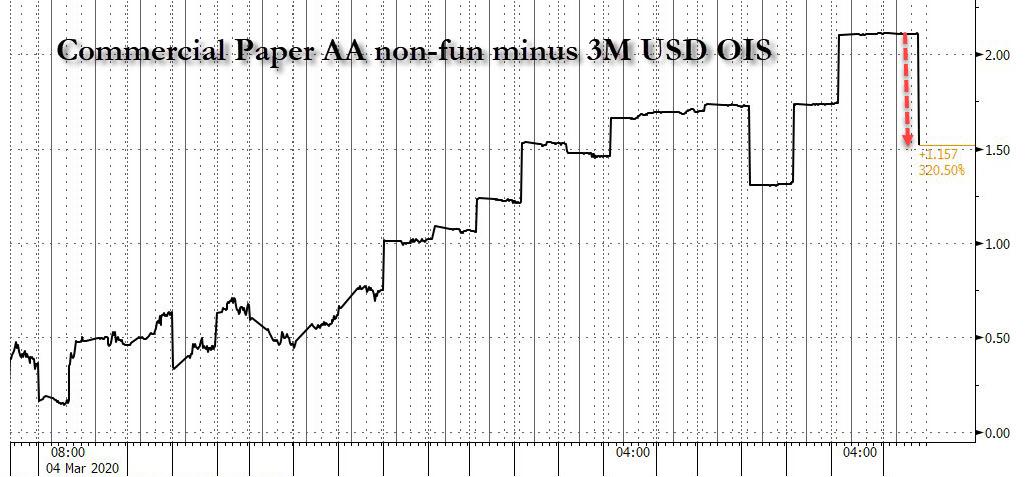

One week after the Fed expanded its “bazooka” by launching a “nuclear bomb” in the words of Paul Tudor Jones , at fixed income capital markets which it has now effectively nationalized by monetizing or backstopping pretty much everything, some signs of thaw are starting to emerge in the all important commercial paper market, where the spread to 3M USD OIS is finally starting to tighten, coming in by 60bps overnight.

But while the move will be welcomed by companies in dire need of short-term funding, it is nowhere near enough to unfreeze the broader commercial paper market, with the spread still precipitously high even for those companies that have access to commercial paper, which is why most companies continue drawing down on revolvers.

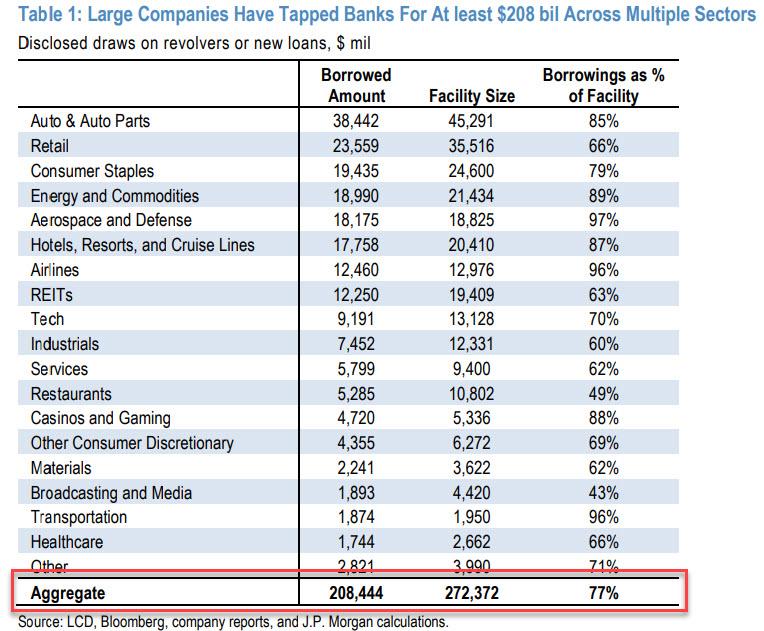

As we reported over the weekend, according to JPMorgan calculations, aggregate corporate revolver drawdowns represent 77% of the total facilities, with JPM noting that the total amount of borrowing by companies is likely significantly greater than this, well above 80%, as it only reflects disclosed amounts by large companies, and there are likely undisclosed borrowings by middle market companies.

In nominal terms, this means that corporates that have tapped banks for funding has risen further to a record $208 billion on Thursday, up $15 billion from $193 billion on Wednesday and $112BN on Sunday. That’s right: nearly $100 billion in liquidity was drained from banks in the past week; is there any wonder the FTA/OIS has barely eased indicating continued tensions in the interbank funding market.

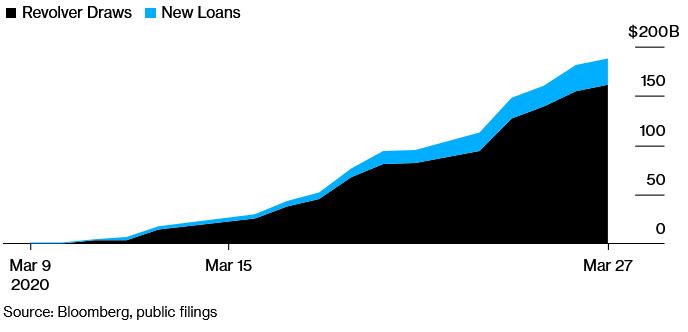

Yet the bigger problem remains: with banks already pressed for liquidity, they are suffering a modern-day “bank run”, where instead of depositors pulling their money, corporations are drawing down on revolvers at unprecedented levels, something we first described three weeks ago “Banking Crisis Imminent? Companies Scramble To Draw Down Revolvers.”

Of course, at the end of the day, liquidity is liquidity, and banks are starting to fear when and if this revolver run will ever end, and just how much liquidity they need to provision, especially since many of these companies will have to file for bankruptcy in the coming months, sticking banks with a pre-petition claim (albeit secured).

As a result, and as Bloomberg reports, the biggest U.S. banks have been quietly discouraging some of America’s safest borrowers from tapping existing credit lines amid record corporate drawdowns on lending facilities.

To banks, this tidal wave of revolver demands is a two-edged sword. On one hand it impacts their profit margins, on the other it jeopardizes their overall liquidity levels:

as Bloomberg notes, investment-grade revolvers, “especially those financed in the heyday of the bull market,” are a low margin business, and some even lose money. The justification is that they help cement relationships with clients who will in turn stick with the lenders for more expensive capital-markets or advisory needs. While this is fine under normal circumstances when the facilities are sporadically used, “with so many companies suddenly seeking cash anywhere they can get it, they’re now threatening to make a dent in banks’ bottom lines.“

The second issue is more nuances: while Bloomberg claims that the drawdown wave “is not an issue of liquidity for Wall Street” we disagree vehemently, and as proof of strained bank liqidity we merely highlight the fact that after $12 trillion in monetary and fiscal stimulus has been injected, it has failed to tighten the critical FRA/OIS spread which remains at crisis levels.

The good news is that at least some corporations – those who have the most alternatives – are willing to oblige bank requests, turning instead to new, pricier term loans or revolving credit lines rather than tapping existing ones. “McDonald’s last week raised and drew a $1 billion short-term facility at a higher cost than an existing untapped revolver” Bloomberg notes, adding that while rationales will vary from borrower to borrower, analysts agree that for most, staying in the good graces of lenders amid a looming recession is important.

The bad news is that most companies remain locked out of other liquidity conduits – be they new credit facilities, or commercial paper – and are thus forced to keep drawing down on existing lines of credit, which puts bankers – especially relationship bankers – in a very tough spot.

“The banker is coming at it trying to manage two things — the relationship profitability and their portfolio of risks and assets,” said Howard Mason, head of financials research at Renaissance Macro Research. “Bankers have some cards to play because they can talk to their clients that have undrawn credit lines. The sense is that there’s a relationship involved so relationship pricing and good will applies.”

Meanwhile, as banks quietly scramble to raise liquidity of their own – because, again, liquidity is always and everywhere fungible – U.S. financial institutions have sold almost $50 billion of bonds over the past two weeks to bolster their coffers, ironically even as corporate bankers are advising companies not to hoard cash unless they urgently need it. Some are even telling certain clients to hold off on seeking new financing to avoid over-stressing a system already stretched to its limits operationally as bankers are inundated with requests while stuck at home due to the coronavirus pandemic.

“The banks are open but if everybody asks at the same time then it’s going to be difficult from a balance sheet perspective,” Bloomberg Intelligence analyst Arnold Kakuda said in an interview.

Kinda like the whole fractional reserve concept: banks have money in theory… as long as not all of their depositors demand to withdraw money at the same time. With revolvers, it more or less the same thing.

“The corporate banker doesn’t want everybody to take a hot shower at the same time in the house,” said Marc Zenner, a former co-head of corporate finance advisory at JPMorgan Chase & Co. “They want to use their capital where it’s most beneficial.”

Amusingly, even McDonald – right after it signed a new revolver – immediately tapped the full $1 billion as a “precautionary measure” to reinforce its cash position, the company said in a regulatory disclosure Thursday. It also priced $3.5 billion of bonds last week as part of its broader liquidity management strategy.

In short, it’s a liquidity free for all, and the bottom line is simple: those bigger companies that still have access to liquidity will survive; those that are cut off, will fail, giving the bigger companies even greater market share, and crushing the small and medium businesses across America.

As a result, the prevailing thinking across corporate America is is “it’s ‘better safe than sorry,” said Jesse Rosenthal, an analyst at CreditSights Inc. “They might believe with all their hearts that the bank has all the liquidity they need, but it’s just fiduciary duty, due diligence, and prudence in a totally unprecedented situation.” Ironically, we reported last week that a bankrupt energy company, EP Energy, listed a trolling risk factor in its annual report, in which the company mused that it may be challenged if one or more of its lender banks collapsed.

Meanwhile, confirming that this latest freakout is all about liquidity, bankers are now including provisions in new deals that ensure they’ll be among the first to be paid back when companies regain access to more conventional sources of financing, according to Bloomberg sources.

And for those insisting on drawing down revolvers now, Renaissance Macro’s Mason says banks will ultimately seek to recoup the costs down the line.

“The message to corporate clients is, ‘you can continue to do this, but we are looking at profitability on a relationship business, so if we don’t make our hurdles here we need to make them somewhere else,’” Mason said. Of course, those companies which have already drawn down on their revolvers and/or have anything to do with the energy sector… see you after you emerge from Chapter 11.

Tyler Durden

Mon, 03/30/2020 – 17:05

via ZeroHedge News https://ift.tt/2UuTLHT Tyler Durden