Texas Or Canada: Where Will Oil Hit $0 First

Looking at the future of oil prices, Goldman was downright apocalyptic in its short-term forecast, when in a note published this morning, the bank’s chief commodity strategist Jeffrey Currie speculated that as the current production glut “shock” cripples the crude transportation networks, “a producer would be willing to pay someone to dispose of a barrel, implying negative pricing in landlocked areas.” To wit:

The global economy is a complex physical system with physical frictions, and energy sits near the top of that complexity. It is impossible to shut down that much demand without large and persistent ramifications to supply. The one thing that separates energy from other commodities is that it must be contained within its production infrastructure, which for oil includes pipelines, ships, terminals, storage facilities, refineries, and distribution networks. All of which have relatively small and limited spare capacity. We estimate that the world has around a billion barrels of spare storage capacity, but much of that will never be accessed as the velocity of the current shock will breach crude transportation networks first, which we are already seeing evidence of around the world. Indeed, given the cost of shutting down a well, a producer would be willing to pay someone to dispose of a barrel, implying negative pricing in landlocked areas.

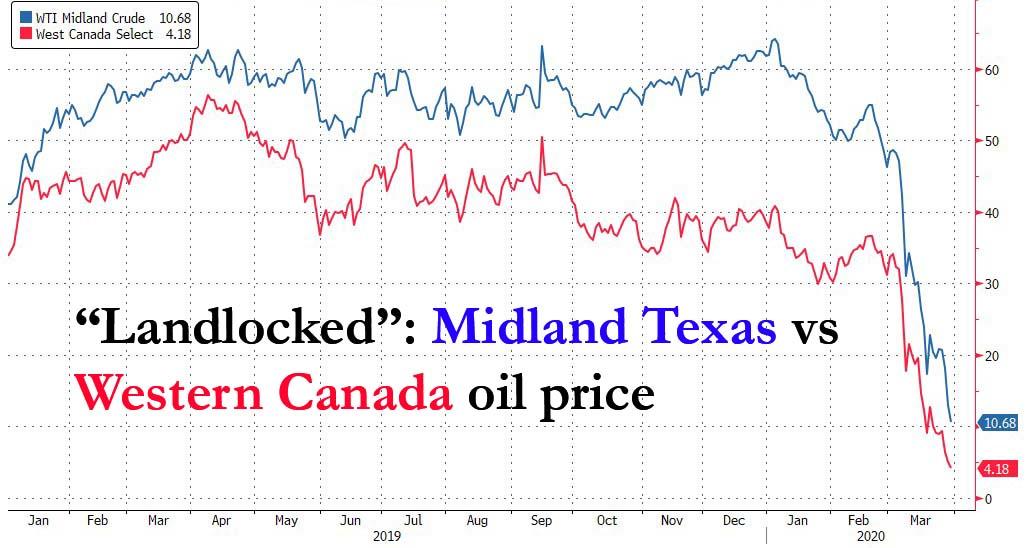

A quick look at two of the most popular landlocked oil producing areas demonstrate that Goldman is precisely right, and as the following chart shows, as of this moment Texas Midland WTI was trading at just baove $10/barrell, while the price of oil produced in the notoriously landlocked Western Canada, as represented by Canada Western Selected index, was just above $4 per barrel, or a little more than what a gallon of gas costs in California.

Looking at the chart above, when it comes to the dash for zero (and negative prices), Canada will take the gold, but Texas won’t be too far behind.

There was some good news: waterborne crudes are unlikely to suffer a similar price implosion. Again, Goldman explains why:

Waterborne crudes like Brent will be far more insulated, staying near cash costs of $20/bbl with temporary spikes below. Brent is priced on an island in the North Sea, 500 meters from the water, where tanker storage is accessible.

In contrast, WTI is landlocked and 500 miles from the water. This illustrates an important point. Shut-ins will be not be based upon where wells sit on the cost curve but rather on logistics and access. High-cost waterborne crude oil that can reach a ship (storage we have historically never ran out of), are better positioned than landlocked pipeline crude oil sitting behind thousands of miles of pipe, like the crude oils in the US, Russia and Canada. In 1998, when surpluses last breached storage capacity, it was these landlocked crude oils that were the hardest hit.

So while markets like WTI, particularly WTI Midland, or Canada’s WCS can go negative, Brent is likely to stay near cash costs of $20/bbl. Ultimately, the market never hits nameplate capacity, as other bottlenecks are also at play. During 2008 and also in this crisis, dollar funding and credit constraints that prevent oil owners from accessing storage and transportation capacity also played a role. We believe that the Fed’s actions last week alleviate some of this risk, but oil itself creates dollar liquidity given its importance in global trade and setting the price of other traded goods and another sharp drop in oil prices could create additional dollar shortages.

In other words, with most of US WTI production landlocked, while Russia and Saudi Arabia all within easy access to seaborne transit, Putin and MBS are at this very moment sharing a big toast via Zoom, and laughing at the wasteland that US shale will be in just a few weeks.

Tyler Durden

Mon, 03/30/2020 – 15:50

via ZeroHedge News https://ift.tt/2ydHyi6 Tyler Durden