Gundlach Live Webcast: “A Tale Of Two Sinks”

There is so much turmoil in markets that whatever Jeff Gundlach said on his last call with Doubleline investrs just two weeks ago is already outdated. Which is probably why, for the first time ever, the bond king is holding a second live webcast with DoubleLine investors and everyone else, which as he himself declared yesterday, “will be of the “Just Markets” variety. The title is “A Tale of Two Sinks” which, as always, contains many layers of meaning.”

I will doing a webcast tomorrow March 31, 2020 at 4:15 pm EDT. It will be of the “Just Markets” variety. The title is “A Tale of Two Sinks” which, as always, contains many layers of meaning.

— Jeffrey Gundlach (@TruthGundlach) March 30, 2020

As usual, readers can register for the free webcast at the following link or by clicking on the image below.

We hope to bring you the key highlights as the call goes on.

* * *

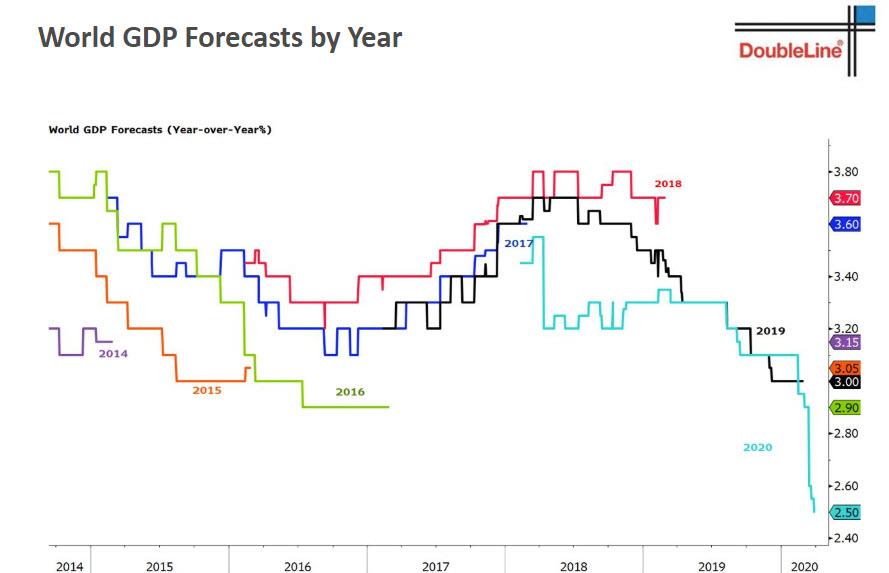

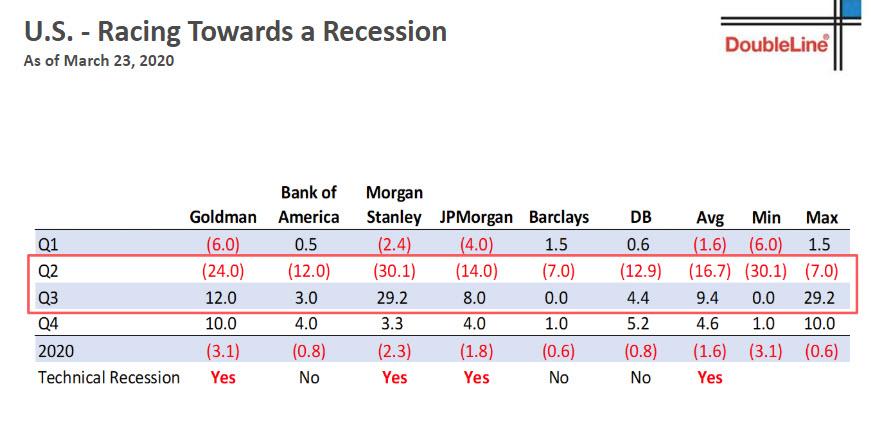

Gundlach starts with the big picture, showing the collapse in GDP forecasts for the rest of the year, a slide he has used recently on several occasions.

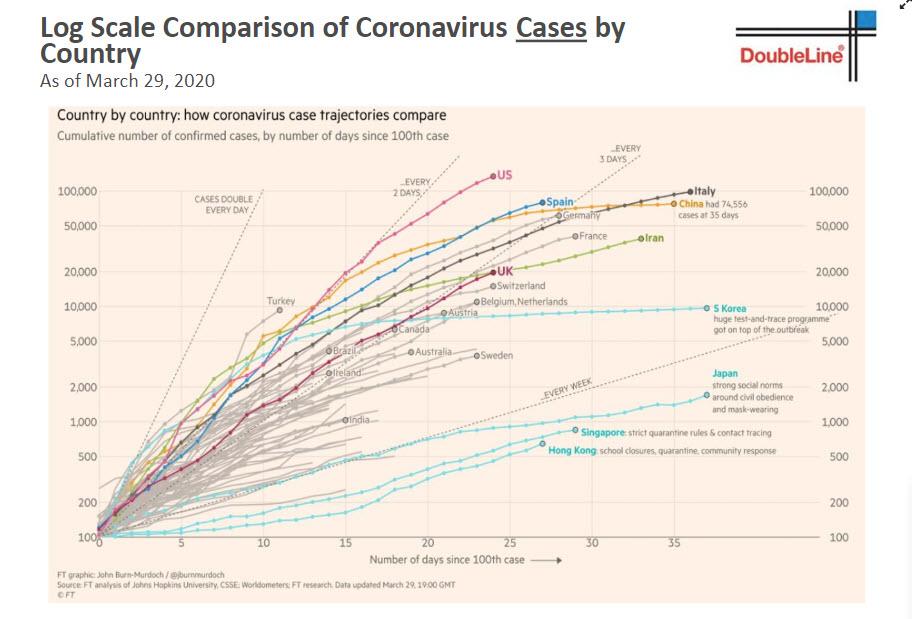

He next lays out the latest development in the coronavirus pandemic, which as most readers know is generally under control (allegedly) in Japan and South Korea, but rampant in Europe and the US.

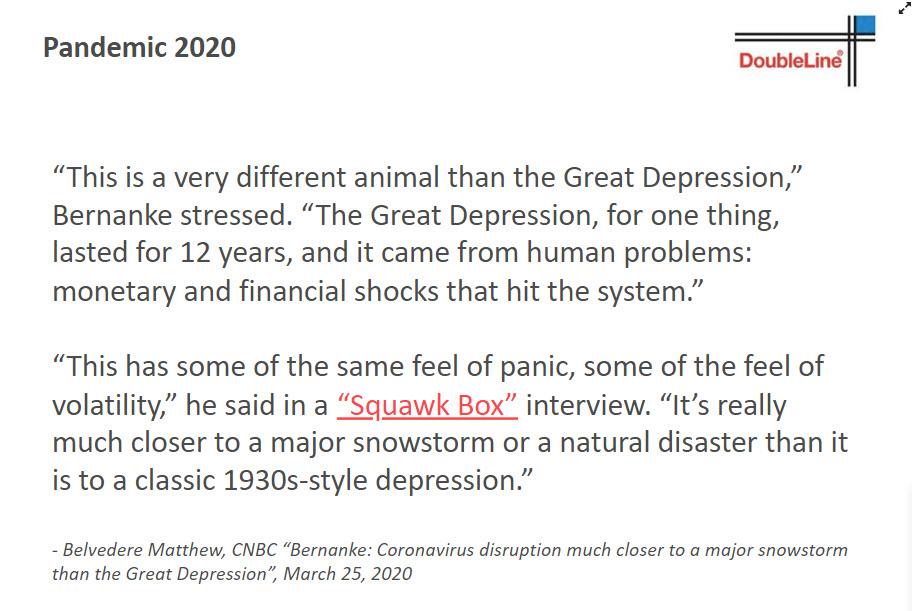

Gundlach then mocked Bernanke’s take that the coronacrisis is “closer to a major snowstorm” than the Great Depression, saying that having grown up in Buffalo, snow storms last a week and are far less exciting.

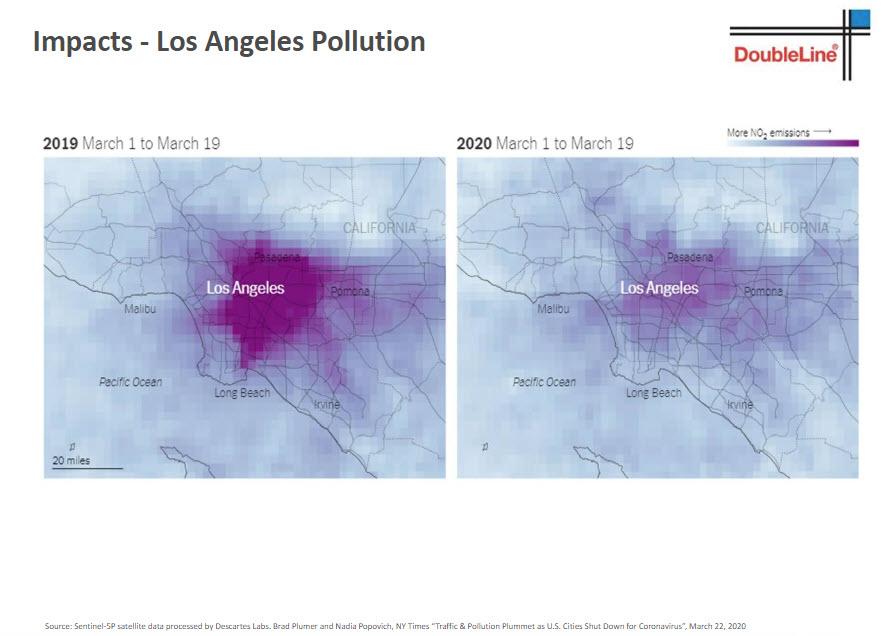

The DoubleLine CEO then showed the impact of the pandemic on LA traffic and pollution, with congestion and smog both apparently gone thanks to the virus.

Gundlach then reveals the source of today’s presentation title: the two sinks are the i) Fed’s kitchen sink and ii) the Treasury’s kitchen sink, which so far are barely keeping risk assets in check, and already the Treasury is contemplating another kitchen sink in the form of Phase IV which Trump hinted today could be $2 trillion and geared at infrastructure.

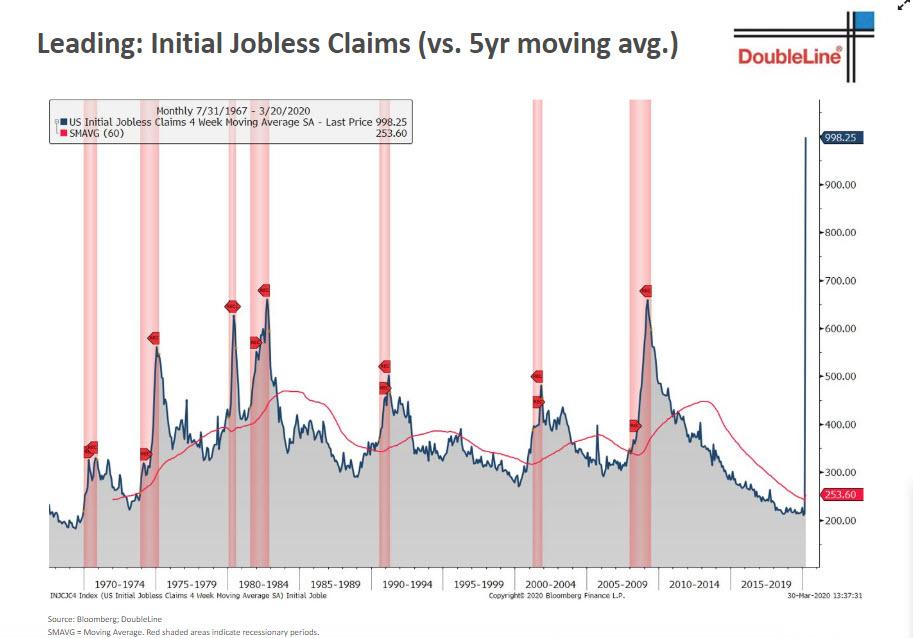

Going back to the economy, Gundlach looks at one of his favorite charts, namely the surge in initial claims which he shows on a 4 week average basis to normalize the outlier of last week’s massive surge.

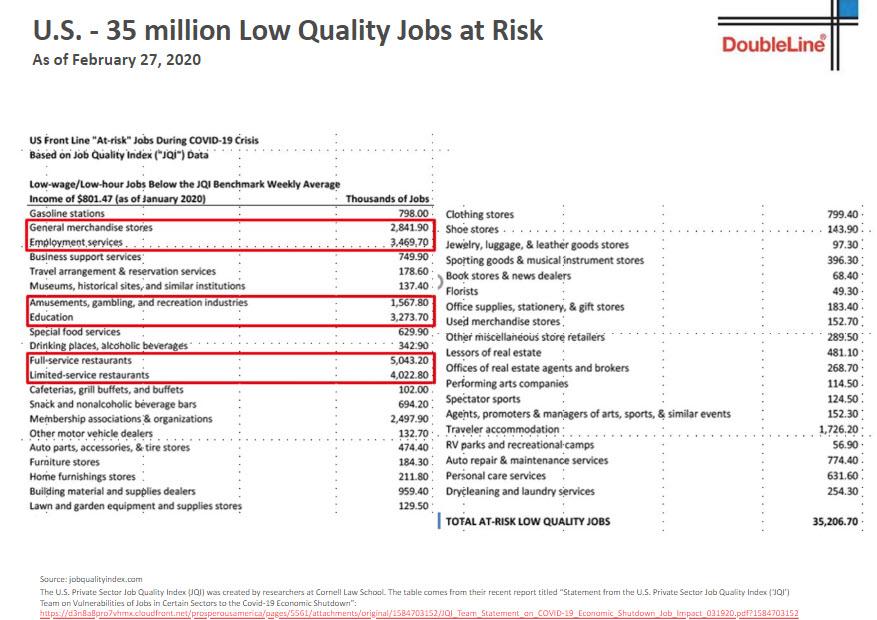

How bad could it get? Gundlach shows a chart of “low quality jobs” which will be the first to go, and could be as large as 35 million.

Going back to GDP forecasts (which exclude Goldman’s latest -34% GDP drop), Gundlach compiles the latest big bank predictions and shows that Q2 will be nothing short of a depression.

Tyler Durden

Tue, 03/31/2020 – 16:16

via ZeroHedge News https://ift.tt/2URznQf Tyler Durden