2020 Crash – Complacency Came Before The Fall

Authored by Sven Henrich via NorthmanTrader.com,

Complacency came before the fall. All of 2019 market participants ignored the non existent earnings growth. Too strong was the now pavlovian reflex to chase easy central bank money. Too trusting in central banks to again produce a reflation scenario that would make all the troubles go away.

Everything was ignored and markets and stocks were relentless chased higher into some of the highest market valuations ever. Even the coronavirus was ignored. A dip to buy in January they said. AAPL warning? Let’s ignore it and buy AAPL to new all time highs again.

Nothing mattered until it did.

Then markets crashed last week. Perhaps not in percentage terms, but in terms of vertical velocity to the downside it was unmatched in history. The fastest 15% correction off of all time highs ever and by far.

Worse, months of buyers of stocks and markets at high valuations suddenly found themselves trapped as the bottom fell out inside of a few days:

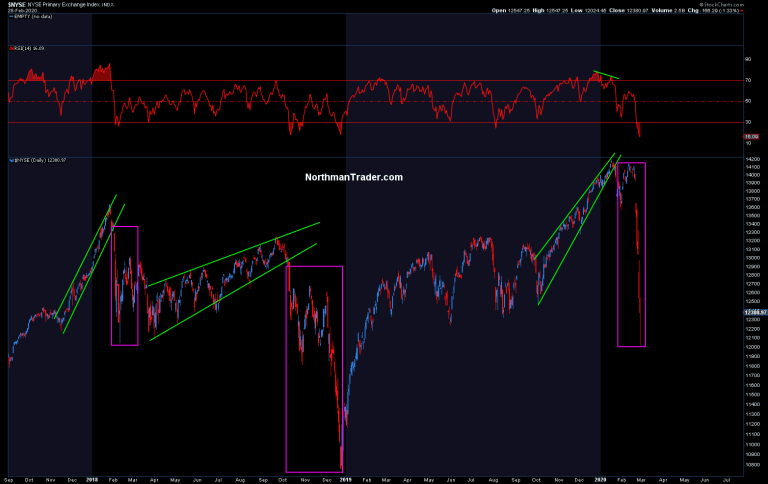

$NYSE, the broader index dropping below the January 2018 highs and closing below the summer 2019 lows now showing an index that has gone nowhere in 2 years and the recent highs being a complete mirage.

The big message: It was not different this time. Bears were right. Full stop.

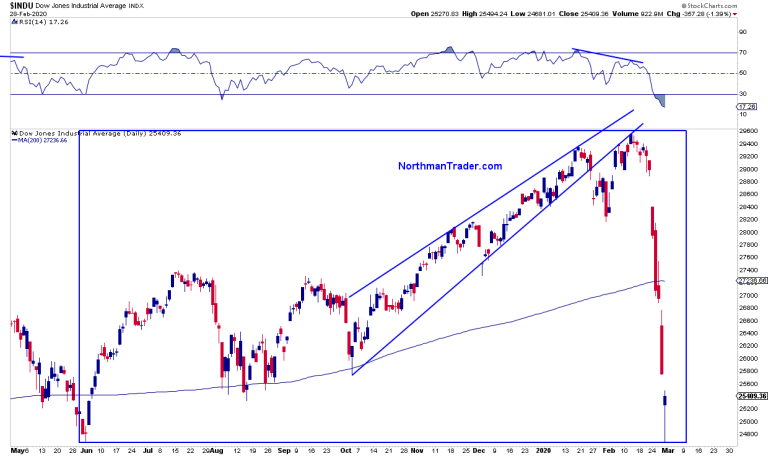

$DJIA fell all the way to the June 2019 low taking out 9 months of buying:

Don’t anybody tell me everybody sold the top. No, lots of buyers are trapped at much higher prices and are now again dependent on central banks coming to the rescue.

The very central banks that have led them into another liquidity trap. By printing, cutting rates, adding to the balance sheet at a record clip and even producing new record holdings of treasury bills the Fed has created a stock buying frenzy. In denial of its actions and the historic valuations that were created in the process the Fed caused a massive melt up in stocks and markets and now investors have paid the price as the Fed lost control:

Loss of control in print. pic.twitter.com/cQBitPTepG

— Sven Henrich (@NorthmanTrader) February 28, 2020

And now everybody is in hopes that the Fed can print even more to rescue markets once again.

Sure enough on Friday Jay Powell came out and tried to “sooth” markets.

It was oh so predictable:

I KNEW IT!!!!!!!!!https://t.co/HyPicKSCiS

— Sven Henrich (@NorthmanTrader) February 28, 2020

And I called it the week before:

Prediction: If markets drop 10%+ before April the Fed will not end repo or its treasury bills buying program as indicated.

If anything they will increase it and cut rates.Why? Because markets will demand it & this Fed has no backbone whatsoever & his beholden to markets.

— Sven Henrich (@NorthmanTrader) February 20, 2020

And here we are, the market now pricing in a 100% probability of a rate cut by March and Powell sending the signal it will come. Indeed markets are now pricing in nearly 4 rate cuts by early 2021 and there’s chatter about an emergency rate cut coming or global coordinated central bank intervention.

They will react for certain and this reaction may well an drive aggressive counter rally in coming weeks from now extreme oversold conditions in markets.

But the bigger issue now is that central banks are very much at risk of losing final control here, having left themselves vulnerable, intervening always at the first sign of trouble, and now they have precious little ammunition to deal with a real emergency if coronavirus is turning into something much more serious.

Money printing does not start production chains or cause airlines to fly. So the risk of a global recession unfolding is a clear and present danger and then futures rallies would continue to get sold and markets may embark on a multi year bear market. That’s the risk they tried to avoid in 2019.

We can’t know how any of this plays out of course and hopes are the virus will calm down in the next month or two and then this current shock to the system can recover and pent up demand can rescue the economy and markets into the second half. It’s possible, but it may also not be possible depending on the severity. Because frankly, we are watching a historic experiment unfold:

Historic experiment:

Let’s take the longest and slowest recovery business cycle & the most indebted global economy, use cheap money to jam markets to the highest market cap to GDP valuations ever and then shut down the global supply chain and then let’s see what happens. pic.twitter.com/ubXzSeYdox— Sven Henrich (@NorthmanTrader) February 28, 2020

I repeat: Nobody can know how this will play out. However we can let the technicals guide us, the very technicals that told us this rally was unsustainable, that it had massive issues, and that a reversion was coming.

In this week’s video I’m focusing on what just happened and why, the damage that has been inflicted, the orchestra of support we witnessed on Friday, and what we may expect going forward including potential for an aggressive counter rally, but also resistance on any moves up given the technical damage that has occurred.

* * *

Please be sure to watch it in HD for clarity. To get notified of future videos feel free to subscribe to our YouTube Channel. For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

Tyler Durden

Sat, 02/29/2020 – 19:00

via ZeroHedge News https://ift.tt/2wkf2L2 Tyler Durden