A Long Way Down To Value Still

Summary

-

The stock market has completed the first phase of a bear market with a rapid and sharp Q1 sell-off caused by massive deleveraging

-

Stocks still need to deal with its valuation problem as well as discounting the long-term financial and economic impact of the Coronavirus shock

-

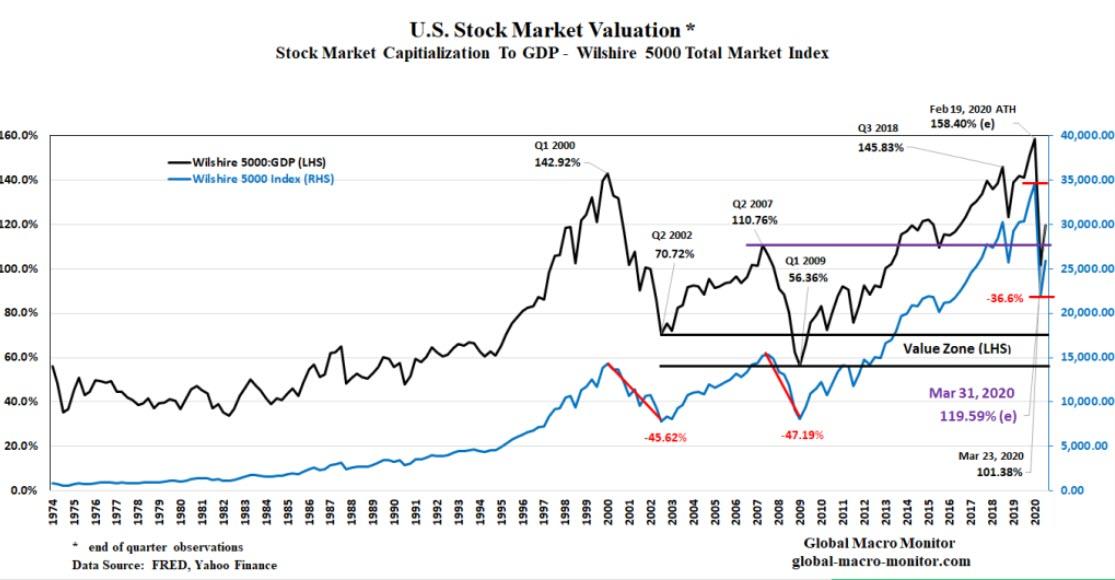

Even with the 25 percent sell-off since the February 19th high, stock market capitalization-to-GDP remains extremely elevated, still higher than its pre-GFC high and at the 85th valuation percentile

-

Our analysis illustrates that stocks still have 40-56 percent of downside to reach the valuation levels where the past two major bear market’s bottomed

-

Time, rather than price, could bring valuations back into line with historical valuation levels as stocks settle in for a protracted bear market

-

A loss of confidence in the dollar as the world’s reserve currency could spark inflation and boost stocks as an inflation hedge

As the historic Q1 2020 (Wilshire 5000 down 21.25%) comes to a close, we take a look at the current valuation of the U.S. stock market as defined by the Wilshire 5000-to-Nominal GDP ratio also known as the Buffet Indicator.

…the Buffett indicator is the total market capitalization of all U.S. stocks relative to the country’s gross domestic product. When it’s in the 70% to 80% range, it’s go time. When it moves well above 100%, it’s time to tap the brakes.

Stock Market Capitalization-to-GDP Valuation Metric

We like this metric for several reasons.

First, GDP is more difficult to manipulate than earnings, which are subject to accounting vagaries and other forms of CFO trickery.

Second, stock valuations cannot be divorced from the economy forever. Earnings should theoretically track long-term economic trend growth.

We wrote about this in 2018 in our post, Asset Prices Divorced From Economic Reality More Than Ever,

The valuation reality coupled with the prevailing, but false, “don’t worry” market narrative sets us up for another major financial crisis.

A third major crisis in 20 years? These are only supposed to happen once in every 100 or 1,000 or 10,000 years, so say the rocket scientists.

Of course, sustained periods of divergence can occur when profit margins experience rapid expansion. The diminished bargaining power of labor, technology-led productivity gains, and the emergence of new economic/market paradigms, such as the rise of Chimerica – though rapidly fading rapidly into the dustbin of history – have all contributed to the expansion of corporate profit margins over the past 20 years.

That is until an event or major shock comes along to reset the economy and financial markets.

Business As Usual?

To believe the economy returns to “business as usual” is a hope based on fantasy and ignores the political winds that coronavirus pandemic has stirred up. Nobody could have ever envisioned the possibility of a tenant “rent strike,” which is now gaining support and almost encouraged by some state and local governments. There is probably no more an applicable case for TINA than this.

Furthermore, corporations who now engage in buybacks, one of the main drivers of demand for stocks over the past few years, and do not “take care of their employees” are now viewed as market lepers. The financial zeitgeist is changing rather quickly.

It is interesting to watch the purest of ideologues suspend their economic theology during this pandemic, which is not a bad thing, in our opinion. To paraphrase Voltaire, when the ship is sinking, you can’t allow the perfect to destroy the good.

We Are All Socialists Now

Wall Street and the financial system has been bailed out and saved from itself once again. What else is new? Maybe the third time in twenty years is the charm?

Nevertheless, we are all socialists now. If you doubt that, go ask “Bernie” Trump.

Still Grossly Overvalued

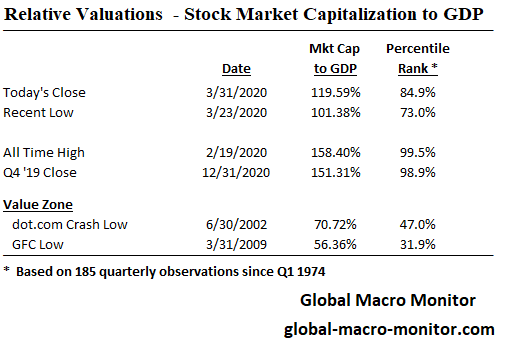

At today’s close, the stock market remains extremely overvalued even with a generous assumption Q1 nominal GDP contracted only 1.41 percent on an annual basis. Market cap-to-GDP finished the quarter at 119.59 percent of GDP, which is still 9 points higher than its peak at the end of Q2 2007, just before the Great Financial Crisis (GFC) began.

That is a very difficult metric for the bulls, who are now touting “the bottom is in,” to digest.

Moreover, today’s close puts the stock market at its 85th percentile in terms of its 185 end-of-quarter valuation levels since 1974, the year the Wilshire 5000 Total Market Index was created. Even at the March 23rd low, 18 percent below today’s level, the Wilshire 5000-to-GDP ratio was at 101.38 percent, the 73rd percentile, hardly a “generational buying opportunity,” in our book.

What’s Up?

Our perception is that markets are dealing with and trying to sort out the confluence of several issues, including financial, economic, and political, which have created a financial and economic “perfect storm.”

Financial Bubbles

Though the catalyst was the Coronavirus, the first leg of the downdraft has been mainly driven by the bursting of multiple asset bubbles, including stocks, bonds, and real estate, which during its initial phase is a massive deleveraging leading to a rapid and trapdoor sell-off. This was inevitable even without the pandemic shock and was a very long time in coming due to the technical condition of most asset markets. The supply and demand imbalance for assets remained favorable for an extended period until it didn’t. See our post, The New “Supply-Side Economics” Fueling Asset Bubbles.

Economic Consequences

The magnitude and speed of the sell-off were sparked by the biggest economic shock the world has experienced since the Great Depression and then some.

It is our opinion, the market still has to grapple and come to grips with its valuation problem, i.e, regress to mean valuations, even before it evaluates the long-term damage and impact the coronavirus shock will have on the global economy.

Politics

Additionally, we have little doubt the domestic and geopolitical landscape is going to look much different on the other side. We have our priors that the political winds, out of necessity, are blowing in favor of:

1) more state intervention in the economy;

2) more national autarky, and

3) the willingness to finally address the country’s growing wealth gap, though the current bear market is already in the process of closing the disyance between the richest and poorest Americans.

All of the above are not stock market positive.

Where Now?

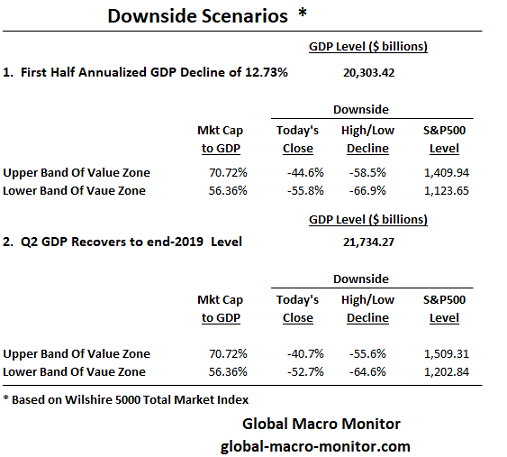

In the last table, we run a couple scenarios based on two trajectories of nominal GDP and what we deem as the “value zone” where the market should/could/or might bottom based on the past two bear markets. Though we can’t stress enough that nobody knows for certain where the bottom is, or that if it is already in, our analysis is not based on a hunch, gut feel, or wishful thinking but on the historical precedent of the prior two major bear markets, excluding the December 2018 Nightmare Before Christmas mini-bear market.

The upper band of the value zone is the market cap-to-GDP ratio where the dot.com bear market bottomed at 70.72 percent. The lower band is the level where the 2007-09 GFC bear market bottomed at a market cap of 56.36 percent of GDP.

The two scenarios are based on the trajectory of nominal GDP to the end of June 2020.

The first scenario assumes GDP declines by an annual rate of 12.73 percent in the first half of 2020, while the second scenario assumes nominal GDP is at the end-2019 level, very generous and not likely.

Both show that the stock market has a long way down until it reaches the “value zone,” a downside range of 40.7 to 55.8 percent lower, or an S&P500 equivalent of 1123.65 to 1509.31. Take these as approximations and don’t get hung up on the exact figures.

It is important to note, our analysis is based on end-of-quarter observations, which may or may not be the high/low points for each particular three-month period.

Time

Our analysis assumes price is the main determinant in regressing stocks to these valuation levels and that it happens at relatively light speed. Alternatively, the stock market could bang around and slowly drift lower for years as the economy recovers and grows into a more realistic historic valuation. That doesn’t seem likely, however, given the rise of the quants, HFT, and algorithmic trading.

Inflation Hedge As The Upside Target

One possible path, which is not a zero probability, is that with all the current monetization of spending and bailouts, with more surely to follow, inflation begins to take off and stocks become an inflation hedge.

The coronavirus could be the beginning of the end of the dollar’s reserve currency status,

The coronavirus crisis should still wreak far less human damage than the Great War, which precipitated the fall of the Austro-Hungarian Empire, but the shock to the global system may be comparably great. According to Michael Howell of London’s CrossBorder Capital Ltd., this is reason to prepare ourselves for another change of global financial leadership. After a century in which the financial world orbited around the dollar, he believes that we are at the beginning of the Chinese century.

If this sounds outlandish, remember that almost everyone suddenly seems to agree life after the coronavirus will be different. This crisis will change us. The disagreement is over exactly what it will change us into.

If so, the demand for the dollar will diminish while the supply is skyrocketing from all the monetization, leading to severe weakness or even its collapse and thus generating a wave of monetary inflation. Not the “good” demand-pull inflation as central bankers have been trying to generate or have been miscalculating.

Upshot

We don’t know for certain how this all plays out but now you have our analysis. We would love to hear from you if you disagree and to see yours. No happy talk, no hunches, no warm feelings in your tummy but hard analysis with the data.

As always, we reserve the right to be wrong.

Tyler Durden

Wed, 04/01/2020 – 09:00

via ZeroHedge News https://ift.tt/2xF90Fr Tyler Durden