China’s Fake Number Parade Continues: Caixin PMI Soars, Prints Just Barely In “Expansion”

One day after China’s official National Bureau of Statistics decided to have some fun at the expense of the sinking US economy, and despite suffering an unprecedented economic crash itself, reported laughably high March PMI numbers, with both the manufacturing and non-manufacturing PMIs surging from their record February lows, smashing expectations by the most on record and in the case of manufacturing’s 52.0 print, rising to the highest level since September 2017 in an apparent confirmation of a V-shaped recovery in China …

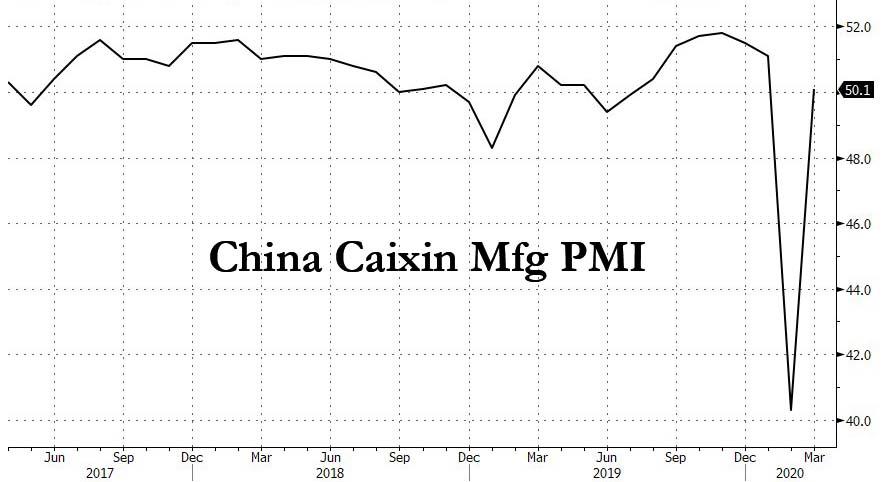

… moments ago the parade of fake numbers out of China continued apace, when Markit reported that the Caixin PMI, which focuses on small companies and private firms (unlike the official PMI number, which tracks mostly state-owned enterprises and other large-sized companies) also smashed expectations of 45.5, and soared from 40.3 in February to the smallest possible print in expansion territory: 50.1

While a remarkable rebound was to be expected after yesterday’s farcical numbers which clearly had a political justification, namely to show Washington just how strongly China’s economy had rebounded – even though as we reported China is suddenly drowning in massive unemployment and facing a tidal wave of consumer defaults – the fact that the Caixin PMI landed precisely at the smallest possible print in expansion territory was yet another obvious joke at the expense of anyone who still believes China reports anything remotely close to honest numbers, whether involving the economy or the coronavirus epidemic.

This is what Markit had to say about today’s laughable print out of China:

After deteriorating at the quickest pace on record in February, business conditions faced by Chinese manufacturers were broadly stable in March. Production rose slightly as more firms reopened following widespread company shutdowns and travel restrictions in February amid the Coronavirus diseases 2019 (COVID-19) outbreak. However, the pandemic continued to weigh on demand conditions and supply chains, with total new work falling for the second month running and delivery times lengthening sharply.

Firms remained upbeat that production would increase over the next year, however, as a number of manufacturers expect

demand to recover once the COVID-19 outbreak subsides.The headline seasonally adjusted Purchasing Managers’ Index™ (PMI™) – a composite indicator designed to provide a single-figure snapshot of operating conditions in the manufacturing economy – rose from a record low of 40.3 in February to 50.1 in March, to signal a broad stabilisation of business conditions. This marked a strong improvement from the previous month when the nation imposed strict measures to stem the spread of COVID-19.

It wasn’t exactly clear how there was a broad stabilizaition of business conditions at a time when not only half of China’s workforce is still MIA, but most of China’s foreign clients have shuttered either temporarily or permanently. But if there is one thing we have learned about China, it is to never ask questions and just accept the numbers, no matter how fake they are. And in light of this…

Business confidence regarding the one-year outlook for output held close to February’s five-year high, with many firms optimistic that demand will pick up once the pandemic situation improves.

… they wouldn’t be more fake:

It gets better, commenting on the China General Manufacturing PMI data, Zhengsheng Zhong, Chairman and Chief Economist at CEBM Group said:

“The Caixin China General Manufacturing PMI rebounded to 50.1 in March from a record low the previous month, indicating limited improvement in manufacturing activity after widespread economic stagnation in February. The data in the survey, which was conducted from March 12 to March 23, reflected that manufacturers were still gradually getting back to work. The March expansion in the manufacturing sector returned to a level seen before the coronavirus epidemic.

* * *

Manufacturers were still quite confident about the next 12 months, although the gauge for future output expectations fell slightly from the previous month. Employment was also relatively stable. The employment subindex returned to the normal level before the epidemic outbreak, despite staying in negative territory. The good news was that fundamental economic factors, such as business confidence and resident income, did not deteriorate substantially.

“To sum up, the manufacturing sector was under double pressure in March: business resumption was insufficient; and worsening external demand and soft domestic consumer demand restricted production from expanding further. Whereas, business confidence was still high and the job market basically returned to the pre-epidemic level, laying a positive foundation for the economy’s rapid recovery after the epidemic.”

In other words, China’s economy had recovered to levels prior to the coronavirus crash, yet paradoxically at the same time “business resumption was insufficient; and worsening external demand and soft domestic consumer demand restricted production from expanding further.” How this makes sense is anyone’s guess, but clearly it was enough for Markit to conclude that the Chinese economy was once again back into expansion.

Our take: the “stimulus” check from Beijing to Markit cleared.

Tyler Durden

Tue, 03/31/2020 – 22:48

via ZeroHedge News https://ift.tt/2w2NMAI Tyler Durden