European Banks Suspend Dividends; Banker Bonuses Are Next

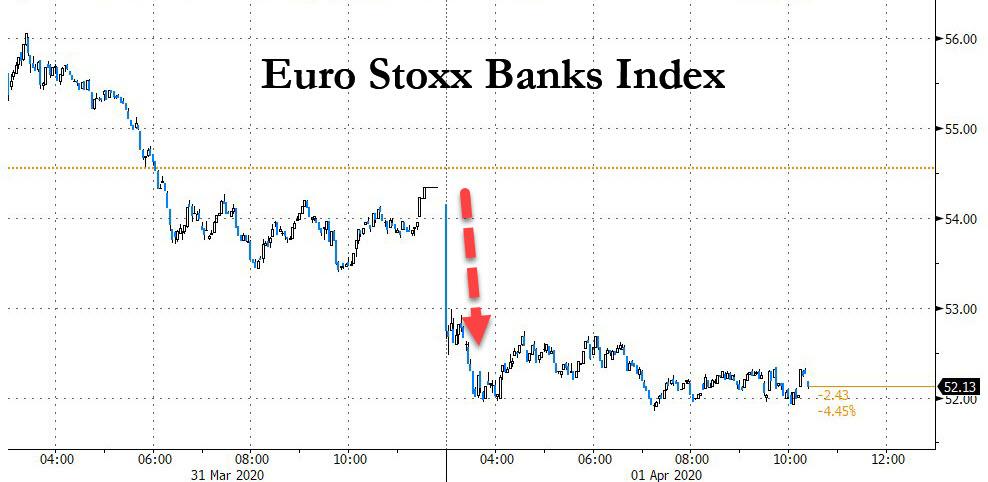

Two of Europe’s largest banks tumbled on Wednesday, dragging down the broader Eurostoxx Bank Index, after they joined the rest of their peers in suspending shareholder payouts.

HSBC plunged in Hong Kong trading after scrapping its dividend and warning revenue and loan losses will be impacted in the first quarter from the coronavirus outbreak. The bank’s shares dropped over 7% bringing this year’s decline to 33%. Meanwhile, Standard Chartered tumbled 5.2% after it too announced a suspension of dividends and a buyback plan.

In a statement on Tuesday, HSBC said that “we expect reported revenues to be impacted in insurance manufacturing, and credit and funding valuation adjustments in global banking & markets, alongside higher expected credit losses.” The bank had earlier said in the most extreme scenario, in which the virus continues into the second half of 2020, it could see US$600 million in additional loan losses.

In order to preserve liquidity amid a global depression, European (and US) banks have been scrapping shareholder payouts to protect their capital cushions. Along with other UK banks, HSBC decided to scrap dividend payments after urging from UK regulators. The lender said it would cancel an interim dividend slated to be paid this month and also make no payouts or do any buybacks until at least the end of the year.

In total, the UK’s five biggest banks had planned to pay out £7.5 billion in dividends over the next two months, with Barclays due to pay more than £1 billion on Friday. That money will now go where it should have been from the start: a rainy day fund, i.e., money that will be spent first before banks ask for – and receive – a bailout.

* * *

But if shareholders are impacted, why not also the biggest source of bank cash: banker bonuses.

Well, it seems that’s next on the docket, because as Bloomberg reports, European banks are coming under increased pressure to reconsider bonus payments and conserve money that can be used to support the economy. In its strongest warning to date, the European Banking Authority said banks should set pay and especially bonuses at a “conservative level” during the crisis. Firms should also consider deferring awards for a longer period and paying staff in shares.

Lenders should review pay plans to “ensure that they are consistent with and promote sound and effective risk management also reflecting the current economic situation,” the EBA, which coordinates standards across the region, said in a statement on Tuesday. The guidance followed a warning from the European Central Bank’s top supervisor, Andrea Enria, who said in a Bloomberg TV interview that lenders should be cautious about awarding bonuses.

“Banks, shareholders, managers and key risk takers should also take part in the rethink of where we are right now and try to preserve as much capital as possible,” Enria said. “Our recommendation to banks is to be very moderate on” bonuses, he added.

Later on Tuesday, the European Banking Authority issued a statement calling on banks to set bonuses at “a very conservative level” and consider paying them in stock rather than cash.

Perhaps realizing that this is a war not worth fighting, many European banks have already taken proactive steps in limiting bonuses, with Spanish lenders among the first to kick off the Europe-wide trend as Banco Bilbao Vizcaya Argentaria on Monday said that 300 of its top executives waived their 2020 bonuses, while Italy’s UniCredit SpA followed suit late Tuesday, and Intesa Sanpaolo SpA’s top management decided to donate some of their bonuses.

Credit Suisse AG Chief Executive Thomas Gottstein signaled to Swiss broadcaster SRF that the lender may also curb variable pay for 2020 to show “solidarity” amid the crisis. Eearlier this year the Swiss bank decided to pay out 3.17 billion Swiss francs ($3.28 billion) in bonuses for last year. Even insolvent Deutsche Bank distributed 1.5 billion euros.

“It’s a bit early to talk about the bonuses for 2020, but we are definitely thinking along the lines of showing solidarity,” Credit Suisse’s Gottstein said in the interview.

Of course, there were also those who were against the bonus cut: Stephan Szukalski, a representative for the German labor union DBV, said that broad-brushed bonus cuts could hit vulnerable staff:

“We oppose a general bonus cut because the bonus pool doesn’t only include staff with very high salaries,” said Szukalski, who also sits on Deutsche Bank AG’s supervisory board. “Many medium- to low-income earners — of which there are many in Deutsche Bank — have made a contribution over the past years through the previous cuts.”

Well, Stephan, maybe vulnerable staff should demand a higher base pay and eliminate the bonus, which in theory should only be paid to non-vulnerable producers who generate outsized gains for the company.

The worst news, however, is for Deutsche Bank staffers, who after years of getting virtually nothing following several consecutive near-death experiences for the biggest German bank, can now write off 2020 as well:

As Bloomberg reports, Deutsche Bank is considering scrapping bonuses for top management this year as regulators urge banks to preserve capital and keep lending through the coronavirus pandemic. Cutting bonuses is just one possibility and the bank is also looking at alternative measures that wouldn’t involve variable compensation, according to a person familiar with the matter. A decision could be announced as early as this week.

Tyler Durden

Wed, 04/01/2020 – 11:35

via ZeroHedge News https://ift.tt/3dKt2Pl Tyler Durden