FIMA Is Yet More Proof – The Potential For A Shadow-Shadow Run Is Very Real

Authored by Jeffrey Snider via Alhambra Investments,

Yesterday was another day ending in “y”, therefore there must be some new liquidity scheme being announced by the Federal Reserve. For a crisis that many seem confident has been put in the past, the optimists still are going to have to factor that even US central bankers feel they have to keep pulling repo rabbits out of their…somewhere.

Yesterday it is FIMA. Not just FIMA but the FIMA Repo Facility! The abbreviation stands for Foreign and International Monetary Authorities which once more uncomfortably points the world’s attention to US dollar conditions outside the United States. Offshore, you might even say.

Offshore and repo, imagine that.

Foreign officials. US Treasuries. Smooth functioning of financial markets. Temporary exchange in lieu of sale. International currency. What the hell is going on here?

I sincerely doubt Jay Powell reads this blog – I know he doesn’t and never will – but it’s exactly what I wrote yesterday. The Fed has certainly been in touch with the IMF, so they are all aware that the global dollar shortage, the real one, hasn’t actually shown up yet.

So, the idiots that a year ago screwed up the largest single bailout in the IMF’s history, Argentina, now want the world to be reassured as we all face up to the prospects for eighty Argentina’s.

Hey NYSE, real GLOBAL DOLLAR SHORTAGE isn’t even here yet.https://t.co/sbnN1x6lUy pic.twitter.com/HBY3Dc6QYO

— Jeffrey P. Snider (@JeffSnider_AIP) March 30, 2020

Thus, you can take FIMA one of two ways:

-

the Fed cultists will be relieved at this proactive stance Jay Powell seems to be taking;

-

or you can whisper HOLY SH%$ under your breath as you understand what it means when the IMF as well as Jay Powell acknowledge just what’s before us.

When even the normally self-blinded can see the thing, is that good or is it an indication of just how starkly abnormal this potential future reality might be?

After all, the Fed was being proactive in its September repo rumble aftermath – for all the good that it did.

There is a fundamental mismatch here that’s even more basic than bank reserves versus collateral. This gets to the very center of the whole issue; starting with the question, what is the Federal Reserve?

Asking members of the public, I would wager 99 out of 100 persons would get the answer wrong; and the one who got it right did so by accident. The Federal Reserve is not a central bank, not by any reasonable definition of one. It is instead a bank authority, more importantly a domestic one. This is no trivial distinction, I assure you.

This by no means is a judgment on the public’s judgment, instead it demonstrates just how distorted Economics has twisted reality. You’ve all been taught from the beginning, as I was, how Alan Greenspan’s Fed is the most powerful force in the universe; and how Ben Bernanke in November 2002 gave that force a nickname called “printing press.” It all sounds so very central bank-y that you are forgiven for believing (it took me a long time to make the leap, too; as Milton Friedman said just before he passed, central banks are good at one thing and one thing only: PR).

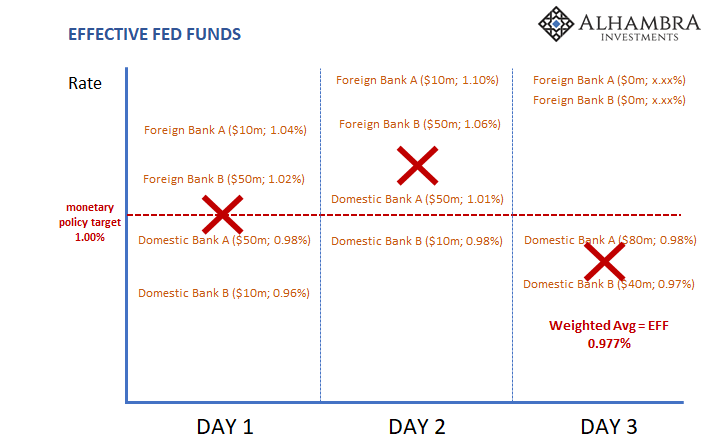

Being converted into a Fed true-believer right from the start you never ask any questions about the details. That’s the thing about faith. How does this purported central bank actually accomplish its central bank chores? Moving the fed funds rate around a quarter point here or there doesn’t quite add up.

And so, we are also taught about Open Market Operations, or OMO’s. The Fed doesn’t just move fed funds around, the textbooks all say it controls the short-term rate via OMO’s. The central bank can, if it chooses, add reserves or take them away by buying or selling securities from or to dealers. Voila! There’s your money printing.

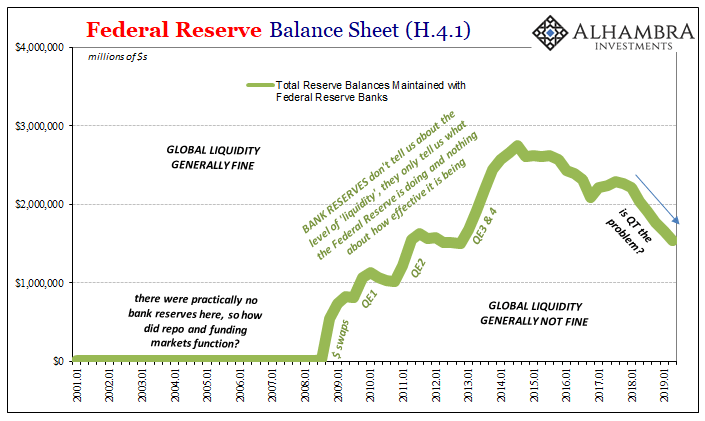

Except, no. That may be the standard theory preached in Economics class, but it didn’t actually happen that way in practice. Throughout the eighties, nineties, and middle 2000’s, there were practically no OMO’s – the level of bank reserves, the accounting remainder the Fed does “print”, never really more than $10 billion or so total.

That $10 billion balance was supposed to have been the Fed’s control element (aside: this is the steep part of the curve they were talking about in recent repo papers) in a multi-tens of trillion system spanning the entire world? And that’s the other thing; where did this LIBOR thing come from?

LIBOR is the London InterBank Offered Rate. Developed in the late sixties for Iran, yes, sixties and Iran, as the name tells you these are dollars offered between banks in London. Everyone knows that the US dollar is the world’s reserve currency, but a big part of Fed faith is never asking what that means, either.

So, we have some vague notions about OMO’s and US dollars doing some things overseas. With Alan Greenspan’s “maestro” performance, there was never any apparent reason to get into specifics. Just go along with it; let the professionals sweat the small stuff.

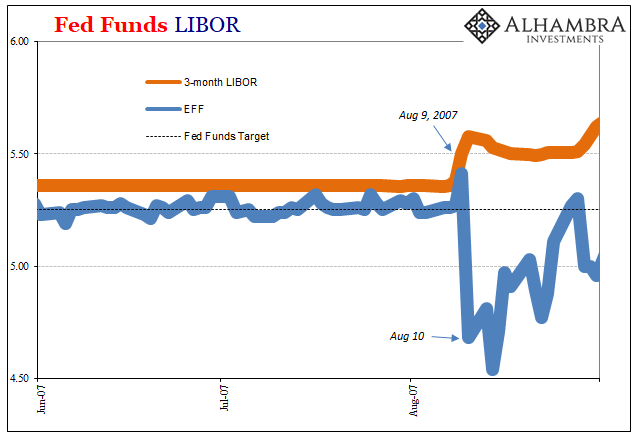

On August 9, 2007, however, suddenly LIBOR and fed funds were dancing to someone else’s tune rather than Ben Bernanke’s.

That point was forever driven home on August 10 when LIBOR went further up while fed funds suddenly plunged.

What followed was first a plea to use the Discount Window followed by rate cuts, OMO’s, TAF’s, TALF’s, PDCF’s, MMFCF’s, etc. In other words, the FOMC attempted to put in practice what had been only theory. Balance sheet expansion, billions and then trillions of bank reserves. Still fed funds down, LIBOR up. Overseas dollar swaps and a healthy dose of foreign names on the TAF lists. Still fed funds down, LIBOR up. GFC1.

This was the whole crisis in one picture. But what did it actually mean?

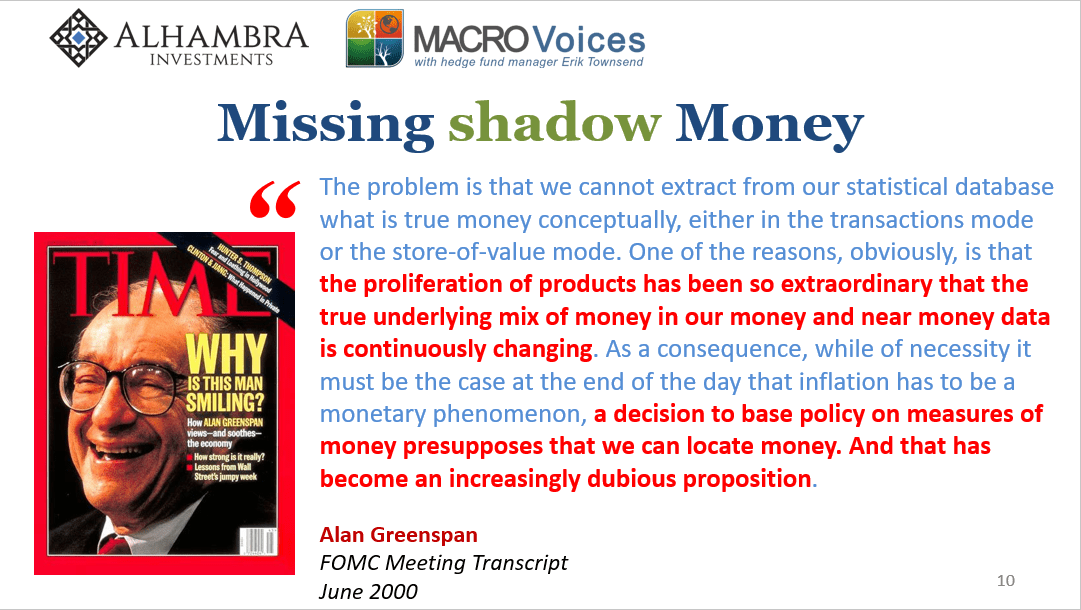

The dollar’s presumed role as global reserve currency had been carried out for decades by a global banking network that only seemed to be responding to the “maestro.” In truth, so long as that monetary system was growing it felt stable with the appearance of the Fed in control (or random good luck). But that growth also meant what Alan Greenspan in June 2000 admitted had been a “proliferation of products” that had long ago expanded and superseded every conceivable monetary boundary – including geography.

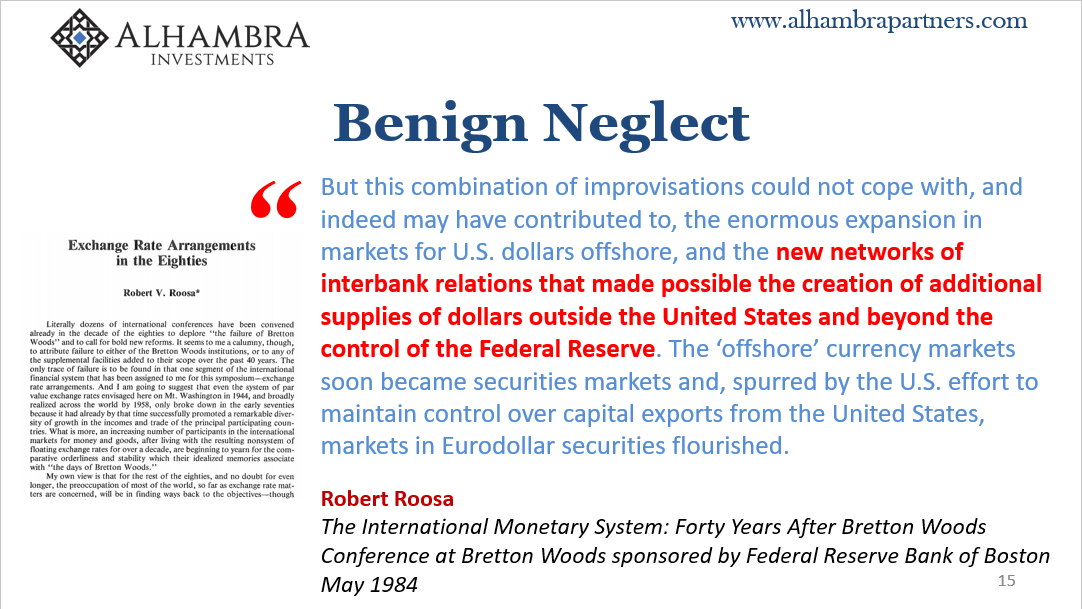

Because the world needed and still needs dollars to function, this offshore US dollar bank system sprang up over the course of more than half a century to meet those needs. While it did, the Federal Reserve was never anything more than a domestic bank authority.

This point was driven home right at the outset of GFC1. As I wrote about back in 2017 on the 10th anniversary of the launch of our first lost decade, in September 2007 the FOMC discussed LIBOR and fed funds, specifically how the former was stubbornly persistent at high positive spreads despite their “best” efforts.

You would think the focus of such solemn discussion would be about what the Fed should be doing to bring them down. Instead, officials kept wondering whose problem this was. Seriously.

MS. JOHNSON. So the spreads of overnight pound LIBOR, relative to target, opened up widely, and they were not addressed. They were allowed to just sort of sit there. The term pound market had a problem, too. Of course, many of the dollar issues that we have spoken of— and that Bill talked about—are really being captured as a London phenomenon. But you might say that, from the point of view of the Bank of England or the U.K. economy, these dollar issues are somewhat separate from the domestic economy. [emphasis added]

Is the central bank responsible for money, in this case dollars – all of them everywhere? Or, is the Federal Reserve merely a domestic bank authority whose authority and attention applies only to banks operating within the US border? We are all taught to believe it is the former when in truth it has always been the latter, as Kathleen Johnson so dutifully pointed out in September 2007.

Let’s boil this down into specifics; if RBS, for example, a bank who had been heavily involved in the global, offshore US dollar system for decades finds itself in trouble for lack of US$ funding offshore, whose problem is that? The Federal Reserve says it is the Bank of England since the specific issue is an English bank, while the Bank of England understands this is a US dollar run.

The domestic bank authority, the Fed, is therefore totally ill-suited to handle the realities of a global monetary system. The inevitable result was the “somehow” Global Financial Crisis; those that might’ve wanted to strike at the crisis directly were unable, while those that, theoretically, could have wanted no part of it; or as little as possible.

To stay true to its mandate, our domestic bank authority came up with overseas dollar swaps in order to literally pass the buck. Bernanke’s Fed acknowledged the “London” dollar problem but in keeping true to its domestic mission simply offered dollar resources, bank reserves, to these other foreign central banks so that the foreign central banks might be able to take care of their own. In US$s.

They weren’t really suited to do that, either. That’s how the repo market ended up being the lender of last resort, until collateral was squeezed right out of it.

To this massive and growing global dollar shortage, Bernanke’s Fed said: not my problem, take some bureaucratically determined dollars and you sort it out!. What got our domestic bank authority moving was only how and where the raging GFC1 impacted their domestic banks (leading to the ridiculously fallacious doctrine of “abundant” reserves), which was guaranteed to happen because it was a world-spanning crisis. The whole house was a raging inferno but Bernanke’s firefighting crew only sprayed down the garage because that’s the instructions they had from the city.

Of course the garage (and house) burnt almost completely to the ground anyway.

The consequences of this mismatch are, and have been, disastrous. GFC1 was only the beginning. Not only are we looking at GFC2, in between them was a full decade without economic growth. I’m not sure how it could have been much worse.

It has only been recently that the official world has begun to understand the implications. Starting with the rising dollar. Not all that long ago considered a good thing, Janet Yellen’s King Dollar embarrassment, the easiest correlation in the monetary world to make was finally made by these Economists in the last few years.

But why does the dollar rise? How do we get it to stop?

If you think those are the questions Jay Powell is right now asking himself you’d be wrong. FIMA is yet more proof. The Fed is still behaving as if this is someone else’s problem.

What I wrote yesterday is that the world is facing an even larger dollar shortage ahead of us than what we’ve already experienced in March 2020. The IMF rarely gets more a single emergency request for funding. It’s gotten around eighty recently with more expected.

Why?

There are, by and large, two ways a foreign location can come up with the dollars it needs (the short) to participate in the global economy; and most places don’t have the luxury of being self-sufficient, so trade isn’t a choice and therefore dollar availability is a must.

The first is the old-fashioned way – mercantilism. You sell goods to other places around the world and they give you dollars in return. When people refer to the so-called petrodollar, that’s what it means where oil rich nations have been concerned (and it isn’t anything more than that despite years of people trying to imbue other purposes).

Global trade, however, is about to be curtailed to an extent that will probably exceed GFC1, in terms of depth and likely duration (for many places the Great “Recession” was sharp but ultimately short). Therefore, countries previously dependent upon mercantile trade to source a great deal of their dollar short requirements are about to be almost totally shut out. For the oil producers, it’s already in the price of oil.

That’s the double in the dollar double whammy; the financial system has already largely shut down. Once those trade dollars dry up, too, where does anyone go to get them?

But that’s not Jay Powell’s problem, he says. The Fed’s answer is banks in whichever country should apply for aid from whomever’s local central bank. Not the Fed.

What the Fed will do is supply limited dollar swaps with some other central banks. Since there are only a dozen or so of them, and the IMF has already reported massive interest from almost all other countries (one of my main points yesterday), in the case of countries whose central bank or monetary authority isn’t a counterparty to the Fed’s dollar swaps there’s now FIMA.

The extra wrinkle is FIMA’s repo piece. Normally, as I’ve been documenting for a very long time, when confronted with a dollar shortage (as have happened two other times in between GFC1 and GFC2) the foreign central bank would “sell US Treasuries” in the attempt to make up the difference. “Sell UST’s” is in practice a euphemism for foreign officials “supplying dollars” that the eurodollar market won’t.

But “selling UST’s” means mobilizing foreign reserves, driving down the visible stock for everyone to see; which advertises to the world just who has the biggest dollar problem (the nightmare scenario). It’s exactly like the Discount Window’s stigma problem only in this case for the dollar short of entire national systems.

The FIMA Repo Facility gives these overseas monetary authorities the option to bypass the “selling” of their UST’s by letting them instead exchange them (repo) with the Fed for cash (bank reserves). For six months (or longer, if extended), foreign monetary officials – and only foreign monetary officials – will be connected to the Fed for bank reserves in a way that hides who is doing what.

Whatever happens to those dollars from there is up to the foreign monetary officials.

If this sounds familiar, it should. The TAF auctions during GFC1 were nothing more than a re-invented Discount Window with anonymity, therefore no stigma. We now have entire countries who wish to hide their dollar shortages instead of just banks seeking to obscure individual funding problems.

As I wrote last October in my FTM series, it really is setting up to be a shadow shadow run (just once I’d really, really like it if I could be right about something good, fun, and happy).

In a shadow panic, like 2008, banks sought to remove liability exposure to other banks – to reduce interbank unsecured lending (that private liquidity I spoke about above). Because it was a bank panic of only banks panicking, it was called shadow (also offshore). As we’ve just been shown, banks are still protecting themselves from this risk – fighting that last war so to speak – by refusing to step in and provide liquidity even in the secured lending market (repo).

A shadow shadow panic might be where some other type of player beyond the visible depositories is hit hardest by liquidity problems. It’ll still be another big funding squeeze, but it’ll be the corporate market or maybe whole countries at the brink.

The FIMA Repo Facility is the Fed confirming that my shadow shadow run scenario is a very real, maybe even a likely possibility. Foreign governments are about to be overwhelmed by dollar problems as the full double whammy of GFC2 is still on the horizon.

Cheery, I know.

And here’s the worst part. With the Fed still refusing total dollar responsibility, no matter how big the eurodollar shortage facing the world, it’s as I wrote yesterday: ¯\_(ツ)_/¯. Hell of a way to face a global crisis.

FIMA doesn’t change anything. Instead of selling UST’s like foreign central banks would be doing they’ll now repo them to the Fed – ending up in the same way as other countries had been using dollar swaps. Did the swaps work? No, of course they didn’t.

None of these things solve the basic underlying dollar problem. This isn’t currency elasticity, it’s the appearance of elasticity without anyone officially acknowledging the real currency. At best, and this is tenuous, they attempt some cover for others to look like they are applying a solution.

Furthermore, instead of the funding markets being able to discern which countries are worst off by simply identifying where reserve balances are shrinking the most, eurodollar banks will now stop funding for everyone because, with reserve balances preserved by the FIMA repo, they can’t identify the weakest cases so, like in every crisis, they’ll just assume everyone is. Since nobody will know just who is the riskiest or how to separate merely a bad situation from an inescapably bad one, it becomes TAF revisited.

Fundamentally, we have a global (euro)dollar system in which the public still believes there is a central bank backstop (thank you, subprime mortgages!) Instead of a dollar central bank, we have a US bank authority whose primary interest is in making the public believe it is a dollar central bank – so long as no one asks questions or thinks too deeply about practical details.

All with a series of elaborate puppet shows, theater which now includes FIMA. Everything our banking authority does is designed to further hide even the biggest problems, not tackle any of them.

That means screw the mandates and regulatory restrictions; this is a crisis. Get them changed immediately. The US boundary doesn’t matter for the monetary system and hasn’t for decades, therefore the central bank (because that’s all we have available at this moment) isn’t a US central bank but a dollar central bank. There’s an enormous difference.

Tyler Durden

Wed, 04/01/2020 – 13:30

via ZeroHedge News https://ift.tt/2xEe50z Tyler Durden