How Low Could US Oil Production Actually Go?

Authored by David Messler via OilPrice.com,

The oil-bears continue their romp across the energy markets with various grades of crude reaching lows not seen in almost twenty years. There will come a point where I can sit down and pen the following words, “We’ve reached bottom, and this is as bad as it gets.” There is a ways to go before it will be possible to make that statement. We are writing off the notion of any recovery in the broad oil and gas market for the next couple of quarters, and probably the rest of 2020. The situation will likely get worse before it gets better, very rapidly. 2021…who knows… things might begin to improve. We will discuss the mechanics of a possible recovery early next year.

The world is awash in cheap oil right now. Goldman Sachs is calling for a final demand decline in March (now) of ~10.5 mm bod, and a projected demand decline of 18.5 million bpd for April. Folks that’s ~20% of total EIA projected global demand.

As discussed in prior OilPrice articles, OPEC and the Russians have drawn a bead on U.S. shale production as the world’s marginal producer. We are beginning to see how rapidly this status may be stripped away as these low cost producers strive to regain their market share lost to American shale production.

In this article we will run down the early indicators the market is sending on where the tipping point will be for shale production. Finally we will include an early estimate for the decline in U.S. shale production by year’s end.

Quick status check for shale

In an OilPrice article last week, I argued that a few things would need to happen before we saw any potential improvement in the market for the oil price. One of them was a reduction in capex across the board for shale. This metric is starting to manifest itself in a couple of ways.

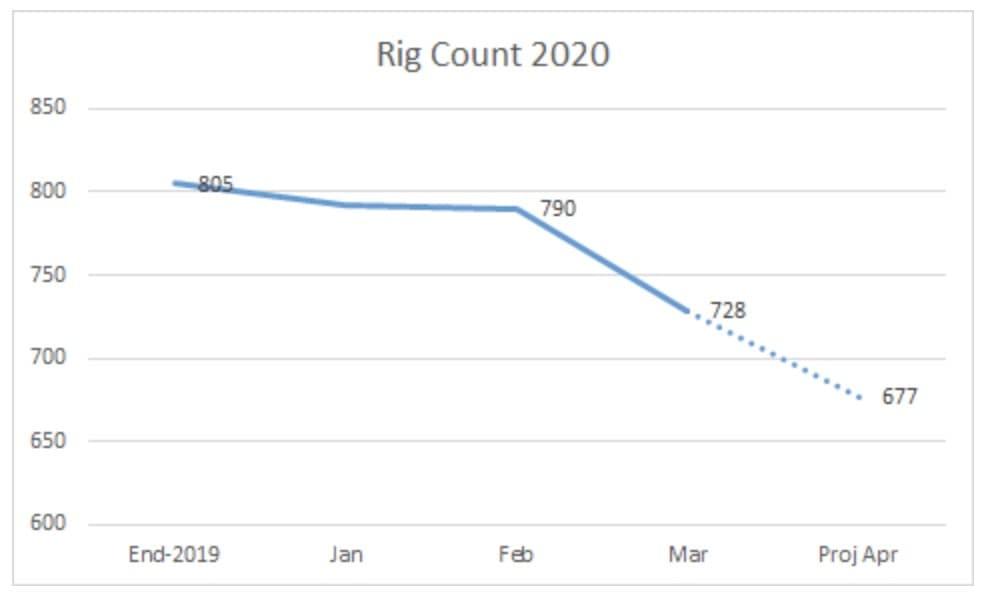

Source: Baker Hughes

The dotted line is a conservative estimate for the slope of the continued decline as operators tighten their belts.

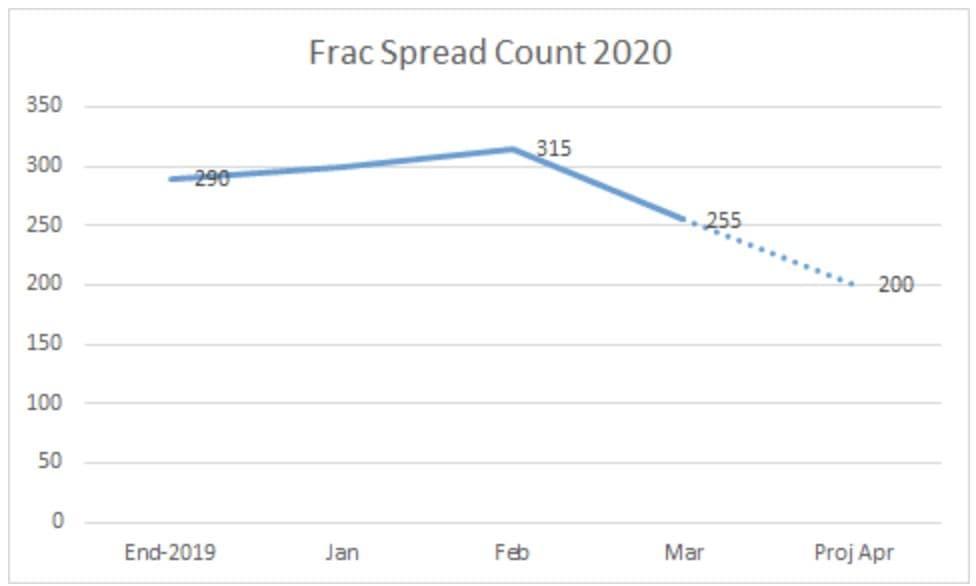

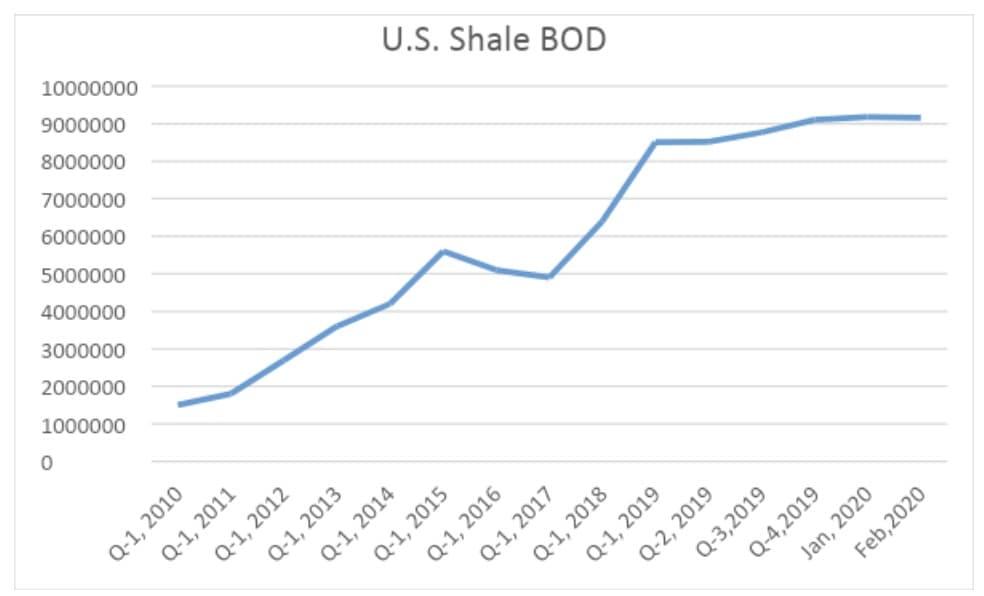

I’ve pointed out that while the rig count has been declining for the past couple of years, Drilled but Uncompleted- DUC, wells withdrawal has helped production to continue its almost inexorable climb. That’s coming to an end as noted by Primary Vision, publishing a drop in Frac Spreads to 255 as of Friday.

Source: Primary Vision

I think the rate of decline in Frac Spreads-equipment used to fracture the reservoir, will accelerate in the month of April reaching ~200 by months end.

My analysis of the upward trend in the Frac Spread line to February was that prices…in the mid-$40s through Feb, were still attractive for DUC withdrawal to March 6th. I’ve been thinking for some time that the next logical step would be for uneconomic producers to….BEGIN SHUTTING IN WELLS ALREADY ON PRODUCTION.

I actually put forward this notion in an Oilprice article on the Marcellus gas play. That article focused on the gas glut that led Chevron,to write down its assets in the Marcellus to focus on the Permian. The Permian is more oil-prone, and is part of the reason operators have focused on it so intensively.

Now this idea is becoming mainstream with analysts putting out estimates for how much shale oil might have to be shut in. Here’s a quote from one of these analysts from a recent article in JPT.

“Uday Turaga, the chief executive officer of oil and gas consultancy ADI Analytics, offered two reasons. The first is that many shale players have hedged large volumes of oil sales in the $50-range through 2020. The other is that shale producers remain too optimistic on the chances of a price recovery coming by year’s end

“We don’t see prices and demand rising before 2021,” shared Turaga. “So this approach of cutting just drilling and not completion of wells in inventory is insufficient—they need to go beyond and have a material impact on production volumes.

ADI Analytics is running several forward-looking models, including one that suggests US shale players need to cut as deep as 2 million B/D from year-over-year production. Such a dramatic reduction would be needed to keep oil prices from remaining locked at marginal cash costs. “We could potentially get there just with capex declines,” said Uday, “but not all operators will cut capex, so a little bit of shut in will be necessary.”

Hopefully you caught the line I bolded about shale producer’s optimism.

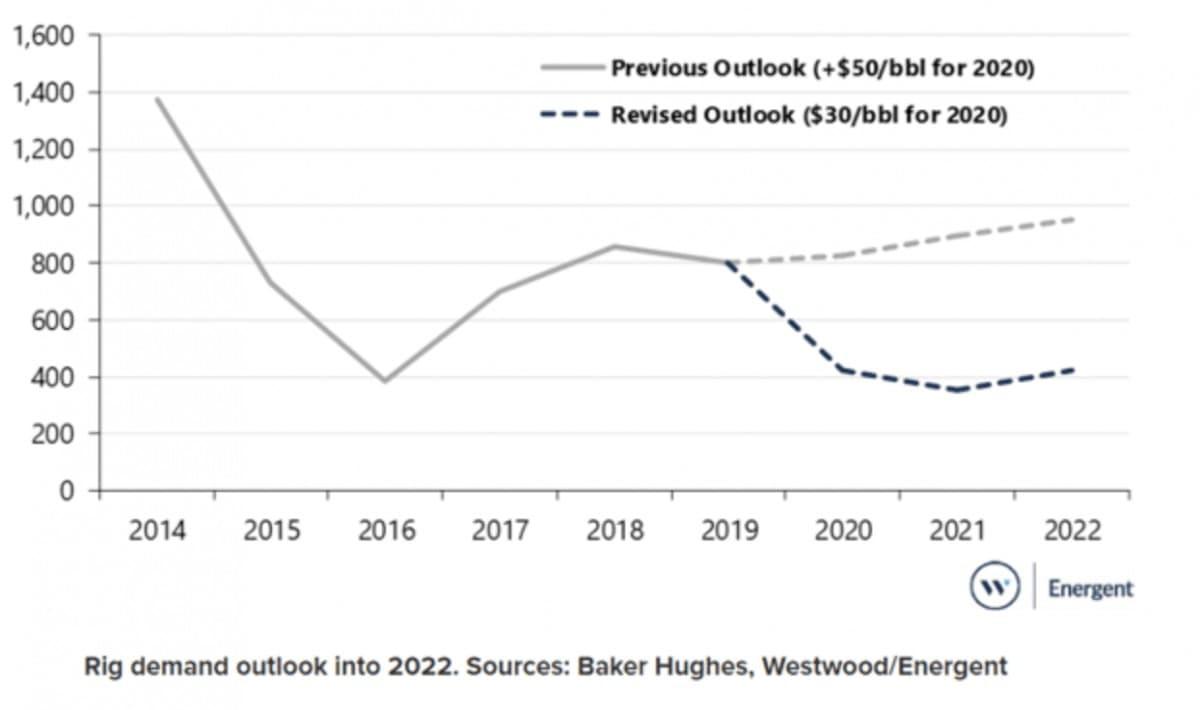

To close this section out here is another graphic from Baker Hughes and Westwood Energent regarding the outlook for the rig count at year end.

Baker Hughes/Westwood Energent

Let’s do some ciphering

Here’s the number you read this article to get.

According to the EIA the incremental new oil per rig is 856 BOPD (the relationship between drilling rigs and daily production is purely statistical, I am just using the EIA’s number to make a guess.) With 728 rigs turning to the right as of March, that works out to…623K BOPD. Reduce the rigs to the high 380’s by late 2020, early 2021 as in the graphic above and you only get…~325K BOPD new incremental production from shale.

Now take the natural decline rate of (again using simple arithmetic here), ~6% per month for shale wells on the average and you get (~9mm Bpd x 540K Bpd. In other words we will be producing about 215 K Bpd below the shale replacement rate as the year closes out. Extending those daily declines to a 30 day period, shale production will be 6 million Bpd LOWER.

That’s an extreme decline I will admit, and you should be reminded I haven’t used any sophisticated analysis to reach this number. A number of factors can and will influence the final amount of the decline. Among them actual new well productivity, and the length of the interval as examples. A higher oil price, responding ironically to the decline in shale production, could actually spur a pickup in new drilling. We will monitor this in future articles and make adjustments to this estimate as production waypoints are passed.

Your takeaway

Game, set, and match to OPEC and the Russians if the scenario I’ve outlined in this article even comes close to playing out. If U.S. production declines to that level, and we return to 2012 in terms of our production. OPEC+ should be happy.

Capturing breaking news in this article it should be noted that President Trump and President Putin have had a chat on the emerging energy depression. I honestly don’t put much store in this having any effect on oil prices in the short-run, even if you assume Putin would have any actual sympathy for the plight of U.S. shale producers. Remember…this debacle started only last month when they ruined the OPEC+ party in Vienna by not agreeing to more cuts to shore up prices.

What’s changed since? Nothing really in terms of their original objective. The Russians have the cash reserves to see this collapse of American shale for at least another couple of quarters, and the collapse in demand due to the Corona virus is going to play out no matter what they do. Basically Putin has no incentive to change course, save as a bargaining chip for sanctions relief. Something that is politically unacceptable in this country as elections draw nearer. This leaves with the status quo firmly in place.

Bottom-line, U.S. shale appears to be on an unavoidable rapid decline. That is bad news for a lot of companies that depend on this activity for their daily bread. The good news is this will inevitably drive higher prices and the growth cycle for energy will begin again.

Tyler Durden

Wed, 04/01/2020 – 18:45

via ZeroHedge News https://ift.tt/2UXGN4s Tyler Durden