Money Market Fund No Longer Accepting New Cash Amid Historic Scramble Into Treasury Bills

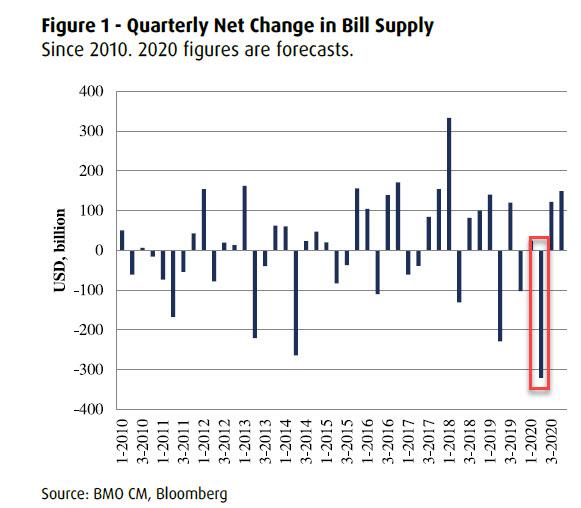

Even before the March market meltdown, the T-Bill market was starting to exhibit symptoms of shortage which was hardly a surprise: after all, as part of its “not-QE” farce where Powell desperately tried to fool the market that he wasn’t engaging in outright QE so as not to spook investors that things are just as bad as they turned out to be (we all know how that worked out for him now that the Fed is monetizing over $100BN per day) the Federal Reserve was buying $60BN in Bills each month to bail out hedge funds somehow “fix” the repo market. It’s also why in mid-January, before anyone had heard of the Coronavirus, we said that as a result of a huge net drain in Bills (i.e., upcoming shortage) the Fed would have no choice but to expand its QE to coupon securities in just months (which it did with a bang).

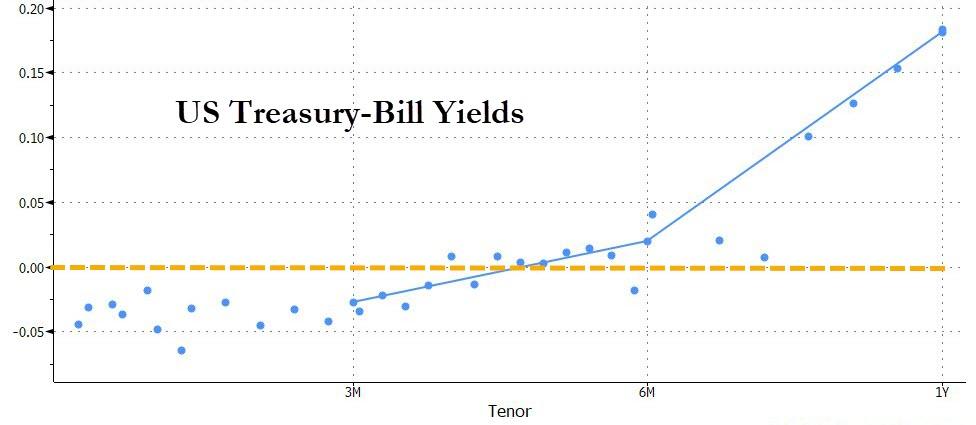

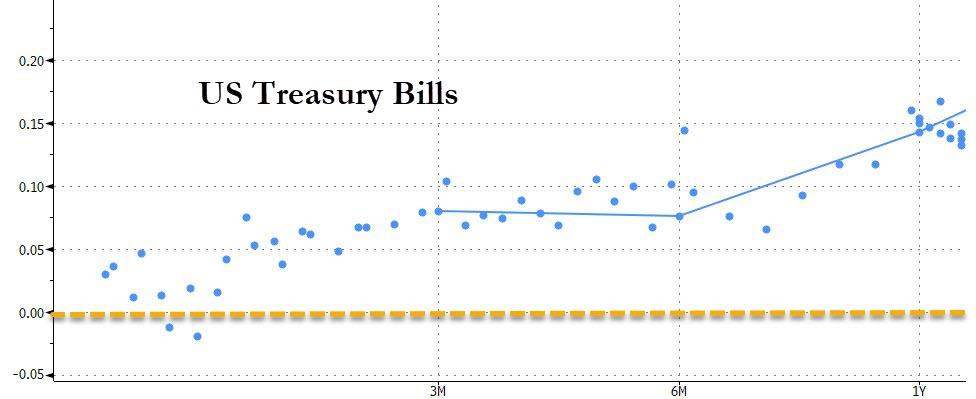

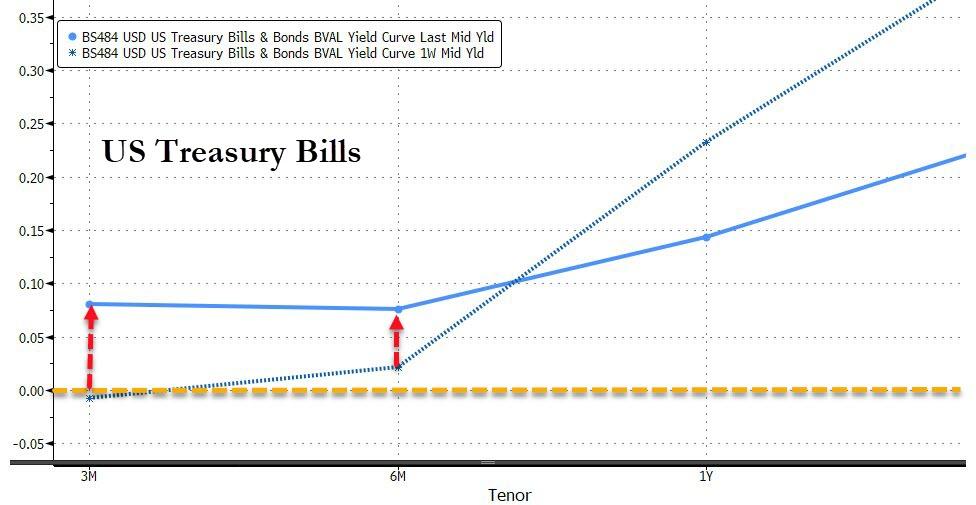

And then just as questions started to swirl about an upcoming Bill shortage, the coronacrisis happened and unleashed a once in a generation scramble for the safety of cash-equivalent securities, chief among them T-Bills making the occasional shortage into the bread shelf at a Brooklyn Costco during the coronavirus quarantine. Naturally, after this surge in demand, Bill yields broke below 0% and turned negative through 3 months even though the Fed has sworn it will never go full NIRP.

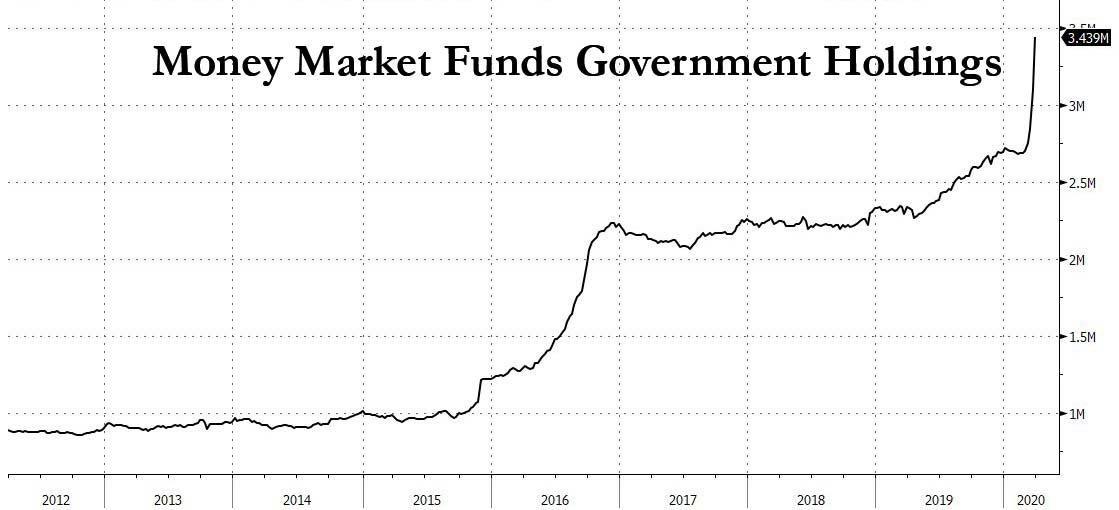

It wasn’t just the Fed and institutional traders who rushed into the safety of Bills (which as we explained previously, provided a risk free guaranteed profit if purchased at the minimum auction yield of 0.000% and then sold at a negative yield in the open market) – so did retail investors, and the result was a record surge in Money Market Funds investing in government securities, i.e., Bills…

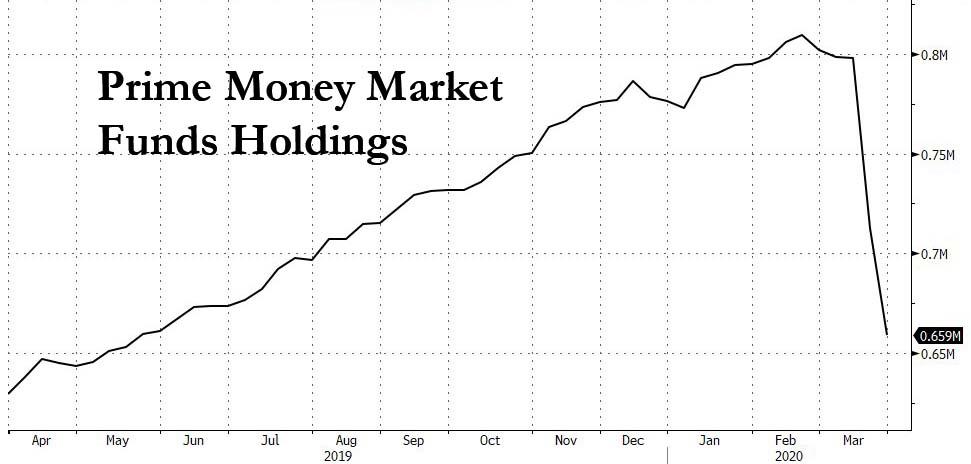

… as investors staged a furious run out of “prime” (which is a delightful misnomer) money markets.

The result was a “perfect storm” of demand for a security that – along with gold – was suddenly the world’s biggest safe haven.

And, in a bizarre twist, today fund giant Fidelity said it would stop accepting new money into three money market funds that invest in US Treasuries, as it sought to protect existing investors from the dramatic decline in interest rates since the outbreak of coronavirus.

As shown in the chart above, with assets in government money market funds exploding, assets in Fidelity’s three funds soared by more than $23BN to $85BN during this month’s clamor for safe assets, and new money has had to be invested in Bills which over the past two weeks have traded with negative yields, assuring losses for anyone who held them through maturity in a few weeks. As a result, new investments into negative yielding Bills could dilute returns for existing investors in the funds, Fidelity said.

In a note to investors seen by the Financial Times, Fidelity said that its Fidelity Treasury Only Money Market Fund, Fidelity Institutional Money Market Treasury Only Portfolio and Fidelity Institutional Money Market Treasury Portfolio would close to new investors from the end of Tuesday.

“Restricting inflows will help reduce the number of new Treasury securities that the funds will need to purchase,” the investor note said. “That’s important because the newer issues generally have lower yields than the funds’ current holdings, and as such they would affect the funds’ ability to continue to deliver positive net yields to shareholders.”

To say that this is ironic is an understatement: whereas most asset managers would kill to have too much demand for a given asset, in this case it’s just the opposite – the fact that there is a relentless surge of demand for Bills which would only push yields even more negative, has made the fund uneconomical and is forcing Fidelity to impose limits for new investors.

“The faster these funds take in new money, the faster returns head to zero,” said Pete Crane, who runs money market fund data provider Crane Data. “The only glimmer of hope is that the torrential flows into Treasury money market funds has some of them looking to shut their doors. Fidelity is doing this to protect existing investors.”

According to the FT, existing holders of the three affected funds will still be able to add more money. The closures to new investors do not affect the rest of Fidelity’s range of money market funds which invest in Treasury and other government debt.

And yet, as we noted last night, all this could reverse instantly and the record deluge into Bills may be about to end with a bang. As we reported last night, “The Flood Begins: Treasury To Sell Over A Quarter Trillion Bills In 48 Hours“, which means that while until now demand dominated, suddenly investors will get concerned about all the supply that is about to be unleashed.

And in a remarkable shift, whereas most of the T-Bill curve yesterday through 3M was negative, just 24 hours later it is again back in positive territory…

… a staggering overnight reversal.

Subadra Rajappa, SocGen’s head of US rates strategy echoed what we said on Monday, namely that an expected deluge of new issuance of Treasury bills, to fund the record $2tn stimulus package agreed by US legislators last week, could change behavior: “Once you start seeing the supply surge, you might start to see money funds more willing to take in extra cash.”

Which again is an understatement: if and when the realization that the Treasury is about to swamp the globe with its debt dawns on investors as they realize that helicopter money, aka Magic Money Tree has arrived for good, not only will gold be the only money-good instrument, but all those money funds that are turning down cash now will be begging for it tomorrow.

Tyler Durden

Tue, 03/31/2020 – 21:45

via ZeroHedge News https://ift.tt/2UyqSuE Tyler Durden