Fitch Downgrades 9 Retailers In One Day, Including Macy’s, Nordstrom And J.C. Penney

Authored by Ben Unglesbee of RetailDive,

Summary:

-

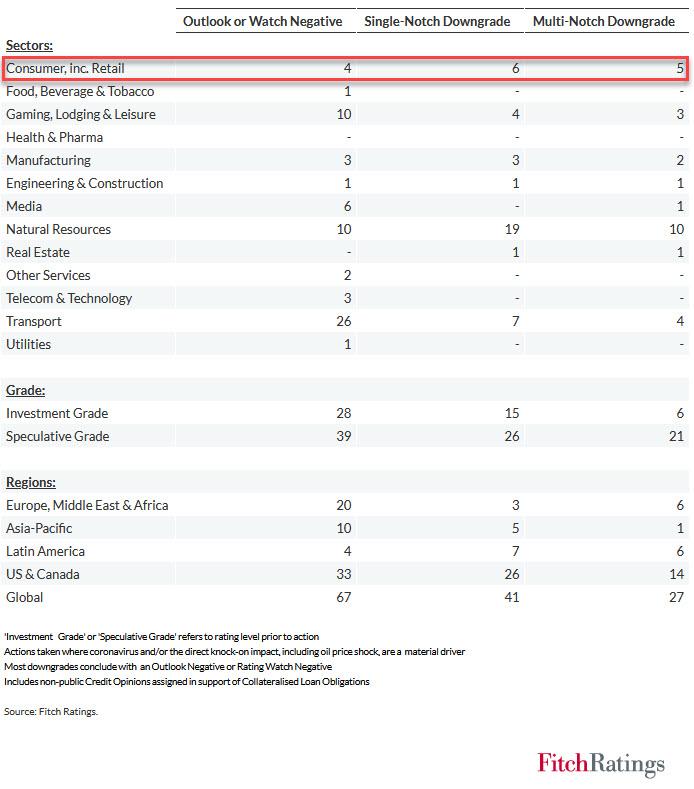

Ratings agency Fitch has downgraded 11 consumer and retail companies because of the financial disruption caused by the COVID-19 pandemic.

-

On Wednesday alone, Fitch downgraded credit ratings for nine retailers, according to emailed client notes.

-

Among them were J.C. Penney, Macy’s, Nordstrom, Kohl’s, Dillard’s, Capri, Tapestry, Levi’s and Signet.

As COVID-19 rips through the country, retailers have shuttered stores, furloughed employees, dipped into their credit lines and made other painful decisions about what costs to pay.

As though the halt to physical sales wasn’t difficult enough, across the economy layoffs have surged into the millions and some economists say that the U.S. has already entered a recession.

Many of the department stores downgraded Thursday by Fitch had struggled to maintain or grow sales even in a booming economy. Now they are trying to manage their operations through an unprecedented market shock.

In modeling for the retailers, Fitch analysts assumed discretionary retailers would stay closed through mid-May as the country tries to slow COVID-19’s spread. Revenue could fall up to 90% for those retailers, even if some sales shift online. Even by 2021, sales for some retailers could down double digits, according to Fitch.

Morgan Stanley analysts said this week that apparel retailers they cover have not signaled any material e-commerce sales growth to offset the collapse of store revenue. Moreover, they found retailers were discounting products online to drive traffic to their sites, which is likely to eat into their margins.

As retailers manage the closures, the key to survival is cash. Cowen analysts found that department stores, as a group, have enough cash to stay afloat for five to eight months. Some, like Macy’s, have even less.

And even once stores re-open, retailers face an uncertain selling environment. Will consumers feel safe returning to stores? Will the economy support discretionary spending? For now, nobody can answer these questions with certainty.

That uncertainty, as well as the sales implosion and disruption to financial markets, have set in motion cascading downgrades. S&P, too, has downgraded major retail names in recent weeks. The crisis has the potential to weaken some of the stronger retail names, and eliminate the weaker.

As Sarah Wyeth, sector lead for S&P Global’s retail and restaurant coverage, told Retail Dive earlier this month, “As the secular headwinds retail is facing accelerate, this could be the nail in the coffin of some of these brick-and-mortar retailers.”

Tyler Durden

Thu, 04/02/2020 – 15:45

via ZeroHedge News https://ift.tt/2X36UtB Tyler Durden