Trump Sparks “Sh*tshow” In Black-Gold As Bullion Demand Soars To 3-Year Highs

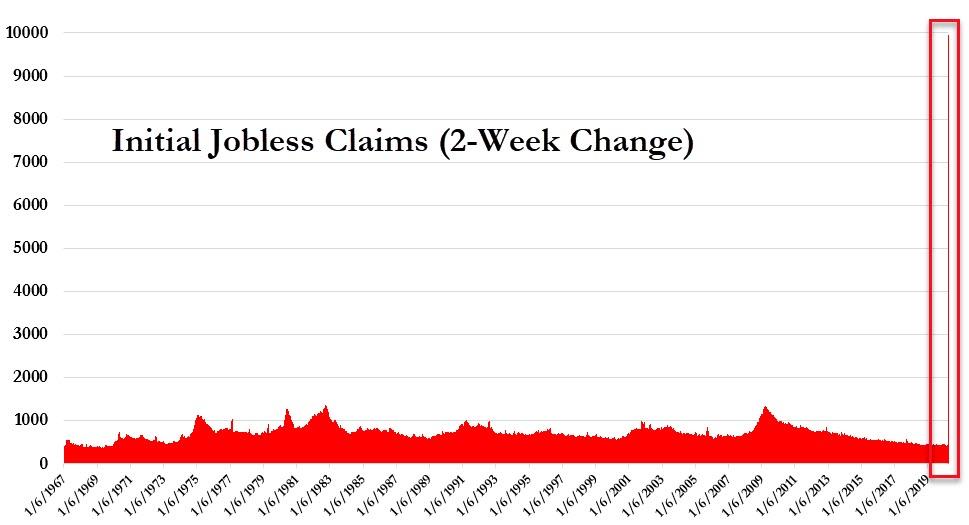

Two things were “unprecedented” today… America’s labor market collapse and global oil markets’ surge in price.

Just shy of 10 million Americans have signed up for unemployment benefits in the last two weeks… quite an outlier historically…

Source: Bloomberg

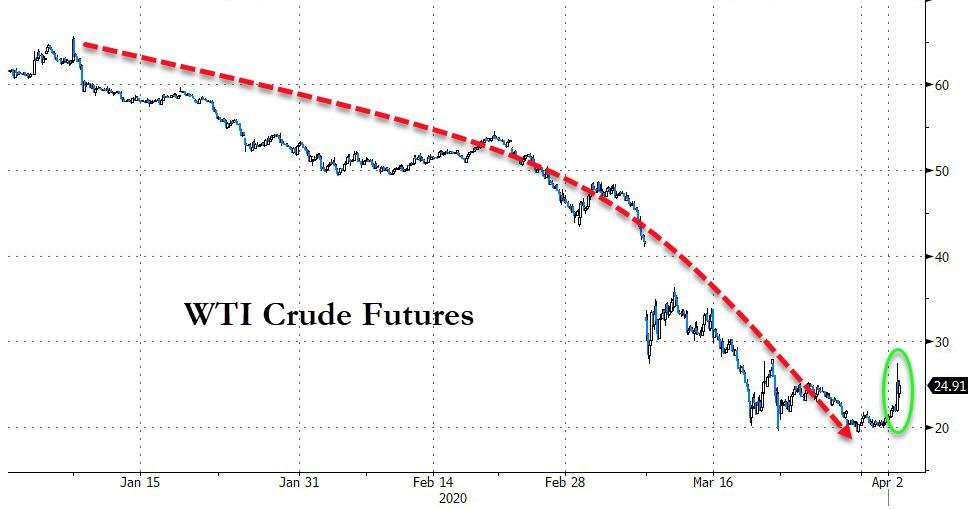

For oil traders, it was the worst of times (biggest quarterly loss ever) and the best of times (today’s manic jawboning and denials prompted the single-best daily gain for crude ever)…

All thanks to President Trump’s apparent lying tweet of an imminent supply-cut deal. Saxo’s Ole Hanson summed things up nicely as Trump triggered everyone’s stops…

I’m normally a very calm person but Trump just created a sh-show in the #oil market which many will loose from. That false rally just sucked in a lot of fresh retail money from traders desperate join the uptrend. It will come but not yet. #OOTT

— Ole S Hansen (@Ole_S_Hansen) April 2, 2020

The 24.7% rise is the largest daily gain for WTI ever (and at one point Brent rose a stunning 47% intraday)…BUT let’s put that in context…

Source: Bloomberg

US equity markets were volatile intraday, but thanks to a late-day surge (seemingly triggered by the ventilator DPA) all ended green, led by S&P and Dow…

Futures show the chaos best though as the frightening labor data sparked a market puke into the cash open, which dip-buyer manically bought…

Despite the mixed picture in indices, the Virus-Fear trade is reaccelerating…

Source: Bloomberg

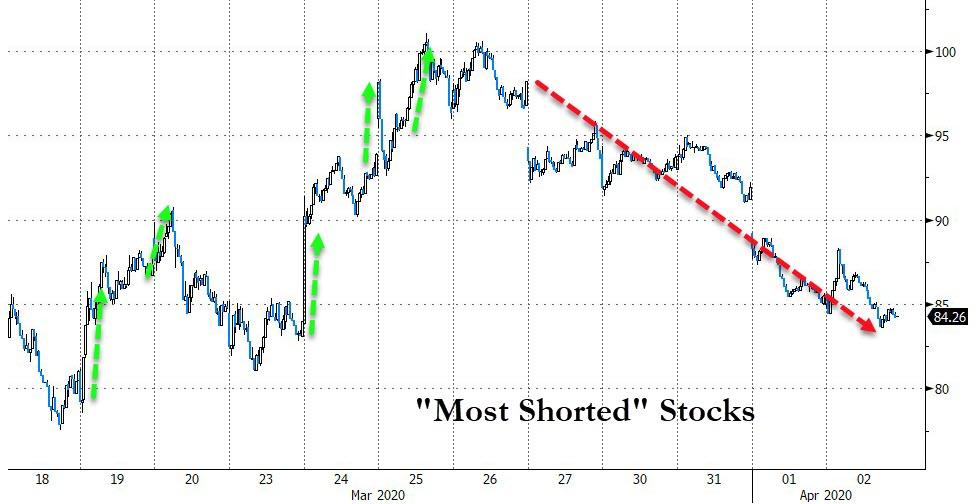

“Most Shorted” Stocks fell for the 5th day in a row…

Source: Bloomberg

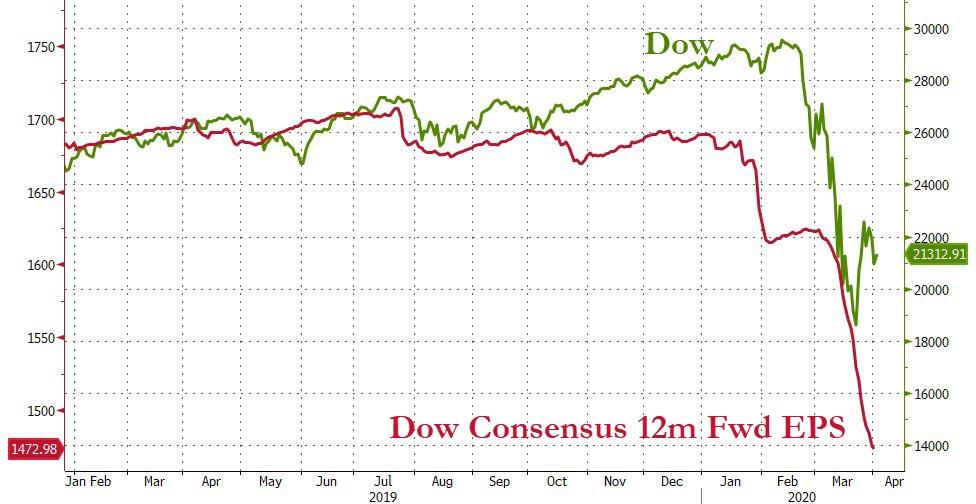

Fun-durr-mentals…

Source: Bloomberg

High-yield bond algos triggered in Trump’s oil deal comments… but that faded rapidly…

Treasury yields were marginally higher today pushing 30Y back to unchanged on the week…

Source: Bloomberg

10Y yields popped back above 60bps…

Source: Bloomberg

The Dollar drifted higher again today…

Source: Bloomberg

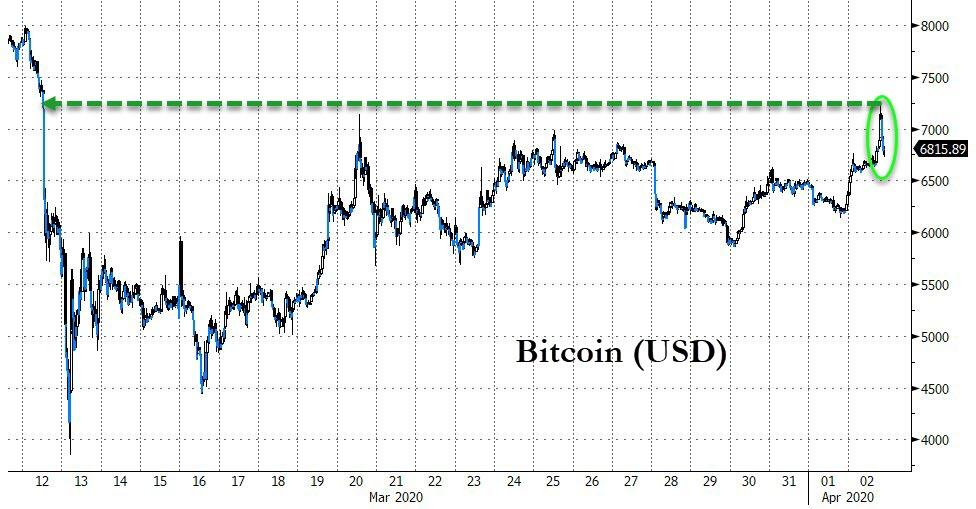

Cryptos spiked today (but fell back after that panic-buying) back into the green for the week…

Source: Bloomberg

Bitcoin spiked above $7200, back to 4-week highs…

Source: Bloomberg

Commodities were all higher on the day (despite dollar gains) with oil the outlier…

Source: Bloomberg

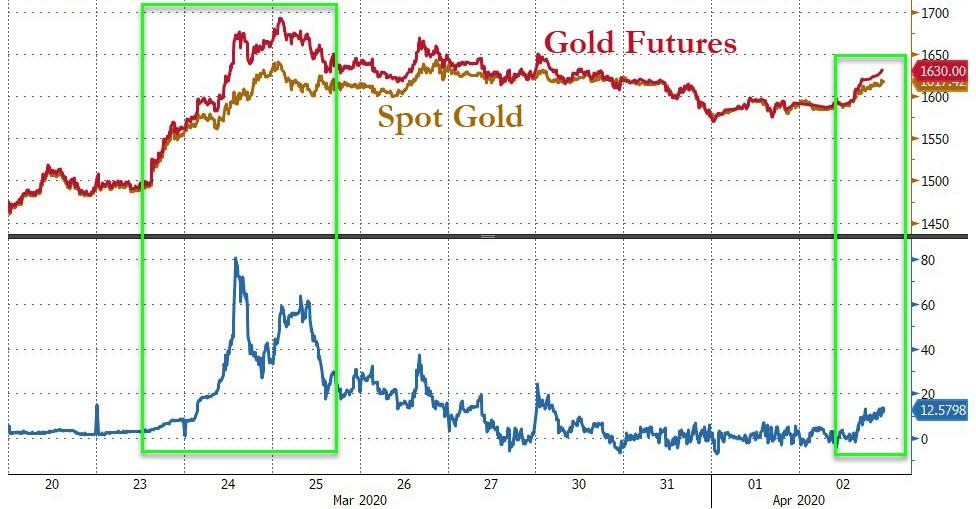

Gold spiked on the terrible jobless data (more helicopter money?)…

Notably, gold futures and spot have started to decouple once again (as physical shortages rear their ugly head again)…

Source: Bloomberg

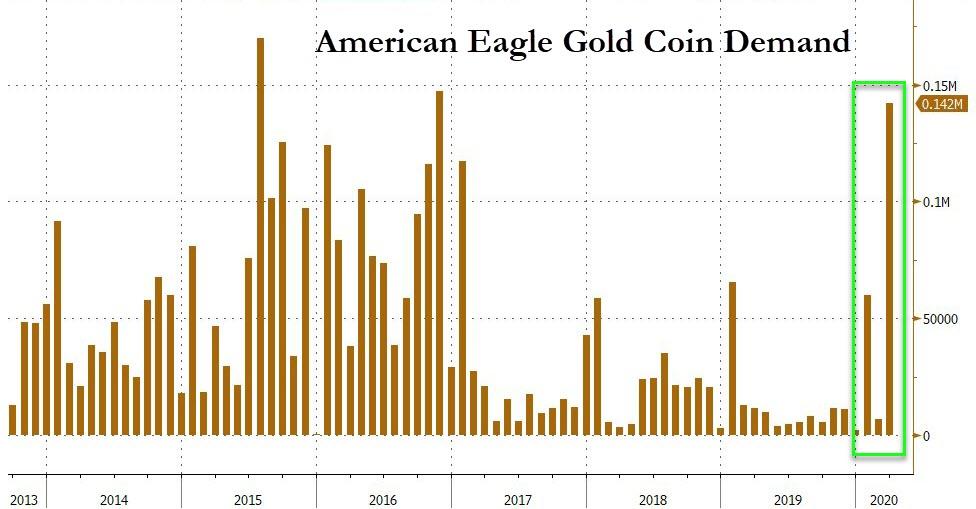

Finally, Gold coins sold by the U.S. Mint were snapped up in March at the fastest pace in over three years as investors flocked to the haven metal amid the coronavirus pandemic.

Source: Bloomberg

As Bloomberg reports, by the end of the month, investors had purchased142,000 ounces of American Eagle coins, the most since late 2016. With so much retail demand, dealers are charging premiums for bullion — and even offering to pay more than spot prices to clients willing to part with their gold bars and coins.

Tyler Durden

Thu, 04/02/2020 – 16:00

via ZeroHedge News https://ift.tt/2JwDL1J Tyler Durden