Unprecedented Demand Destruction Marks The Return Of Crude’s Super-Contango

Authored by Tsvetana Paraskova via OilPrice.com,

These days, every corner of the oil market is “unprecedented” – from the demand destruction to the supply surge and the resulting glut. The oil futures curve is no exception and is also in a state never seen before.

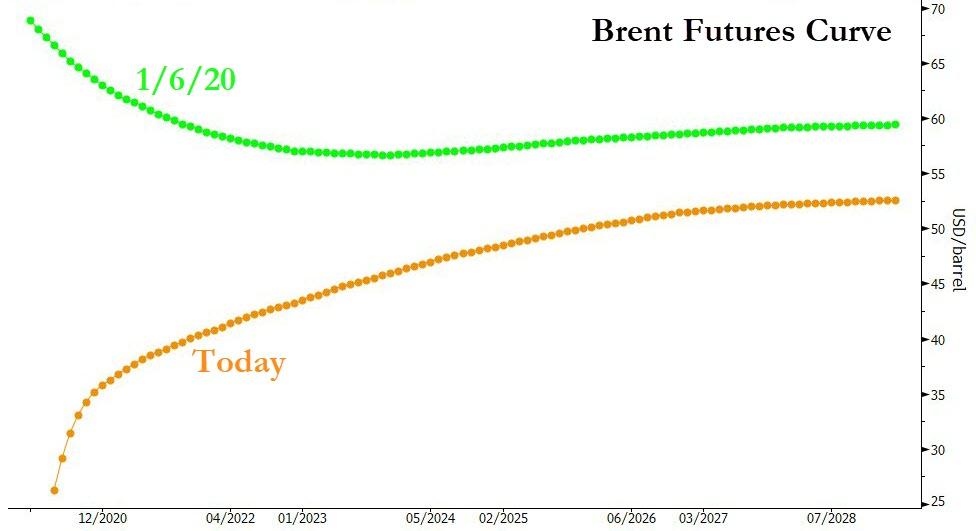

This is the super contango, the market situation in which front-month prices are much lower than prices in future months, pointing to a crude oil oversupply and making storing oil for future sales profitable.

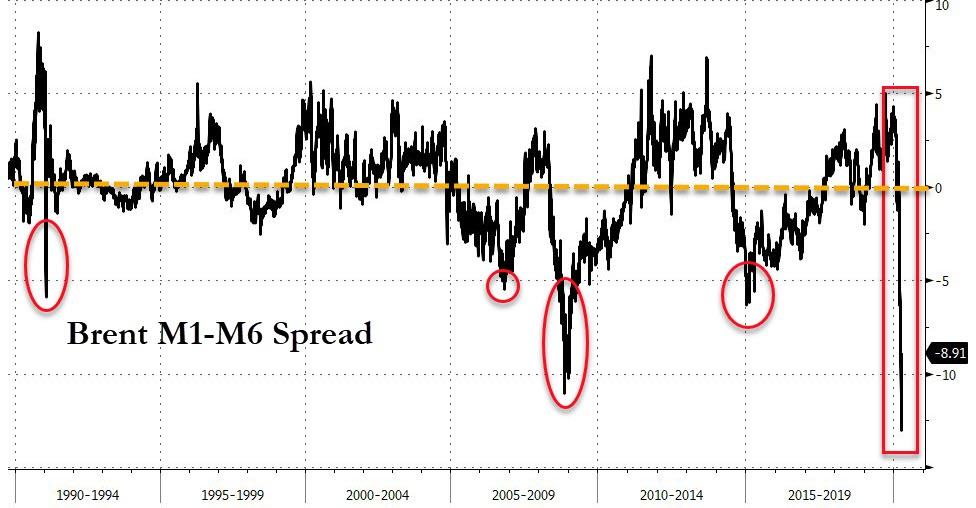

The last time a super contango appeared on the market was during the previous glut of 2015. During the peak of the 2008-2009 financial crisis, the super contango hit a record—the discount at which front-month futures traded compared to longer-dated futures was at its highest ever.

The double supply-demand shock of the past month threw the oil futures market into another super contango. And this super contango is already beating previous records.

[ZH: Update after this morning’s tweet from Trump]

The super contango is representative of the state of the oil market right now: the growing glut with shrinking storage capacity as oil demand craters, OPEC’s leader and the world’s top exporter, Saudi Arabia, intent on further cratering the market with a supply surge beginning this month. Storage costs are surging, and so are costs for chartering tankers to store oil at sea for future sales when traders expect demand to recover from the pandemic-hit plunge.

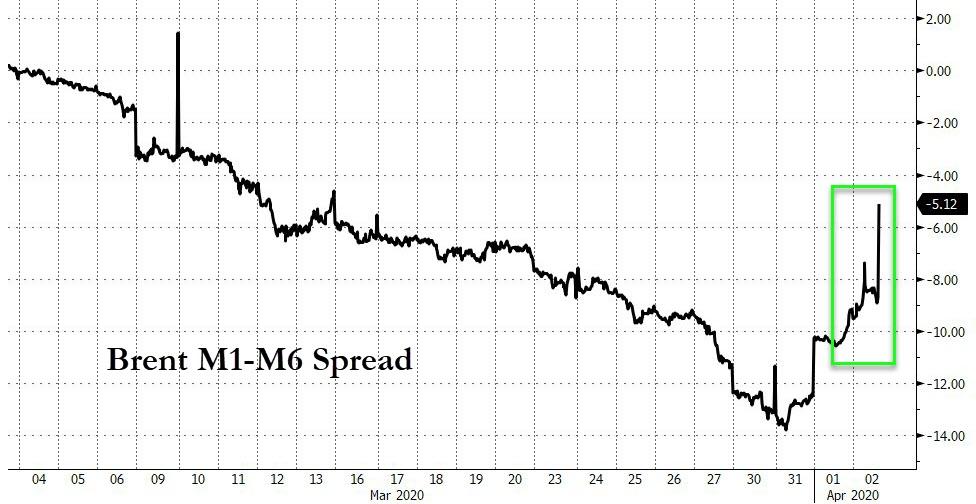

The market structure flipped into contango in early February, when the Chinese oil demand slump in the coronavirus outbreak led to lower estimates for oil consumption. A month and a half later, oil consumption is set to plunge by 20 million bpd, or 20 percent, this month. Add to this the Saudi supply surge, and here we have what analysts expect to be the largest glut the oil market has ever seen.

Earlier this week, the oversupply and fast-filling storage capacity sent the discount of the May futures of Brent to the November futures contract to the widest contango spread ever—$13.95 a barrel, higher than even the super contango at the peak of the 2008-2009 financial crisis.

With the rollover of the front-month futures contract in April, the June Brent futures traded early on Wednesday at a discount of $10.30 a barrel to the November futures, while the June 2020 futures spread to the June 2021 futures was $13.59.

One of the hottest ‘commodities’ in the market right now is storage—be it onshore or offshore—as commodity traders and oil majors are increasingly looking to profit from the super contango in several months’ time.

Apart from the traders who manage to secure storage for stashing crude for sale in a few months, the other big winners of the super contango market structure are set to be tanker owners and operators, as rates for chartering tankers for storage are soaring.

Over the next few months, the tanker companies will be the biggest winners from the double market shock as traders rush to secure what’s left of available crude carriers for storage in the super contango structure.

The inventory buildup around the world will be so high that it will force up to 10 million bpd of global oil production to be “cut or shut-in from April to June 2020 as oil storage fills up and output from financially strapped companies begins to fall,” IHS Markit said on Tuesday.

“Under current conditions second-quarter global demand for oil is expected to be 16.4 million barrels per day less than a year ago. That is more than six times the record drop experienced during first quarter 2009 during the Great Recession. In April the drop will be even bigger,” said Aaron Brady, vice president, IHS Markit.

“A combination of rapidly increasing crude supply and a buoyant market for crude storage is underpinning a very robust tanker freight market and strong cash generation presently,” tanker operator Euronav said in the outlook in its 2019 results release. However, it warned this would be a temporary event.

“The second quarter of 2020 now looks like it will be one of the greatest quarters in history for large crude carriers, and while there will be a hangover at some point, this party is totally worth it,” Eirik Haavaldsen, head of research at Pareto Securities, told Financial Times this week.

After the crude tanker operators, the next in line to profit from the super contango are the traders who will have stored oil to sell at higher prices several months or a year from now.

Tyler Durden

Thu, 04/02/2020 – 14:45

via ZeroHedge News https://ift.tt/2w8Im7j Tyler Durden