US Futures Rebound From Plunge As Oil Jumps; All Eyes On Initial Claims

The market rollercoaster is back, if somewhat less stomach-churning, with US equity rebounding from yesterday’s plunge which – now that the pension fund frontrunning trade is over – was the worst start to a new quarter since the Great Depression.

Q2 is off to a good start pic.twitter.com/Jy4DieoE6S

— Not Jim Cramer (@Not_Jim_Cramer) April 1, 2020

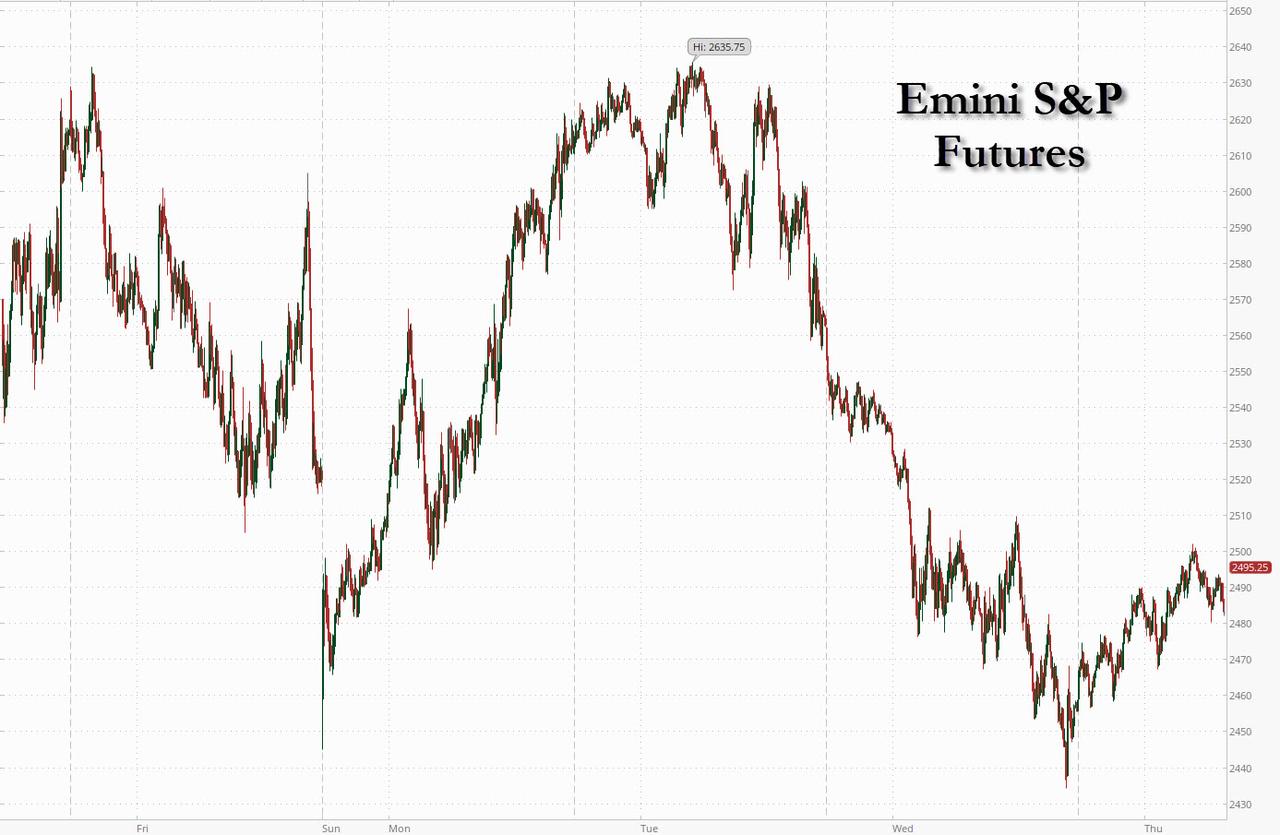

S&P futures rose 1.9%, trading just below 2,500, and keeping track with the bounce in European stocks on Thursday morning…

… as investors braced for the latest unemployment data which some skeptics expect could surge as much as a record 6.5 million.

Futures on all U.S. equity indexes climbed following sharp losses a day earlier, though traders will be wary of further evidence of how the spreading coronavirus is hitting the American job market, as global cases are set to surpass 1 million today. The Stoxx Europe 600 Index fluctuated before turning higher, with energy shares outperforming as oil and gas stocks gained more than 5%, with Royal Dutch Shell, Total SA and BP jumping between 3.3% and 5.0%, thanks to the rise in oil prices. Shares in British Airways owner IAG added 1.5% after a person familiar with the matter said British Airways was in talks with its union about a plan to suspend around 32,000 staff so it can survive the coronavirus pandemic.

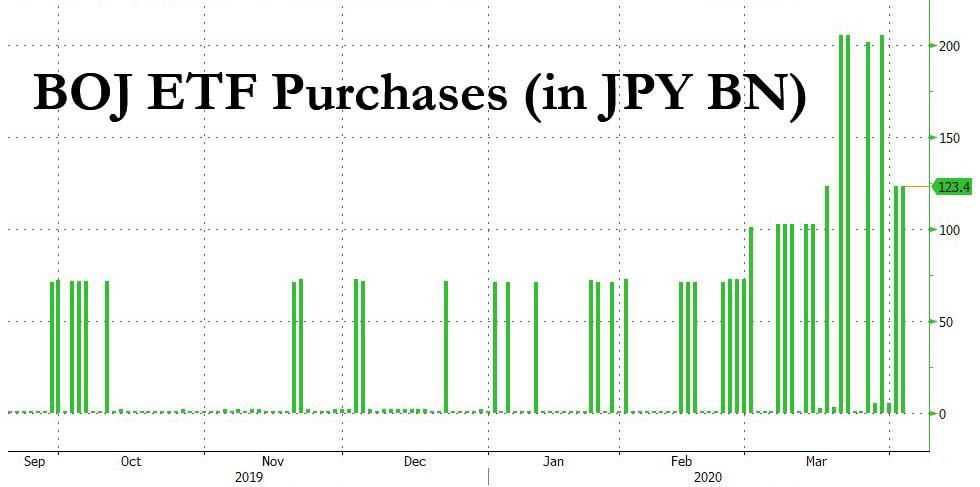

Earlier in the session, stocks in Asia were mixed, with Thailand’s SET and South Korea’s Kospi Index rising, and Australia’s S&P/ASX 200 and Japan’s Topix Index falling. In Japan, the Nikkei index ended down 1.37%, taking its losses to 25% so far this year as the BOJ bought less than the maximum ETFs for a second session.

The Topix declined 1.6%, with Hito Communications Holdings and Sankyo Tateyama falling the most. The Shanghai Composite Index rose 1.7%, with Sinopec Shanghai and JinJian Cereals Industry posting the biggest advances.

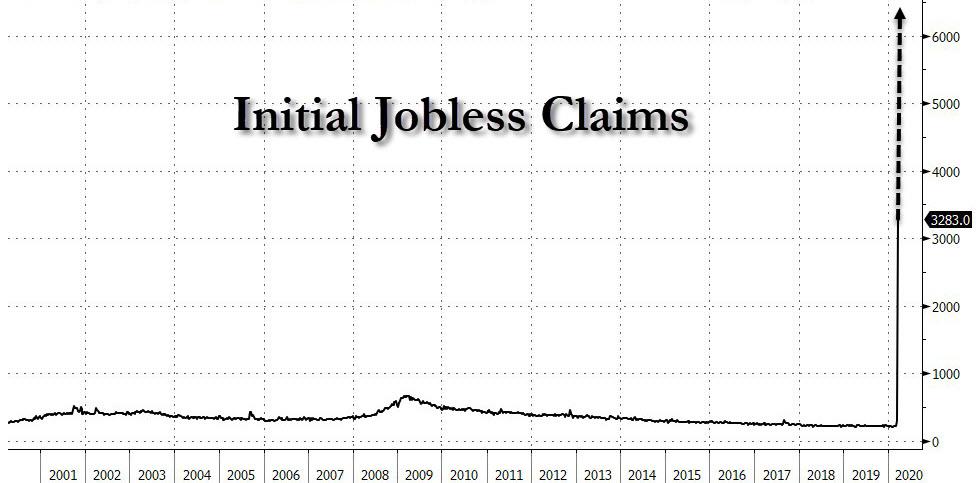

The market’s early bullish mood may deflate after today’s initial jobless claims report. “U.S. jobless claims are expected to surge again and in this environment we cannot talk about a recovery in equities in the short term. The best you can hope for is stablization in the current environment,” said Francois Savary, chief investment officer at Swiss wealth manager Prime Partners.

Initial claims for jobless benefits last week probably broke the week-ago record of 3.3 million, with 3.5 million expected, according to a Reuters survey of economists.

“We think last week’s print of just under 3.5 million is ripe for a dramatic upward revision,” said RBC Capital Markets’ chief U.S. economist, Tom Porcelli. “This week we look for another sizeable 4 million increase.”

Treasuries were broadly unchanged while investors again sought the safety of the U.S. dollar which hung on to recent gains despite the Fed’s announcement it would release Treasurys from its Supplemental Leverage Ratio calculation for one year, a move that in theory should release liquidity in the market and ease the dollar funding stress. The yield on safe-haven 10-year U.S. Treasuries fell as far as 0.5680% before rebounding.

“There had been fears about the bond market blowing up, but for the time being there’s a return to normal correleation in the market, so we don’t see a vicious cycle where bonds bring down equities and equities brings down bonds,” said Savary.

Euro zone government bond yields rose as investors cautiously moved back into riskier assets. The 10-year German government bond yield rose 3 basis points to -0.44%, rising away from the lows of -0.55% touched on Monday.

Oil surged as much as 13% after China unveiled plans to take advantage of a 60% plunge this year to add to stockpiles, coupled with optimism the price war between Saudi Arabia and Russia could moderate. Trump said he had talked recently with the leaders of both Russia and Saudi Arabia and believed the two countries would make a deal within a “few days” to lower production and thereby bring prices back up.

Looking at the latest virus data, China and South Korea have shown signs of controlling the virus, reporting falling numbers of new cases, but progress remains fragile and infections are soaring globally. The World Health Organization said the global case count would reach 1 million and the death toll 50,000 in the next few days. It currently stands at 46,906. U.S President Donald Trump, who had initially played down the outbreak, told reporters at the White House on Wednesday that he is considering a plan to halt flights to coronavirus hot zones in the United States. “Difficult days are ahead for our nation,” Trump said.

The Bloomberg Dollar Spot index rose while commodity currencies rallied with crude prices after a report that China plans to boost its oil reserves. Norwegian krone led Group-of-10 currency gains; USD/NOK slumped as much as 2.2% as Brent oil surged more than 12% on report of China buying plans; the Canadian, Australian and New Zealand dollars also climbed. The pound rose against both the dollar and the euro, rising an eighth straight day versus the shared currency — its best run since 2016. The yen weakened against the dollar for the first time in seven days on positioning flows. The Australian dollar gained 0.6% to $0.6110 and the Canadian dollar firmed 0.65% to C$1.4146. The euro traded down 0.3% at $1.0934 as the dollar advanced. The South African rand hit a fresh low while the Turkish lira touched a two-year low.

Expected data include jobless claims and factory orders. Walgreens Boots and Chewy are reporting earnings.

Market Snapshot

- S&P 500 futures up 1.9% to 2,493.25

- STOXX Europe 600 up 0.4% to 311.87

- Nikkei down 1.4% to 17,818.72

- Topix down 1.6% to 1,329.87

- Hang Seng Index up 0.8% to 23,280.06

- Shanghai Composite up 1.7% to 2,780.64

- Sensex down 4.1% to 28,265.31

- Australia S&P/ASX 200 down 2% to 5,154.30

- Kospi up 2.3% to 1,724.86

- German 10Y yield rose 2.6 bps to -0.432%

- Euro down 0.4% to $1.0921

- Italian 10Y yield fell 1.3 bps to 1.338%

- Spanish 10Y yield rose 3.1 bps to 0.734%

- MXAP down 0.3% to 133.66

- MXAPJ up 0.4% to 431.64

- Brent futures up 10% to $27.31/bbl

- Gold spot down 0.1% to $1,590.11

- U.S. Dollar Index down 0.1% to 99.55

Top Overnight News

- Spain reported 950 new coronavirus fatalities on Thursday, the largest toll in a single day and taking the total number of deaths past 10,000

- China said the U.S. is trying to shift the blame for the outbreak after American intelligence officials concluded the Asian nation concealed infections

- China is moving ahead with plans to buy up oil for emergency reserves after prices crashed, according to people with knowledge of the matter

- A county in central China has been put under lockdown again after a flare-up in coronavirus cases, pointing to the difficulty of sustaining outbreak containment in the face of carriers who show no signs of sickness

- German Chancellor Angela Merkel and auto-industry officials discussed in a phone conference Wednesday measures to minimize contagion risks and protect workers’ health once assembly lines resume churning out vehicles, according to people familiar with the talks

- German companies have applied for state aid worth 10.6 billion euros ($11.6 billion) under a government program run by state bank KfW

- U.K. house prices were climbing at the fastest pace in more than two years before the coronavirus pandemic almost brought the market to a standstill, according to Nationwide Building Society

- The number of Spaniards filing for jobless claims surged in March, the latest example of how the coronavirus pandemic is upending people’s livelihoods around the world

Asian equity markets traded mixed after a weak handover from Wall St where stocks extended on the prior quarter’s historical rout to finish the day with losses of more than 4% and the DJIA suffered a near 1000-point drop amid ongoing coronavirus fears. ASX 200 (-1.98%) was dragged lower by its top-weighted financials sector after the RBNZ ordered all banks in New Zealand to suspend dividends which pressured Australia’s big 4 that have operations across the Tasman and amid concerns there could be similar restrictions domestically, with airline shares also in a tailspin after the government denied Virgin Australia’s request for a loan and indicated it would not provide the Co. with a bailout. ASX 200 (-1.98%) was was also downbeat but off lows as the JPY-risk dynamic remained the main driver for Tokyo sentiment and with automakers lacklustre following abysmal monthly sales updates. Hang Seng (+0.8%) and Shanghai Comp. (+1.69%) initially struggled for direction amid the broad cautiousness and after PBoC liquidity inaction, while tensions with the US also risk flaring up as the latter is to tighten rules to prevent China from obtaining US tech for commercial purposes that could also be applied for military use and following US intelligence reports that alleged China concealed the coronavirus outbreak and underreported the number of cases and deaths. Finally, 10yr JGBs initially continued its pullback to below 152.50 with demand sapped heading into the 10yr JGB auction, although prices the rebounded on return from the lunch break and following mixed results in the 10yr auction which was mixed but still showed a jump in the b/c and minimal tail in price.

Top Asian News

- Thailand Imposes Curfew to Step Up Fight Against Coronavirus

- Qatar Is Said to Hire Banks to Raise Over $5 Billion in Bonds

- Iron Ore Now at ‘More Realistic’ Price After Fall on Virus Shock

- Japan Not Yet Ready to Declare Virus Emergency, Abe Says

European stocks attempt to clamber from yesterday’s steep losses (Euro Stoxx 50 +0.4%) after sentiment somewhat improved in APAC trade following a downbeat session on Wall Street. Bourses see modest broad-based gains, with Netherland’s AEX (+1.2%) leading the pack – propped up by Shell’s (+9%) Dutch listing and with ABN AMRO (+8.3%) and ING Groep (+1.8%) rebounding from the broad downside seen in banks yesterday. Meanwhile, US equity futures see more pronounced gains with the contracts higher to the tune of 2%. Sector-wise, Energy significantly outperforms – led by the price action in the oil complex as President Trump voiced optimism regarding a Saudi/Russia resolution, whilst demand from China keeps the sector underpinned. Other sectors are broadly mixed with underperformance seen in IT and Utility names – sectors do not reflect a specific risk tone. Travel & Leisure reside at the bottom of the pack as it feels no reprieve from the demand destruction caused by the virus outbreak. In terms of movers, the top of the Stoxx 600 was initially largely dominated by oil and gas names with Aker BP, Subsea losing steam as trade went underway whilst Tullow Oil (+8.0%), BP (+5.5%) and Shell remain among the top gainers. IAG (+2.5%) sees upside amid reports that the Co’s British Airways is nearing a deal to suspend 36k workers given the impact of operations from COVID-19. On the flip side; Carnival (-8.6%) sees pressure after S&P cut its rating to “BBB-“ from “BBB; the lowest investment grade level. Centrica (-7.4%) is weighed on by dividend and guidance suspensions coupled with the interruption of its Spirit Energy divestment. Elsewhere, Handelsblatt reported that the heads of Daimler (+1.0%), BMW (+3%) and Volkswagen (+1.0%) had a conversation with German Chancellor Merkel in which they wanted to explore how the corporations can rekindle production. The auto makers also raised worries regarding supply chains and expressed great concern regarding Southern Europe. On that note, Fiat Chrysler (-1.0%) slid at the open after Italy reported car registrations slumping 85.4% YY in March amid the lockdown measures in the country.

Top European News

- Citigroup Hires Ex-Danish Prime Minister Rasmussen as Adviser

- One of the World’s Best Welfare States is Starting to Crack

- EasyJet Founder Escalates Feud With Board Over Massive Jet Order

- Hungary Central Bank Pays Dividend to Boost State Virus Warchest

In FX, The Norwegian Krona and its Scandinavian partner are forging more gains on a combination of constructive technical factors, Euro underperformance and a recovery in oil prices prompted by China replenishing crude reserves at cheaper levels and US President Trump expressing confidence about resolving the spat between Russia and Saudi Arabia. Eur/Nok has been down below 11.2000 and Eur/Sek sub-10.9350, with the former also gleaning encouragement from ramped up Norges Bank selling of foreign currencies in April. Meanwhile, the Loonie is also benefiting from the firmer bounce in oil alongside the Rouble and Mexican Peso, as Usd/Cad tests support around 1.4100, Usd/RUB straddles 78.0000 and Usd/MXN pivots 24.0000. Elsewhere, the Kiwi and Aussie are consolidating off recent lows amidst less volatile trading conditions than seen of late, with Nzd/Usd holding firmly above 0.5900 and Aud/Usd not far from 0.6100 against the backdrop of relatively stable risk sentiment and Moody’s reaffirming NZ’s top notch triple A rating.

- EUR/CHF/JPY – As noted above, the single currency remains under pressure across board as COVID-19 cases and deaths continue to rise in the Euro area, while chart impulses turn more bearish after shallower rebounds in Eur/Usd and even Eur/GBP despite the UK also suffering mounting nCoV infections and fatalities. Indeed, the headline pair has not been able to revisit 1.1000 and looks more prone to relinquishing 1.0900, while the cross is capped beneath 0.8800 after waning well short of 0.8900. Moreover, further or ongoing erosion in Eur/Chf towards 1.0550 is helping to keep the Franc on a fairly even keel vs the Dollar within confined 0.9687-51 parameters, and the Yen is almost as restrained between 107.56-06 eyeing big option expiries in close proximity, but also extending from 106.50 to 108.00-05 – full details on our Headline Feed as 7.29BST.

- USD – Cautious trade ahead of the 2nd instalment of post-coronavirus global outbreak US initial claims that are widely expected to top last week’s circa 3.3 mn biggest ever total, with GS among those lifting already sky-high projections to 6 mn. The DXY is straddling 99.500 in the run up.

In commodities, US President Trump said he thinks Saudi and Russia will make a deal regarding oil production and suggested that he may know how to solve it. There were also comments from the US Energy Department which urged Saudi Arabia, Russia and others to work together to calm oil markets, while it noted it is frustrating that Saudi and Russia are boosting production and do not advance shared interests in stable markets. Senior Gulf source said Saudi Arabia supports cooperation among oil producers to stabilize oil markets and that oil market turmoil was caused by Russia opposition to OPEC+ cuts at the meeting in early March.

US Event Calendar

7:30am: Challenger Job Cuts YoY, prior -26.3%

8:30am: Initial Jobless Claims, est. 3.7m, prior 3.28m; Continuing Claims, est. 4.94m, prior 1.8m

- 8:30am: Trade Balance, est. $40.0b deficit, prior $45.3b deficit

- 10am: Cap Goods Ship Nondef Ex Air, est. -0.8%, prior -0.7%; Cap Goods Orders Nondef Ex Air, est. -0.8%, prior -0.8%

- 10am: Factory Orders Ex Trans, prior -0.1%;

- 10am: Durable Goods Orders, est. 1.2%, prior 1.2%; Durables Ex Transportation, est. -0.6%, prior -0.6%

- 10am: Factory Orders, est. 0.2%, prior -0.5%

DB’s Jim Reid concludes the overnight wrap

With governments indicating that we’re going to be in a prolonged period of lockdowns that are pushing towards the dates we outlined in our “The exit strategy” note, it wasn’t exactly the strongest start to Q2 yesterday for global equity markets. They continued to decline as investors grappled with the implications of the coronavirus moving forward. Last week was the peak week of the great stimulus reveal but this week is seeing the reality of the situation re-emerge.

The S&P 500, which had already fallen by 20% in Q1 in its worst quarterly performance since 2008 (see our March/Q1 performance review here), fell a further -4.11%. The pullback was the biggest one day drop in 2 weeks, with the index falling 3 of the past 4 days now. Every sector and industry group was lower, though defensives like consumer staples continue to outperform their more cyclical counterparts. In Europe the STOXX 600 fell -2.93%. Banks underperformed with the STOXX Banks index down -4.34% as it fell for a 4th successive session. UK banks saw some of the biggest falls, including Lloyds (-11.66%) and Barclays (-10.34%) after they announced that they would not be paying outstanding 2019 dividends, nor would there be dividend payments or share buybacks this year after guidance from their regulators. While this is an understandable move, there is a slight financial stability risk as banks need investors and if investors believe they are going to be penalised then they are less likely to commit capital. A difficult balance to strike. On this topic, overnight, the Reserve Bank of New Zealand has also asked lenders that come under its jurisdiction to stop dividend payments for an indefinite period and focus on building capital. They will also not be allowed to redeem any non-Tier 1 capital notes.

Talking of the U.K., this is one country where covid-19 fatalities are still rising. They are up +31.5% over the last 24 hours, the second largest one-day increase over the last week. Cases also increased by +17%, as Prime Minister Johnson continues to call for additional testing. Elsewhere Italy and Spain continue to see slowing trends, with day-over-day changes in fatalities dropping again. Meanwhile cases in the US continue to grow. See our Corona Crisis Daily note for the full tables, graphs, and commentary. Note that as of today we have broken New York State out in our daily tables, with the 4th largest state in the US now having more cases than those reported in China as a whole. Overall US reported cases are now in excess of 200,000 and even VP Pence yesterday suggested that the country was on a similar trajectory as Italy. President Trump also said he was considering restricting flights between heavily affected ‘hot spots’, but that it may affect industry more. Dr. Fauci says that 18 month remains the timetable for a vaccine, and that we remain on target for it.

Staying with virus-related news, overnight, an article in China’s SMCP has suggested that a county in Henan have been asked to stay at home following news that there were three infection cases due to a doctor returning from Wuhan having the virus and already spreading to his colleagues. It’s unclear if this is a one-off, but if this is a re-surge of cases particularly as mobility picks up, then clearly there is the risk of lockdowns again.

A quick check on markets this morning and most bourses in Asia have pared heavier declines from the open. The Shanghai Comp (+0.33%) and Kospi (+0.52%) are now up while the Hang Seng (-0.09%) and Nikkei (-0.33%) are posting modest losses. The Australia’s ASX is down -2.03% with banks that have subsidiaries in New Zealand under pressure following the RBNZ news mentioned earlier. Meanwhile, futures on the S&P 500 are up +1.47% with the US dollar index and yields on 10y USTs being largely unchanged. Elsewhere, Brent crude oil is up +5.78% this morning with President Trump set to meet executives from the US oil companies tomorrow as the White House seeks ways to help the industry reeling from price drop.

Over in fixed income yesterday US Treasuries rallied further, with 10yr yields down by -8.6bps to 0.583%, their second lowest level ever and closing in on their all-time closing low earlier this month of 0.541%. They rallied 5bps of that after the US equity market had closed on news that the Fed is easing strains in the Treasury market by excluding Treasuries and deposits at the Fed from its supplementary leverage ratio rule. They hope this will also make it easier for banks to extend credit. This will last a year.

The yield curve also flattened, with the 2s10s curve down by -5.0bps to 37.0bps, its flattest level in nearly 3 weeks after peaking at 68.3bps back then. In Europe peripheral spreads were set for their 4th successive widening but a story hit the tape just as the market was closing that left them more mixed, with Italy slightly tighter and Spain still a touch wider. The story suggested that the Dutch were floating the idea of a €20bn fund as an EU virus response. As a sum it hardly touches the sides of what DB thinks will be a 20pp increase in Debt/GDP in Italy and Spain in 2020, but if it shows the direction of travel after the lack of progress at last week’s EU leader’s summit then this is a small step that the market will like.

One of the main events to look out for today will be the latest weekly initial jobless claims in the US, which is one of the most important real-time indicators for markets right now as to what’s going on in the economy. Following last week’s record 3.283m claims, our US economists are forecasting 3.3m for the week ending 28 March, which as was pointed out last week far exceeds anything seen during the financial crisis, when the peak week in March 2009 was at 665k. Today’s release is actually more important than tomorrow’s jobs report for March, as the end of the survey period for that came before the spike in jobless claims we saw last week, so it won’t be as up-to-date on the current economic situation as jobless claims are.

In terms of data out yesterday, the manufacturing PMIs confirmed much of what we already knew from the flash releases last week, in that just about every country in the world has moved into contractionary territory. Looking at the major countries, the Euro Area PMI came in at 44.5 (vs. flash 44.8), while the German reading was also revised down slightly from the flash to 45.4 (vs. flash 45.7), as was the US which fell to 48.5 (vs. flash 49.2).

Over in the US, the ISM manufacturing was actually not as bad as expected, at 49.1, (vs. 44.5 expected). However, this was thanks to a jump in supplier delivery times, with the index rising to 65.0. Normally, slower deliveries mean that the economy is strengthening thanks to rising demand, but in this instance it is supply issues that are causing the problem, so it’s not much consolation. Furthermore, the new orders index fell to 42.2, the lowest since March 2009, while the employment index fell to 43.8, the lowest since May 2009.

To wrap up yesterday’s data, the ADP report of private payrolls saw a -27k decline in March (vs. -150k expected), and its second worst month going back to February 2010. However, as the ADP themselves acknowledged, the report doesn’t cover the full impact of the coronavirus as the report uses data through March 12th. We also got German retail sales for February, which rose by +1.2% mom (vs. +0.1% expected).

To the day ahead now, and there are a number of data highlights from the US, including the previously mentioned weekly initial jobless claims, factory orders and the trade balance for February, as well as the final reading for durable goods orders for February. Elsewhere, we’ll get the Euro Area PPI reading for February, the UK Nationwide house price index for March, along with Canada’s international merchandise trade for February.

Tyler Durden

Thu, 04/02/2020 – 08:24

via ZeroHedge News https://ift.tt/2wMAg4Q Tyler Durden