Goldman Answers Key Questions On COVID Testing, Treatments, & Vaccines

Hot on the heels of positive-sounding news on Gilead’s anti-viral therapy drug Remdesivir, Salveen Richter, GS lead analyst for the US Biotechnology sector, answers key questions on where we are on US testing, treatments and vaccines for COVID-19.

Q: What are the different ways that healthcare companies are tackling COVID-19?

A: As the impact of the COVID-19 pandemic on the global economy and modern-day society continues to unfold, diagnostics (testing for infection), treatments (to treat symptoms of COVID-19) and prophylactic vaccines (to prevent infection of SARS-CoV2—the virus that causes COVID-19) are being developed. There are primarily two types of diagnostic tests: molecular and serological. While molecular tests quantify the presence of viral infection (implies infection), serological tests detect the presence of antibodies to coronavirus in the blood (implies immunity). Of the ~49 diagnostic tests approved by the FDA under its emergency use authorization (EUA), over 80% are molecular. However, as state and federal policy makers begin to think about restarting the economy, serology tests with high specificity are becoming a focus.

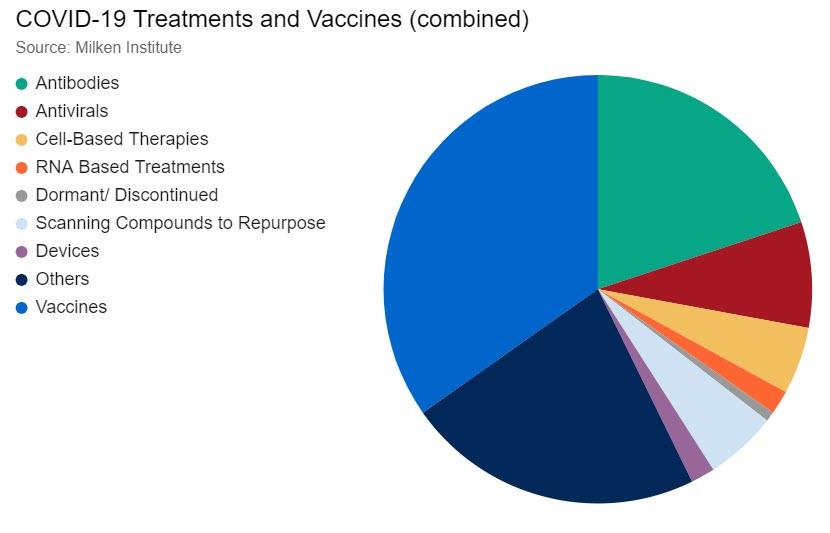

On the therapy side, there are two broad groups for COVID-19—prophylactic vaccines and treatment. Prophylactic vaccines are intended to provide protection from infection and confer immunity in people who have not been exposed to COVID-19, while treatments address the different symptoms associated with COVID-19, such as acute respiratory distress syndrome (ARDS). According to the Milken Institute COVID-19 tracker, there were over 250 therapies in the pipeline as of April 27, with 96 of these being vaccines and 55 antibodies. We note that according to the WHO, there are 89 vaccines currently in the pipeline, seven of which are in clinical development.

Q: What progress have we made in ramping up diagnostic testing capacity in the US and globally, and where are we still falling short?

A: The global capacity for molecular diagnostic testing of COVID-19 is now at ~30 million tests per month. While the current testing capacity is not sufficient to meet the entire demand on a population basis, we note an improvement in testing in the US over the past few weeks according to the COVID Tracking Project, from a total of 866 tests as of March 4 to 4.7 million tests as of April 23—largely driven by the FDA’s flexibility towards labs and manufacturers in this time of crisis. We expect the FDA’s decision to implement its EUA (emergency use authorization) on in vitro diagnostics for the detection and/or diagnosis of COVID19 will continue to accelerate testing efforts. The FDA emergency use guidelines relax the standards that allow tests to be available, in part by expediting review timelines to as little as one day and allowing labs to begin testing prior to FDA review of the validation data. But while the increase in available tests represents meaningful progress compared to the past couple of weeks, the availability of resources, including swab samples and trained professionals to collect these samples, and testing turnaround times continue to hinder the widespread scale up and availability of testing. Errors in the tests themselves, such as false negatives, present an additional hurdle for diagnosing COVID-19. As capacity for testing increases, it will be key to delineate between testing for the presence/absence of the actual infection, where there was meaningful progress in March, and testing for immunity generation, which will be relevant going forward.

Q: What is the status of antibody testing, and when can we expect to see a ramp up of such testing in the US?

A: Serological testing (i.e. presence of antibodies) can provide insight into herd immunity (the resistance to the spread of disease

within a population resulting from a sufficiently high proportion of individuals immune to the disease), which is important because

once approximately >60% of the population is immune to the virus, a “next wave” of infections stemming from the same version

of the virus is unlikely. Several companies are developing antibody tests to measure the markers of an immune response to

COVID-19, namely immunoglobulin M (IgM) and immunoglobulin G (IgG) antibodies. IgM antibodies are the first to appear in

response to the initial exposure of a viral infection, and they begin to fade after the infection ends. As the body clears the

infection, there is an increase in IgG antibodies, which provide long-term immunity. Thus, COVID-19 IgM antibodies may indicate

more recent exposure to the virus, and the detection of COVID-19 IgG antibodies may indicate a later stage of infection. In order

to determine the stage of infection, it is therefore critically important to have a highly specific test that identifies the specific

antibody present rather than a highly sensitive test that quantifies levels of the antibody. To that end, we highlight two serological

tests: Abbott’s, which has a specificity and sensitivity of 99.6% and 86.4%, respectively, and Roche’s, which has a specificity and

sensitivity of >99% and >95%, respectively.

Based on the different proposed plans for the path forward in the US, we estimate the country would need an estimated 50 to 100 million antibody tests per month. In the US, Abbott committed to shipping 4 million tests in April, ramping to 20 million tests in June, and notes that its testing instruments can run up to 100 to 200 tests per hour. Roche is currently working with the FDA for an EUA on its tests, and plans to reach a capacity of 100 million tests per month by June, with a goal to ramp up further towards year-end. According to Roche, its instruments can run up to 300 tests per hour, depending on the analyzer used.

Q: What are the most promising types of treatments for active cases being developed right now, and what is a realistic timeframe for having an effective treatment widely available?

A: In broad terms, treatments for COVID-19 include approved drugs that can be repurposed, antiviral therapies that counteract the virus, antibody therapies that introduce neutralizing antibodies against the virus and convalescent plasma therapies, in which plasma from convalescent patients is administered to those infected. On the therapeutic side, Gilead’s remdesivir and Regeneron’s antibody cocktail are most in focus. Gilead’s remdesivir is an Nuc inhibitor that terminates viral replication by preventing the function of RNA-dependent RNA polymerases (an enzyme that catalyzes the replication of RNA), resulting in a decrease in viral RNA production. Thus far, there has been emerging data for remdesivir in COVID-19 but we await full Phase 3 results in late April (for severe patients), late May (for moderate patients) and data from the NIAID sponsored study in mid-to-late May to elucidate the profile of the drug. Regeneron is developing a novel multi-antibody cocktail that can be used as a treatment for COVID-19 in infected individuals. This treatment will use two undisclosed antibodies that target different parts of the virus to protect against multiple viral variants. Regeneron’s antibody cocktail will be ready to enter the clinic by early summer, with a goal of producing hundreds of thousands of doses per month by the end of summer.

As it relates to symptomatic relief of COVID-19, anti-IL6 inhibitors are in development, with Roche’s Actemra in a Phase 3 trial (data in 2H20, potentially in the summer) and Regeneron/Sanofi’s Kevzara currently in Phase 2/3 testing. On the latter, going forward, the Phase 3 trial will only include “critical” patients with results (US) expected in June and the rest of the global studies in 3Q20. We also highlight Grifols, Takeda and CSL Behring, all of which are independently developing a novel convalescent plasma therapy against COVID-19. One potential limitation of this approach is the requirement of donor plasma, which could limit its scale.

Q: What are the most promising vaccines currently in development, and what is the earliest timeline we can expect to see for getting a vaccine to the public?

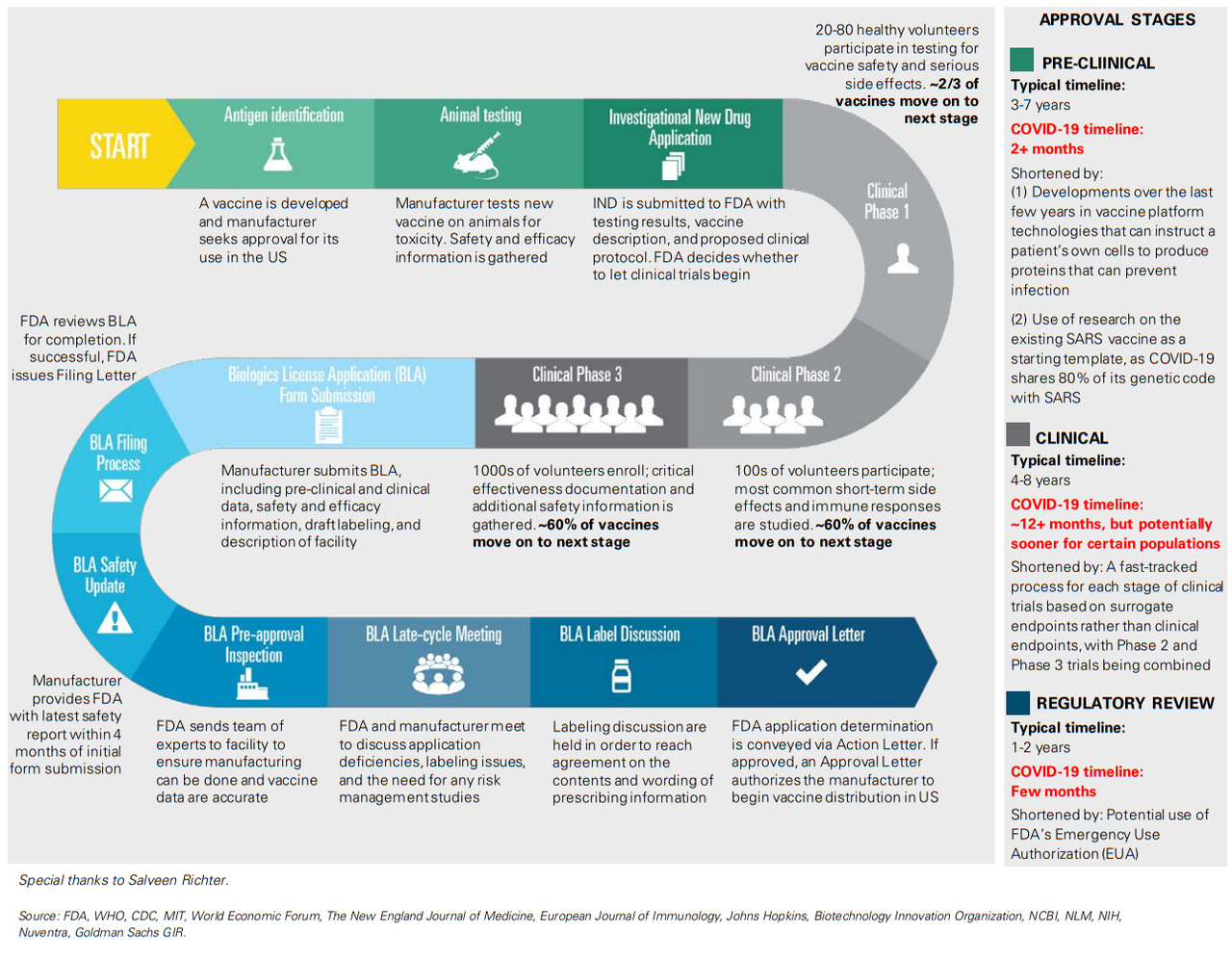

A: With several vaccines in development, we believe Moderna’s mRNA-based vaccine (mRNA-127) and Johnson & Johnson’s vaccine candidate, which uses established and validated AdVac technology, are the leading contenders to address the public health needs of the global community. Moderna has previously issued guidance on the potential for emergency vaccine use in primary populations (including physicians) as early as fall 2020, following the release of Phase 1 safety data in the spring and immunogenicity data in the summer and Phase 2 initiation in 2Q20. We expect Johnson & Johnson to initiate Phase 1 trials in September, with topline safety and immunogenicity data expected by the end of 2020, and note the vaccine could be available under EUA in early 2021.

Q: Will any vaccine need to be administered every year, like a flu vaccine, or will it be effective over a multi-year period?

A: On the duration of efficacy, it is unclear if the COVID-19 vaccine will be similar to the yearly flu vaccine or whether it will be able to confer multi-year efficacy. While some experts believe multi-year protection is likely, more research is needed to determine if this is the case based on what we know about similar viruses. Using the 2002 SARS and 2012 MERS epidemics as analogs is not helpful in this case because there is not much known about their reinfection rates given the limited epidemiological details of both – there were >8,000 cases of SARS over 3 months, and only 2,500 observed cases of MERS over 8 years.

Tyler Durden

Wed, 04/29/2020 – 09:30

via ZeroHedge News https://ift.tt/2YfDp8o Tyler Durden