Tesla Stock Soars Despite COVID-19: Retail Ignoring Reality Or “Larger Forces” At Play?

Are Tesla retail investors simply unfazed by the coronavirus panic?

Perhaps a better question to ask would be: what continues to cause Tesla’s stock price to soar over the last couple of weeks while the company has been completely idled, argued with Alameda county authorities and recently just disclosed that its own CEO is now indemnifying its Board of Directors in lieu of D&O insurance?

That’s one question Reuters starts to address in a recent piece where they note, innocently, that the coronavirus for some reason hasn’t had an effect on Tesla’s stock price. Analysts and institutional investors remain focused on Tesla’s 2020 cash flow and potential ideas for boosting demand, but it appears retail investors simply don’t seem to fear the virus’s impact on the company.

After all, here’s how Tesla stock has performed while the global economy has ground to a halt and the worldwide automotive sector has all but imploded:

Rather, retail investors seem focused on great sounding stories, but not ones that will necessarily impact the company’s bottom line in a positive way over the short term.

For instance, Reuters says that questions for the company’s upcoming Q1 conference call including questions about “Tesla’s steps to expand into the robotaxi market, the company’s self-driving technology and even plans to create airless tires to reduce maintenance costs.”

That’s right: forget about burning billions of dollars per year and the global pandemic, let’s talk about airless tires.

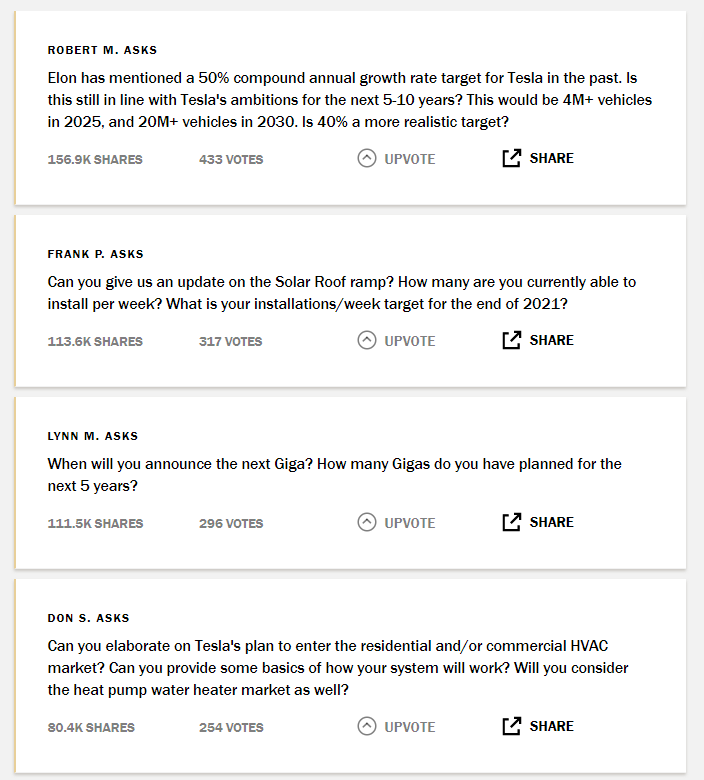

Of the top 50 questions submitted, only 4 refer to the virus and safeguards that Tesla will implement to protect its employees at U.S. factories. The questions for the conference call are now essentially being crowdsourced in Reddit-like fashion from retail at this website.

Elon Musk, on April 29, Tweeted: “FREE AMERICA NOW”, ostensibly in an push to get his Fremont factory up and running again. We had previously reported that Musk wanted to bring workers back to Fremont before the county’s stay-at-home order expired, but had reversed that decision after it was widely reported in the media.

But anticipation about the upcoming conference call, or airless tires for that matter, still may not adequately explain the stock’s wild recent move higher for some people.

The issue was raised on Tuesday in a podcast with well known Tesla skeptic “Montana Skeptic”, who recently authored an article about Tesla potentially turning into a Chinese company that we highlighted just days ago.

“When you look at the share price, do you think about things like [Elon’s] compensation package, which requires a $100 billion market cap?” Skeptic was asked by the host.

Skeptic responded: “I don’t know. It’s easy to become conspiratorial because the price is just so outrageously detached from fundamentals and because the level it’s reached appears to be conveniently close to what he needs to achieve his next compensation award. I mean, as I tell the people who read my articles, right now stay away from this.”

“There are forces larger than us moving this share price. There are forces larger than us. Do I fully understand them? No. Might it be Chinese money? Sure. Might it be offshore accounts of some sort? Possible. Might there be some unseemly things going on? It’s always a possibility, too,” he continued.

Skeptic concluded: “Regardless, my innocent assumption is there are a lot of people out there including big institutional investors that still either believe in the growth story or believe that it hasn’t ended yet and that it makes sense to ride this thing with a momentum trade. And that’s what we have to deal with.”

Tyler Durden

Wed, 04/29/2020 – 13:25

via ZeroHedge News https://ift.tt/2W8Wnei Tyler Durden