WTI Holds Impressive Gains After Smaller-Than-Expected Crude Build, Production Plunge

Oil prices extended their hope-filled gains on the heels of a smaller than expected crude build reported by API last night and ongoings headlines dropped with interesting timing about further output cuts to counter the unprecedented global glut.

“You have a correlation to equities, which are ripping,” Bob Yawger, director of the futures division at Mizuho Securities USA, said. “You have a best possible scenario API report.”

Additionally, there have been tentative signs of a recovery in European physical oil markets. Key pricing contracts in the North Sea and Russia have rallied in recent days, though there are still concerns that the world is on the brink of filling its storage capacity. Major producers were due to start output cuts on May 1, but some, including Saudi Arabia, are now curbing output early.

But once more, all eyes will be on crude inventory increases particularly after the API reported a smaller-than-expected build last week (smallest in 5 weeks).

API

-

Crude +9.978mm (+11mm exp)

-

Cushing +2.486mm

-

Gasoline -1.108mm (+2.7mm exp)

-

Distillates +5.462mm (+3.7mm exp)

DOE

-

Crude +8.991mm (+11mm exp)

-

Cushing +3.637mm

-

Gasoline -3.669mm (+2.7mm exp)

-

Distillates +5.092mm (+3.7mm exp)

This is the 14th weekly crude build in a row but the lowest in 5 weeks and a surprise gasoline draw to boot…

Source: Bloomberg

According to Bloomberg Intelligence Energy Analyst Fernando Valle, the buildup in diesel stockpiles is quickly becoming a concern as economic activity slows.

That will further diminish refiners’ margins, driving plants to be temporarily shut over the coming weeks and bringing U.S. utilization down to the mid-60%s. Gasoline inventories are at historic highs, and with lockdowns in Latin America becoming more severe, exports could drop and exacerbate the glut.

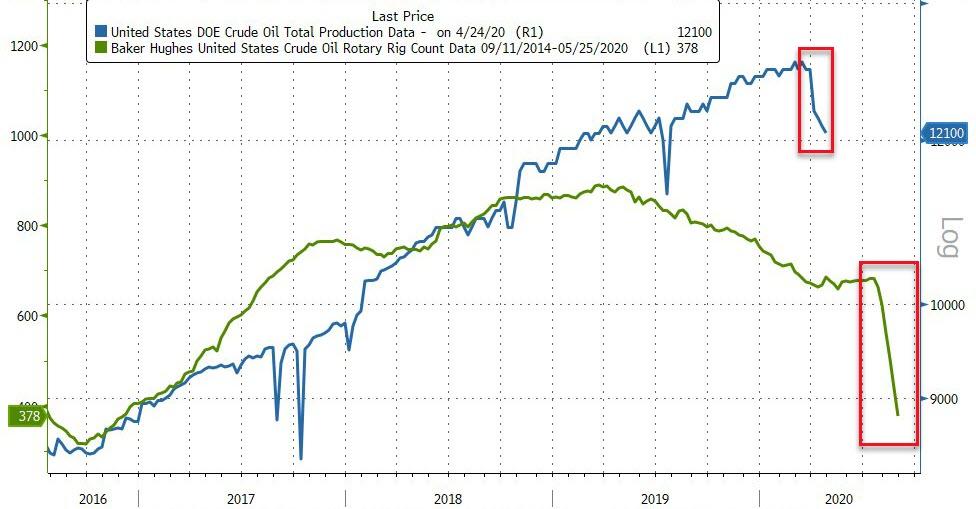

US Crude output tumbled (as the rig count collapses by the most on record)…

Source: Bloomberg

Producers in North Dakota have shut about 6,200 oil wells, which account for about 405,000 barrels a day of supply.

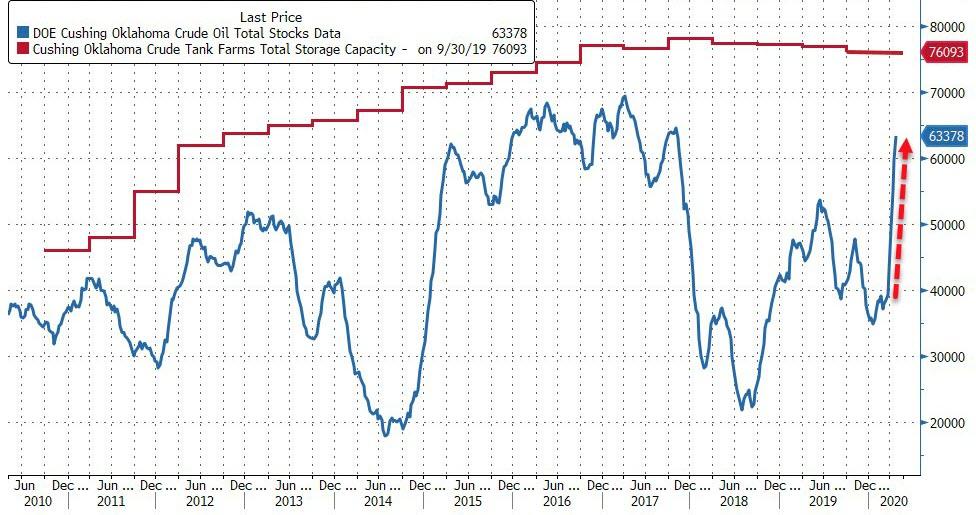

Storage capacity is being tested as a worldwide glut of fuels and crude expands due to coronavirus-led demand destruction with Cushing approaching its limits…

Source: Bloomberg

Front-month (June) WTI futures are up 25-30% (yeah that volatile) ahead of the DOE data, hovering around $15.50… and held those gains

Bloomberg Intelligence Senior Energy Analyst Vince Piazza says production shut ins will take time to work through system, while April demand degradation is likely is the worst of 2Q… Even if states reopen in May, the slow slog will lead to a lethargic recovery for transport-fuel demand.

Tyler Durden

Wed, 04/29/2020 – 10:35

via ZeroHedge News https://ift.tt/3aIFv37 Tyler Durden