Fed Expands Scope, Eligibility For Main Street Lending Program, Adds New Option For Heavily Indebted Firms

As Steven Mnuchin previewed last week when he said he’s considering an additional lending facility for troubled U.S. energy companies, at 10am on Thursday the Fed – which is now joined at the hip with the Treasury – announced that it is expanding the scope and eligibility for the Main Street Lending Program which was developed “as part of its broad effort to support the economy” and “to help credit flow to small and medium-sized businesses that were in sound financial condition before the pandemic.”

Specifically, the central bank said businesses with up to 15,000 employees or up to $5 billion in annual revenue are now eligible, compared to the initial program terms which were for companies with up to 10,000 employees and $2.5 billion in revenue, doubling the revenue limit from previous guidelines and raising the employee limit by 5,000.

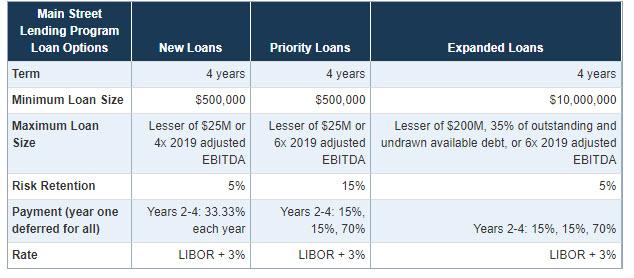

The maximum loan size would be limited to 4x adjusted 2019 EBITDA while the minimum loan size was lowered to $500,000 from $1 million.

The Fed also added a third loan option for companies was higher debt. Under the new loan option, lenders would retain a 15% share on loans that when added to existing debt do not exceed 6x EBITDA. This compares to the existing loan options where lenders retain a 5% share on loans, but have different features.

Under all of the loan options, lenders will be able to apply their industry-specific expertise and underwriting standards to best measure a borrower’s income. All the loans will have a 2-4 years term and pay interest at a rather high Libor+3% rate (on the flipside, there are no covenants).

In total, three loan options—termed new, priority, and expanded—will be available for businesses. The chart below summarizes the different loan options.

It wasn’t immediately clear if the adjustments on the Fed facility are meant to make it easier for energy companies to access the Fed’s loans. Previously, the Fed’s reading of its emergency lending authority has been that it doesn’t permit the central bank to erect a facility to support a specific industry.

The unspoken message here is that with every passing day, the Fed is expanding its various bailout programs suggesting that demand for Fed backstops is far greater than expected, which then also means that the economic damage is much broader than the Fed anticipated just weeks ago.

Tyler Durden

Thu, 04/30/2020 – 10:11

via ZeroHedge News https://ift.tt/3aSeESv Tyler Durden