S&P Futures Reverse Rally On Poor European Earnings As Oil Rebound Continues

US equity futures dipped on Thursday, reversing an overnight rally that pushed the S&P just shy of 3,000 as traders turned nervous at the end of the strongest month for stocks in 50 years with investors awaiting the weekly jobless claims data, while Nasdaq futures rose after upbeat earnings from Facebook and Tesla.

Futures for the S&P 500 turned lower on Thursday following a drop in European shares after a three-day surge as investors weighed corporate results, more dismal data and the latest virus news. Despite the wobble in the Emini, the underlying S&P index remains on track for its best month since 1974.

Nasdaq 100 futures clung to the green following strong results from Microsoft, Facebook and Tesla after the Wednesday close. Crude futures jumped for a second day after gasoline consumption started to recover in the world’s biggest economies.

Facebook rose 8.6% after beating analysts’ estimates for first-quarter revenue and saying it had seen “signs of stability” for ad sales in April after a plunge in March. Tesla gained 8.5% after posting its first ever GAAP quarterly profit, taking investors by surprise as its automaker peers were hit by a slump in consumer demand and factory shutdowns. Investors will now focus on the two remaining FAANG stocks – Apple and Amazon.com – which report results after markets close.

Europe’s Stoxx 600 Index also gave up an early gain to trade lower after Societe Generale SA posted a surprise first-quarter loss and Royal Dutch Shell cut its dividend for the first time since World War II. The ECB did not expand its pandemic bond-buying program in the wake of data showing the French and Spanish economies plunging into record contractions and German unemployment surging, however it did launch a new series of non-targeted pandemic emergency longer-term refinancing operations (PELTROs) which will be conducted to “support liquidity conditions in the euro area financial system and contribute to preserving the smooth functioning of money markets by providing an effective liquidity backstop.”

Earlier we found that the eurozone’s economy shrank by the fastest rate on record in the first quarter of 2020 as measures to contain the coronavirus pandemic froze business and household activity, according to figures published on Thursday. The GDP of the eurozone fell by 3.8% in the first quarter compared with the previous quarter, preliminary estimates from Eurostat found. This is the largest drop since the series began in 1995, and larger than seen in the worst of the financial crisis.

Earlier in the session, Asian stocks gained, led by energy and materials, after rising in the last session. The Topix gained 1%, with MS Consulting and TechnoPro rising the most. The Shanghai Composite Index rose 1.3%, with Routon Electronic and Shanxi Coal posting the biggest advances.

As Bloomberg notes, investors continue to weigh a brutal global recession against hopes for a coronavirus treatment and an eventual end to lockdown measures across the world. The U.S. government’s top infectious-disease expert, Anthony Fauci, said early results from the Gilead drug trial offered “quite good news,” while results from tech giants show some parts of the economy have remained resilient. That’s even as many firms slash dividends and data shows Europe slumped into a recession last quarter alongside America.

Although today’s data is likely to show weekly jobless claims stabilized around 3.5 million after scaling record highs in March, other numbers have shown that the U.S. economy is set for its sharpest contraction since the Great Recession. On Wednesday, the Federal Reserve pledged on Wednesday to expand emergency programs to revive growth but dashed hopes for a fast rebound, saying the economy could feel the weight of consumer fear and social distancing for a year.

In FX, the dollar gauge headed for its first monthly loss in four months following a recovery in global risk appetite. The Bloomberg Dollar Spot Index slipped and the dollar weakened against most Group-of-10 peers. Norway’s krone advanced, tracking gains in oil prices. The yen pared gains amid month-end flows and positioning related to Japan’s Golden Week holiday; traders digested reports that Prime Minister Shinzo Abe will extend a national state of emergency by a month.

In rates, Treasuries and U.S. equity futures edged up, while the euro slipped and German bonds gained after the European Central Bank’s policy decision disappointed some traders who were hoping for more.

In commodities, oil advanced a second day on signs fuel consumption is starting to recover in the world’s biggest economies

Looking at the day ahead, the ECB decision and President Lagarde’s subsequent press conference are likely to be the highlight. There’ll also be a number of data releases, including both Q1 GDP and April’s CPI for the Euro Area, France and Italy. There’ll also be the Euro Area and Italian unemployment rate for March, the Germany change in unemployment for April and Canadian GDP for February. And from the US we have March’s personal income, personal spending, the core PCE deflator, as well as weekly initial jobless claims, April’s MNI Chicago PMI and Q1’s employment cost index. Finally, earnings releases include Apple, Amazon, Visa, Comcast, McDonald’s, Amgen, Gilead Sciences and Twitter.

Top Overnight News

- Coronavirus upheavals and wider credit premiums are stoking a shift toward medium-length tenors in the euro corporate bond market. The proportion of deals maturing in five years to seven years has doubled since the outbreak

- China’s first official data for April suggest the economy has split into two tracks as weak overseas demand contrasts with a domestic rebound

- A recovery in emerging-market assets has failed to bring much relief for governments sweating the risk of default

- In the simmering contest to succeed German Chancellor Angela Merkel, Bavarian Premier Markus Soeder has emerged as the uncrowned king of the crisis. His hard line to clamp down on the spread of the disease in the wealthy southern state has propelled him to the forefront of Germany’s conservative bloc

- Gilead Sciences Inc. said there are more than 50,000 courses of the company’s experimental Covid-19 therapy, packed in vials and ready to ship as soon as the drug is authorized for emergency use by U.S. regulators

- Coronavirus patients who remain positive weeks after diagnosis may harbor dead virus particles that can’t be distinguished from infectious ones in standard tests, scientists in South Korea found

Asian equity markets traded positively as the region took impetus from the gains on Wall St where sentiment was underpinned by coronavirus treatment hopes after preliminary results from Gilead’s Remdesivir drug trial showed a 31% faster recovery time and lower mortality rate compared to patients that were given a placebo. Furthermore, the Fed reiterated to keep supporting the economy as necessary and encouraging earnings from several tech heavyweights after-market briefly added fuel to the momentum for US index futures. ASX 200 (+2.4%) was lifted by strength in the energy sector as oil prices continued to make up ground and with a slew of corporate updates in focus. Nikkei 225 (+2.1%) outperformed as it played catch up on return from the holiday closure and as a weaker currency provided an uplift to exporter sentiment, while Industrial Production and Retail Sales data were not as bad as had been feared despite both printing in contraction territory. Shanghai Comp. (+1.3%) was also positive ahead of the extended 5-day weekend in the mainland for Labor Day holidays and amid several blue chip earnings, although gains were somewhat capped by the absence of Hong Kong participants and following mixed Chinese PMI data in which official Manufacturing and Caixin Manufacturing PMIs fell short of estimates but Non-Manufacturing and Composite PMIs both improved. Finally, 10yr JGBs were lacklustre with demand subdued by gains in riskier assets and following a similar uninspired tone in T-notes, while the absence of the BoJ in the market today and resistance ahead of the 153.00 level also ensured the mundane price action.

Top Asian News

- Japan’s Abe Set to Extend Virus Emergency Into June, Reports Say

- Malaysia May Skip Spot LNG Sales With Prices at Record Lows

- Tokyo Steel Warns of Slump in Profit This Quarter as Virus Bites

- BlackRock Buys India Sovereign Debt as Others Head for Exit

European equities waned off highs since the cash open (Euro Stoxx 50 -0.2%) and failed to sustain the momentum from a positive APAC handover, as markets digest a slew of earnings and sets sights on the ECB’s policy announcement later . Overall, bourses trade mixed with mild outperformance in the CAC 40 (+0.1%) – aided by the likes of Safran (+1.7%) post-earnings and Airbus (+5.4%) as shares are underpinned after its CEO noted the group is in talks with French states – yesterday Finance Minister Le Maire said the gov’t could aid Airbus if the time is right. Sectors remain mixed and do not reflect a clear risk tone. Energy is the clear laggard as Shell (-6.3%) plumbs the depths post-earnings, afflicting the FTSE 100, after the group cut dividends for the first time since 1945 amid the oil price slump. The sector breakdown is similarly diverse but sees Travel & Leisure as the top amid hopes of looser global lockdown measures. Individual movers again largely consist of post-earning action; Lloyds (-5.9%) remains pressured after reporting a slump in Q1 pre-tax profit alongside a rise in impairments of around GBP 1.2bln YY. BASF (-1.0%) is lower after missing on Adj, EBITDA expectations, and cutting Q1 EPS to EUR 0.96/shr from EUR 1.53/shr whilst withdrawing guidance. Orange (+1.1%) holds onto opening gains as the group does not expect to significantly deviate from its FY targets. BBVA (-1.5%) holds onto losses after reporting an impairment charge of over EUR 2bln. Other earnings-related movers include Swiss Re (-2.5%), Deutsche Boerse (+2.6%), Nokia (+3.7%) and Danske Bank (-1.8%) Elsewhere, Wirecard (+4.8%) rises as its chairman does not see CEO Braun behind replaced, which follows activist Hohn’s call to remove the CEO. Finally, AstraZeneca (+3.3%) sees upside after the Co. and Oxford Uni announce landmark agreement for a COVID-19 vaccine, aims to secure CHADOX1 vaccine potential to patients. Co. would, under this agreement, be responsible for the worldwide manufacturing and distribution – with the CEO stating it should have a good idea in June or July whether its COVID-19 vaccine works.

Top European News

- Homebuilders Cancel Land Purchases as U.K. Economy Shrinks

- Transport Giant DSV to Cut 3,000 Jobs as Crisis Upends Business

- SocGen Posts Loss as Equities Trading Wiped Out in Rout

- Lloyds Books 1.4 Billion-Pound Charge and Scraps Targets

In FX, the Dollar is holding up relatively well in wake of the FOMC and presser from Fed Chair Powell that was forthright in terms of appraising the sever economic impact of the coronavirus containment efforts and the high probability that even more stimulus will be required, monetary and fiscal, to try and ensure a robust post-pandemic recovery. Moreover, the Greenback remains prone to further month-end outflows for rebalancing purposes and erosion of safe-haven premium given buoyant risk sentiment based on hopes for an anti-COVID-19 treatment and/or vaccine. However, the DXY is managing to stay within proximity of the 99.500 level that has been pivotal within recent ranges and is still keeping the index resistant on approach towards 99.000

- CHF/GBP – The major “outperformers”, albeit amidst quite restrained parameters overall, as the Franc inches closer to 0.9700 and further away from 1.0600 vs. the Euro, while Cable rebounds towards 1.2500 and Eur/Gbp recoils towards 0.8700 on a mix of month end demand and technical factors. Note, one bank model is pointing to outsize Sterling demand vs. the Buck and especially from 1500BST to 1600BST when fund managers re-hedge stock portfolios, while the cross is back below the 200DMA again.

- CAD/EUR – Another upturn in oil prices has helped the Loonie consolidate gains above 1.3900 and almost match the current mtd peak not far from 1.3850 ahead of Canadian data comprising monthly GDP and PPI, while the Euro is still meeting resistance ahead of 1.0900 and last week’s apex just shy of the round number, though also finding underlying bids on dips despite more downbeat Eurozone data in the run-up to ECB

- JPY – The Yen also looks locked between decent option expiries and a key chart level that was marginally breached on Wednesday, while many Japanese participants were otherwise engaged given a market holiday on the penultimate trading session of April, but did not trigger stops to test 106.00. Subsequently, Usd/Jpy is meandering between 106.87-42 and back above the aforementioned technical mark (50% Fib retracement at 106.45)

- AUD/NZD – Aud lost impetus around 100 DMA at 0.6567, and mega 2.7 bn expiry at 0.6570. Nzd hampered by bleak NBNZ Biz survey.

- New Zealand ANZ Business Confidence (Apr) -66.6% (Prev. -63.5%). (Newswires) New Zealand ANZ Activity Outlook (Apr) -55.1% (Prev. -26.7%)

In commodities, Energy contracts wane off best levels as European trades goes underway, but nonetheless remain firmly in positive territory, with WTI June +14% just above USD 17/bbl (intraday range USD 15.45-17.75/bbl) while the Brent July contract sees gains of around 8%, with prices just north of USD 26/bbl (intraday range USD 24.41-26.66.bbl). In terms of fresh developments, Norway Oil Ministry said Norway will be cutting oil output by 250k BOE/D in June and then lowered to 134k BPD in H2 until year-end, while the start-up of production at several fields will be delayed until 2021 and that production in December 2020 will be 300k BPD less than originally planned. Meanwhile, over in the US, Texas regulators released details on a proposed order to cut Texan output by around 1mln BPD, with a potential vote next week. Albeit, Texas Railroad Commission Chairman Christian said he still opposes mandated oil production cuts to address global oil curb. Elsewhere, US President Trump said they will have a plan to support oil companies soon. Other reports also noted the Trump administration is close to rolling out new lending facilities to help oil and gas companies struggling from a collapse in prices. Amongst all this, IEA’s Chief Birol warned that global storage could be full by mid-June and called on OPEC+ to mull further cuts, with the initial pact set to officially come into effect tomorrow. Elsewhere, spot gold sees modest gains as equities pull back from highs, with the yellow metal towards the top of its daily band of USD 1709.79-1719.66/oz. Base metals focus on lower mining output and the prospect of economies reopening for business, with Copper prices firmer on the day, albeit off highs, as the red metal meanders around mid-range at USD 2.4/lb and Zinc rallying some 2% in overnight trade.

US Event Calendar

- 8:30am: Personal Income, est. -1.5%, prior 0.6%; Personal Spending, est. -5.0%, prior 0.2%

- 8:30am: Real Personal Spending, est. -5.7%, prior 0.1%

- 8:30am: PCE Deflator MoM, est. -0.3%, prior 0.1%; PCE Deflator YoY, est. 1.3%, prior 1.8%

- 8:30am: Initial Jobless Claims, est. 3.5m, prior 4.43m; Continuing Claims, est. 19.5m, prior 16m

- 8:30am: Employment Cost Index, est. 0.6%, prior 0.7%

- 9:45am: MNI Chicago PMI, est. 37.7, prior 47.8

- 9:45am: Bloomberg Consumer Comfort, prior 41.4

DB’s Jim Reid concludes the overnight wrap

One has to be so careful that you’re own biases don’t influence you’re own thinking. After an awful few days at home where the twins are going through their terrible two stage together (biting, punching, scratching, hysterical crying etc) and my four year old is bored without school my wife continues to be at the end of her tether. I hide out in my office as much as I can but it’s not pleasant seeing her so frazzled when I go down to make a coffee or get lunch. So when I saw a U.K. Telegraph article overnight that no child has been found to have passed coronavirus to an adult I immediately showed it to my wife and we did a little jig. Who knows if it will ever be peer reviewed but the study did involve a partnership with the Royal College of Paediatricians.

We can only hope but there is more and more evidence that children do not have a big role to play in transmitting the virus which given the person hygiene of my twins sounds very strange.

Anyway more hope was in the air as it was a bumper day for financial markets yesterday before, and especially after, Gilead Sciences (+5.68%) announced that early results from a clinical trial showed that the remdesivir drug helped patients recover more swiftly from the coronavirus. At the White House Anthony Fauci, the government’s top infectious-disease specialist and head of NIAID confidently pronounced that this shows a “drug can block the virus”. Fauci has been relatively circumspect to date so this was an encouraging departure in tone. The New York Times reported later in the US session that the FDA was looking at granting emergency authorization for the drug soon. Gilead Sciences CEO Daniel O’Day said overnight that there are more than 50,000 courses of the company’s experimental Covid-19 therapy, packed in vials and ready to ship as soon as the drug is authorized for emergency use by the FDA. Later in the day, President Trump announced “Operation Warp Speed”, a program that will try to organize private pharmaceutical companies, government research agencies, and the military to try to cut vaccine development time down to under 8 months. While we’re on the virus, today’s CCD has a couple of graphs on NYC fatalities which add to yesterday’s UK demographic data (in the CCD), and also show what percentage had underlying health conditions. See that for more.

After all that excitement the Fed unsurprisingly announced that they voted to keep IOER and forward guidance unchanged and that they would keep them so until the economy was “on track”. The committee said that they believe the virus will continue to heavily effect economic activity, employment, and inflation in the short term, while also posing “considerable risks to the economic outlook over the medium term.” This could imply that the governors do not believe a true V-shaped recovery is in the works and that their accommodative monetary policy may be in place for longer. In the press conference, Chair Powell said that he expects reopening will boost consumption but not to prior levels and that there are concerns about ‘scarring’ that the crisis may have caused leading to a longer period of adverse conditions. Please see our US Economists full recap of the meeting here.

In terms of the broader market performance yesterday, the news from Gilead sent equities higher, with the S&P 500 ending the session up +2.66%, withstanding a little more two-way trading during Fed Chair Powell’s press conference. This means that the index is now over 30% above the lows reached back on 23 March, an astonishing rise in such a short space of time given the circumstances. The index is ‘only’ just over 13% down from February all-time highs. In further positive news, the VIX index of volatility also declined further to 31.23pts yesterday, its lowest level in over two months, while Bloomberg’s financial conditions index for the US eased to its most accommodative level in nearly 8 weeks. Over in Europe, equities were similarly buoyant, with the STOXX 600 (+1.75%) and the DAX (+2.89%) both advancing strongly.

After hours earnings supported the buoyant mood. Microsoft rose over 5% in extended trading before settling at +2.15% as cloud services and internet-based software demand has seen a sharp increase with companies shifting to work-from-home practices. Facebook rose +10.49% in after-hours trading, with the social media company reporting a +18% increase in Q1 revenue with sales coming in at $17.7bn (vs. $17.3bn consensus). The company has seen an uptick in engagement with more and more customers confined to their homes – daily users of all Facebook-owned apps was 2.36bn in March vs. 2.26bn in December.

The positive sentiment has continued in Asia but before detailing that China PMIs have come out overnight with the state manufacturing PMI printing at 50.8 (vs. 52 last month and 51.0 expected) while non-manufacturing PMI rose to 53.2 (vs 52.3 last month and 52.5 expected) bringing the composite PMI print to 53.4 (vs. 53.0 last month). In the details for the manufacturing PMI, new export orders plunged to 33.5 (vs. 46.4 last month), the second largest drop on record, suggesting the lack of external demand as much of the external world remained in lockdown. Meanwhile, the unexpected rise in the non-manufacturing PMI could be largely because the respondent believe that the situation has improved viz-a-viz the previous two months as on ground cinema halls are still closed and inter-city travel is still limited. So whilst encouraging the reading seems to be over-stating the recovery and a problem that diffusion indices are likely to suffer until the global situation normalises. The National Bureau of Statistics said alongside the release that “Some manufacturing companies said newly signed export contracts have dropped sharply, and some existing orders were cancelled.” Separately, China’s Caixin manufacturing PMI, which is more biased towards export oriented SME slipped back into contractionary territory with a reading of 49.4 (vs. 50.1 last month and 50.5 expected). Elsewhere, China and South Korea have agreed to ease quarantine requirements for business travellers under the so-called “fast-track” entry scheme which will take effect from May 1.

Bloomberg has also reported overnight that the Trump administration may today announce a plan to offer loans to the ailing oil industry possibly in exchange for a financial stake. Earlier, at the White House press conference Treasury Secretary Mnuchin had said that “This is not going to be a bailout,” and added that a team at both the Treasury and the Energy department are talking with people around the world and are considering “a lot of different strategies.” Another interesting bit which Mnuchin mentioned at the conference was that the administration has been considering a way around the storage capacity issue by buying undeveloped oil reserves and making them part of the U.S. emergency stockpile. Under the approach, the government would also effectively pay some domestic drillers to halt production indefinitely — or at least until prices rebound. So, one to watch. Elsewhere, Reuters reported overnight that Trump said that he thinks that China is determined to see him lose the November election based on Beijing’s response to the coronavirus and he was considering various ways to punish the Chinese government. He added that the US trade deal with China has been “upset very badly” by the economic fallout from the pandemic.

Asian markets are trading up this morning with the Nikkei (+2.83%), Shanghai Comp (+1.30%) and ASX (+2.34%) all advancing. Markets in Hong Kong and South Korea are closed for a holiday. Futures on the S&P 500 are up +0.48% overnight while those on the Nasdaq are up +0.83% on the after hours earnings beat by Microsoft, Facebook and Tesla. Elsewhere, WTI oil prices are up a further +15.74% this morning to $17.44 while most base metals are also trading up with iron ore being up +2.18%.

In other overnight news, the Nikkei is reporting this morning that Japan will extend a national state of emergency over the coronavirus by a month to June with the report adding that the final decision will be made after a meeting of experts tomorrow.

With the Fed now out of the way, attention will turn to the ECB’s latest monetary policy decision today, along with President Lagarde’s press conference afterwards. In their preview (link here ), our European economists write that they think an increase in the Pandemic Emergency Purchase Plan (PEPP) is becoming more likely as the downside economic scenario becomes more realistic. However, they note that size is not a constraint yet, as by today the ECB may only have spent around €100bn of the total €750bn commitment. The more relevant question in the near term would be a signal of a stronger PEPP reaction function to rising yields, something that could be done with a verbal signal or indirectly through the ECB’s market activities. Separately, they also think that the composition of the PEPP could be adjusted today, as following last week’s decision to suspend the minimum credit rating rules for collateral they think it’s possible that the Governing Council harmonises the collateral rules with the asset eligibility rules for the asset purchase programmes. So for credit investors will they grandfather fallen angels? From our side on balance probably not today but the prospect is getting more likely over time given the recent Fed move.

Elsewhere, sovereign debt generally had a good day, with bund yields falling -2.6bps. Italian BTPs were the exception however, which sold off following the ratings downgrade from Fitch to BBB-. The spread of yields on 10yr BTPs over bunds was up +5.4bps by the end of the session, bringing to an end a 5-day run of narrowing Italian spreads. To be fair they opened over 10bps wider and spent the risk-on session slowly recouping around half their losses. US 10yr Treasuries were slightly weaker, with yields up by 1.4bps to 0.627%.

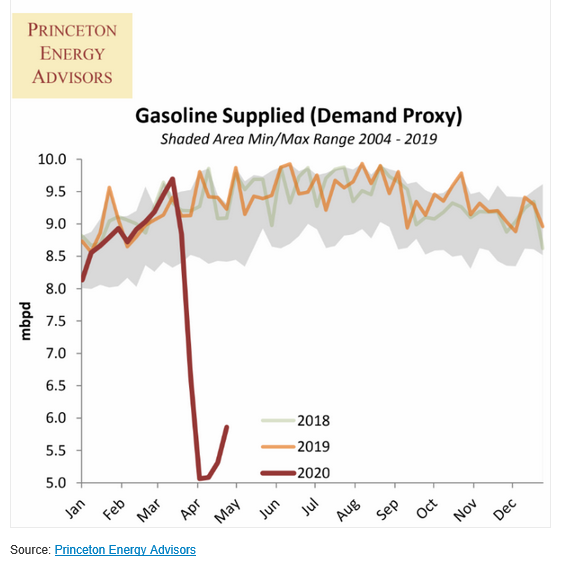

Other risk assets performed strongly as well on the back of the Gilead news, with oil also surging higher. WTI was up +22.04% to $15.06/barrel, while Brent Crude was up +10.17% to $22.54/barrel, in turn seeing energy stocks outperforming on both sides of the Atlantic, and sending the Russian ruble up +1.51% against the US dollar. The oil complex was helped by some better inventory data, especially demand for motor gasoline. Could it also be that the recent evidence from mobility data that more drivers are back on the road is increasing demand a little? US gasoline inventories fell by 3.67mm barrels compared to a build of 2.49million. A demand indicator, weekly gasoline supplied, rose by 549k barrels a day. The Mnuchin news mentioned above may have helped as it is in the Asia session.

As well as the ECB, attention today will also be on the advance reading of Q1 GDP for the Euro Area in March, which will give us a first indication of how output has fared with the lockdowns. The Bloomberg consensus is expecting a -3.8% quarter-on-quarter decline, which if realised would be the worst single quarter since the single currency’s formation back in 1999. While we’re on the Q1 GDP readings, we should mention that the US number released yesterday saw an annualised contraction of -4.8%, (vs. -4.0% expected), which was the biggest quarterly contraction since Q4 2008. As we all know Q2 will be worse given the lockdowns. They’ll give analysts a starting point to adjust Q2 numbers though.

For those seeking out more high frequency data, all eyes will once again be on the latest weekly initial jobless claims later today from the US, covering the week ending April 25. Our economists are looking for a 3.7m reading, which would be the 4th consecutive weekly decline. Although that would be a positive in that we appear to be past the most rapid period of job losses, that shouldn’t make us lose sight of the fact that the last 5 weeks’ readings have been the worst 5 in the data series going back to the late-1960s, with job losses of an unprecedented speed and scale, as over 26m initial jobless claims have been made.

Wrapping up with yesterday’s other data points, the European Commission’s economic sentiment indicator fell to 67.0 (vs. 73.1 expected) in April, its lowest level since March 2009. However, M3 money supply growth for the single currency bloc rose by 7.5% yoy in March, its fastest growth since December 2008, mostly driven by the increase in QE. Finally, US pending home sales in March fell -20.8% (vs. -14.3% expected), the largest monthly decline since May 2010.

To the day ahead now, and as mentioned the ECB decision and President Lagarde’s subsequent press conference are likely to be the highlight. There’ll also be a number of data releases, including both Q1 GDP and April’s CPI for the Euro Area, France and Italy. There’ll also be the Euro Area and Italian unemployment rate for March, the Germany change in unemployment for April and Canadian GDP for February. And from the US we have March’s personal income, personal spending, the core PCE deflator, as well as weekly initial jobless claims, April’s MNI Chicago PMI and Q1’s employment cost index. Finally, earnings releases include Apple, Amazon, Visa, Comcast, McDonald’s, Amgen, Gilead Sciences and Twitter.

Tyler Durden

Thu, 04/30/2020 – 08:22

via ZeroHedge News https://ift.tt/2VR6Zzi Tyler Durden