Banks Battered, Absymal Breadth But The Big-Tech Buying-Bonanza Continues

The Nasdaq is now up over 40% off the March lows…

As Nasdaq earnings continue to collapse…

Source: Bloomberg

Valuations are soaring back near record highs…

Source: Bloomberg

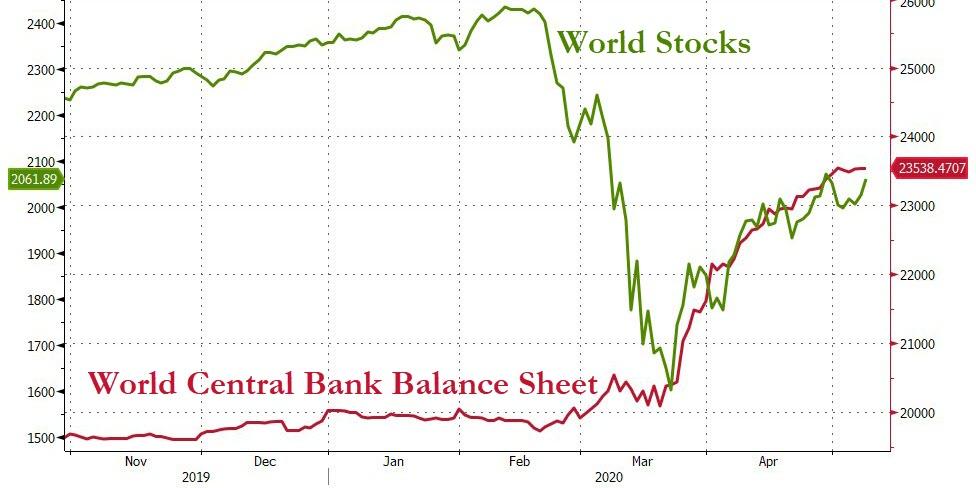

As world stocks ride the ‘white pony’ of central bank narcotics…

Source: Bloomberg

Because The Fed went full “Rick Astley”…

You’re welcome!

Everything opened lower… then the bid for big tech stepped in – buybacks and robinhood’rs… but a weak closing hour left Dow and Small Caps red (very ugly last few seconds)…

As Nasdaq soared, the median US stock was notably lower today…

Source: Bloomberg

Breadth was abysmal…

Source: Bloomberg

Another epic short-squeeze continues (6 days in a row higher)…

Source: Bloomberg

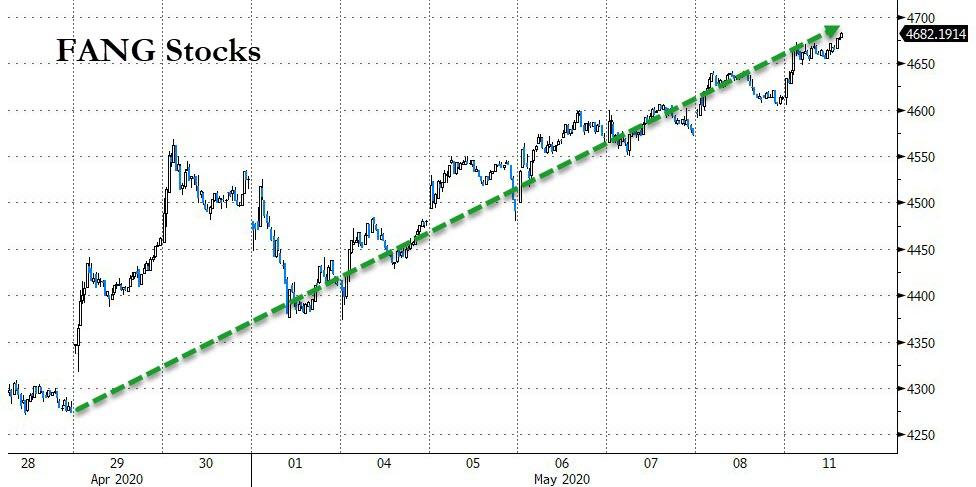

FANG stocks surged to new record highs today (up 43% off the March lows)…

Source: Bloomberg

This is the 6th day higher in a row (and 8th day of the last 9)

Source: Bloomberg

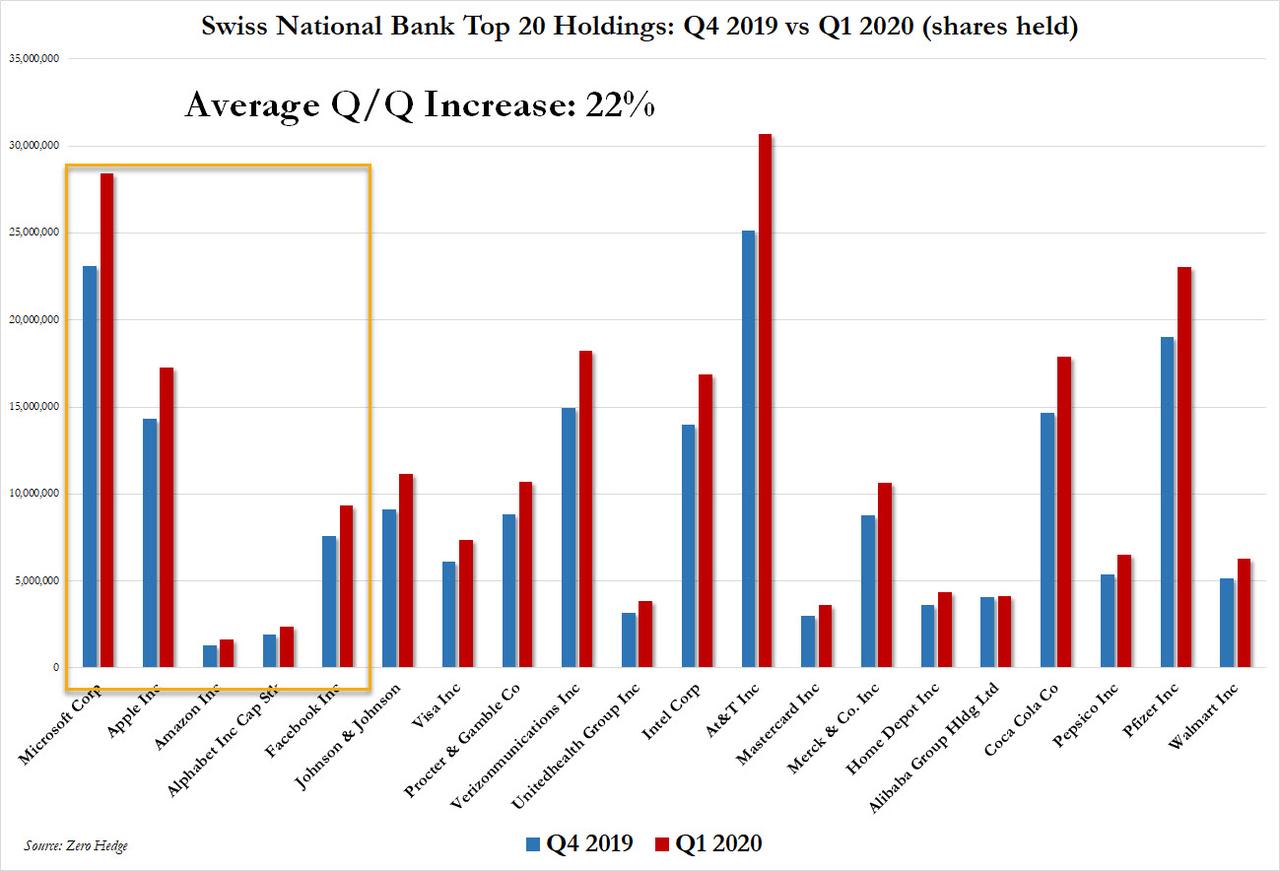

All thanks to The SNB…

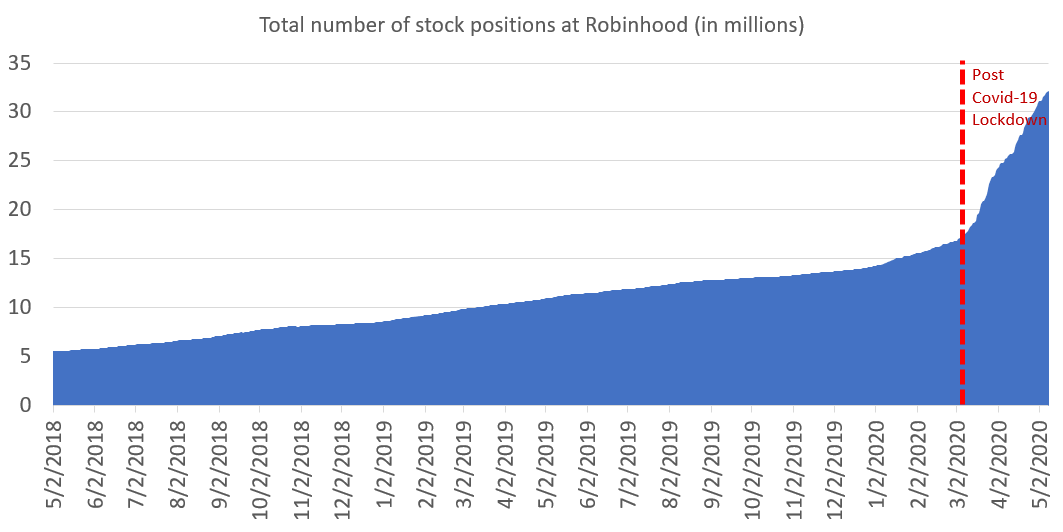

And Retail bagholdering…

Biotech stocks soared to a new record high…

Source: Bloomberg

But Banks were battered lower today…

Source: Bloomberg

And in case you are wondering why banks are getting battered (on such a glorious day of panic-buying), here’s why! Market expectations of negative rates are soaring…

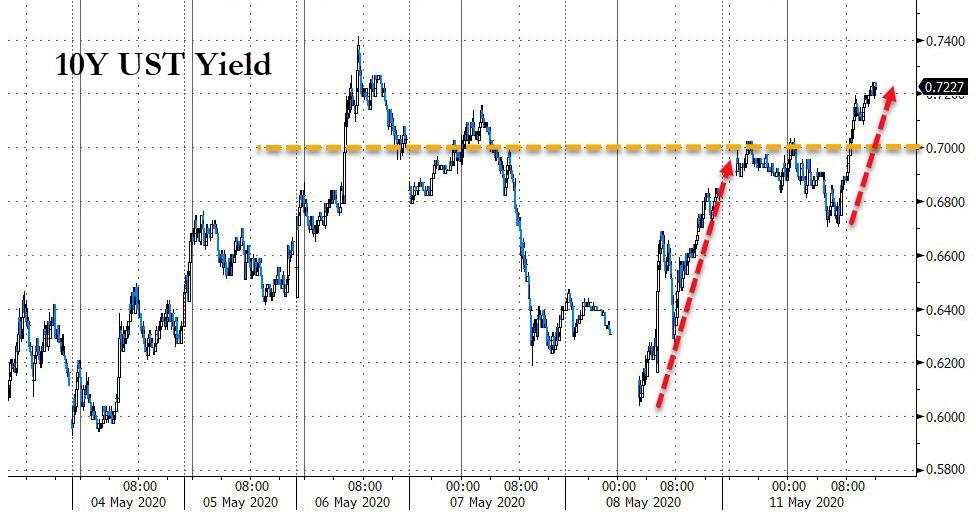

Treasury yields were higher across the curve with the long-end steepening…

Source: Bloomberg

10Y back above 70bps…

Source: Bloomberg

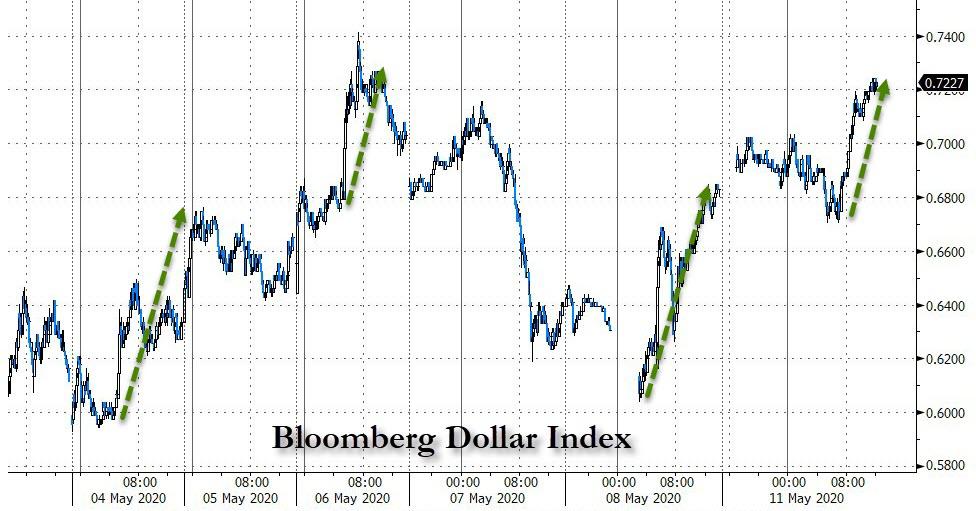

The dollar surged today (bets day in over 4 weeks) after a couple of days of weakness…The last two days moves look a lot like last week’s…

Source: Bloomberg

Just hours ahead of Bitcoin’s once-every-four-years ‘Halving’, the cryptocurrency chopped around after its big loss yesterday

Source: Bloomberg

The rest of the crypto space is hurting too since Friday…

Source: Bloomberg

Oil chopped around today on Saudi production headlines but all the major commodities ended lower…

Source: Bloomberg

June WTI outperformed with yet another panic-bid into the settlement…

Finally, Spot The Odd One Out… What do stocks “know” that bonds and commodities don’t about the re-opening of the world’s economy?

Source: Bloomberg

Tyler Durden

Mon, 05/11/2020 – 16:00

via ZeroHedge News https://ift.tt/3cmr3zu Tyler Durden