NIRP Panic Fades, But Here’s One Reason Why The Fed May Have No Other Choice

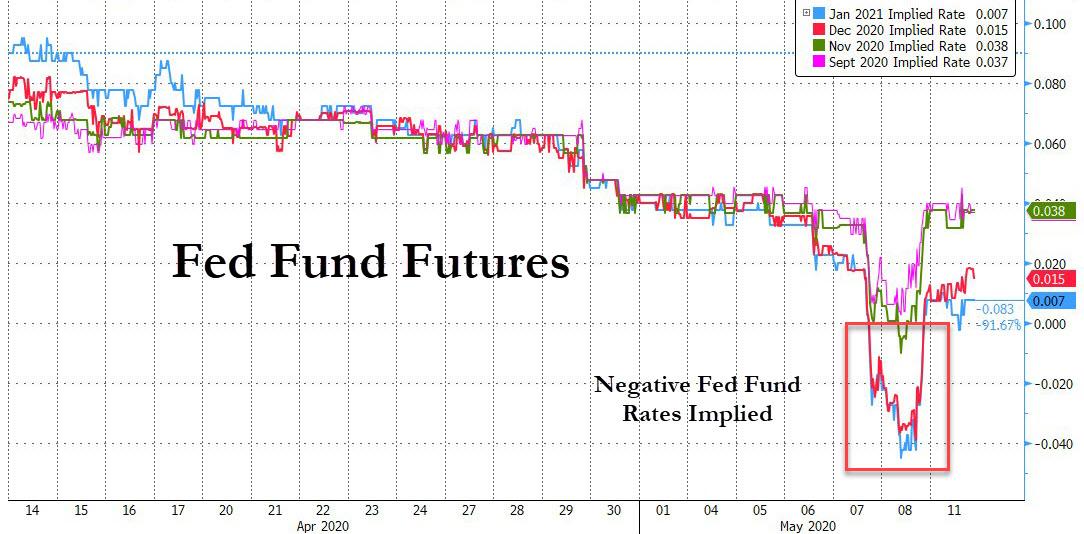

After last week’s negative rate scare, which hammered the dollar as fed fund futures traded above par as close as the November contract…

… suggesting markets were pricing in negative rates in just 6 months – prompting much confusion in markets given prior Fed assurances the Fed would not follow Europe and Japan into negative territory – on Monday the fed funds complex normalized with far-dated fed fund futures now implying just 1 basis point of easing over the next 12 months currently, after pricing in far more late last week, helping the dollar maintain broad gains after Federal Reserve officials downplayed the idea of negative rates would be used as a policy tool to combat the coronavirus.

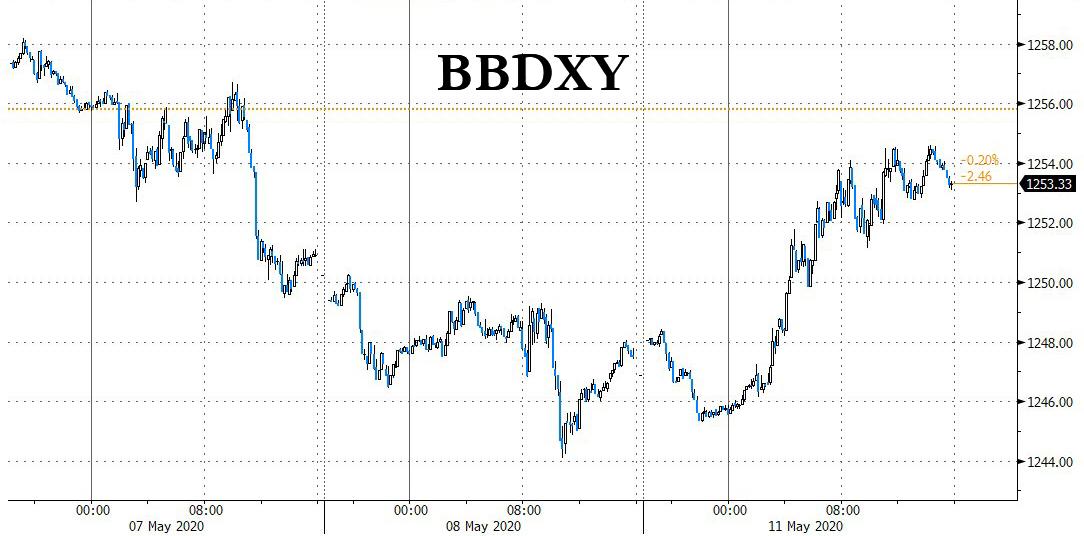

The Bloomberg Dollar Index also benefited, rising 0.6%, the most since mid-April and 10Y Treasury yields were higher by 4bps to 0.72% after Chicago Fed President Charles Evans downplayed the idea negative rates would be used while Atlanta Fed President Raphael Bostic said the use of negative rates not a good option in a crisis.

Of course, the big question is what Fed Chair Jerome Powell will say when he appears Wednesday in webinar discussing “current economic issues.”

Some, such as UBS head of U.S. rates strategy, Michael Cloherty, wrote that bets on the path of Federal Reserve interest rates, “is an accounting-driven move” as banks are insuring against hedges on assets turning negative, to avoid shifting to a costly mark-to-market framework, by buying options on instruments such as Fed funds falling below 0%. This leaves the counterparty on the other side of the trade exposed to negative yields.

“The magnitude of the accounting risk is likely to be very large,” said Cloherty. “If the dealer community has significant exposure to negative Fed funds, stop-outs can temporarily push futures into negative rates that seem highly unlikely.”

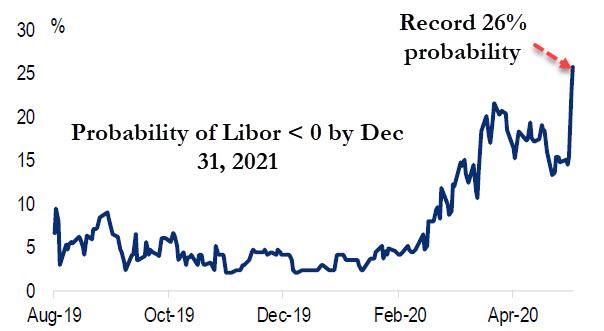

Not everyone was convinced, and others said that technical factors or simpler still, growing deflation fears, were behind the push: the scale of the move was reflected by the jump in outstanding positions on Thursday, which rose 62,000 contracts. January 2021 futures accounted for almost half the volume, rising 18%. Furthermore, despite Today’s reversal in fed funds, the probability of negative LIBOR rates by Dec 31, 2021 soared as high as 26% late last week.

This confirms trader speculation that despite the Fed’s stern refusal to consider negative rates, Powell is unlikely to rule out negative rates definitively as it makes strategic sense for the “prudent” Fed to keep all options on the table given that the

cost/benefit analysis of implementing negative rates may change in the future, especially if there is a second infection wave later in the year. Not to mention, the lack of an explicit denial grants the Fed another liquidity put in the form of ‘constructive ambiguity’ which keeps financial conditions easy without actually lowering rates below zero as some have observed. Of course, if Powell pushes it too far, then Eurodollars will again surge and push rates well below negative forcing the Fed to repeat the song and dance all over again.

In a lengthy comment on the risk of NIRP coming to America, Nordea’s FX strategists wrote that “if the Fed Funds pricing over summer 2021 actually depicts a bet on negative interest rates, it may just as well be that markets are betting on NIRP over the coming 3-4 months. There is essentially a 0% risk of a hike over the coming 12-18 months, why you could just as well bet on the cut in a Spring-2021 Fut instead of a Fall-2020 Fut. It basically yields the same result if the Fed cuts in September, but you keep the door open for a later than anticipated cut.”

Extending the commentary, Nordea adds that if the Fed was to go negative, it would be viewed “as a favour to the rest of the world and in particular emerging markets, as killing the USD spot level would be the main reason for going negative.”

On the other hand, “it would be a slap in the face for domestic USD savers and likely also for USD based banks”, although if there is one thing the Fed demonstrated amply over the past decade, is that it has zero qualms about punching savers in the face. Repeatedly.

“Negative interest rates hurt banks’ balance sheets, with the ‘wealth effect’ on banks overwhelming the small increase in incentives to lend.” as Stiglitz said. If you need empirical evidence, just take a look at banks vs. the broad equity market in the Euro zone – not looking pretty since the introduction of NIRP in the Euro area.

Yet with most strategists convinced that the move was largely technical – considering the Fed would only go NIRP in a catastrophic, for the economy, scenario – Nordea asks “what could force the Fed into pondering NIRP given how firmly Powell has neglected the possibility of going negative?”

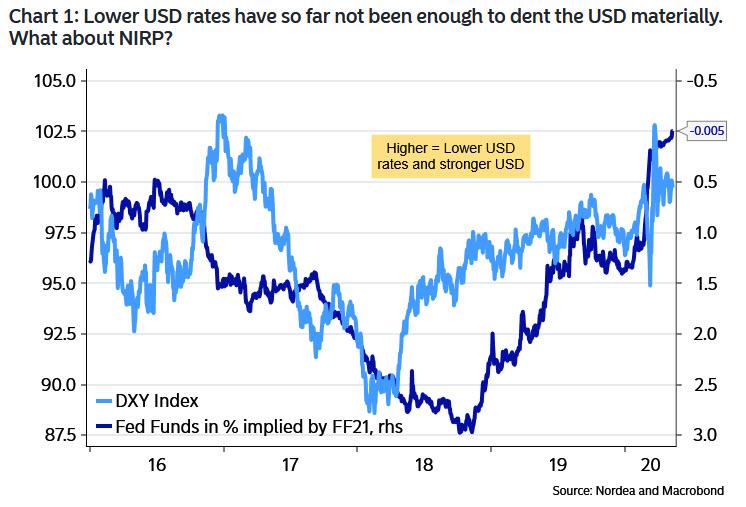

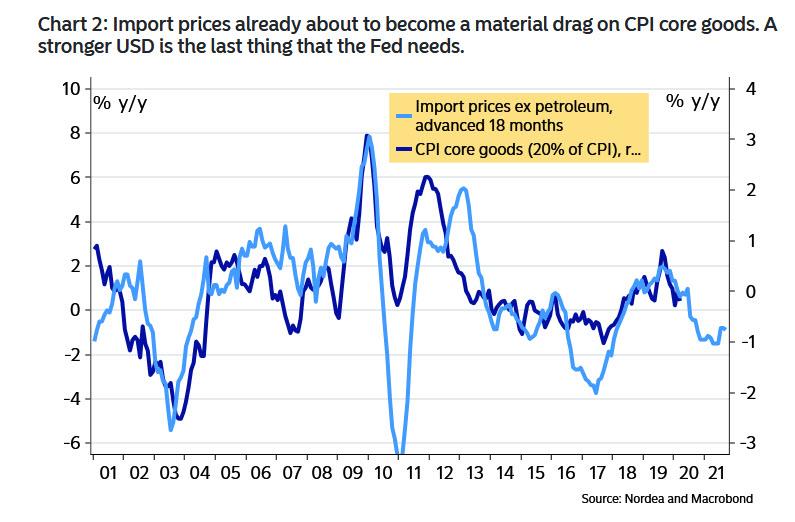

Nordea’s answer: “Import prices are already about to put a big downside pressure on CPI core goods over the coming 12 months, and should USD strengthen from here it would of course only emphasize the downside pressure.”

And with headline inflation about to fall off a cliff, core inflation will likely follow suit during H2-2020, which is “why it could be argued that the last thing that the Fed needs right now is a further strengthening of the USD as it risks leading to a damaging disinflationary spiral.”

As the bank concludes, “everyone and their mother is currently incentivized to support measures that could weaken the USD, also even the Fed. This is exactly why it is not 100% out of the question that NIRP is coming to America.”

Which leads us to the next obvious question: will negative rates actually lead to a lower dollar? We will provide the surprising answer shortly in a follow up analysis.

Tyler Durden

Mon, 05/11/2020 – 16:54

via ZeroHedge News https://ift.tt/35QO9Mc Tyler Durden