Small-Cap Stocks & Silver Soar As Social Unrest Rages, Nation Burns

Tyler Durden

Mon, 06/01/2020 – 16:01

Nothing says buy domestically-focused small cap US stocks like a nation under curfew due to widespread looting, images of police precincts on fire on every media outlet, many cities suffering “the worst social unrest since the 60s”, and still facing pandemic-crisis economic lockdowns and fears (oh, and PMI/ISM Manufacturing missing expectations and ongoing US-China trade and politial tensions)…

Futures show the malarkey best as Sunday’s open was met with significant selling (riots) only to be magically bid back up and then again on reports that China cut some US imports, only to magically bid once again. The cash open saw weakness, but that was again magically bid higher…

‘Investors’ appear to “love the smell” of burnt-out-businesses in the morning…

Shorts were squeezed once again…

Source: Bloomberg

S&P glued around the 3050 level…

FANG Stocks rallied…

Source: Bloomberg

Virus-affected sectors soared at the open (most notably Cruise Lines and Airlines)…

Source: Bloomberg

Bank stocks surged out of the gate but faded late on…

Source: Bloomberg

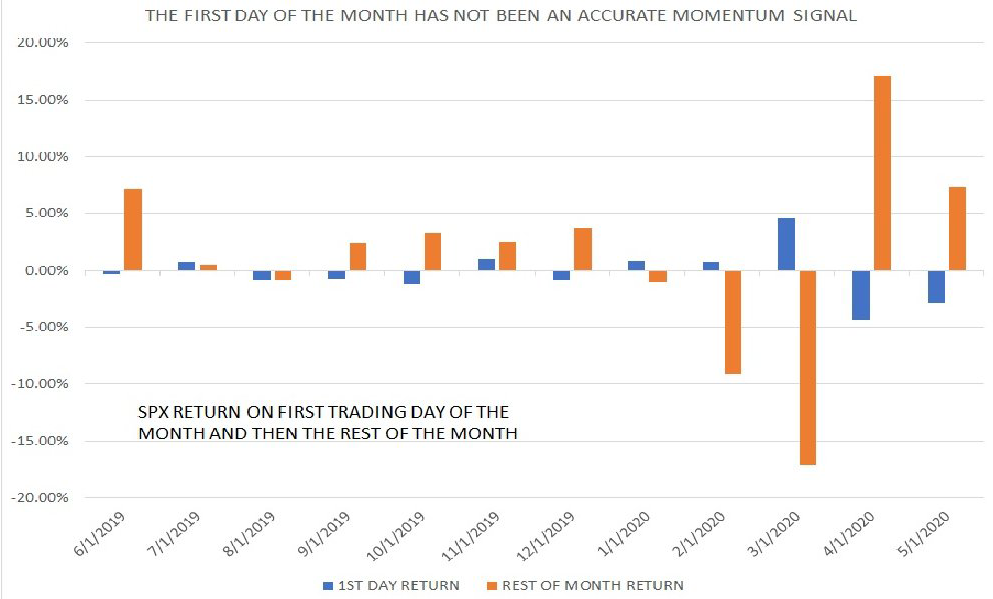

But before you get too excited about the rally today, Bloomberg’s Cameron Crise notes that in every month since last November the direction of the S&P 500’s return on the first trading day has been reversed over the rest of the month. And in many cases, the reversal has been spectacular. So a 0.375% gain today bodes poorly for the month if history repeats…

Oh and this happened… at around 0938ET – as stocks were being puked after the cash close – Schwab and Robinhood started suffering outages; these were not completely resolved until around 1250ET…

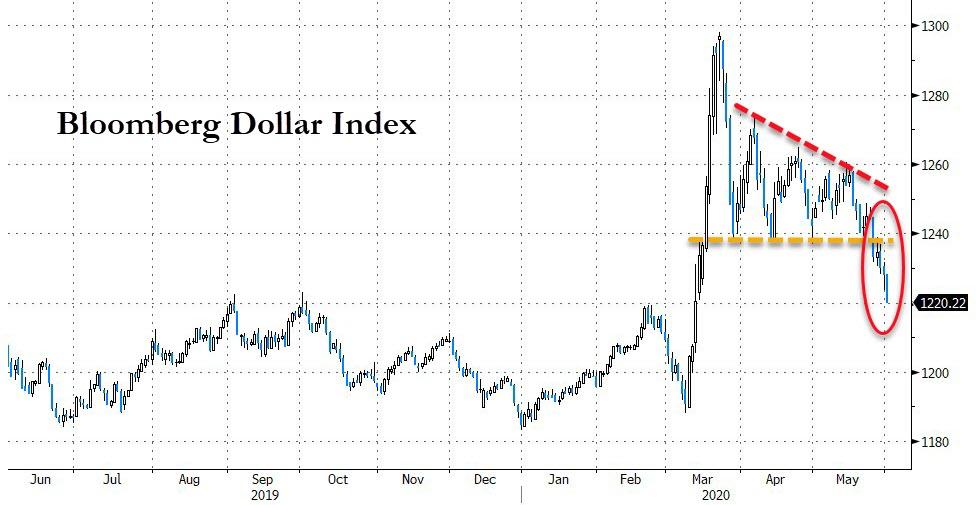

The dollar fell for the fifth day in the last six, back at near 3-month lows…

Source: Bloomberg

Pushing the dollar back near 3-month lows…

Source: Bloomberg

Bonds were sold today, especially the long-end, not helped by AMZN’s huge offering…

Source: Bloomberg

Corporate bonds were dumped at the open but HY rallied comfortably into the green (paging The Fed?) as IG bond prices drifted lower…

Source: Bloomberg

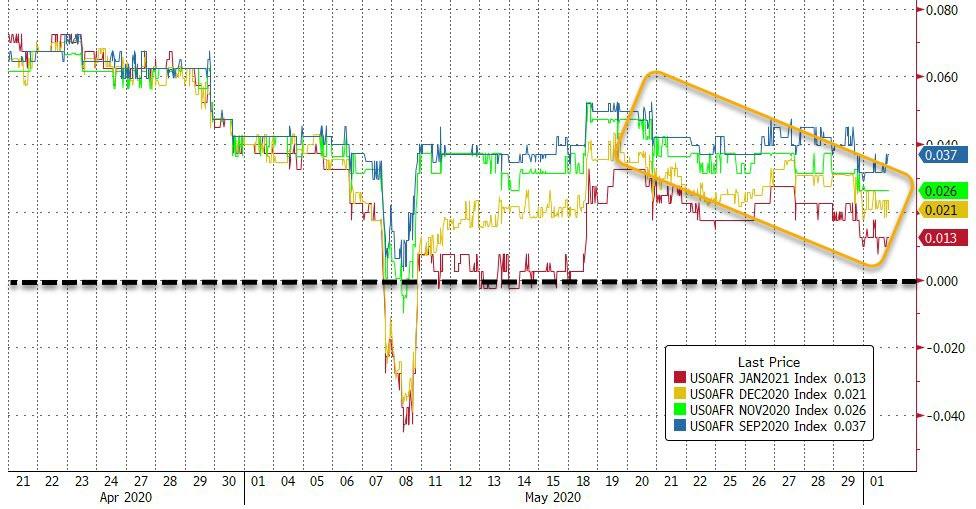

Short-term Fed Funds Futures shifted dovishly today, with Jan 2021 back close to implying negative rates…

Source: Bloomberg

Cryptos are all higher since Friday with Ethereum the biggest gainer…

Source: Bloomberg

All major commodities (even crude today) managed gains amid the weaker dollar…

Source: Bloomberg

And silver continued its outperformance of gold…

Source: Bloomberg

Finally, one wonders just how long this disconnect can last?

Source: Bloomberg

via ZeroHedge News https://ift.tt/36Q1LYF Tyler Durden