After The Biggest Rally Since 1933, JPMorgan Finally Tells Its Clients To Buy US Stocks

Tyler Durden

Mon, 06/22/2020 – 17:50

Last Friday, we were amused to report that only after the biggest 3-month rally in European stocks in more than 5 years…

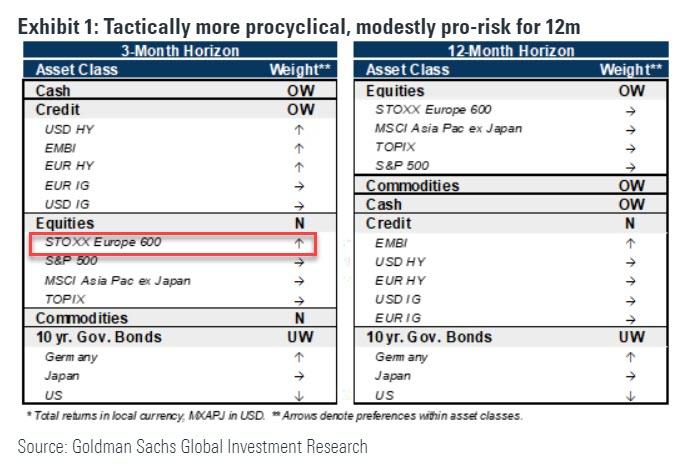

… did Goldman, which until that point had been Underweight stocks in general and Neutral on Europe in particular, decide to change its recommendation and urge clients to buy Europe, while raising its overall Equities reco from Underweight (i.e., sell) to Neutral.

Today, it’s JPMorgan’s turn.

First, some background: with just over a week to go until the end of the 2nd quarter, the Dow is on track for its largest quarterly gain since Q1 1987, the S&P 500 since Q4 1998, and the Nasdaq since Q4 2001. According to Goldman, “we’ve just seen the strongest rally out of a bear market since … 1932.”

So is now a time to buy stocks after the massive Q2 rally has largely fizzled (absent the Fed launching YCC of course)? According to JPMorgan’s equity strategist Mislav Mateja the answer is yes (even though another JPM strategist Nick Panagirtzoglou said that a mini correction is imminent) that after being Neutral on US equities since the start of the year, he is returning to an Overweight (i,e,m buy) stance, up from Neutral.

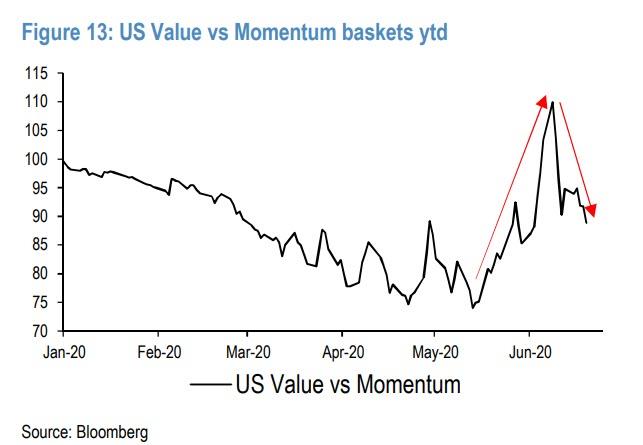

According to Matejka, the recent Cyclical rotation is ending, noting that “we called for a tactical rotation into Cyclicals and Value style on 18th of May, but believe the trade is largely done, and have recently advised to close it.” Matejka also notes “that US Value/Momentum baskets appear not to be making gains anymore” and adds that “value will struggle to sustainably rebound as long as bond yields do not confirm the rotation”…

… and instead urges clients to focus on “more favourable sector tilts” which is why he maintains “OW Tech and advised re-entering bond proxy sectors – Pharma, Staples and Utilities.”

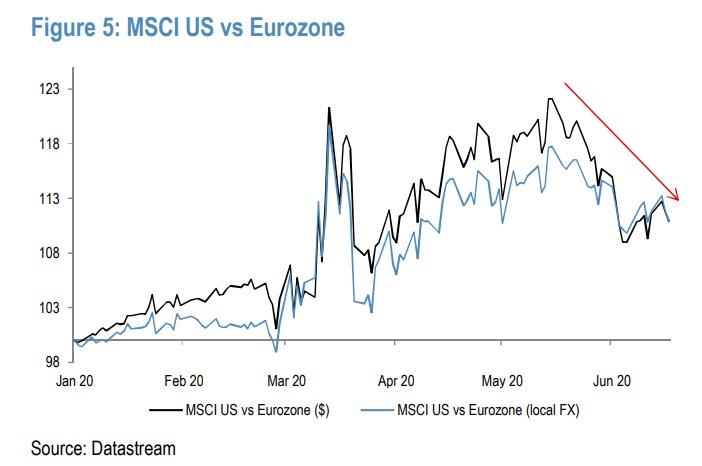

“During the recent value rally, U.S. equities surrendered some of the gains to international stocks, in particular to Europe. We now believe that the bulk of the value rotation is behind us, and that the market leadership will once again be dominated by defensive and growth names,” said Matejka. “U.S. equities typically perform better in such an environment.”

In short, JPM believes “the sector/style leadership will return to Tech and Defensives in 2H, with US the likely regional outperformer.”

Said otherwise, just like Goldman did with European stocks, so JPM’s prop desk has now accumulated a large enough inventory of US stocks, and only after the biggest stock market rally since the Great Depression, and after the Nasdaq rose for 7 days in a row – its longest streak since the late 2019 meltup – and up 18 of 21 days, is JPM telling its clients to buy all those US stocks, and especially FAAMGs that it has to sell. Luckily for JPM, there are more than enough Robinhooders who will gladly eat up everything it has to sell.

via ZeroHedge News https://ift.tt/2AZaLiF Tyler Durden