Platts: 4 Commodity Charts To Watch This Week

Tyler Durden

Mon, 06/22/2020 – 14:10

Via S&P Global Platts Insight blog,

The outlook for global oil demand and key trends in gas and LNG markets are in the sights of S&P Global Platts news editors this week, amid a stuttering recovery from the coronavirus pandemic continues.

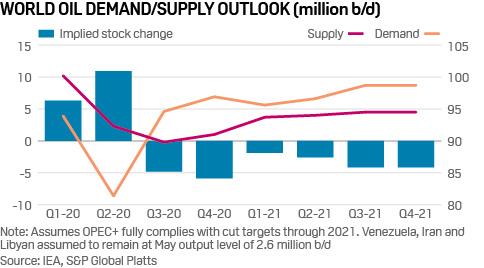

1. Oil demand recovery in spotlight as IEA suggests tighter market in 2021

What’s happening? The global oil market is set to tighten next year with demand recovering from the coronavirus pandemic at a faster pace than supply, according to the International Energy Agency, giving OPEC and its producer allies scope to unwind their agreed-upon output cuts faster than expected. Global oil demand will grow 4 million b/d more than supply next year, which would mean shifting some of the huge oil stock overhang that has built up during the pandemic, the IEA said in its latest monthly oil market report released June 16.

What’s next? On the demand side, markets are closely monitoring the pace of the oil demand recovery and the potential for a second-wave of COVD-19 infections to flatten the demand recovery curve, pushing its tail end well into 2021 and perhaps beyond. On supply, OPEC+ efforts to clamp down on quota busting by some of its members, such as Iraq and Kazakhstan, is key to the full implementation of the producer group’s massive 9.7 million b/d of output cuts to the end of July. Any slowdown in oil demand recovery could trigger OPEC+ to consider ending the cuts beyond July.

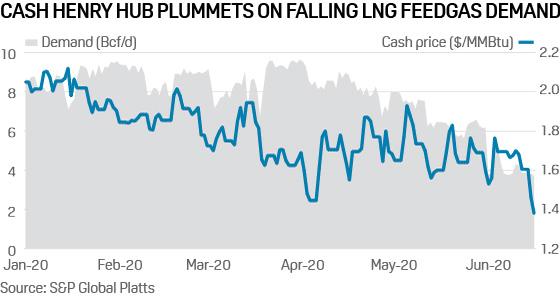

2. US natural gas output starts to climb despite price slump

What’s happening? US benchmark natural gas prices plummeted to a 20-year low on June 16, settling at just $1.38/MMBtu as falling LNG feedgas levels and a slower-than-anticipated recovery in gas demand from the coronavirus weigh on the US market balance. The bearish sentiment is pulling futures and forwards markets lower too, with both the NYMEX prompt and the balance-of-summer contracts at the Henry Hub now trading in the low to mid-$1.60s/MMBtu.

What’s next? For the week ending June 18, US gas production averaged over 86.9 Bcf/d – up about 400 MMcf/d from its late May average, S&P Global Platts Analytics data shows. As curtailments in major supply basins ease, the incremental production could prove bearish for US gas prices this summer. In the Permian, output recently climbed to over 11 Bcf/d, up from a 16-month low at 9.8 Bcf/d on May 20. In Appalachia, a renewed commitment by the US’ largest gas producer, EQT, to restore some 1.4 Bcf/d in shuttered output by July, could push basin-level production back to annual highs seen in early May.

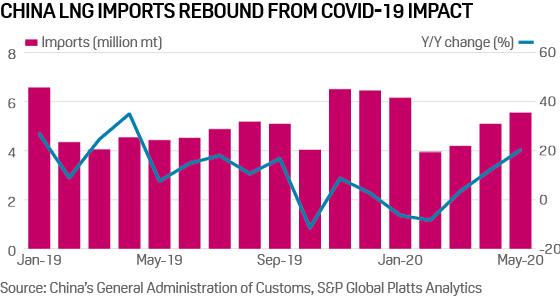

3. Chinese market awash with LNG despite demand outlook uncertainty

What’s happening? China’s LNG imports have ticked up steadily since February 2020 when imports had sunk due to the impact of the coronavirus on the economy and demand destruction in domestic natural gas markets. As the Chinese economy started to pick up, it raised hopes of a full recovery. Record low oil and LNG prices meant that gas importers were incentivized to procure more LNG cargoes. However, while domestic demand has grown many industries reliant on exports are yet to recover. Together with high inventories, the domestic gas market is oversupplied and China’s top LNG importers are engaging in price competition.

What’s next? Many domestic sources remain bearish in their view of the coming months, as LNG imports continue to pour in, contributing to China’s supply glut. The JKM LNG spot price averaged $3.50/MMBtu, $3.10/MMBtu, $2.80/MMBtu, and $2.10/MMBtu, on a DES basis, for March, April, May and June delivery, respectively, S&P Global Platts data showed. Chinese gas importers do not have an optimistic view on the demand outlook for the remainder of the year, as many uncertainties could cripple the growth potential of this demand center.

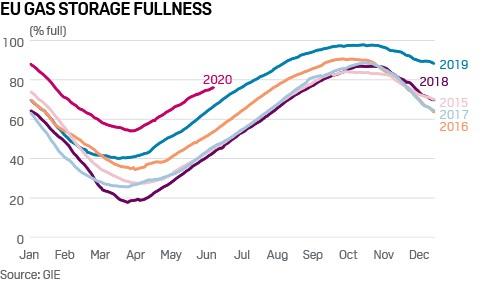

4. EU gas injections slow but high stock levels remain a concern

What’s happening? European gas storage injections have eased in the past few weeks, giving some respite to a market that had been under significant price pressure. Injection rates have slowed across Europe, but especially in Germany, France and Italy, according to S&P Global Platts Analytics data, as European gas prices move higher.

What’s happening? There remains concern that European gas storage sites will fill well before the end of the injection season, possibly as early as August, which would be bearish for a market that has already seen record low prices in 2020. Data suggest, however, that at current injection rates, storages will drop back to the same level witnessed last year by around mid-August.

via ZeroHedge News https://ift.tt/3fS2MCV Tyler Durden