The Magnitude Of The 2nd Round Of Job Losses Won’t Be Apparent Until After The Election

Tyler Durden

Mon, 06/22/2020 – 14:40

Authored by BMO Capital Markets rates strategists Ian Lyngen and Jon Hill.

Financial markets are entering a period with limited data or other scheduled developments from which to derive any meaningful trading direction. It’s the final full trading week of what promises to be a dismal second quarter and while the trajectory of economic activity has improved via the reopening process, the fact remains that it will most likely require years to claw back the ground lost during the pandemic. This isn’t new information however and as investors look forward, the focus remains on gauging the pace with which the labor market is reengaged and consumers’ propensity to spend is reestablished. While improvement in sentiment surveys and the surprisingly strong retail sales environment in May have added a positive skew to the near-term outlook, for the constructive momentum to accelerate the jobs landscape needs to continue improving. With a nod to all of the Fed’s accommodative efforts and Washington’s stimulus push, these measures are by definition temporary fixes designed to provide a bridge for firms to weather the pandemic with the objective of successfully reopening, reestablishing, and retooling in the new normal.

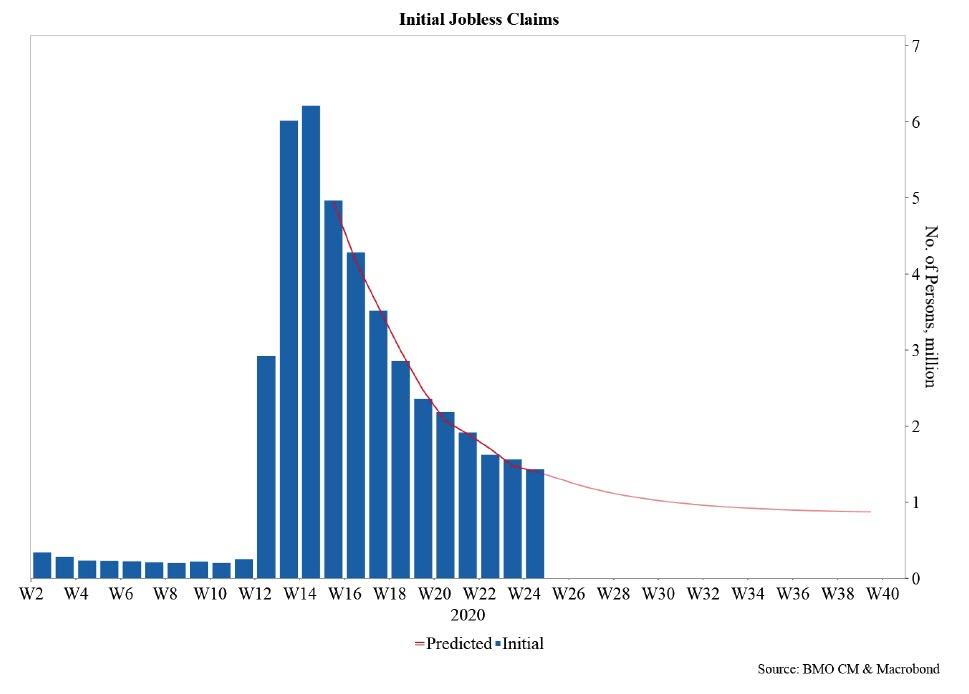

These ambitions are consistent with reemploying as many workers displaced by the pandemic shutdown as possible, but the fact of the matter is a large number of the jobs lost during the second quarter simply are not going to return. This isn’t to suggest that an elevated unemployment rate will be a permanent feature in the US, rather that the snap-back scenario is unlikely given the dizzying array of uncertainties that persist. The October 31 expiration of the payroll protection program has undoubtedly kept the ranks of the unemployed lower than had the initiative not been deployed; even if a more cynical interpretation implies that another round of job-shedding has only been delayed to the final two months of 2020. The fact the magnitude of the second-round losses won’t be evident until after voters go to the polls on November 3 isn’t lost on us; but was it ever going to be any other way? We digress.

With this context, this week’s economic data is unlikely to materially recast the macro narrative even if the domestic real estate sector continues to defy the downside implications from the pandemic. Durables and personal spending and income will incrementally add to investors understanding of the state of the economy, as well as the weekly jobless claims release. Nonetheless, the July 2 BLS report is the true litmus test of the V-shaped optimism. In this context, the consensus call for a gain of 3.6 million jobs during June on top of the 2.5 million seen in May will be in obvious focus. The unexpectedly strong May print (10 million stronger than the consensus) has raised the bar of how quickly investors expect the labor force to be redeployed and any significant downside miss will bring into question not only the trajectory of the recovery but also the reliability of the mid-pandemic data.

We’ve long maintained that issues of data collection and the accuracy of traditional measures of economic activity will plague the market until the pandemic has passed and NFP speaks to this dynamic. Moreover, the magnitude of the losses in employment and consumption lack sufficient context or comparison and are therefore challenging for investors to evaluate. Layer in the assumption that much of the downside in Q2 will be reversed in Q3 and a collective sense of flying-blind quickly develops. This isn’t particularly actionable for today’s trading session; although it does speak to the degree of conviction one might anticipate in the event of any outsized repricing in the US rates market. 10-year yields at 68 bp this morning reflect the new equilibrium and the 40-day moving-average at 69.5 bp offers a focal point as the week gets underway. 2s/10s at 50 bp offer a similarly uninspired departure point as we contemplate the next several trading days. Our longer-term steepening bias remains intact, as does our assumption that the outright yield ranges in 2s, 10s, and 30s will hold at least until NFP. In the event next week’s employment report is unable to trigger a durable repricing, then the range will be extended will into the summer months.

via ZeroHedge News https://ift.tt/2zXOOQA Tyler Durden