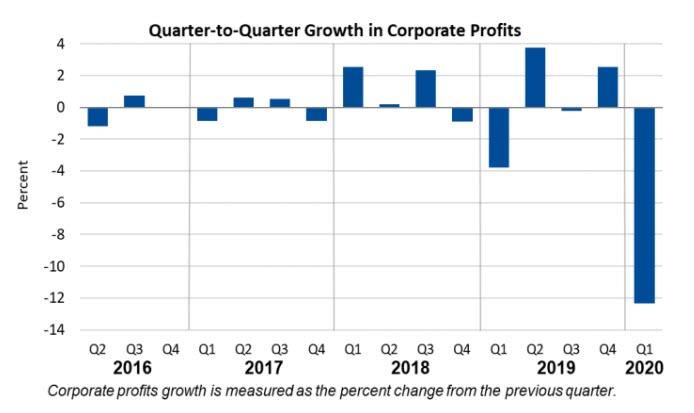

Q1 GDP Unchanged At -5.0% In Final Revision As Corporate Profits Tumbled 12.3%

Tyler Durden

Thu, 06/25/2020 – 08:44

While hardly even worth mentioning at a time when everyone is focusing not so much on Q2 GDP but whether Q3 will stage a V-shaped recovery, it is perhaps worth noting that today’s final Q1 GDP revision came in right on top of expectations, and unchanged from the 2nd revision of -5.0% annualized.

While the overall change in GDP was unrevised from the second estimate, an upward revision to business investment was offset by downward revisions to inventory investment, consumer spending, and exports.

The changes between the first and second estimate are as follows:

- Personal Consumption revised lower: from -4.69% to -4.73%

- Fixed Investment revised higher: from -0.41% to -0.21%

- Change in Private inventories revised higher: from -1.43% to -1.56%

- Exports revised slightly lower: from -1.02% to -1.06%

- Imports also largely unchanged: from 2.34% to 2.37%

- Government Consumption was also flat: from 0.15% to 0.20%.

Personal consumption fell 6.8% in 1Q after rising 1.8% prior quarter, and also in line with expectations.

The GDP price index rose a modest 1.4%, also in line with last quarter, and also unchanged, while core PCE posted a modest increase and beat, coming in at 1.7% vs 1.6% expected and in the 2nd revision.

Corporate profits decreased 12.3% at a quarterly rate in the first quarter after increasing 2.6% in the fourth quarter. Corporate profits decreased 6.9% in the first quarter from one year ago.

- Profits of domestic nonfinancial corporations decreased 15.4 percent after increasing 4.8 percent.

- Profits of domestic financial corporations decreased 9.2 percent after increasing 0.2 percent.

- Profits from the rest of the world decreased 8.0 percent after decreasing 0.3 percent.

While we knew that this would be the worst print since the financial crisis, the real question is what Q2 GDP will be, and more importantly whether Q3 GDP for a quarter that begins in less than a week, will show the dramatic improvement already priced into stocks.

via ZeroHedge News https://ift.tt/3fUYieG Tyler Durden