Record Large 7Y Treasury Auction Prices With Record Low Yield Amid Popping Demand

Tyler Durden

Thu, 06/25/2020 – 13:12

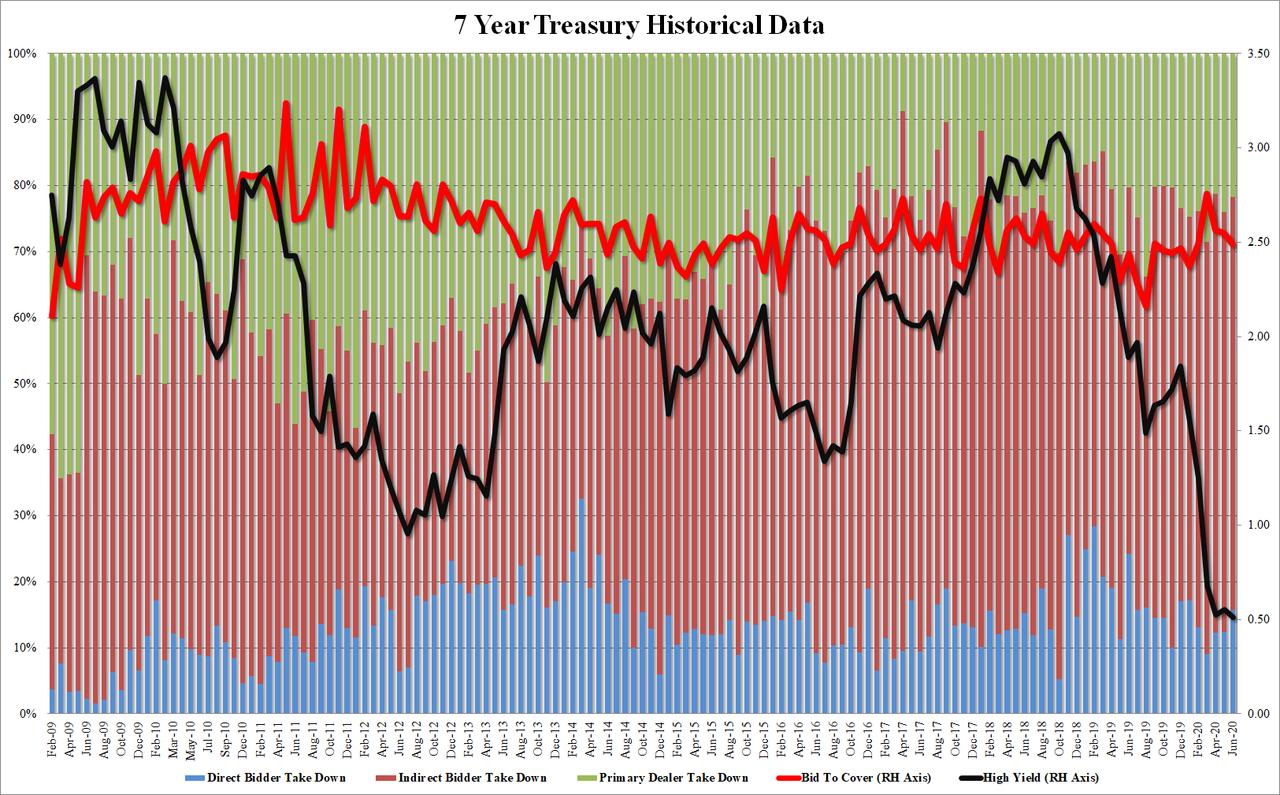

After a medicore 7Y auction last month, but following a very strong 5Y auction yesterday, moments ago the Treasury sold a record $41 billion in 7 year paper at the lowest yield on record, or 0.511%, 0.5bps through the When Issued 0.516%, with strong internals, confirming that there continues to be no shortage of demand for Treasury paper.

With a total of $41 billion in paper looking for buyers today, the largest amount for a 7Y auction ever…

… there was $102 billion in bids tendered, resulting in a bid to cover of 2.49, just shy of last month’s 2.55, and on top of the 2.53 six-auction average. While this was the lowest bid to cover since February, it is well above the prevailing level of BTCs during much of 2019.

The internals were also solid, with Inidrects taking down 62.6%, below last month’s 63.6%, but just above the recent average of 62.1%. And with Directs taking down 15.7%, the most since January 2020, Dealers were left holding just 21.7%, below May’s 24.0% and below the recent average of 24.3%.

Overall a strong auction, which like yesterday, benefited from the relatively flat market in TSYs today, where the 10Y is trading about 1bp below the Thursday close.

via ZeroHedge News https://ift.tt/31c8uvg Tyler Durden