US Bank Stocks Sink As Fed Caps Dividends, Forbids Share Buybacks In Stress Tests

Tyler Durden

Thu, 06/25/2020 – 16:35

Bank stocks surged today ahead of what analyst Mike Mayo called “the most high-profile stress test since the financial crisis” thanks to handout on Volcker Rule and swap margin easings and hope for tonight’s Fed release of a data avalanche showing how the top 34 banks would fare in a hypothetical crash (including, for the first time, a pandemic scenario) and whether they will be allowed to execute their dividend plans.

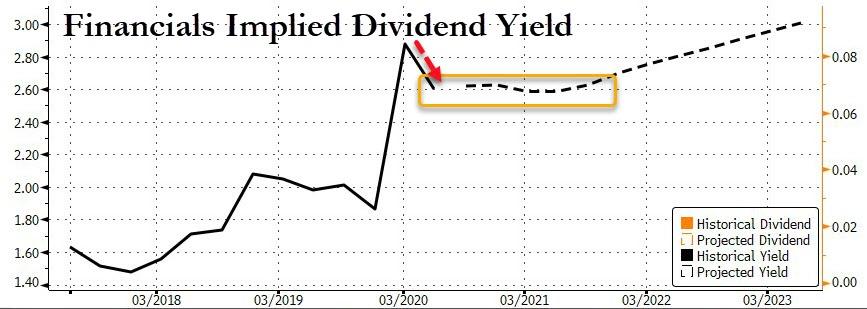

The market is pricing in a modest dividend cut and then flat for the next 12 months…

As The FT reports, ahead of the results, US policymakers, led by Mr Quarles, have gone against the grain in their messaging on dividends, speaking publicly of the importance of continuing payments. European supervisors, by contrast, ordered their banks to halt distributions while economies are ravaged by the pandemic.

So far, US banks have only voluntarily suspended share buybacks.

* * *

So what did the results say?

The Fed said in a release that big banks will be required to suspend share buybacks and cap dividend payments at their current level for the third quarter of this year. The regulator also said that it would only allow dividends to be paid based on a formula tied to a bank’s recent earnings.

Furthermore, the industry will be subject to ongoing scrutiny: For the first time in the decade-long history of the stress test, banks will have to resubmit their payout plans again later this year.

“While I expect banks will continue to manage their capital actions and liquidity risk prudently, and in support of the real economy, there is material uncertainty about the trajectory for the economic recovery,” Fed Vice Chair Randall Quarles said in a statement.

“As a result, the Board is taking action to assess banks’ conditions more intensively and to require the largest banks to adopt prudent measures to preserve capital in the coming months.”

Bank stocks are not happy…

Wells Fargo and BofA are the worst hit after hours…

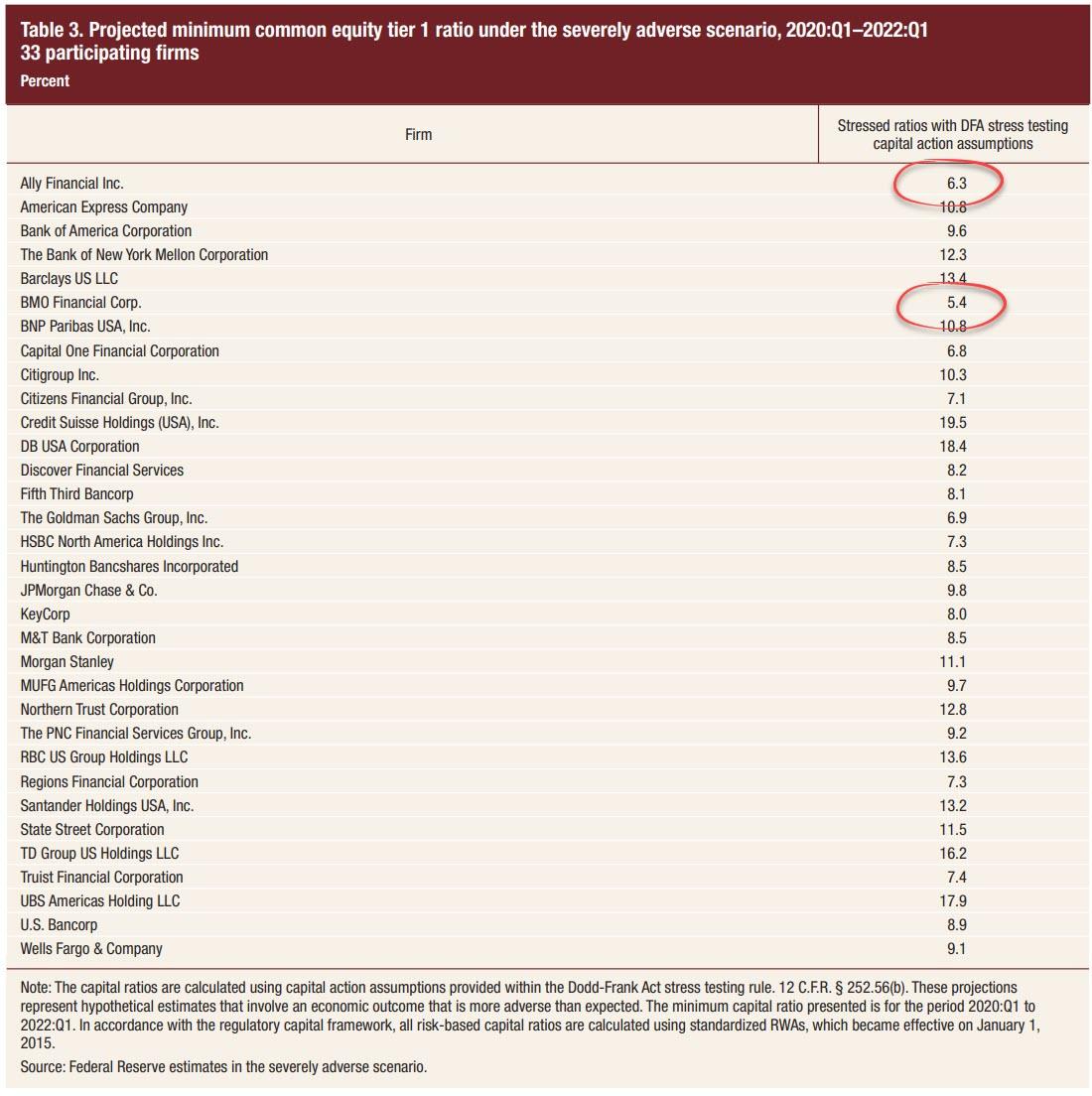

Ally Financial and BMO had the lowest common equity tier 1 ratio in the severely adverse scenario:

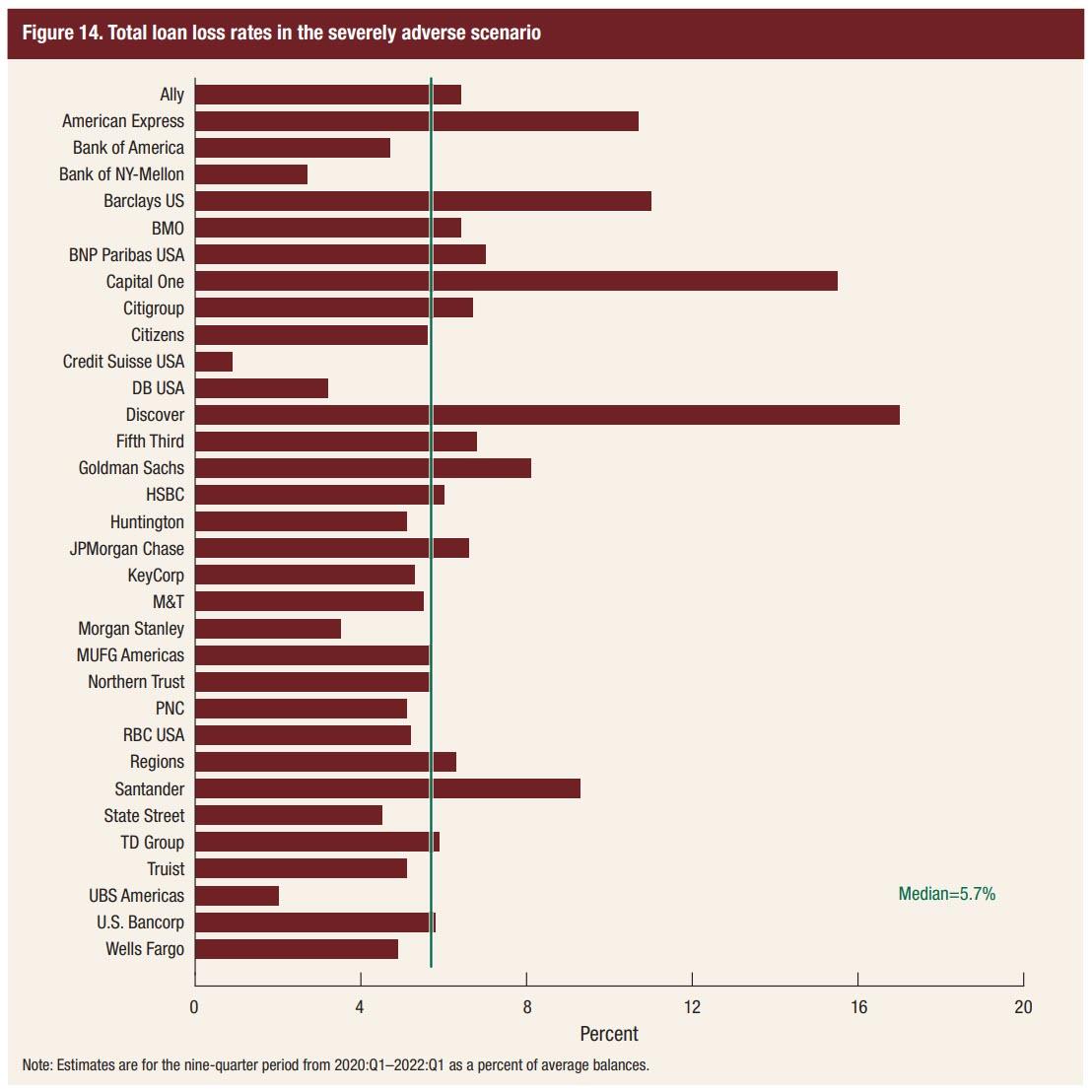

Discover, Capital One, Barclays, and Amex face the biggest loan losses…

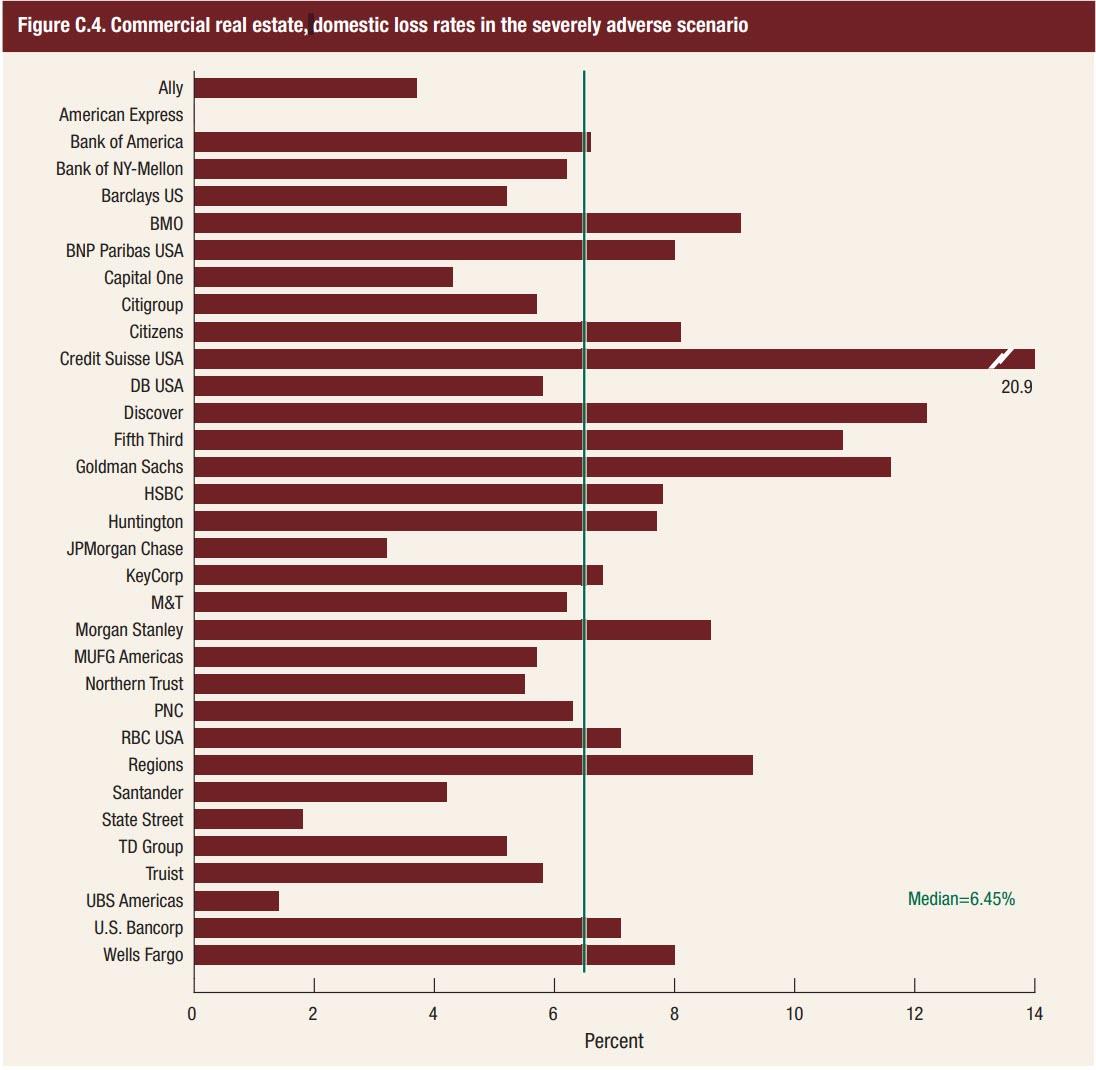

Credit Suisse is the most exposed to losses from Commercial Real Estate…

* * *

The Federal Reserve Board on Thursday released the results of its stress tests for 2020 and additional sensitivity analyses that the Board conducted in light of the coronavirus event.

“The banking system has been a source of strength during this crisis,” Vice Chair Randal K. Quarles said, “and the results of our sensitivity analyses show that our banks can remain strong in the face of even the harshest shocks.”

In addition to its normal stress test, the Board conducted a sensitivity analysis to assess the resiliency of large banks under three hypothetical recessions, or downside scenarios, which could result from the coronavirus event. The scenarios included a V-shaped recession and recovery; a slower, U-shaped recession and recovery; and a W-shaped, double-dip recession.

In the three downside scenarios, the unemployment rate peaked at between 15.6 percent and 19.5 percent, which is significantly more stringent than any of the Board’s pre-coronavirus stress test scenarios. The scenarios are not predictions or forecasts of the likely path of the economy or financial markets.

In aggregate, loan losses for the 34 banks ranged from $560 billion to $700 billion in the sensitivity analysis and aggregate capital ratios declined from 12.0 percent in the fourth quarter of 2019 to between 9.5 percent and 7.7 percent under the hypothetical downside scenarios. Under the U- and W-shaped scenarios, most firms remain well capitalized but several would approach minimum capital levels. The sensitivity analysis does not incorporate the potential effects of government stimulus payments and expanded unemployment insurance.

In light of these results, the Board took several actions following its stress tests to ensure large banks remain resilient despite the economic uncertainty from the coronavirus event. For the third quarter of this year, the Board is requiring large banks to preserve capital by suspending share repurchases, capping dividend payments, and allowing dividends according to a formula based on recent income. The Board is also requiring banks to re-evaluate their longer-term capital plans.

All large banks will be required to resubmit and update their capital plans later this year to reflect current stresses, which will help firms re-assess their capital needs and maintain strong capital planning practices during this period of uncertainty. The Board will conduct additional analysis each quarter to determine if adjustments to this response are appropriate.

During the third quarter, no share repurchases will be permitted. In recent years, share repurchases have represented approximately 70 percent of shareholder payouts from large banks. The Board is also capping dividend payments to the amount paid in the second quarter and is further limiting them to an amount based on recent earnings. As a result, a bank cannot increase its dividend and can pay dividends if it has earned sufficient income.

The Board also released the results of its full stress test designed before the coronavirus. The results from that test are comparable to the V-shaped downside scenario in the sensitivity analysis, in aggregate, and show that all large banks remain strongly capitalized. The Board will use the results of this test to set the new stress capital buffer requirement for these firms, which will take effect, as planned, in the fourth quarter. Additionally, the Board will not be objecting to five foreign banks whose capital planning practices were evaluated as part of the stress tests.

* * *

Full Results below:

2020-dfast-results-20200625 by Zerohedge on Scribd

via ZeroHedge News https://ift.tt/2ZgfiWe Tyler Durden