Air Cargo Boom Stalls As Rates Plunge Back To Earth

Tyler Durden

Fri, 06/26/2020 – 13:00

Weekly average air freight prices on major global routes have plunged, signaling the demand-driven boom for personal protective equipment (PPE), which started in late February, has peaked and is now over.

As Reuters notes, declining Air freight prices could be a significant headwind to “carriers that are scrambling to move cargo to offset weak passenger revenues as they rebuild networks by flying reopened routes with half-empty cabins.”

Phil Seymour, president of aviation consulting firm IBA, said, “rates are coming down” as the market is “becoming flooded with belly freight capacity.”

Collapsing travel demand and global flight restrictions squeezed carriers at a time PPE demand was surging, leading some airlines to convert passenger jets into temporary cargo aircraft.

Global Air freight capacity declined 27% in the week starting May 31 compared with a year ago, according to Accenture data. The data showed passenger capacity was slowly rising as flight routes return.

This year, air freight will contribute about 26% of airline industry revenue, up from 12% in 2019.

David Goldberg, chief executive of DHL Global Forwarding USA, said, “PPE via air freight has drastically slowed down in the last couple of couple weeks, and it’s probably because the second round can afford to go ocean freight.”

“We’ve seen more rationalization of the air freight rates. They’re still at high levels,” said Goldberg.

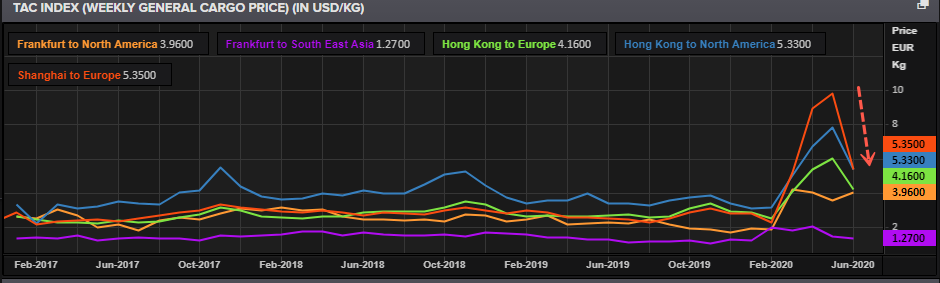

Global air freight (weekly) cargo prices via TAC Index for major routes

Air freight prices for Hong Kong to Europe and Hong Kong to North America peaked mid-May, and have plunged in the first half of June.

Air freight prices for Frankfurt to North America remain elevated, while Frankfurt to South East Asia have round-tripped pre-corona prices.

Air freight prices for Shanghai to Europe have quickly faded.

Air freight prices across the world’s top routes have all faded into June.

Year to date price performance for top routes is still elevated.

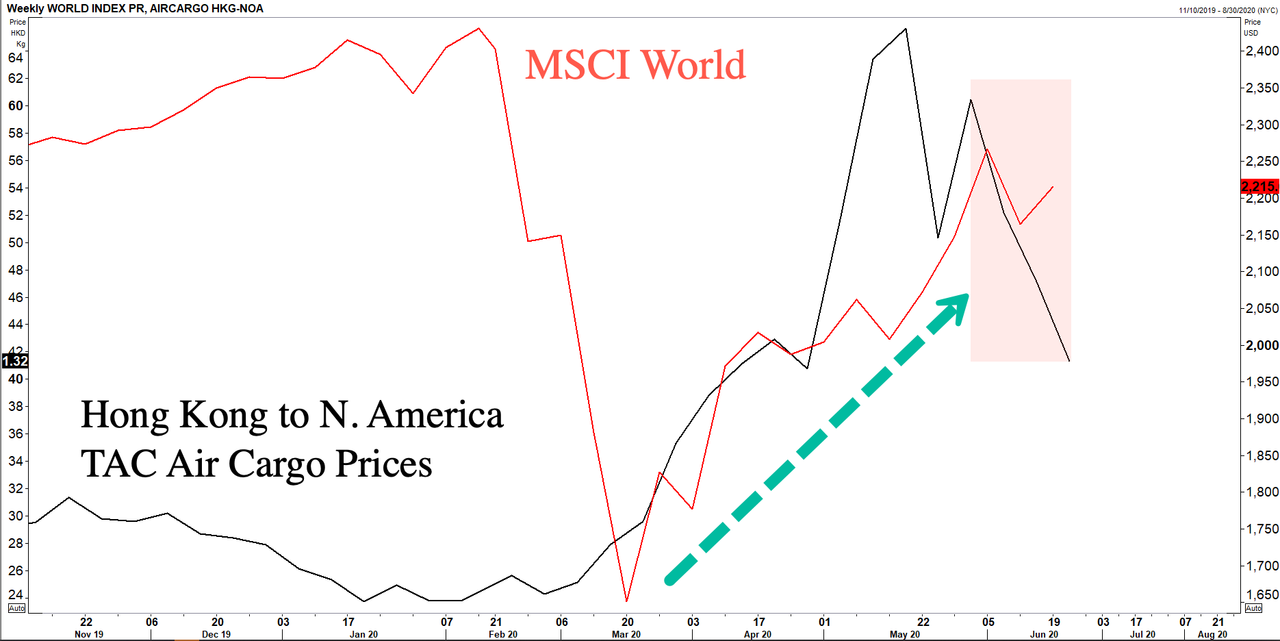

While soaring demand for air freight was seen around March 20 when world stocks bottomed – and it was at that time the revival narrative of the global economy went into full swing – the slump in air freight prices could suggest the global recovery is starting to fade.

The air freight industry might be in luck, BMO Capital Markets has recently suggested the second coronavirus wave has arrived, which could result in increased demand for PPE via air cargo.

via ZeroHedge News https://ift.tt/382kf8O Tyler Durden