US Spending Surges At Record Pace In May As Government Wages Crash

Tyler Durden

Fri, 06/26/2020 – 08:38

Following the somewhat surprising surge (stimulus checks) in personal incomes in April (after March’s collapse), May’s income data was expected to fade as spending rebounded strongly (on the pent-up-demand after re-opening).

On a month-over-month basis, personal income did drop, but less than expected (-4.2% MoM vs -6/0% exp) but spending rose less than expected (+8.2% MoM vs +9.3% exp) – this was still the biggest surge in spending on record (since 1958).

Source: Bloomberg

Year-over-year, income growth slowed (as stimulus checks slowed) but spending’s slump rebounded only modestly (remaining down a shocking 9.3% YoY)…

Source: Bloomberg

Note that personal income (ex-transfer receipts – i.e. stimulus checks) rebounded very modestly…

Source: Bloomberg

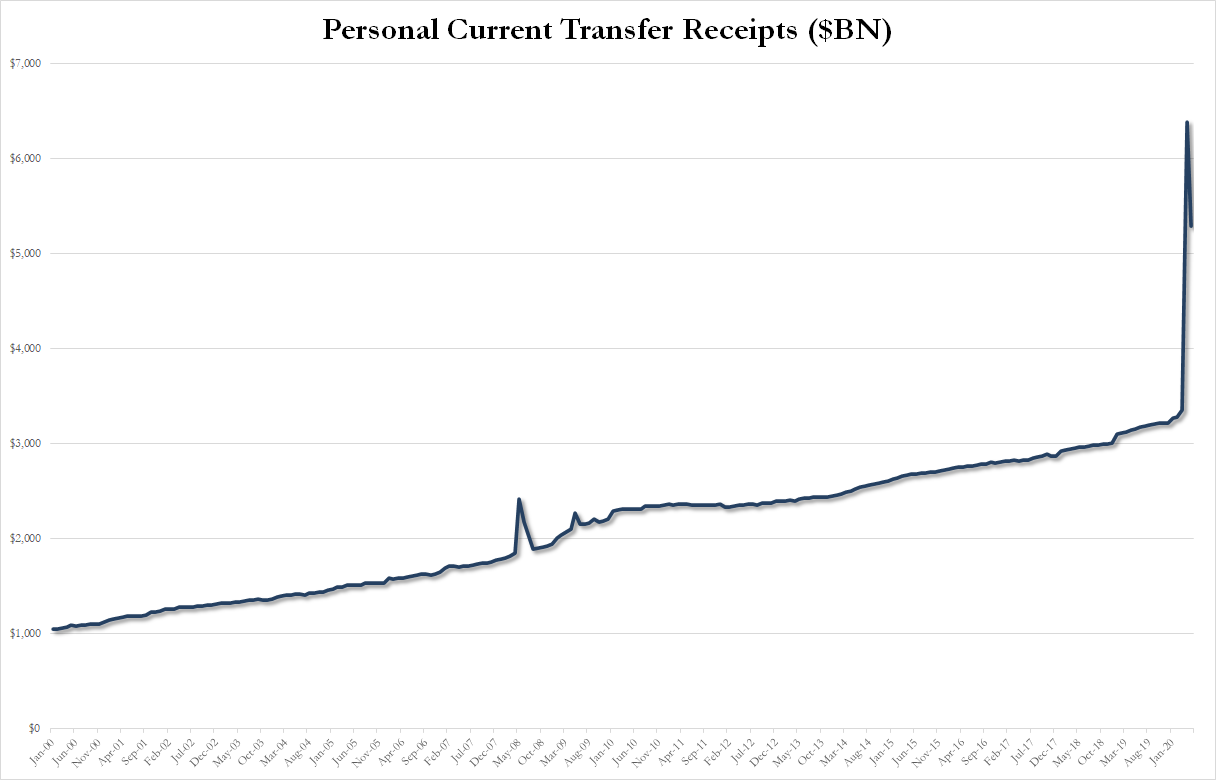

…as government handouts plunged by $1.1 trillion to $5.3 trillion…

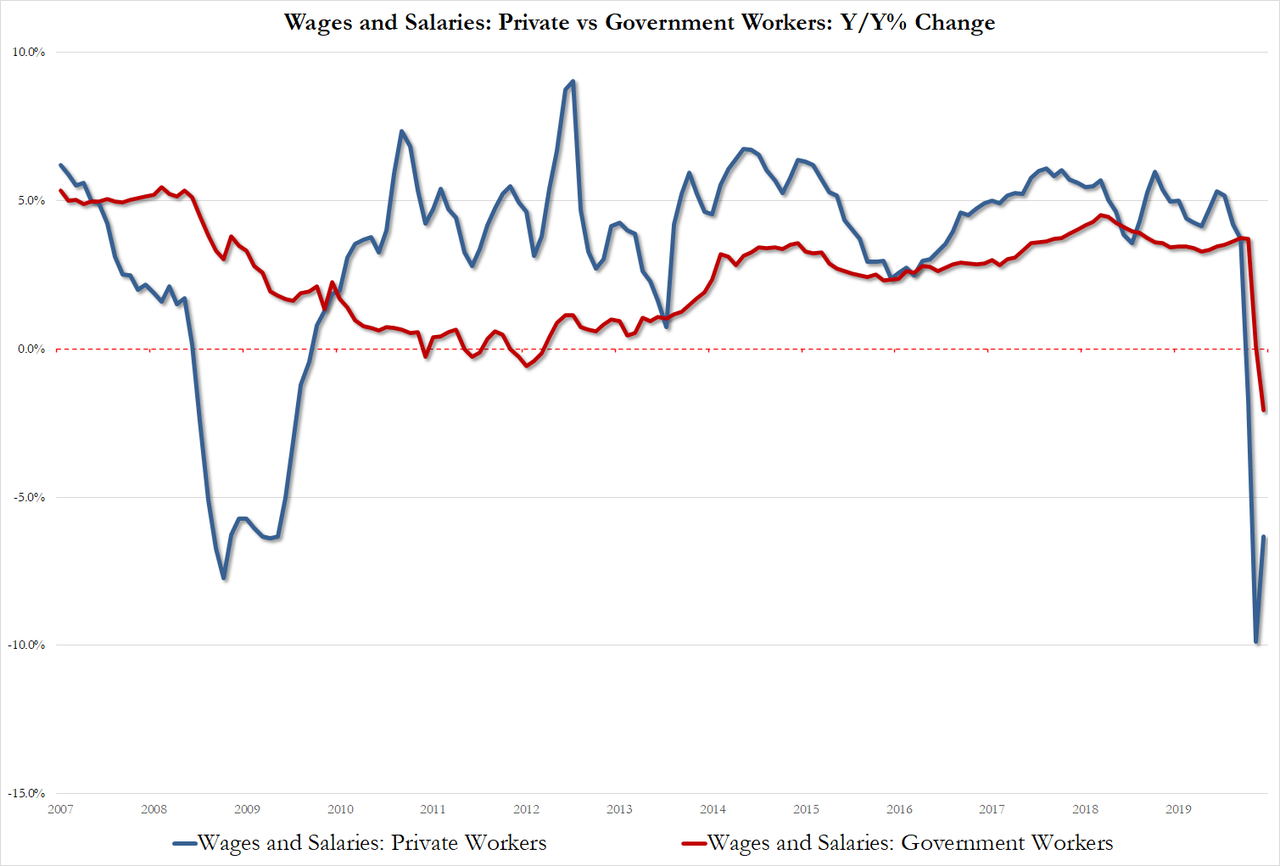

In fact, on the income side of the equation, May saw the biggest drop in government wages on record…

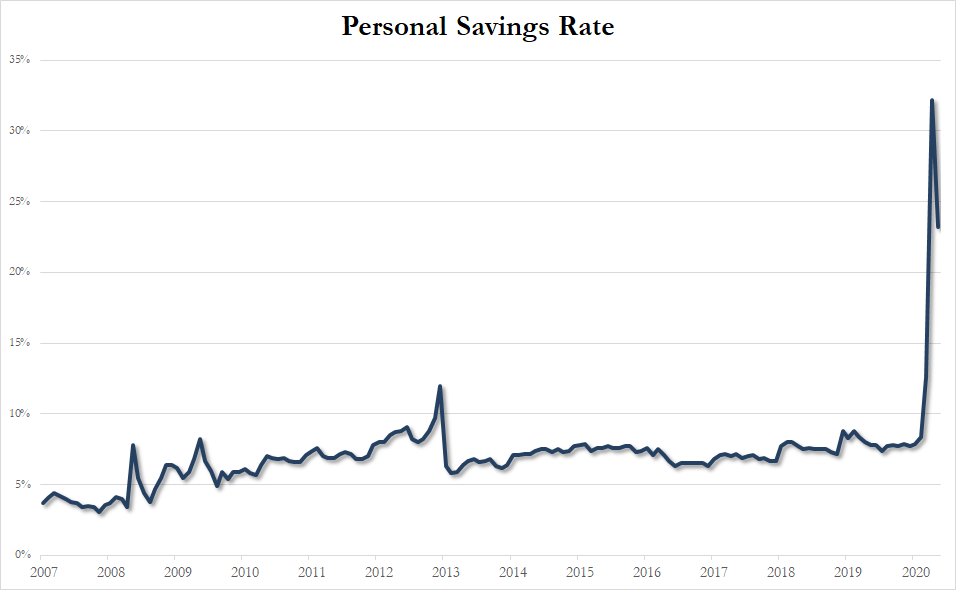

All this chaotic noise has sparked massive volatility in the implied savings rate, which plunged back towards old normal (from 32.2% to 23.2%) but still remains extremely high…

Source: Bloomberg

Finally, we note that The Fed’s favorite inflation indicator – Core PCE Deflator – slowed even firther to +1.0% YoY (slightly hotter than the +0.9% YoY expected)…

Source: Bloomberg

Providing Powell and his pals cover to keep on pumping.

via ZeroHedge News https://ift.tt/3842O7S Tyler Durden