Central Banker Musical Chairs: Fed Exits LBMA Board, Banque de France Joins

Tyler Durden

Sat, 06/27/2020 – 08:10

Submitted by Ronan Manly, BullionStar.com

For a group famous for its caution in appearing associated with and endorsing gold, Western central bankers seem to have made an exception when it comes to sitting on the board of directors of the world’s largest bullion bank gold cartel, the London Bullion Market Association (LBMA). But maybe that’s the point. Because, if central banks and their proxies are close to the action in the gold market, they will be able to control their interests, as well as influence and control others.

Which may explain why Isabelle Strauss-Kahn, former Market Operations director of the Banque de France (BdF), and formerly at the World Bank and Bank for International Settlements (BIS), is being appointed to the Board of the LBMA as an “Independent” non-executive director, with effect from 1st July. The Banque de France market operations role also included Strauss-Kahn being in charge of the French central bank’s gold and FX reserve management.

Until the Music Stops

In a classic case of musical chairs, Strauss-Kahn’s new appointment comes from a vacancy which has arisen due to the departure from another “Independent” LBMA board non-executive director, former Federal Reserve Bank of New York (FRBNY) head of FED Markets Group, Simon Potter. Potter had left the Fed in May 2019 and joined the LBMA board just last January.

But although Potter, who was also system open market account manager when at the FRBNY, had a brief stint on the LBMA, it coincided with some memorable gold market action when both the London and COMEX gold markets blew up in the week of 23 March, and when the LBMA and COMEX hit the panic button, rolling out there “nothing to see here” messages for the mainstream media.

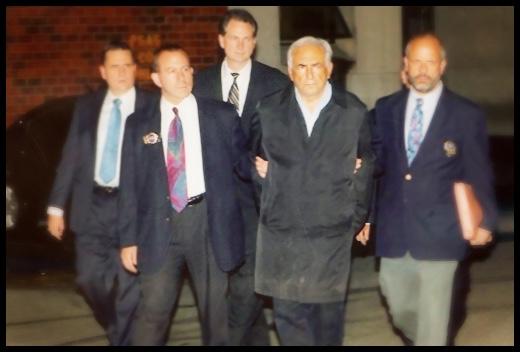

The Other Strauss-Khan

Isabelle Strauss-Kahn, who is also a member of the advisory board of the LBMA cheerleading organization, the World Gold Council , additionally has the distinction of being the sister-in-law of the infamous Dominique Strauss-Kahn (DSK) who many people will recognize as former managing director of the International Monetary Fund (IMF) from 2007 until that gig was cut short by his inglorious IMF exit in May 2011. Isabelle’s husband is Marc-Olivier Strauss-Kahn (MOSK), career executive at the Banque de France, and older brother of DSK.

Brother-in-law DSK also knows a thing or two about gold, having been IMF managing director during the time when the IMF claims to have sold 403.3 tonnes of gold between October 2009 and December 2010 in a series of ‘off-market’ sales to the central banks of India, Sri Lanka, Bangladesh and Mauritius ( a combined 222 tonnes), and secretive ‘on-market’ sales of the remaining 181.3 tonnes, possibly to China or to bail out bullion banks.

In fact, Isabelle Strauss-Kahn, her husband Marc-Olivier Strauss-Kahn (MOSK), and MOSK’s brother Dominique (DSK) were all living in Washington D.C. from 2008 onwards due to their respective jobs at the World bank, Banque de France US representative, and International Monetary Fund, respectively, so if gold was a frequent subject of discussion at their dinner parties, it would not have been a surprise.

MOSK was from 2008 to 2011 the “representative in America of the Banque de France” in Washington, as well as “senior visiting advisor” at the FED, as well as French administrator at the Inter-American Development Bank, a post that Christine Lagarde, then French finance minister, is said to have helped organize for him. Lagarde herself would go on to be managing director of the IMF in 2011 after DSK departed, showing the small circle in which these French central bank and monetary elites move.

Racketeering, Spoofing, Market Manipulation and Fraud

Note for the record that this LBMA Board is the same board that until September 2019 included one Michael Nowak, JP Morgan managing director and head of the bank’s global precious metals desk. Until that is, Nowak was indicted by the US Department of Justice (DoJ) for a “massive, multiyear scheme to manipulate the precious metals markets” over an 8 year period. This involved according to the DoJ, a “racketeering conspiracy”,”wire fraud affecting a financial institution, bank fraud”, “conspiracy under the RICO Act, widespread spoofing, market manipulation and fraud”. Quite a mouthful.

A series of unfortunate indictments which even the LBMA could not spin their way out of, and once again in panic mood reacted by removing Nowak from the LBMA Board a few days after the scandal blew up. So yes, this is the same LBMA Board we are referring to here.

Independent of What Exactly?

On Isabelle Strauss Kahn’s appointment to this same above board LBMA Board, Ruth Crowell, LBMA chief executive said: “We look forward to working with Isabelle, whose extensive experience in the financial services industry – specifically with central banks, will further strengthen LBMA’s global reach and independence of the Board.“

With central banks some of the main players in the gold market through their secretive gold leading, swaps and leases, not to mention their behind the scenes accumulation, distribution and repatriation of the yellow metal, the degree of ‘independence’ that influential former central bankers can have when on the board of the LBMA is debatable, to put it mildly. “Independent of what?” may be the best question, and why the secrecy?

Let’s not forget that other claimed ‘Independent’ member of the LBMA Board, the Chairman of the LBMA Board in fact, Paul Fisher, came to the LBMA in September 2016 after a career with the Bank of England, where “from 2002, he ran the Bank’s Foreign Exchange Division where he had a constructive relationship with the LBMA and developed a working knowledge of the bullion market” (perhaps a working knowledge of how to intervene in the London Fixing in the style of his predecessor “gold operator” Terry Smeeton). Fisher’s LBMA appointment at the time led to an incisive tweet from Jim Rickards which nicely summed up the move:

Banks pick central banker to head #gold market. Like putting an oil exec in charge of Tesla: https://t.co/mwHzNQCBZU pic.twitter.com/k2oJJPdYnh

Banks pick central banker to head #gold market. Like putting an oil exec in charge of Tesla: https://t.co/mwHzNQCBZU pic.twitter.com/k2oJJPdYnh

— Jim Rickards (@JamesGRickards) July 13, 2016

At the Behest of the Bank of England

But with the LBMA actually established in 1987 at the behest of the Bank of England when the Bank tapped bullion banks of the likes of N.M. Rothschild, J.Aron (now Goldman), Morgan Guaranty Trust, and Mocatta & Goldsmid to formalise the London bullion bank cartel, can anyone be surprised that central bankers alumni from the three largest gold trading central banks in the world, the Bank of England, New York Federal Reserve and Banque de France, are invited onto or place themselves on the LBMA board?

Not only that but that the three people in question (Fisher, Potter and Strauss-Kahn) are all former heads of the foreign exchange and gold market departments at their central banks, and expertly versed in market operations (i.e. FX and currency interventions). What are the chances of this happening unless it was a pre-planned drive to recruit these people or else the central banks made an offer the LBMA could not refuse?

Gold to Central Bankers is like the Sun to Vampires

For a profession with a long and documented history and a vested interest in containing the gold price through gold price smoothing and stabilization operations, or as Strauss-Kahn’s predecessors at the Bank for International Settlements in Basel said “to break the psychology of the market”, the question that maybe should be asked is what are former central bankers (indeed the very heads of market operations) even doing near the gold market, let alone on the board of directors of the LBMA? Unless, shock horror, they are there to represent the interests of central banks, interests which are proven to want to scupper gold’s free market price performance.

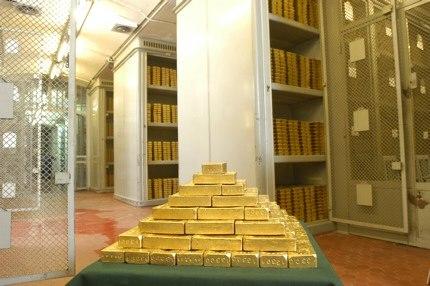

With Isabelle Strauss-Kahn now on ‘Board” with the bullion banks, we can also ask how safe and unemcumbered are the Banque de France gold reserves, all 2435.4 tonnes of them, nearly all of which are stored in the Banque de France “La Souterraine”gold vaults, in the 8th lower basement below the Bank’s mammoth headquarters in Paris.

Given that JP Morgan opened a gold account with the Banque de France towards the end of 2018 to take advantage of the Banque de France’s gold services (which include gold lending), will those French gold bars stay safe in the silence of the Parisian vaults, or will the main security entrance of the Banque de France on Rue de Valois be now seeing more activity, as more Good Delivery gold bars flow out of the vault in security trucks destined for “liquidity and market operations”? The answer to that is that we may never know, for while central banks constantly claim to be transparent in the gold market, they are nothing of the sort, quite the opposite actually.

In October 2018, Isabelle Strauss Kahn’s first dalliance with the LBMA was penning an article for the LBMA publication the Alchemist with the misleading title of “Removing the Cloak from Central Bank Gold Operations”, which was filled with anecdotes and many words but which unsurprisingly did not remove any cloak from the gold market.

Absent were any mention of the identities of central bank gold holders at the gold storage facilities of the Banque de France, Bank of England, New York Federal Reserve and Swiss National Bank. Absent were any details of the extent of outstanding gold loans and swaps among the world’s central banks or any quantification of these loans. Absent were the identities of the bullion bank counterparties to these central bank gold loans and swaps. You get the picture. In fact nothing was revealed at all.

However, the Strauss-Kahn article ended with this nugget from the author on the subject of transparency, when she said that:

“In conclusion, while central banks may not disclose everything and must preserve some mystique, as evoked by Stefan Zweig, they should be as open and transparent as possible, and should not seek to be shrouded in mystery just for the sake of it.”

Welcome to the world of central bank oxymorons where black is white, and white is black. But a model answer for a central banker who is sure to do well on the LBMA Board and may even be asked to help draft LBMA press releases. Just put non disclosure, mystique, open, transparent, not shrouded in mystery, in the same sentence and hope nobody reads it.

The reference to Stafen Zweig (which Strauss Kahn refers to earlier in her article) is interesting however. Zweig a journalist and novelist, while visiting the “La Souterraine” Banque de France gold vault in Paris in 1932, described the French gold reserves as “the heart of our economic world, the epicentre of the invisible waves that affect markets, stock exchanges, banks”. Zweig was describing how not only gold is the centre of the monetary world, but that gold when it makes its moves, affects the entire system.

In the aftermath of the 23 March 2020 liquidity events that have sent shockwaves through the London and COMEX gold markets, and with the gold price now breaking out in US dollars terms, perhaps Strauss-Kahn and the LBMA Board are about to witness the invisible waves of physical gold that Zweig so perceptively described all those years ago in Paris when visiting the gold vaults of ‘La Souterraine’. Those interested in Stafen Zweig’s perspective can see a modern recreation of his visit to the Banque de France gold vaults here.

This article was originally published on the BullionStar website under the title “Central banker Musical Chairs at the LBMA – Fed exits, Banque de France joins.”

entral banker Musical Chairs at the LBMA – Fed exits, Banque de France joins“.

via ZeroHedge News https://ift.tt/388q3xv Tyler Durden