Bears Capitulate: Institutions Hammered With 3rd Biggest Short Squeeze In History

Tyler Durden

Sun, 06/28/2020 – 18:30

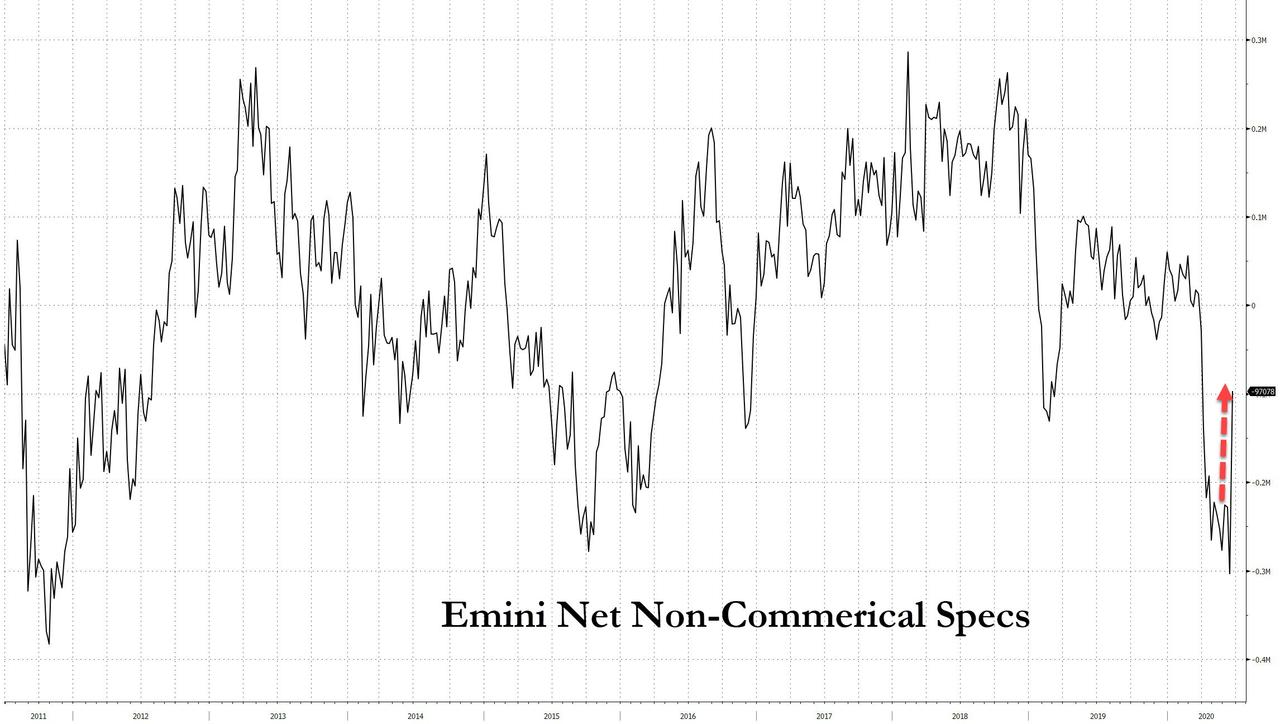

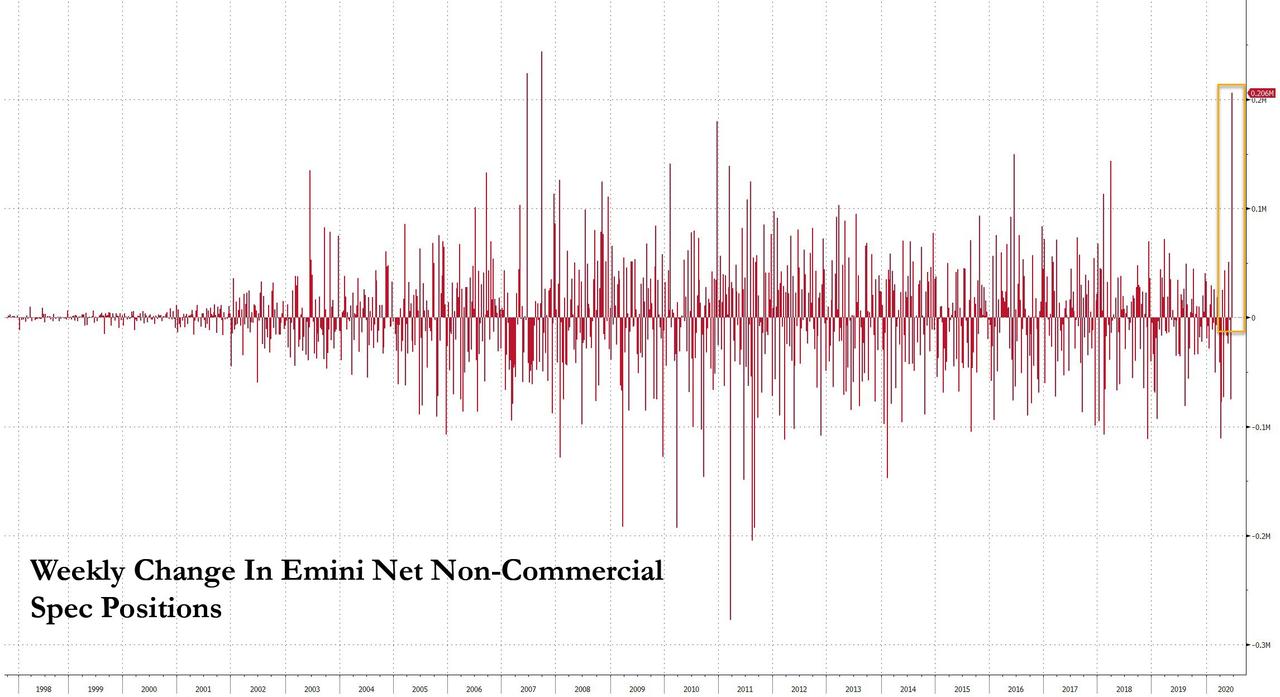

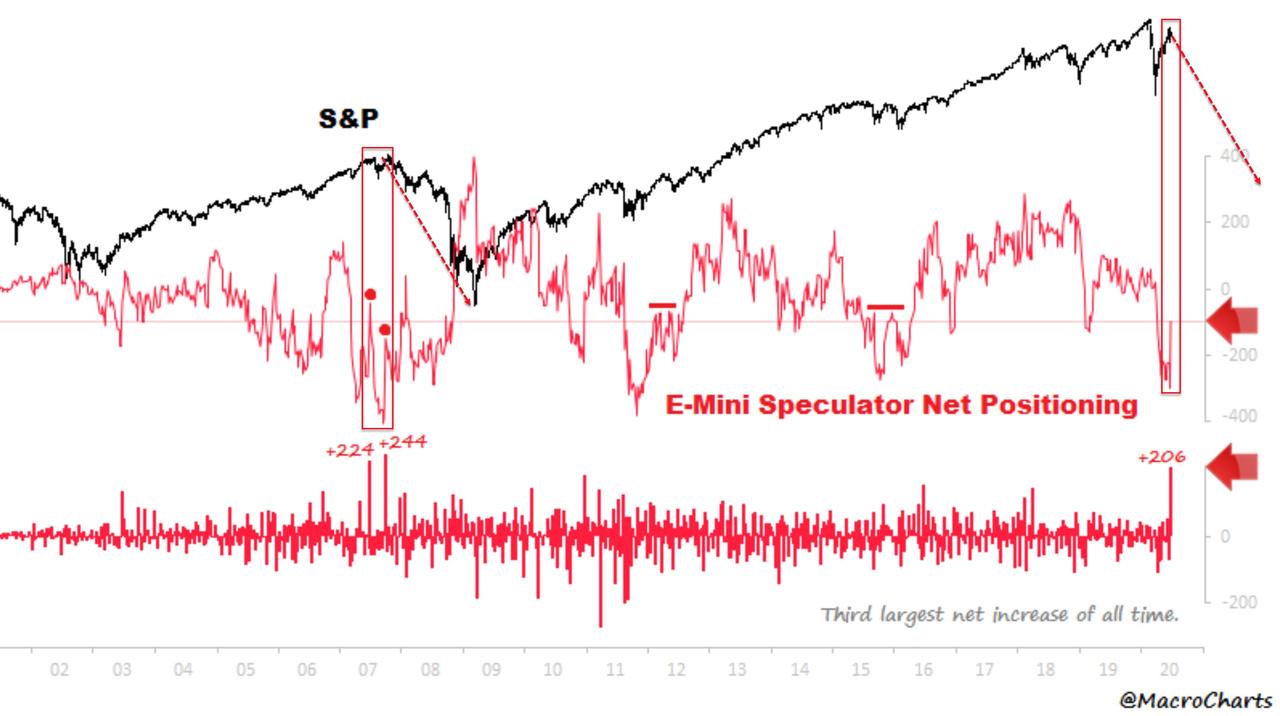

After three months of relentless contrarian bearishness by institutional investors, even as retail investors first, and hedge funds subsequently (latest HF net leverage is 99%-ile) flooded into stocks, large institutions such as vanilla mutual funds and pensions finally capitulated to the Fed which is now openly pushing stock prices higher. In the CFTC’s latest weekly futures data, the amount of net short covering of Emini futures among non-commercial speculative investors exploded, and was the biggest since 2007 and the third highest on record.

As a result, in the week ended June 23, ES net specs surged to -97,078 from -303,305 which was the biggest ES net short position since the Sept 2011 US credit rating downgrade. The collapse in short exposure of more than 206K contracts was the third biggest on record, and was surpassed only by two short-squeezes observed right around the time of the great quant crash in the summer of 2007.

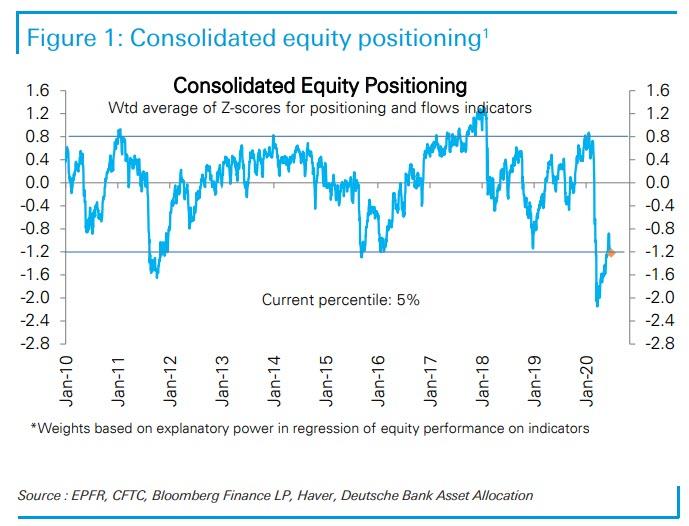

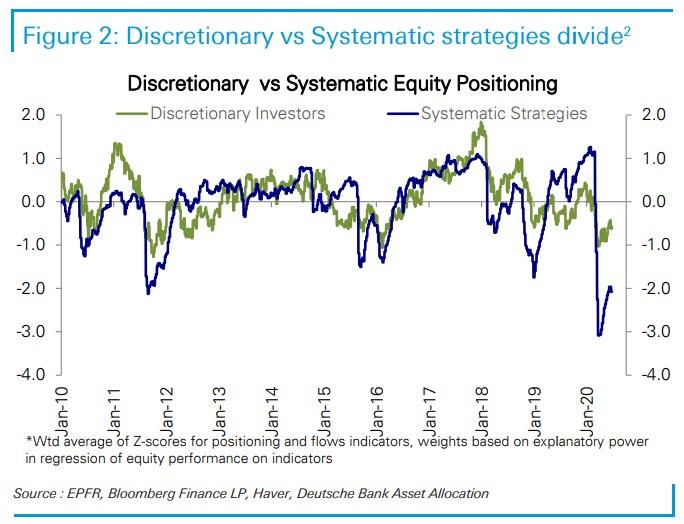

Were capitulating institutions the latest to ring the bell at the top of the market? It certainly seems like it: according to Deutsche Bank’s Parag Thatte, both consolidated….

… discretionary and systematic strategies, have all turned decidedly more bullish in recent days after mostly ignoring the recent market ramp.

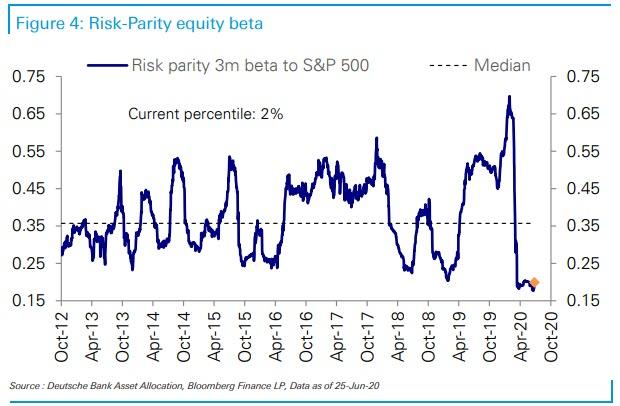

That said, Risk Parity funds continue to lag re-entering the market, which means that after suffering substantial losses on the way down, RP funds such as Bridgewater have failed to recover losses on the upside.

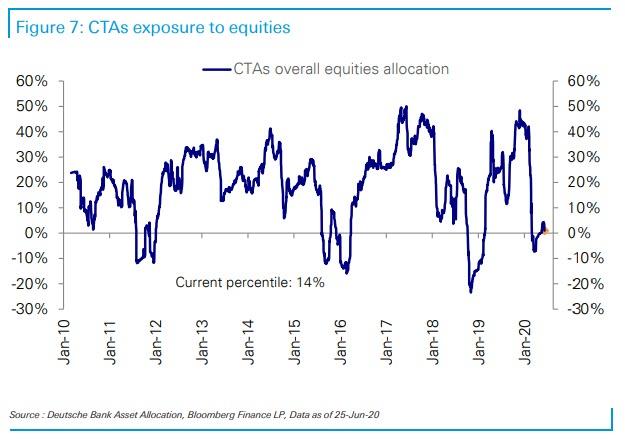

The same thing appears true for CTAs, which as we reported last week, have been flip-flopping on either side of bullish or bearish in recent months.

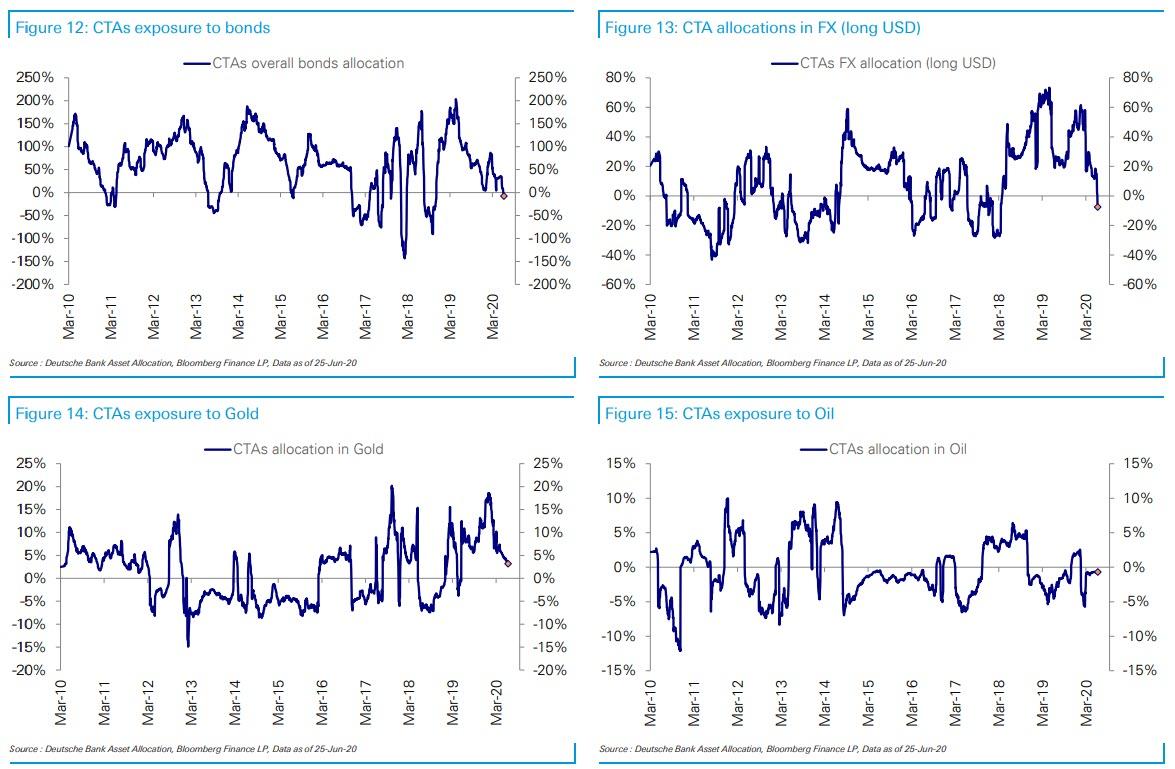

Curiously, the general chaos and lack of directionality across markets means that CTAs have zero conviction about any assets class, not just stocks, with bonds, USD, gold and oil all at roughly 0% exposure.

Incidentally, as MacroCharts showed after we first pointed out this surge in short covering, the last time we observed such a dramatic move higher in net short exposure – which is basically an unwind of downside hedges – the market predictably tumbled. We doubt this time will be different.

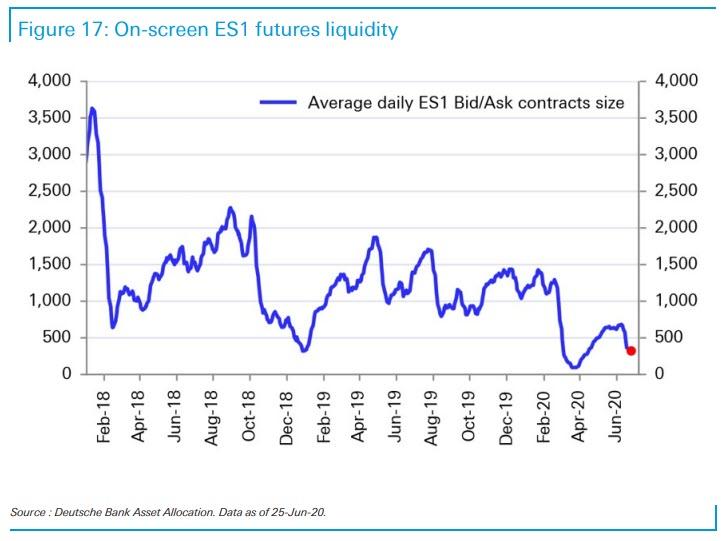

And what’s worse: at least in 2007 there was liquidity as markets were still markets, not reliant on the Fed to backstop even a modest 5% drop. Now, between HFTs that turn off at the smallest sign of trouble, and asset managers who go bidless the moments there is a -1000 TICK, liquidity is non-existant. Which is why all that would take to trigger the next crash is some concerted selling.

via ZeroHedge News https://ift.tt/387saBM Tyler Durden