Futures Slide In Early Trading

Tyler Durden

Sun, 06/28/2020 – 18:33

In a repeat of last Sunday’s gloomy open (which had fully reversed overnight with futures nice and green by morning), futures slumped after reopening at 6pm with two key catalysts emerging: i) coronavirus deaths around the world topped half a million and infections continued to mount in American states, coupled with ii) concerns about the growing advertiser boycott of Facebook.

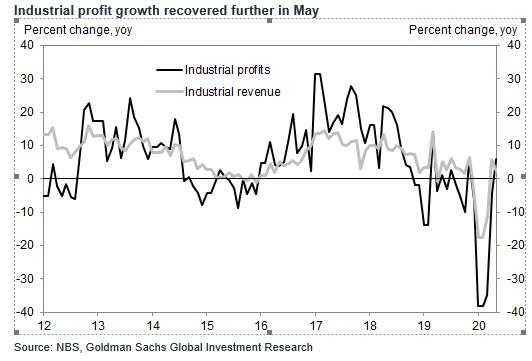

S&P 500 futures opened below 3,000, just as they did last Sunday, sliding to 2,988, or 0.6% lower, alongside oil and the dollar, while gold rose. However, there was some comfort over the weekend from the latest Chinese “data” which showed local industrial production growth was +6.0% yoy in May compared with -4.3% yoy in April, the first positive year-over-year growth since the virus outbreak as downstream industries continued to see stronger profit growth compared with upstream industries, and overall profit margins widened in May (that said, by now we doubt anyone believes any Chinese reporting).

Offsetting this boost to sentiment were growing fears about Facebook’s revenue base as a growing number of advertisers have announced intentions to halt spending on social media, undermining the company’s sales outlook and putting its stock price under further pressure. A partial list of the companies that have said they’re curtailing ad spending on Facebook and its peers is shown below:

- Unilever

- Verizon

- Hershey’s

- Honda

- The North Face

- Ben & Jerry’s

- REI

- Patagonia

- Eddie Bauer

- Upwork

- Mozilla

- Magnolia Pictures

- Birchbox

- Dashlane

- TalkSpace

- LendingClub

Bloomberg writes that “as more brands publicize plans to join boycotts or otherwise rein in ad spending, Facebook shares remain under pressure. The stock tumbled 8.3% Friday after Unilever, one of the world’s largest advertisers, said it would halt spending on Facebook properties this year, eliminating $56 billion in market value and shaving the net worth of Chief Executive Officer Mark Zuckerberg by more than $7 billion. Shares closed at $216.08 Friday after reaching a record $242.24 the preceding Tuesday.”

While no single company can significantly dent growth at Facebook, which generated $17.7 billion in revenue last quarter alone, a rising tally adds to pressure on other brands to follow suit, and when combined with a pandemic-fueled economic slowdown, the threat to Facebook deepens.

“Given the amount of noise this is drawing, this will have significant impact to Facebook’s business,” Wedbush Securities analyst Bradley Gastwirth wrote in a research note. “Facebook needs to address this issue quickly and effectively in order to stop advertising exits from potentially spiraling out of control.”

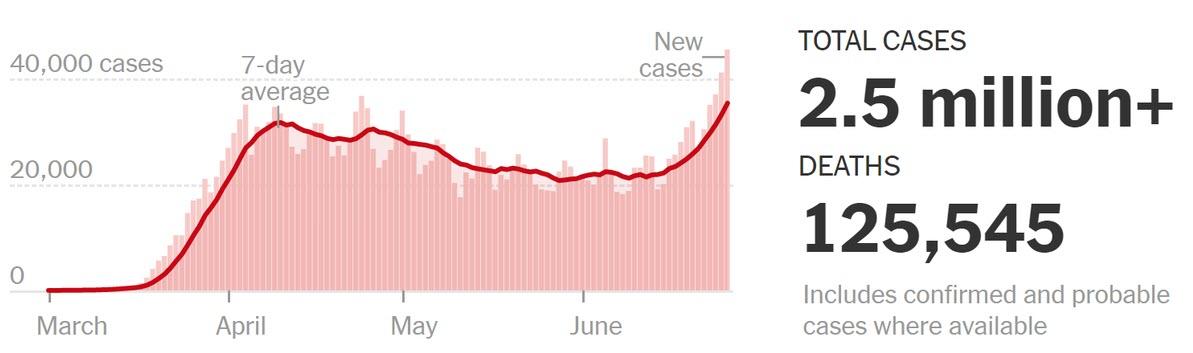

Facebook aside, the continued emergence of the coronavirus in several US hotspots has been the dominant theme for short-term sentiment. As of this weekend, global confirmed cases have now topped 10mln worldwide with the death toll nearing 500,000. As such, Amplify Trading writes that “it remains critical to remain vigilant for further updates with the daily US case numbers… now a main feature of the daily calendar. Below is a snaphot of the total cases and deaths in the United States as of 28th June 2020 via the NYTimes.”

Amid the growing uncertainty from the rising number of covid infections and fears about Facebook’s tech dominance, last week’s risk-off stance could endure.

Of course, central banks are on their way: as Bloomberg notes, China’s central bank said it will implement new monetary tools to make sure liquidity reaches the real economy. The People’s Bank of China said it will increase the proportion of smaller company, credit and manufacturing loans, and continue to lower lending rates, while reiterating that it will keep the yuan stable.

Looking ahead, here are some of the key events and features to keep a close eye on, courtesy of Amplify Trading:

Payrolls & Powell

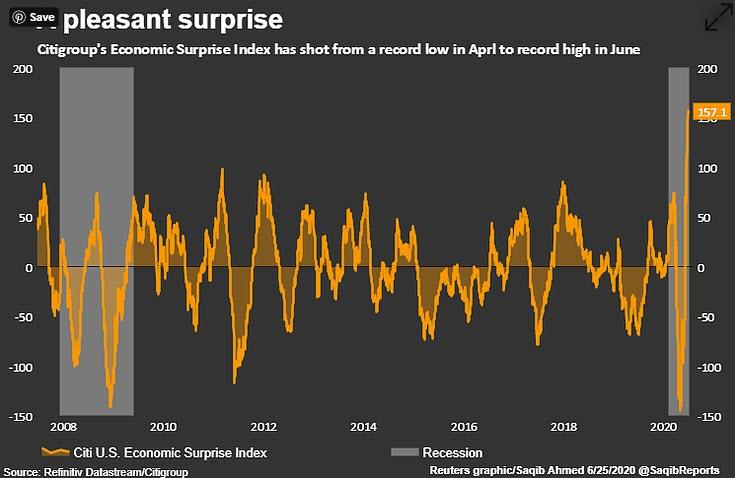

US Markets are closed on Friday due to the July 4th Independence Day holiday. As such, the latest US jobs report will be released on Thursday and I would make a mental note that the week as a whole will be somewhat front-loaded. Recent US economic indicators in the US have continued to surprise to the upside with the Citi Economic Surprise Index standing at a record high.

Expectations are that the US has added another 3.074mln jobs in the last month with unemployment expected to decrease once again to 12.3% from 13.3%.

However, I think it would be unwise to take these figures on face value as with an emerging second wave virus across several of the largest US states, in addition to the methodology quirks that have under reported the true level of unemployment, I think the data will do little to change markets current thinking.

Analysts at ING also note that average hourly earnings will fall sharply, but this is a statistical effect caused by lots of relatively low earning workers regaining employment, dragging the “average” level of hourly wages lower – therefore, it is meaningless.

On Tuesday, Fed Chair Powell is scheduled to testify again in Washington with Treasury Secretary Steven Mnuchin about the stimulus and lending facilities to support the economy in the pandemic. Although unlikely to be a market moving event it may give some indication as to the timing and appetite towards further stimulus measures from the US government following Trump’s comments last week that he favoured sending Americans another stimulus check..

Meanwhile, Wednesday night sees the release of the latest FOMC minutes which will be srutinised for any insights as to the risks to the recovery and what methods the central bank may adopt if the situation were to change.

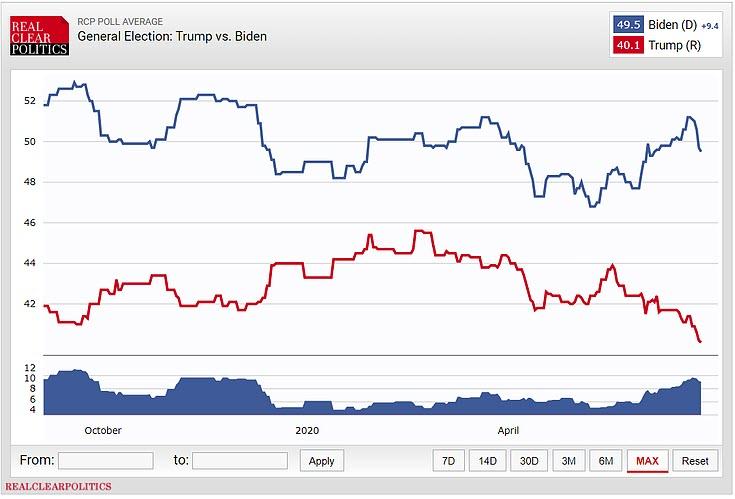

Is Trump already too far behind Biden?

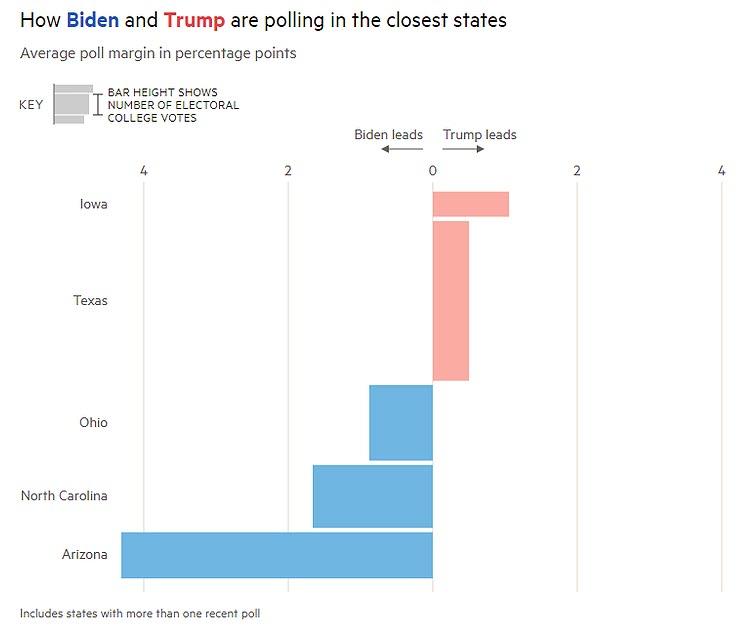

This was the headline from the FT’s Big Read this weekend and comes in the context of Biden holding a 9.4 point lead in the Real Clear Politics Average poll of polls.

The FT article explains how Trump’s ratings have nosedived as he has been criticised over his handling of the lockdown and the reaction to the killing of George Floyd. This has led to the President hitting the road again holding rallies in Oklahoma and Arizona, the latter being a crucial political pawn given the recent rise in COVID cases and a key battleground in the upcoming election.

By comparison, Biden has been hunkering down and in a similar tactic in what we saw the former Labour leader Jermey Corbyn deploy against Theresa May during the initial Brexit negotiations, he appears content to let Trump self-harm until these political hot potatoes cool off. The problem comes when, at some point, Biden will need to emerge and confront the combative President and therein lies the problem in my mind.

The FT notes that Biden has struggled to excite the Obama coalition of the young and people of colour and that is right where Trump has already been targeting the democrat candidate in numerous jibes and memes.

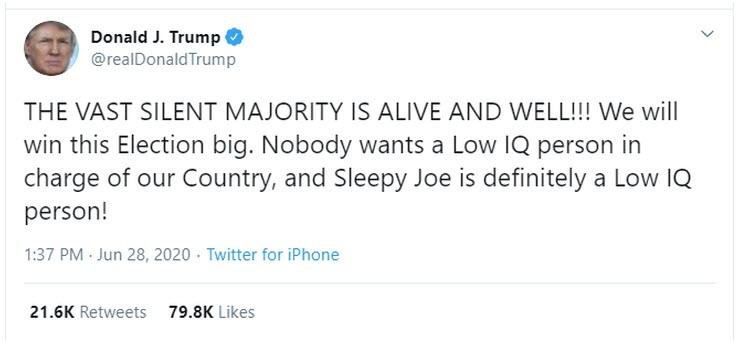

Although people are fully aware of Trump’s diversion and deflection tactics on Twitter, I still believe that this direct and unfilered line of communication is as effective as ever for the US President.

For now, my view is that the wound of division post the financial crisis never truly healed and the pandemic has only further amplified the underlying inequalities that exist in American society today. Although this should be the catalyst for change, I think it will only polarise the ‘law-and-order’ narrative over the coming months, whether that be against the protestors or the Chinese virus. As a result, I still see Trump winning the election come November, despite what the polls indicate as of today.

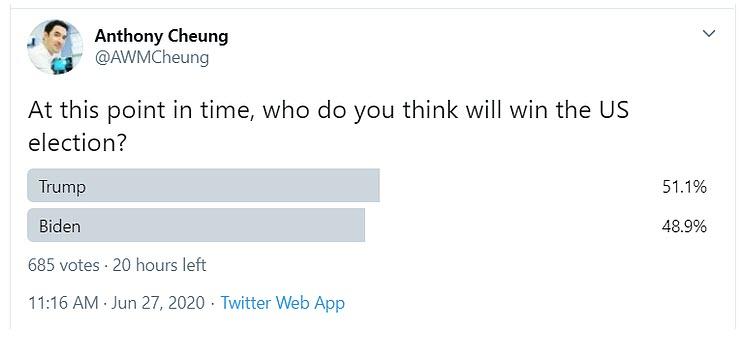

I asked my Twitter followers this weekend what they thought – this was the result:

Growing challenges in China

The Chinese central bank said on Sunday that the country’s economic growth faces challenges from the global coronavirus pandemic, despite signs of improvement amid business re-openings. The cautious observation comes ahead of the official manufacturing PMI data for June scheduled for release on Tuesday, which is expected at 50.6.

Despite the headline figure reflecting an expansion of the manufacturing sector, many analysts have begun to question the strength of the recent bounce back in confidence as the rest of the world continues to grapple with rising COVID cases and the subsequent impact on orders for Chinese products.

Not only this, reports in the SCMP this weekend say that a county in northern China (Anxin) has been “sealed off” with its 400,000 residents placed under tight restrictions after more than a dozen Covid-19 cases were reported – all linked to the Xinfadi market cluster in Beijing.

CALENDAR HIGHLIGHTS via newsquawk

Monday

- Data: Japanese Retail Sales, EZ Consumer Confidence (Final), Economic Sentiment, German CPI (Prelim)

- Speakers: Fed’s Daly, Williams, BoE’s Bailey & Vlieghe, ECB’s Schnabel

Tuesday

- Data: Japanese Unemployment, Chinese NB Official Manufacturing PMI, UK GDP, EZ CPI (Flash), Canadian GDP, US Consumer Confidence

- Speakers: Fed’s Powell & US Treasury’s Mnuchin Testify, Williams & Brainard, BoE’s Haldane & Cunliffe, ECB’s de Guindos, RBA’s Debelle

- Supply: Germany

Wednesday

- Data: Japanese Tankan, Chinese Manufacturing PMI (Final), German Retail Sales, Unemployment & Manufacturing PMI, EZ, UK & US Manufacturing PMI (Final), US ADP & ISM Manufacturing

- Events: Riksbank Rate Decision, FOMC Minutes

- Speakers: ECB’s Panetta, BoE’s Haskel

- Supply: UK

Thursday

- Data: US Labour Market Report, Initial Jobless Claims & Factory Orders

- Speakers: ECB’s Mersch & Schnabel

- Supply: French & UK

Friday

- Data: Australian Retail Sales, Trade Balance, EZ & UK Services & Composite PMIs (Final)

- Speakers: ECB’s Knot

- Holiday: US Independence Day

via ZeroHedge News https://ift.tt/3i9VwnD Tyler Durden