Royal Dutch Shell To Write Down Up To $22 Billion After COVID Hit

Tyler Durden

Tue, 06/30/2020 – 08:40

Royal Dutch Shell published its second-quarter 2020 outlook Tuesday morning, warning that it would write down up to $22 billion worth of assets and revise its long-term energy price outlook.

This is an update to the second quarter 2020 outlook provided in the first quarter results announcement on April 30, 2020. The impacts presented here may vary from the actual results and are subject to finalisation of the second quarter 2020 results.

Unless otherwise indicated, presented post-tax earnings impacts relate to earnings on a current cost of supplies basis, attributable to shareholders, excluding identified items.

In addition, given the impact of COVID-19 and the ongoing challenging commodity price environment, Shell continues to adapt to ensure the business remains resilient. In light of this, Shell is announcing today a revised long-term commodity price and margin outlook, which is expected to result in non-cash impairments in the second quarter results. Details of the outlook and impairments are provided in the later part of this document. – Shell second quarter 2020 update

Based on these reviews, aggregate post-tax impairment charges in the range of $15 to $22 billion are expected in the second quarter. Impairment charges are reported as identified items and no cash impact is expected in the second quarter. Indicative breakdown per segment is as follows:

Integrated Gas $8 – $9 billion, primarily in Australia including a partial impairment of the QGC and Prelude asset values

Upstream $4 – $6 billion, largely in Brazil and North America Shales

Oil Products $3 – $7 billion across the refining portfolio

– Shell second quarter 2020 update

Given the commodity bust and global economic downturn – Shell provides a revised outlook for spot Brent and NatGas:

-

Brent: $35/bbl (2020), $40/bbl (2021), $50/bbl (2022), $60/bbl (2023) and long-term $60 (real terms 2020)

-

Henry Hub: $1.75/MMBtu (2020), $2.5/MMBtu (2021 and 2022), 2.75/MMBtu (2023) and long-term $3.0/MMBtu (real terms 2020)

Shell shares trading on the Eurex Exchange is down 2.54% on Tuesday following the news of the write-down.

Credit Suisse analyst Thomas Adolff said the company’s write-down in the second quarter was already expected given market conditions. Adolff called the update a “wake up call.”

“While revised volume guidance looks weak in absolute terms, it was in fact better than previous guidance for 2Q,” he wrote.

Bloomberg Intelligence noted:

“However, better operational performance when prices are low and tax effects go against you does not, unfortunately, get you very far,” Bloomberg Intelligence says Shell’s forecast for asset impairments confirms BI’s view of a “historically weak quarter.”

RBC Capital Markets said the update in the second quarter is “much better” than the guidance provided at the end of April:

“Lower refining-margin assumptions over time were a bigger surprise than lower near-term price deck for oil and gas,” analyst Biraj Borkhataria wrote.

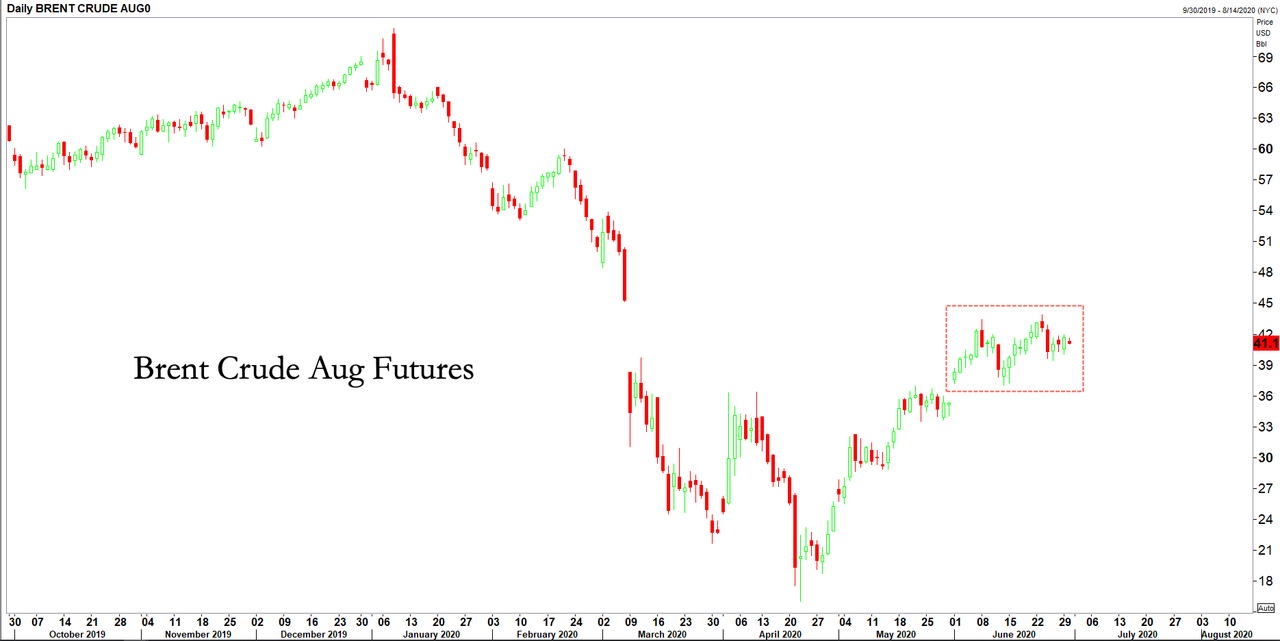

Brent crude August futures show prices have stalled in the 43-39 range for the last 20 sessions.

We noted last week that much of the “recent optimism in oil markets has left many analysts scratching their heads, with no real fundamental reason for the shift in sentiment.”

via ZeroHedge News https://ift.tt/2Zmra94 Tyler Durden