Banks’ New Dilemma: They Cannot Tell Who Is A Good Risk

Tyler Durden

Wed, 07/01/2020 – 13:24

Authored by Mike Shedlock via MishTalk,

Are people paying their bills on time? Thanks to Covid regulations, there is no way to tell.

Banks Are Flying Blind

Businesses are not allowed to report to the credit agencies who is in mortgage, credit card, or auto loan forbearance plans.

So how do banks decide who is a good credit risk when they are Flying Blind?

“Without accurate information, their only option is to pull back on credit,” said Michael Abbott, head of banking for North America at consulting firm Accenture PLC. “Banks don’t know who is going to pay and who isn’t. It’s like flying blind into a credit storm.”

Banks started tightening their underwriting standards in March, when the first wave of coronavirus layoffs began.

By early April, 33% of banks that responded to the Federal Reserve’s senior loan officer survey said they had increased their minimum credit-score requirements for credit cards over the previous three months, up from 14% in January. Bank respondents tightened lending standards for all consumer-loan categories tracked by the survey.

Loan originations have fallen, a result both of the tightening and a decline in consumer demand. An estimated 79,000 personal loans were extended in the week ended May 10, compared with 226,000 in the week ended March 22, according to Equifax Inc. Auto loan and lease originations fell to 266,000 from 390,000 during the same period. General-purpose credit-card originations totaled 483,000, down from 856,000. In 2019, weekly card originations rarely fell below 1.2 million.

Some lenders pay for phone data to see who is calling the unemployment office. Other lenders are using natural disaster codes instead of late payment codes.

TransUnion is selling data on deferrals but supposedly it is against the law for lenders to use it.

Fair Isaac is rolling out a new index to inform lenders how likely the applicant is to withstand financial difficulties during the downturn.

Lending Standards Tightest in Six Years

With lending standards at tightest in six years, it’s easy to see a higher % of pending home indications not come to fruition because of denied applicants

To your point, pending home sales will overshoot transactions until unemployment abates which is key to income verification https://t.co/xc5zqzXBSO

— Danielle DiMartino Booth (@DiMartinoBooth) June 29, 2020

Mortgage Applications

absolutely. as we hinted in past, lower mortgage approval rates. So need to take lending applications (MBA) with large pinch of salt. 💪 pic.twitter.com/ljHfD8blFx

— Τάκης Χριστοδουλοπουλος (@takis2910) June 29, 2020

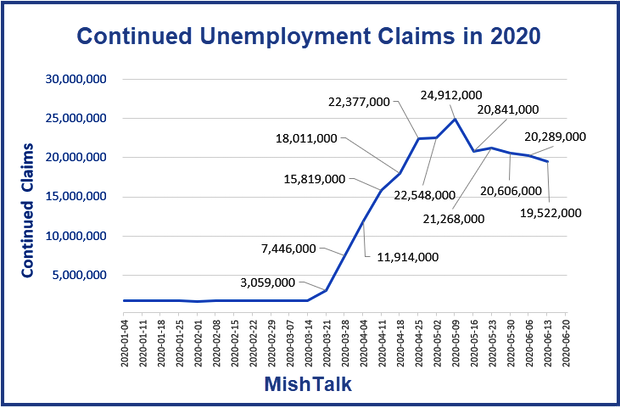

At Least 20 Million Out of Work

Impossible to Sugarcoat the Disastrous Unemployment Claims

There are close to 20 million unemployment claims a the state level. That does not count perhaps as many as another 10 million in federal payment protection programs.

For discussion, please see Impossible to Sugarcoat the Disastrous Unemployment Claims.

Mortgage Forbearance On the Rise

Mortgage forbearance plans topped the $1 trillion mark in unpaid principal last week.

These loans are not reported to credit agencies as delinquencies.

For details, please see Mortgage Forbearances Rise for the First Time in 3 Weeks

Since banks have no idea who is paying the bills, they have curtailed credit.

Meanwhile, reopenings are in reverse in several place including Arizona, Texas, and Florida.

Reopenings in Reverse

- Drinking Banned at Florida Bars and What About the NBA?

- Texas Shuts Bars at Noon as Covid Cases Surge

The only solution is more free money.

Got Gold?

In case you missed it, please see More Gold Hype: No Escape for Shorts

via ZeroHedge News https://ift.tt/3ip24PI Tyler Durden