Futures Slide In Downbeat Start To New Quarter

Tyler Durden

Wed, 07/01/2020 – 08:10

Following Tuesday’s last 10 minute spike which only emerged as there were not as many sellers as some had predicted (such as JPMorgan whose forecast of $170BN in forced quarter-end selling failed to materialize), global markets have been under pressure to start the new quarter, and S&P futures fell on Wednesday as today the corona mood was one of concern over hope (this is sure to reverse tomorrow) as a record single-day spike in coronavirus cases in the country heightened fears of another lockdown, while fresh signs of geopolitical tensions involving Hong Kong where the first protesters were arrested under the new security law also triggered some selling.

After notching up its biggest three-month gains since 1998 in the previous session, the S&P 500 looked set to begin the third quarter on a glum note as COVID-19 cases rose by more than 47,000 on Tuesday, with California, Texas and Arizona emerging as new epicenters. A warning from Anthony Fauci that the number of daily cases could soon double to 100,000 also took the shine off data showing a slump in global manufacturing was easing as economies reopened from sweeping lockdowns imposed to contain the spread of the novel coronavirus.

US equity futures extended losses after the U.K.’s foreign secretary said China’s national security legislation constitutes a “clear violation” of the autonomy of Hong Kong. Battered cruise line operators Norwegian Cruise Line Holdings, Royal Caribbean Cruises and Carnival Corp tumbled between 2.3% and 2.6% in premarket trading. In a bright spot, FedEx jumped 11.5% after posting better-than-expected quarterly profit and revenue, helped by a surge in pandemic-fueled home deliveries.

“We feel like a lot of the good news is priced in,” Jim McDonald, chief investment strategist at Northern Trust, said on Bloomberg TV. “The market’s got some optimism that we are going to see more of a V-shaped recovery, so there is risk of some modest disappointment.”

The Stoxx Europe 600 Index erased an earlier advance as data showed German unemployment rose to the highest level in nearly five years and U.K. businesses reported a record slump in sales.

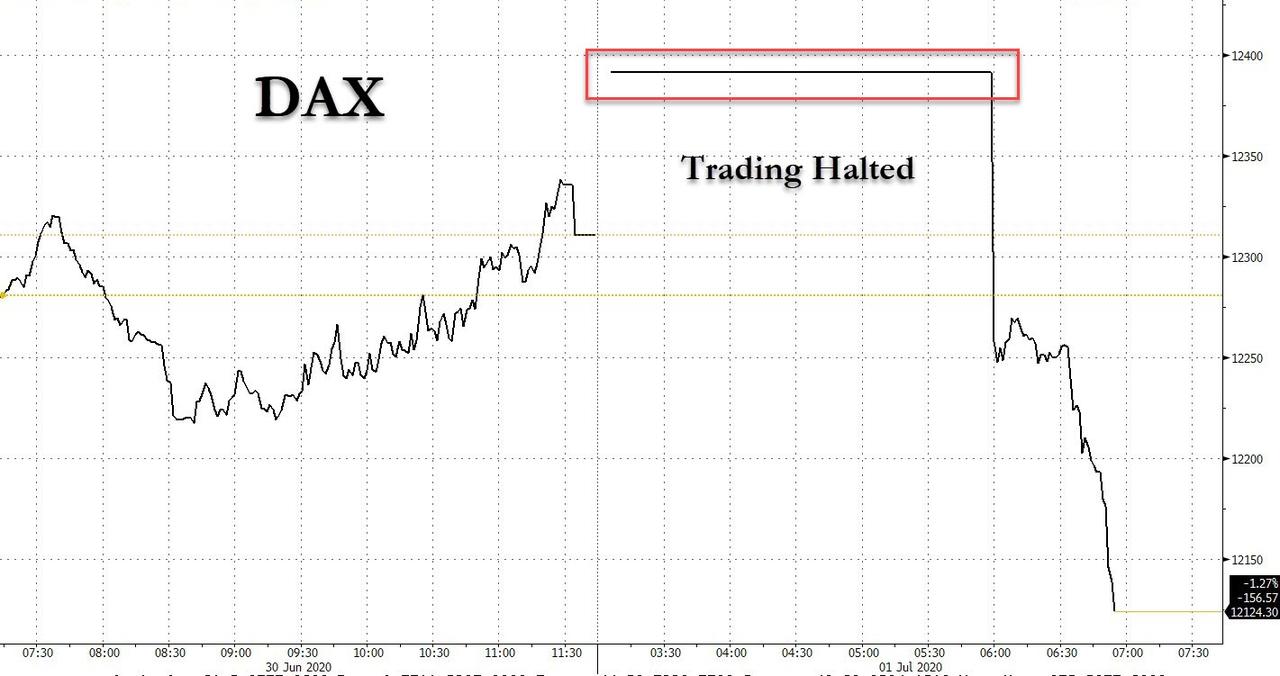

Many European markets were shuttered for much of the morning due to a technical outage at German electronic trading platform Xetra.

Asian stocks were little changed, with health care falling and energy rising, after rising in the last session. Most markets in the region were up, with Shanghai Composite gaining 1.4% and India’s S&P BSE Sensex Index rising 1.3%, while Japan’s Topix Index dropped 1.3% after data showed confidence among large manufacturers in Japan fell to the lowest since 2009, while stocks ticked higher in Shanghai and Sydney. The Shanghai Composite Index rose 1.4%, with Hebei Hengshui and Greenland Holdings posting the biggest advances. Trading volume for MSCI Asia Pacific Index members was 12% above the monthly average for this time of the day.

Yield edged higher and the dollar was steady ahead of minutes from the Federal Open Market Committee’s June meeting. Gold was near $1,800 an ounce.

Treasuries pressured lower following a wider bear-steepening move across the German curve. Gilts also pressured lower following drop in demand for U.K. 30-year bond sale, also weighing on Treasuries. Upside pressure on yields emerged from the cash open as month- and quarter-end support evaporates. Yields were cheaper by as much as 3bp across the curve with long-end- led losses steepening 2s10s, 5s30s by~2bp; 10-year yields around 0.68%, cheaper by ~2.5bp. Bunds and gilts underperform by around 1.5bp each vs. Treasuries, weighing into the early New York session. Five-year note’s yield declined to a record low 0.264% on June 30 with outperformance driven by expectations for Federal Reserve policy, specifically the prospect of yield-curve control.

In FX, the dollar reversed an earlier drop as risk assets slumped into the European trading session; the euro slumped to the lowest level in months while Norway’s krone was largely unchanged before rallying with oil prices. The yen gained against almost Group-of-10 currencies as Japanese shares declined and concerns over the spread of coronavirus spurred haven demand; the currency advanced agains the dollar for first time in six days. Sweden’s krona traded little changed against the euro after shrugging off the central bank’s decision to boost QE.

In commodities, oil rose after its best quarter in almost three decades following a report pointing to the first drop in U.S. crude stockpiles since May. Gold saw some modest weakness as risk assets rolled over.

Figures on U.S. manufacturing activity and private payrolls for June are due later in the day, followed by the Labor Department’s closely watched nonfarm payrolls report on Thursday. The closely watched FOMC minutes are also due at 2pm today.

Markets Snapshot

- S&P 500 futures down 0.2% to 3,085.75

- STOXX Europe 600 up 0.3% to 361.42

- MXAP down 0.01% to 157.85

- MXAPJ up 0.4% to 515.33

- Nikkei down 0.8% to 22,121.73

- Topix down 1.3% to 1,538.61

- Hang Seng Index up 0.5% to 24,427.19

- Shanghai Composite up 1.4% to 3,025.98

- Sensex up 1.4% to 35,411.86

- Australia S&P/ASX 200 up 0.6% to 5,934.40

- Kospi down 0.08% to 2,106.70

- German 10Y yield rose 1.7 bps to -0.437%

- Euro up 0.04% to $1.1238

- Brent Futures up 2.9% to $42.45/bbl

- Italian 10Y yield fell 3.9 bps to 1.131%

- Spanish 10Y yield rose 1.9 bps to 0.486%

- Brent Futures up 2.9% to $42.45/bbl

- Gold spot up 0.4% to $1,787.81

- U.S. Dollar Index down 0.1% to 97.27

Top Overnight News from Bloomberg

- German unemployment surged in June as one of the country’s leading economic research institutes warned of a slower-than- expected economic recovery from the coronavirus pandemic.

- Factories across the euro area recorded a stronger performance than initially reported in June, a final manufacturing PMI showed, with consumer-goods producers growing again. But despite countries easing restrictions and life slowly returning to normal, output continued to contract and demand — especially among exporters — remained weak

- China described Hong Kong’s new security law as a “sword of Damocles” hanging over its most strident critics, after Beijing asserted broad new powers to rein in sources of opposition, from pro-democracy protesters to news agencies to overseas dissidents

- A spike in Libor rates at the height of the coronavirus crisis drove up financing costs and offset the benefits of interest-rate cuts, the Financial Stability Board said

- The government of the euro zone’s third- biggest economy sold consumers a semi-retail bond called BTP Italia in May with record results, and now officials are marketing a first fully retail-based security for sale next week. This one is dubbed as BTP Futura

- Russian President Vladimir Putin is on course to secure a resounding endorsement of his bid to extend his two-decade-long rule potentially up to 2036, as the Kremlin faces criticism for its heavy-handed efforts to marshal support

- Asia’s factory managers saw glimmers of hope in June, with the region’s purchasing managers indexes turning up across the board as demand from China picked up

Asian equity markets began H2 with a mild positive bias after Wall St extended on gains to top off its best quarterly performance in over 2 decades amid vaccine optimism and outperformance in the energy and tech sectors, while better than expected Chinese Caixin PMI data also contributed to the upbeat mood in overnight trade. ASX 200 (+0.6%) and Nikkei 225 (-0.8%) both opened higher as they took impetus from their US counterparts with gold miners and tech front-running the gains in Australia, although the advances in Tokyo were later wiped out amid the negative BoJ Tankan survey which showed the outlook amongst the large manufacturers was at the weakest level since 2009. Elsewhere, Shanghai Comp. (+1.4%) was positive following reports the PBoC will lower rates for relending and rediscounting programs for small and agriculture-related firms by 25bps from today, and after Chinese Caixin Manufacturing PMI data topped estimates to print a 6-month high which conforms to the strong official PMI figures released yesterday. However, upside was capped given another firm liquidity drain by the PBoC and amid a holiday closure in Hong Kong for the anniversary of the handover to China, while the verbal tit-for-tat between the 2 largest economies in the world continues as China’s Foreign Ministry reiterated they will take retaliatory measures against the US removing preferential treatment for Hong Kong and with President Trump tweeting that he becomes more and more angry at China as the pandemic spreads globally and that tremendous damage has been done to the US. Finally, 10yr JGBs were lower after the bear steepening in US and as JGB yields continued to rise which saw the 30yr yield at its highest since March last year, while the BoJ’s presence in the market today and its increased purchases of 3yr-5yr maturities failed to spur prices.

Top Asian News

- Najib’s 1MDB Trial on Hold to Let Him Join Malaysia Politics

- Tokyo Offices Seen Facing Record Vacancies on Shift to Telework

- Hundreds of Protesters Gather Despite Ban: Hong Kong Update

- Secret Ballot Broke Deadlock in Vote on Samsung Heir’s Fate

A rocky start to the second half of the year with cash bourses opening flat/mixed whilst Eurex and Deutsche Boerse experienced an outage heading into the cash open. The APAC lead was mostly positive but the sentiment failed to sustain into European hours amid further tit-for-tat measures between US and China in which the latter tightened rules on four US media branches in China – a move that reciprocates US’ designation of four Chinese media outlets as foreign missions. Add to that the rising pushback against the Hong Kong National Security law which saw at least 30 people arrested hours after its implication. Furthermore, US House Speaker Pelosi called on US President Trump to sanction China under the Magnitsky act – which provides governmental sanctions against foreign individuals over human rights abuses or corruption, China said it will reciprocate if the US takes measures. Stocks are ultimately choppy in recent trade and have seen more pronounced downside after an earlier pickup, with France’s CAC (-0.9%) the current laggard, weighed on by shares in Renault (-4.3%) after the group stated it sees its French market contracting by some 20% this year, whilst Airbus (-2.3%) shares unwelcome the 15k global job cuts as the group does not expect a recovery to pre-crisis levels until 2023. Meanwhile, DAX Sept futures fell below a support level at 12,220 upon resumption of trade. Sectors are also mixed with no clear risk-tone to be derived; energy outpaces amid gains in the complex. In terms of individual movers, Wirecard (-26%) offices are said to be raided by investigators in relation to the deepening scandal, whilst sources noted that any sale of its subsidiaries needs to happen in weeks, which came after reports that chime with some last week regarding interests over parts of Wirecard. Sainsbury’s (-1.4%) failed to garner much traction despite noting that Q2 will mark the 11th consecutive quarter of strong double-digit online growth. Hammerson (-0.4%) is propped up after it announced steps to increase the covenant headroom and improve liquidity.

Top European News

- Euro-Area Manufacturing Stems Its Slump With Jobs at Risk

- Putin Set for Big Win in Vote That May Extend His Rule to 2036

- Fighting Italy’s Next Crisis Means Enlisting Citizen Help

- German Watchdog Faces Wirecard Grilling From Lawmakers

In FX, the SEK was not the biggest G10 mover, but in focus at the start of the new month given additional policy stimulus from the Riksbank in the form of an expanded and extended asset purchase remit and lower bank financing rates. However, the Bank left the benchmark repo unchanged as expected and its projected path steady at zero percent right through to Q3 2023 despite reiterating a ‘willingness’ to ease if necessary, although the fact that it opted to implement more QE rather than loosen conventional monetary policy indicates otherwise. Hence, Eur/Sek has remained relatively stable within a circa 10.4450-4870 range.

- JPY – The major outperformer, or at least extending its recovery from yesterday’s late lows to revisit offers and resistance vs the Dollar around 107.50, irrespective of a disappointing Tankan survey overnight and pretty downbeat comments from the BoJ. The Yen may have regained an element of safe-haven demand due to renewed unrest in Hong Kong just a day after China officially implemented its new National Security legislation.

- NZD/CAD/AUD – All firmer against their US counterpart as the DXY labours between tight 97.482-220 parameters well below Tuesday’s highs ahead of ADP jobs data, ISM manufacturing, construction spending and FOMC minutes. The Kiwi is pivoting 0.6450 where 1bn option expiries reside, the Loonie is meandering between 1.3586-46 and gleaning underlying support from firm crude prices, while the Aussie is clinging to the 0.6900 handle amidst conflicting drivers via another encouraging Chinese PMI in contrast to concerns over the situation in Melbourne caused by COVID-19.

- GBP/CHF/EUR – Somewhat contrasting fortunes for the Pound, Franc and Euro, as Sterling straddles 1.2400 following a fleeting venture above the round number as stops were tripped in Cable around 1.2403, but Usd/Chf bouncing ahead of 0.9450 following a deeper sub-50 Swiss manufacturing PMI and Eur/Usd running into supply just shy of 1.1250 even though Eurozone manufacturing surveys were broadly firm, German retail sales smashed consensus and unemployment was not as bad as forecast. Perhaps the single currency is conscious about recent failed approaches towards 1.1300 and decent option expiry interest at 1.1270-75 (1.9 bn), not to mention the fact that it breached technical support at 1.1205 (100 WMA) yesterday on the way down through 1.1200 to 1.1191.

- FIXED Bonds are extending losses in wake of another weak UK DMO auction that bucks the broad trend seen since funding requirements initially ballooned due to COVID-19 fiscal support. The 10 year UK benchmark has now been down to 136.96 (-68 ticks on the day), but still not as feeble as Bunds and the Eurozone semi-core that have succumbed to even more intense selling pressure since returning from their unscheduled Eurex break. Indeed, the 10-year German future is heading for a full point fall at 175.60 vs its previous 176.52 close, with French OATs not that far behind. Similarly, US Treasuries are feeling the weight of heavier bear-steepening impulses awaiting ADP, manufacturing ISM, construction spending and FOMC minutes.

In commodities, a session of solid gains thus far for the oil complex as WTI and Brent front month futures continue to feed off the substantially deeper-than-expected draw in Private Inventory Data (-8.2mln barrels vs. Exp. -0.7mln barrels), whilst the Iraqi total oil exports average decline markedly MM (2.8mln BPD vs. Prev. 3.44mln BPD); alluding to an improvement in compliance with the OPEC+ pact. WTI had extended on gains towards USD 40.50/bbl (vs. low 39.50/bbl) while its Brent Sep counterpart gains a footing over USD 42.50/bbl (low 41.55/bbl). Looking ahead, participants will be eyeing the weekly DoE’s in the absence of fresh macro news flow and ahead of the FOMC minutes. Elsewhere spot gold have given up recent gains to test 1780/oz to the downside albeit remains close to fresh 8yr highs amid safe-haven demand as COVID-19 cases resurface globally, with technicians eyeing 1789/oz for potential resistance (high 1788/oz). Shanghai copper meanwhile rose to its highest level in over five months amid rate cut hopes by the PBoC and better-than-forecast Chinese Caixin Manufacturing PMI. Finally, steel futures drifted lower with Shanghai rebar and hot-rolled coils prices declining amid seasonal demand drops.

US Event Calendar

- 7am: MBA Mortgage Applications -1.8%, prior -8.7%

- 7:30am: Challenger Job Cuts YoY, prior 577.8%

- 8:15am: ADP Employment Change, est. 2.9m, prior -2.76m

- 9:45am: Markit US Manufacturing PMI, est. 49.6, prior 49.6

- 10am: ISM Manufacturing, est. 49.7, prior 43.1

- 10am: Construction Spending MoM, est. 1.0%, prior -2.9%;

- 2pm: FOMC Meeting Minutes

- Wards Total Vehicle Sales, est. 13m, prior 12.2m

DB’s Jim Reid concludes the overnight wrap

I’ve got my first parents evening of my life today and in keeping with the new world it’s going to be via Zoom. My father used parents evenings to suggest that I should be top of the class in everything and that if I wasn’t it was the teacher’s failings not mine. He meant well and was deadly serious but it was incredibly embarrassing for me, my mum and was sadly and wildly misinformed. I’ve vowed to not follow in his footsteps on this front but who knows whether those competitive juices will flow when I’m told that little Maisie is mid-table at something.

There was nothing mid-table about Q2 performance in markets. This morning we start the second half of the year and over the next hour we’ll publish our June, H1 and Q2 performance review. Q2 was the best quarter for many assets for a few decades. So watch out for the note from Henry. H2 starts with PMIs this morning so watch out for these.

We’ve also published our H2 outlook for credit this morning (link here) where we see a bright Q3 but potential for the gains to be given up in Q4. There has been more two-way price action in credit over the last month with the recent rise in covid-19 cases in several US states impacting confidence. It’s too early to make firm conclusions but there is some evidence to suggest that they aren’t picking up anywhere near as high as they did across the globe in March and April. So while the rising case numbers will stall US re-openings and impact short-term economic activity and market sentiment, it could at least give us some confidence that we are treating the virus better and that the demographics of who is getting infected are changing for the better. As such there could be a medium-term silver lining to these worrying new case developments. A spike in fatalities soon will be a big negative though as the US will be back closer to square one in terms of the public health element of this crisis. For now this is not our base case scenario but this will unfold relatively quickly.

The view is that there’s enough pent-up economic demand to keep Q3 a positive one for economies and risk assets. We think credit is following equities again since the Fed became the buyer of last resort and positioning is light in equities which helps the technicals of all risk assets. So we expect tighter spreads in Q3.

However by Q4 economies will hit a limit well below pre-covid levels as social distancing prevents normality. At the same time a northern hemisphere winter will likely lead to a more indoor life, more caution, and fears over a resurgence of the virus. So at this stage we think you’ll see a reversal of Q3’s gains. In the note we highlight our short-term recommendations.

As a turbulent first half of the year came to a close, negative newsflow on the coronavirus continued but risk assets fought through the gloom and ended the day on a strong footing with the S&P 500 +1.54% and ending the quarter up +18.70% on a total return basis – the best since Q4 1998. This comes after Q1 was the worst since Q4 2008. More on markets later but in terms of the latest virus developments, the US continued to be the main source of bad news, with Texas announcing a further expansion of its ban on elective surgery to save capacity, while New York added 8 new states to its list from which arrivals would need to quarantine for 2 weeks. Meanwhile in Florida, cases rose by a further 4.2% (versus 3.7% the day before), with Dr Fauci saying that he was “quite concerned” about the rising caseload in a number of states. Arizona saw cases rise 6.3% over a two-day period (they had data issues yesterday on lab results) but with the average of those two days below the 5.0% average seen in the week prior. Notably, the Arizona Governor has closed bars, gyms, movie theaters, and water parks for the next month, citing the need to “relieve stress on our health care system and give time for new transmissions to slow.” Also yesterday, the United Auto Workers union in Texas asked GM to temporarily close its large-SUV plant in the Arlington after the daily average of new cases recently passed 5000 per day, further highlighting how the uncontained spread is having economic effects.

In a sign that this concern about the US is gaining traction internationally, the EU extended its travel ban for US residents. Puerto Rico, a U.S. commonwealth and heavily reliant on tourism, is also now requiring travellers to show evidence of a negative Covid-19 test or submit to a two-week quarantine.

We would again stress that there is still no sign of fatalities gathering much momentum in these troubled US states though. Arizona is the worst on this measure but still well behind the trends seen elsewhere in the first wave. A crucial few days awaits though but one that could start to change the way we collectively think about the virus.

Back to markets and tech stocks led the advance in equities yesterday, with the NASDAQ up +1.87% (+12.67% YTD and +30.95% in Q2 alone). Energy stocks were the best performing S&P sector on the day as Saudi crude exports for June fell to 5.7mln barrels a day, the lowest since Bloomberg began tracking the data at the start of 2017. Even still, oil prices moved marginally lower on the day, with WTI down -1.08% and Brent down -1.34%. As with US equities it was a particularly strong quarter for crude prices, with Brent rallying +80.96%, the most since Q3 1990.

Over in Europe, indices closed lower for the most part missing the late US rally, with the FTSE 100 (-0.90%) and the CAC (-0.19%) both losing ground. However a strong performance from German stocks, where the DAX rose +0.64%, helped the Stoxx 600 to eke out a +0.13% gain. In particular it was technology stocks outperforming in both the Stoxx 600 (+1.24%) and DAX (+1.79) that caused the indices to remain above water.

In response to the US rally, Treasury yields climbed +3.3bps to 0.656. In Europe there was a divergent performance between core and periphery, with 10yr bund yields +1.6bps, whereas peripheral yields including those on Italian (-4.0bps) and Greek (-4.9bps) debt fell. Finally in commodity markets gold set new records as it closed up +0.46% at a fresh 7-year high, and copper similarly continued to climb, rising +1.27% to a fresh 5-month high. As you’ll see in our performance review Gold is the leading asset class YTD and is up around 17.38%.

The majority of Asian markets have started Q3 on the front foot with the Shanghai Comp (+0.91%), Kospi (+0.88%) and ASX (+0.59%) all up. The exception is the Nikkei (-0.20%) while Hong Kong is closed for a holiday. In FX, the Japanese yen is up +0.27%. Meanwhile, yields on 10y USTs are up +2.4bps and futures on the S&P 500 are down -0.19% as we type. In commodities, oil prices are up c.1% and spot gold prices are up +0.19%.

Overnight, China’s Caixin June manufacturing PMI showed steady improvement, printing at 51.2 (vs. 50.5 expected and 50.7 last month). Japan’s final manufacturing PMI reading also got revised up to 40.1 from 37.8 in the flash. Other manufacturing PMI readings in the region also improved with Australia printing at 51.2 (vs. 49.8 in flash), Vietnam at 51.1 (vs. 42.7 last month), Taiwan at 46.2 (vs. 41.9 last month) and South Korea at 43.4 (vs. 41.3 last month). It’s worth noting however that while the trend is positive, the majority of PMIs are still below their pre-Covid levels.

In other news, Hong Kong’s new security law came has come into force and City’s Chief Executive Carrie Lam reiterated that the law wouldn’t impact Hong Kong’s high degree of autonomy or judicial independence. Yesterday UK PM Johnson said that he was “deeply concerned” about the law, and Australia said it was “troubled”, while the Trump administration has vowed “strong actions”.

In other news, Fed Chair Powell and Treasury Secretary Mnuchin appeared before the House Financial Services Committee yesterday. Chair Powell stressed the need to keep the virus at bay for the US recovery to take hold, while also noting that the bounce back in economic activity is “sooner than expected.” The Fed chair indicated that, a “full recovery is unlikely until people are confident that it is safe to re-engage in a broad range of activities.” The question remains if that is before a vaccine is delivered. Secretary Mnuchin said that it was the administration’s goal to get another round of fiscal stimulus done by the end of July, while not indicating if it would be based off the $3.5trn bill that was passed by the House in May. Senate Majority Leader McConnell called that bill a non-starter and that his caucus would draft a bill, with Bloomberg reporting that Republicans want to keep the overall cost under one trillion.

Here in the UK, Prime Minister Johnson confirmed yesterday that there would be no return to the type of austerity we saw in 2010 as the UK seeks to recover from the economic effects of the pandemic. Nevertheless, our UK economist Sanjay Raja writes (link here) that while austerity in its previous form is not an option, there won’t be any blank cheques either, with Chancellor Sunak already having noted that the bar for state bailouts is “very high”. Finally on the UK, it’s worth noting some comments from the BoE’s chief economist Haldane (who was the only one of the MPC not to vote for further QE at the last meeting), who said that since the May meeting, “positive news on demand has, in my opinion, more than counterbalanced the rise in downside risks to employment.”

Looking at yesterday’s data, the main highlight was the flash estimate of Euro Area CPI, which rose to +0.3% in June (vs. +0.2% expected). Core CPI fell by a tenth to 0.8% however, it’s lowest in over a year. With the higher-than-expected inflation, market expectations also rose, with five-year forward five-year inflation swaps for the Euro Area at 1.12%, their highest level since early March.

In terms of other data, the contraction in the UK’s Q1 GDP was revised to show a larger -2.2% fall (vs. 2.0% previously). Meanwhile French inflation in June fell to a 4-year low of +0.1% (vs. +0.5% expected), while the Italian reading sunk into deflationary territory with a -0.4% reading that also marked a 4-year low. On the other side of the Atlantic, Canadian GDP fell by -11.6% month-on-month in April. And in the US, we got the MNI Chicago PMI for June, which rose by less than expected to 36.6. However the Conference Board’s consumer confidence indicator from the US rose to a stronger-than-expected 98.1 (vs. 91.5 expected), and the expectations reading was also up to a 4-month high of 106.0.

To the day ahead now, and the highlight will likely be the manufacturing PMIs for June, along with the ISM manufacturing index from the US. Otherwise, from Germany there’ll be May’s retail sales as well as the unemployment report for June, while in the US there’ll also be June’s ADP employment report and May’s construction spending. From central banks, we’ll get the FOMC minutes from their June meeting, along with remarks from the Fed’s Evans, the ECB’s Panetta and the BoE’s Haskel. Finally, Germany will today take over the rotating presidency of the EU, while the USMCA trade agreement will come into effect.

via ZeroHedge News https://ift.tt/31AtHPE Tyler Durden