Dip-Buyers Rescue Big-Tech From Dreaded Down-Day As Bond Yields Plunge

Tyler Durden

Thu, 07/09/2020 – 16:00

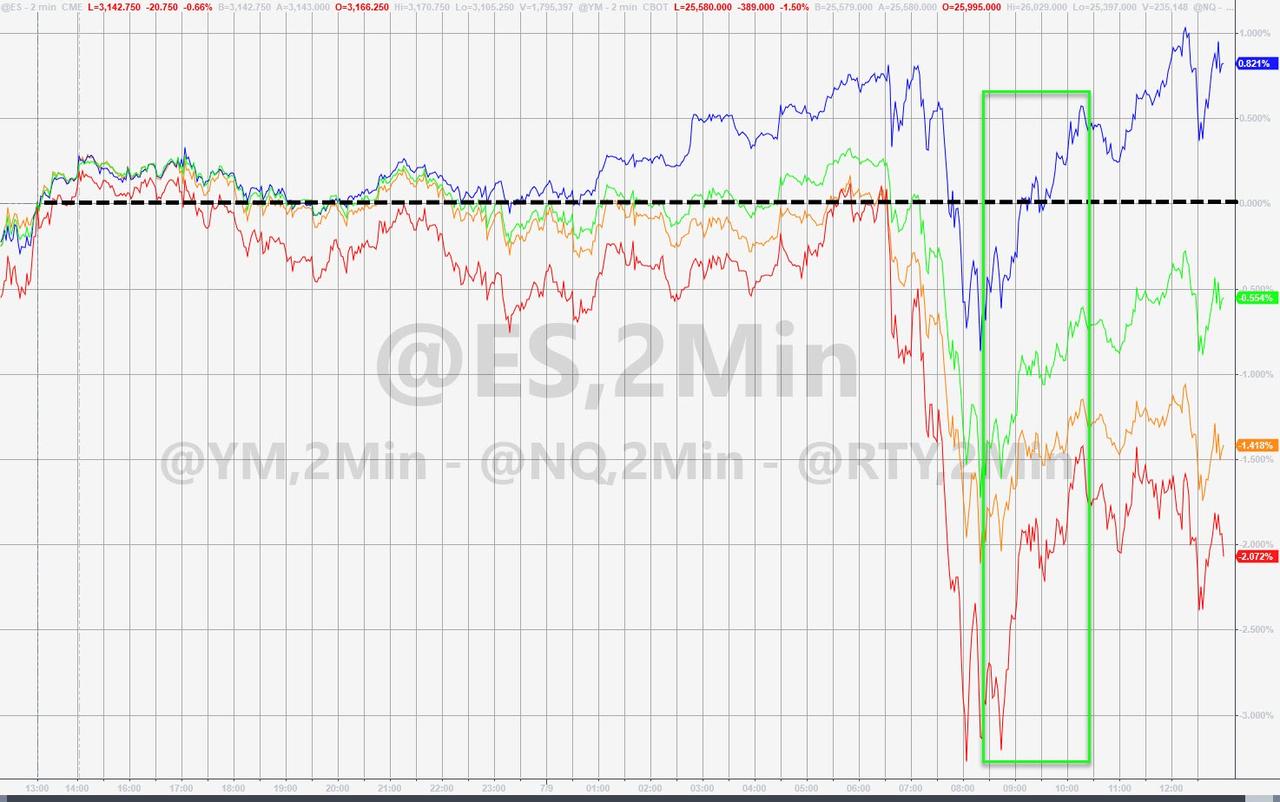

Another day, another dip-buying panic to rescue the Nasdaq from the terrible outcome of a down-day, instead another record high.

Overnight was the standard slow and steady rally and then these events hit, taking the shine off the gains:

-

0935ET *U.S. READYING FEDERAL CONTRACT BAN FOR COS. USING HUAWEI: RTRS

-

1010ET *SUPREME COURT SAYS N.Y. GRAND JURY CAN GET TRUMP’S TAX RETURNS

-

1100ET ARIZONA CASES/DEATHS

But as soon as Europe closed, US stocks were magically bid once again, with only Nasdaq back in the green…

The sellers have been sanctionedhttps://t.co/CDNXwkVtGw

— zerohedge (@zerohedge) July 9, 2020

We note that Biden gave an economic speech in the last hour and appeared to spook stocks with these

-

1520ET *BIDEN: ENDING THE ERA OF ‘SHAREHOLDER CAPITALISM’ IS OVERDUE

-

1530ET *CHINA IPHONE JUNE SELL-IN DATA WEAKER THAN EXPECTED: NOMURA

and then this sent stocks vertical…

-

1548ET *TRUMP SAYS ON TRACK TO LAUNCH VACCINE `VERY SOON’

The Dow remains rangebound between key technical levels…

Is someone “meddling with the primal forces of nature…”?

And bear in mind that while Nasdaq roars to record-er and record-er highs, the rest of the major US equity indices all topped a month ago…

Source: Bloomberg

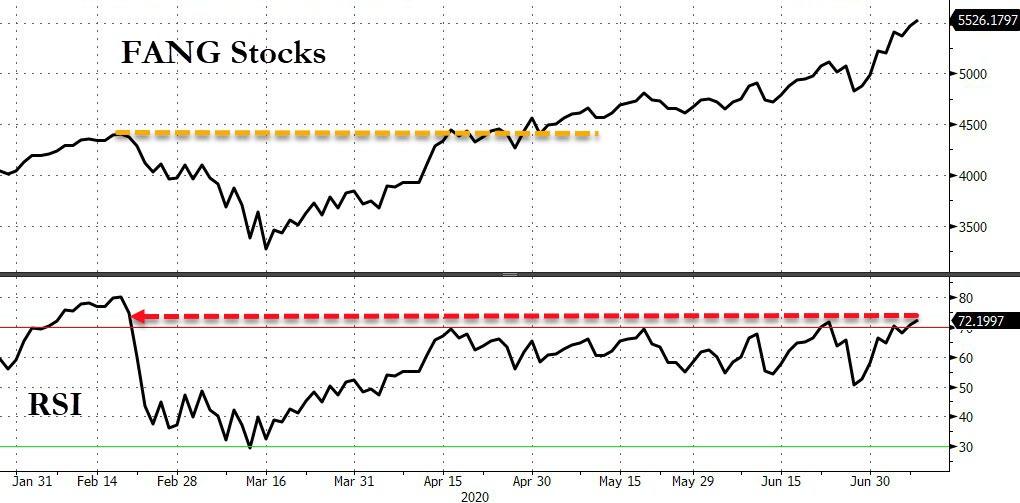

FANG stocks soared to a new record high, reaching the most overbought since the February peak…

Source: Bloomberg

Virus ‘Fear’ rose notably today…

Source: Bloomberg

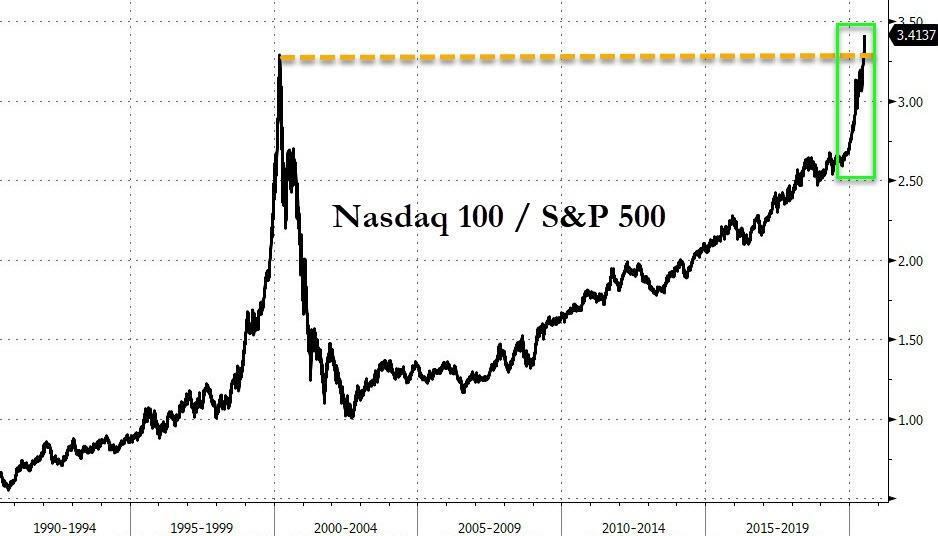

It’s different this time…

Source: Bloomberg

Nasdaq has a little further to run against Small Caps to reach peak crazy…

Source: Bloomberg

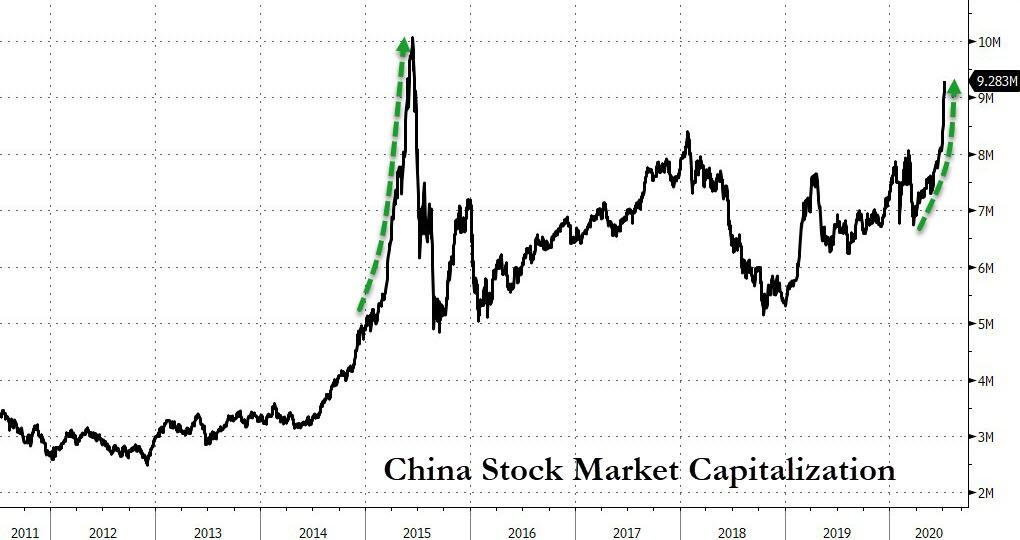

And don’t forget, China stock market cap is exploding too…

Source: Bloomberg

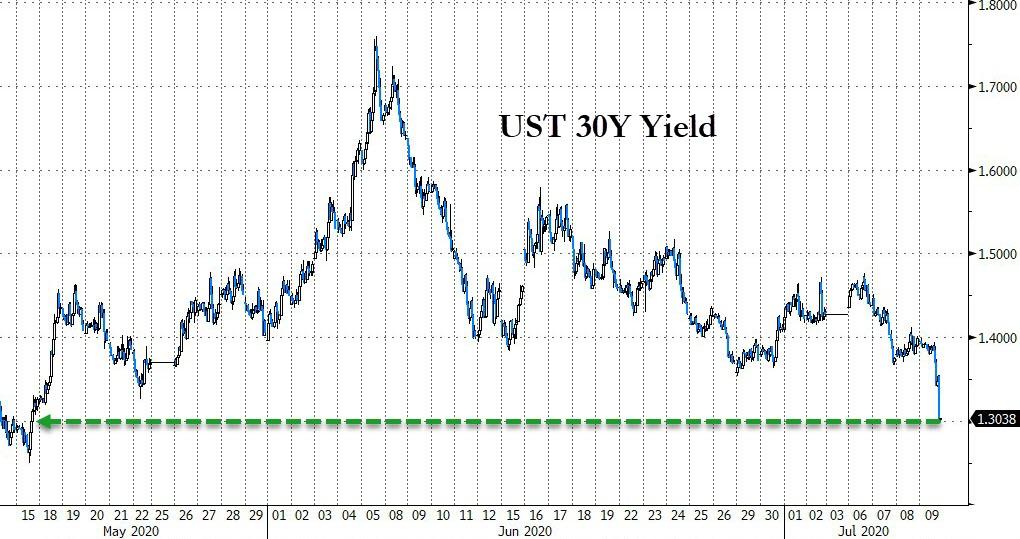

A super-strong 30Y auction helped extend gains in bondland with Treasury yields tumbling on the day with considerable flattening (30Y -9bps, 2Y -1bp)…

Source: Bloomberg

Pushing 30Y Yields back two-month lows (30Y back below 1.30% and 10Y back below 60bps)…

Source: Bloomberg

The yield curve is now at its flattest in two months…

Source: Bloomberg

The dollar bounced back today as stocks and bond yields fell, bouncing off support…

Source: Bloomberg

The DXY dollar index rallied today after making a death cross on Wednesday…

Source: Bloomberg

Cryptos were lower today but are all holding gains on the week (for now)…

Source: Bloomberg

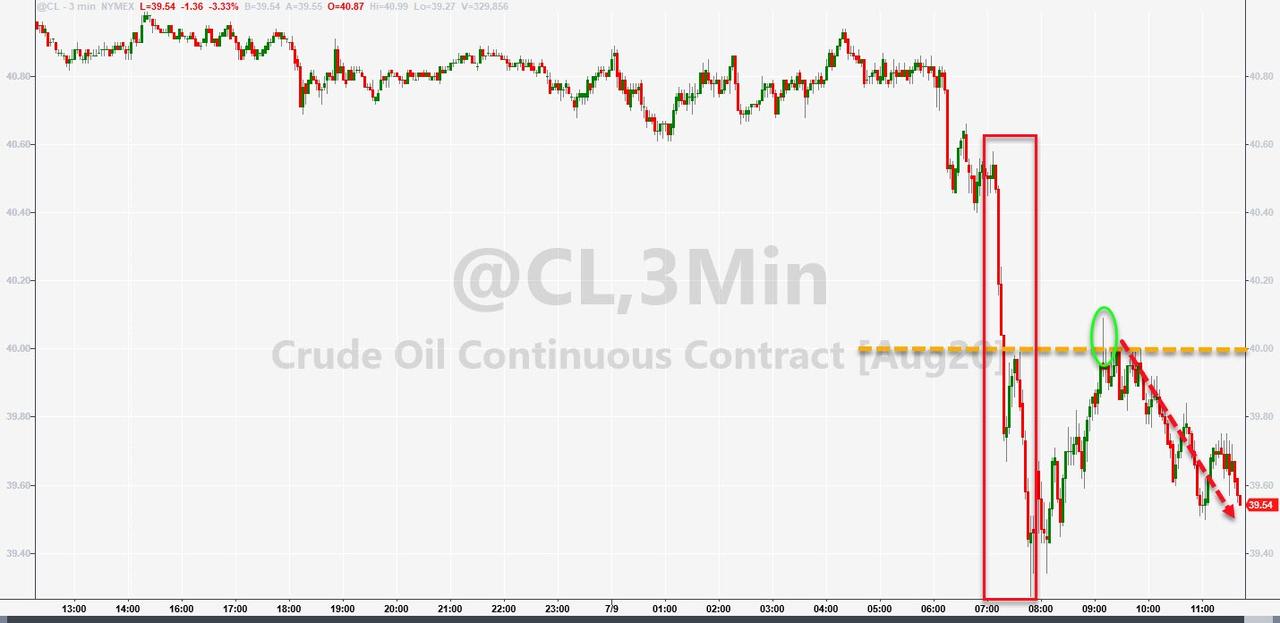

Copper was higher (again) on the day but crude and precious metals slipped lower…

Source: Bloomberg

WTI tumbled early on the headlines above, was ramped back to tag $40… then fell back…

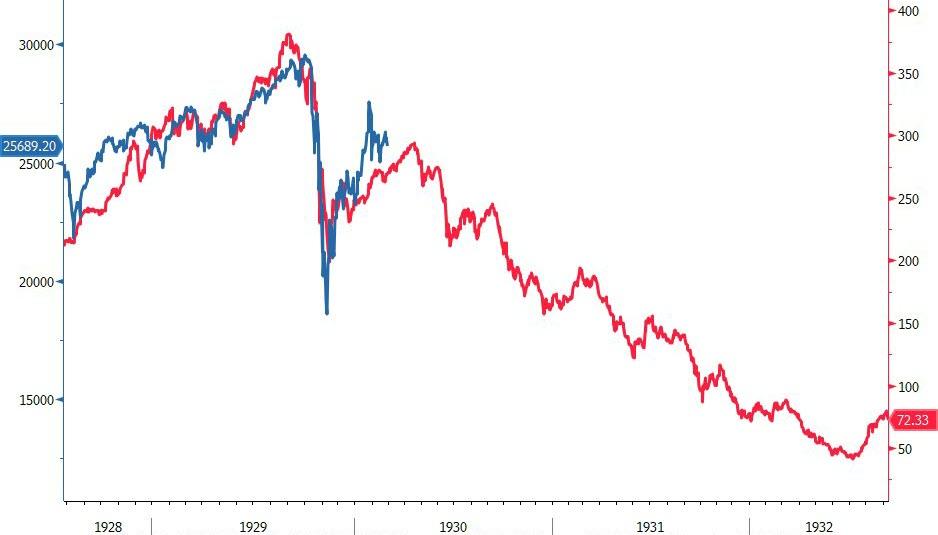

Finally, there’s the total decoupling between stocks and bonds…

Source: Bloomberg

And good luck to whoever is buying these FAAMG stocks at almost 30x…

Source: Bloomberg

What could go wrong?

Source: Bloomberg

So to sum the day up… Dow down, S&P down, Small Caps down, Transports down, Crude down, Bond yields down… but Nasdaq up thanks to FANG new record highs.

via ZeroHedge News https://ift.tt/38SGAX7 Tyler Durden