S&P Forecasts $2.1 Trillion In Global Bank Credit Losses Over Next Two Years

Tyler Durden

Thu, 07/09/2020 – 14:31

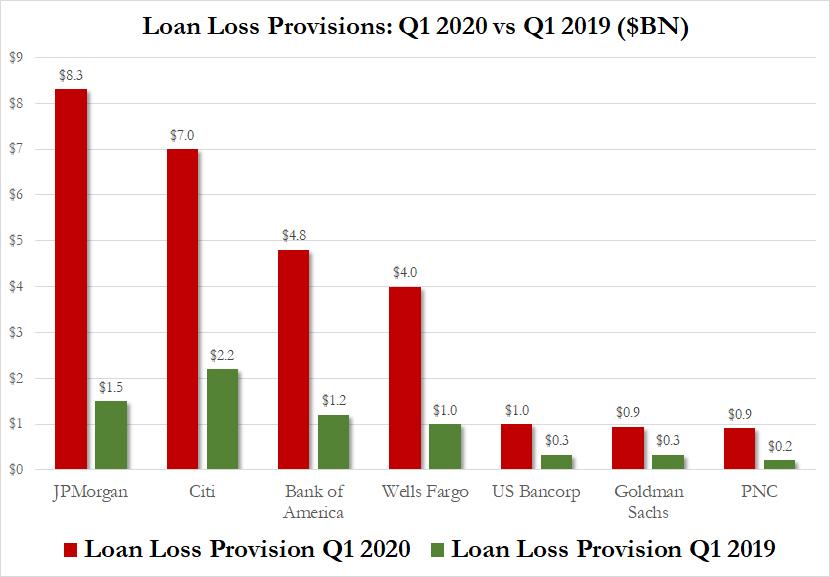

Three months ago, when US commercial banks reported a surge in loan losses in Q1 earnings as a result of the covid pandemic, we said that the banks have a “big problem”, because while the largest US banks did anticipate a nearly 4x surge in loan losses from a year ago…

… this was nowhere near enough to account for the deluge of total losses that we coming.

However, it now appears that even our pragmatic assessment will end up obliviously optimistic if S&P analyst Osman Sattar is correct.

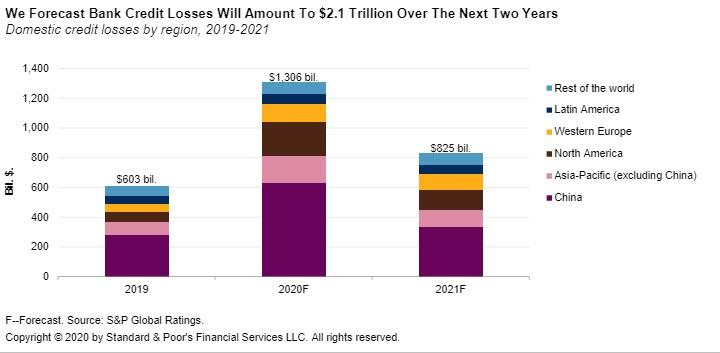

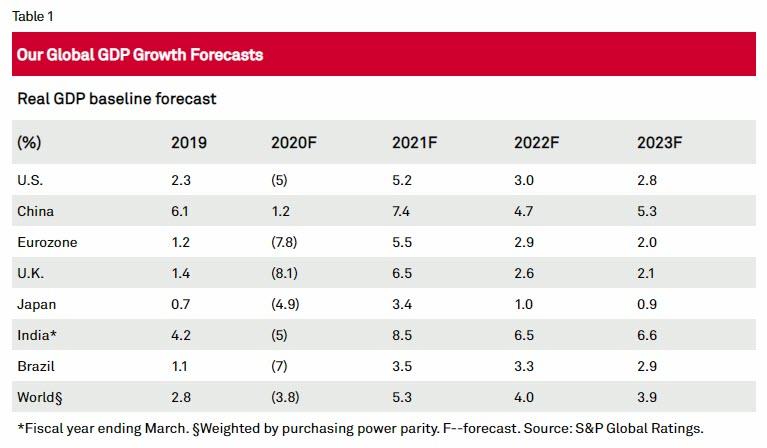

In a new note published by S&P Global Ratings, the agency correctly anticipates that the COVID-19 pandemic and responses to it will have huge and long-lasting effects on bank asset quality. In fact, across the 88 banking systems S&P Global Ratings covers, S&P forecasts their credit losses will be about $1.3 trillion in 2020–more than double their 2019 level of $0.6 trillion.

And while S&P is optimistic enough to project a strong recovery in 2021, it still expects losses in that year will be a staggering $0.8 trillion, more than one-third above the 2019 level: “Indeed, we expect that 2019 marked the end of a multiyear period of benign credit losses for banks globally”, according to Sattar.

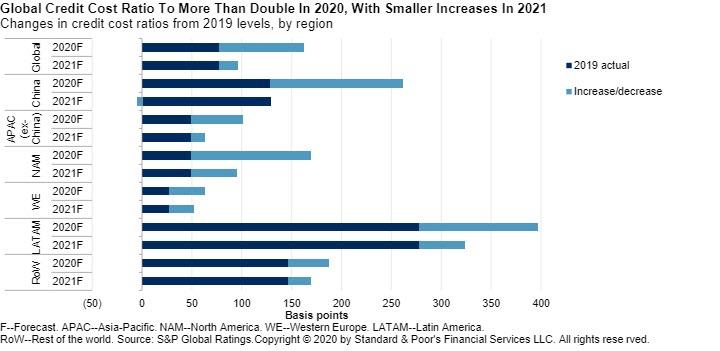

Looking at 2020, S&P expects that on a global scale, bank credit cost ratios in 2020 will be around 160 basis points (bps), more than double their 2019 level of 78 bps.

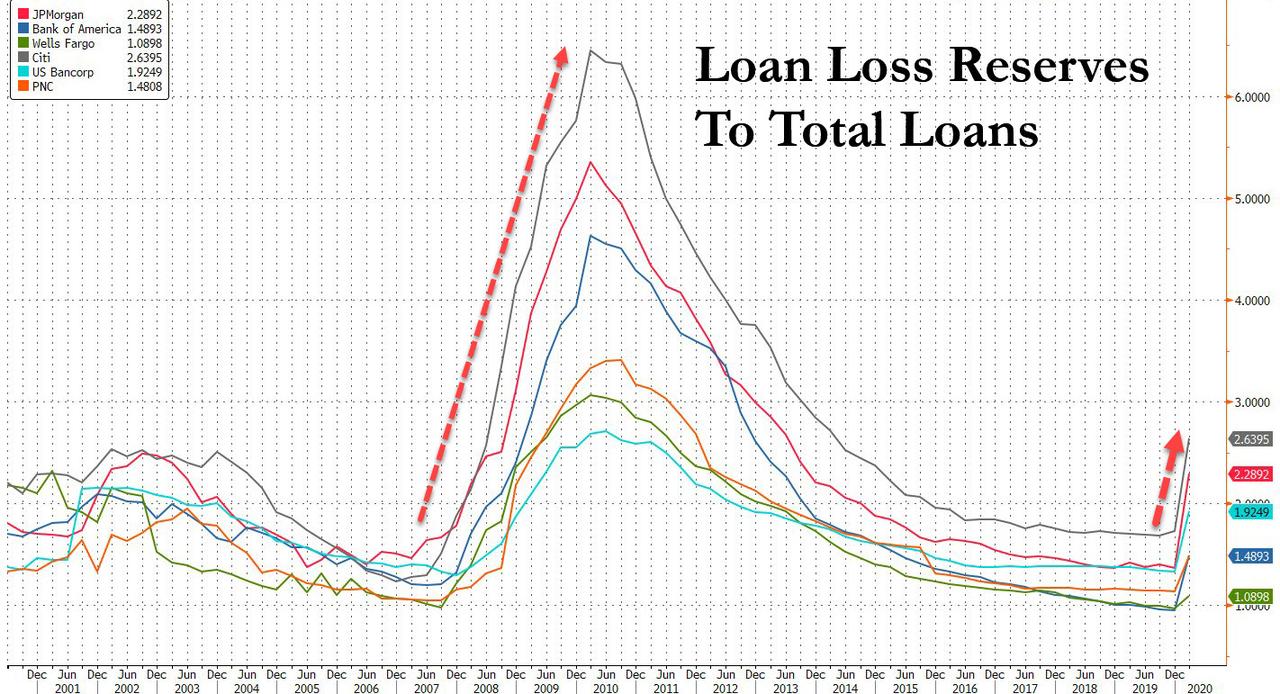

The rating agency estimates this ratio was around 100 bps to 120 bps in the aftermath of the 2008-2009 global financial crisis, which confirms our speculation from April that banks will need to take far, far more loss reserves to catch up to the upcoming dismal reality. Furthermore, current accounting rules require a more timely recognition of credit losses than during the financial crisis. On the other hand, the composition of global lending is more weighted toward developing-market economies (including China) that tend to have weaker asset quality, and that the financial crisis had a more limited effect on loan asset quality in some regions (including Asia-Pacific, for example) than S&P expects to be the case now.

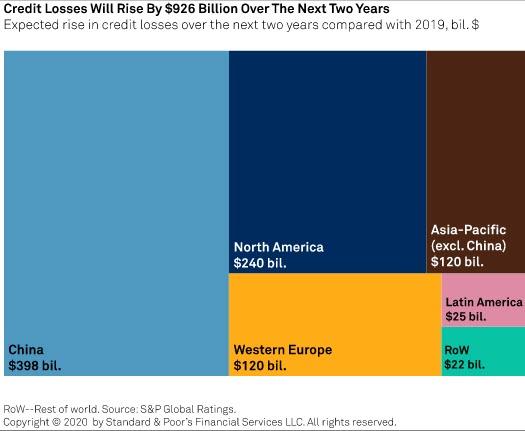

As shown in the next chart, S&P projections for credit losses vary widely among regions, in size and timing of their recognition. Of the $926 billion total increase in credit losses, the agency forecasts over this year and next (from the 2019 level), Asia-Pacific accounts for $518 billion, dominated by $398 billion of losses in China. In large part, this reflects the sheer size of the Chinese banking system in a global context. In terms of customer loans, the Chinese banking system is approximately the same size as the U.S., Japanese, German, and U.K. banking systems combined. Moreover, the banking system in China is relatively much more important in the supply of credit to its economy than the U.S., where borrowers can typically benefit from a deep, liquid, and mature bond market, a large nonbank financial institution sector, as well as access to funding via the banking system. North America’s regions account for a further $240 billion of the increase, followed by $120 billion in Western Europe.

These differences can arise for myriad reasons. China was first hit by the outbreak, but this was put under (draconian) control and the economy has improved since the peak in the first quarter of this year. The large loan exposures to state-owned enterprises (which tend to assume some levels of government support) buffer the potential loan quality fallout. Substantial monetary and targeted fiscal stimulus also helped stabilize confidence and contribute to bankers’ having an improved view of recovery. Sectorwide, there are substantial loan provisions–about 1.8 times the level of official NPLs. However, this is much lower, at about 50%–once our estimate for forborne loans is included. Banks in China are required to comply with strict regulatory provision standards once these forborne loans migrate to weaker classifications. In addition, some listed Chinese banks must consider IFRS 9 provisioning requirements and apply the higher of the two requirements.

What does all this mean for long-term bank viability?

According to the report, while major banks will be able to absorb credit losses from earnings, they will be left with sharply reduced headroom for further upticks. More from S&P:

We estimate that the top 200 rated banks represent about two-thirds of global bank lending. Pro rata, for 2020 we estimate that credit losses for these banks would absorb about 75% of their preprovision earnings. Under our base case, this ratio improves to about 40% in 2021. By way of comparison, in 2019 the ratio was just 30%. These figures illustrate how the sharp uptick in credit losses, combined with muted earnings from slower economic activity, leaves limited capacity to fully absorb further losses from current earnings.

S&P then notes, that should the COVID-19 pandemic prove to be worse or last longer than its current base case economic forecasts assume, then a combination of higher credit losses and lower earnings will inevitably hit banks across the world.

In particular, S&P economists note that the economic damage associated with the pandemic is nonlinear: If containment of the virus takes twice as long as expected, for example, the economic damage will be more than twice as bad as the length of the recession, with recovery longer and weaker (with more lost output). Moreover, even if the spread of the virus were to end tomorrow, the effects could linger, especially if social distancing becomes a new normal or business and consumer spending doesn’t bounce back as people await the arrival of a vaccine.

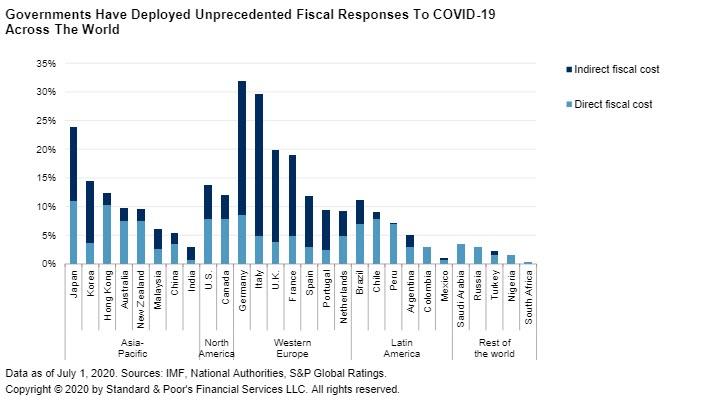

Meanwhile, even as fiscal measures provide “essential and immediate support to the economy” their eventual withdrawal could reveal new fragilities in asset quality.

As S&P ominously warns, while the unprecedented level of fiscal support that many governments across the world have deployed in response to the pandemic-related slowdown has been a key factor in supporting their citizens and economies during lockdown periods, it is unclear how if ever this support can ever be removed: time will tell whether the size and duration of such support has been effective enough.

“From a bank credit risk perspective, perhaps the greater danger at this time is the reduction of such support too early, resulting in a longer and deeper economic contraction, further impairing banks’ asset quality and increasing credit losses.” While S&P does not see evidence of this yet, even under our base case, the recovery will take time, with lower GDP growth (and higher unemployment) for a number of years.

While there is much more in the full paper (link), we wanted to focus on S&P’s forecast for North American banks which report Q2 earnings next week, and where we expect tens of billions more in loss reserves will be booked:

North America: Robust uptick in loan provisions driven by regulatory requirements

We forecast credit losses of $366 billion over the two years to end-2021 for the U.S. and Canada. This compares with losses of just $63 billion in 2019. For the U.S., our base case estimate is that loan loss rates will be about half the roughly 6% level the U.S. Federal Reserve has projected in its nine-quarter severely adverse scenario (which is unrelated to the pandemic) in its last two annual stress tests. We expect banks to provision for those losses faster than banks in most other regions, and particularly in 2020, because of this year’s implementation of the CECL accounting methodology.

In fact, in the first quarter of 2020, U.S. FDIC-insured banks reported a robust $53 billion in provisions for credit losses, and some banks have indicated that provisions could be just as high in the quarter ended in June. As a result, the ratio of allowances for credit losses to loans and leases rose to 1.80% at March 31, 2020, from 1.18% at the end of 2019.

We underscore the fluidity of the current situation and the difficulty in forecasting credit losses. Whether our estimate proves too conservative or lenient will depend heavily on the performance of the economy and the continued effectiveness of support measures the government has provided individuals and businesses. Our estimate factors in the U-shape, gradual recovery our economists have set as their base case as well as the assumed benefits of government support measures.

As part of the stress test results released in June 2020, the Fed also provided a sensitivity analysis where it estimated potential losses related to the pandemic under three scenarios for the 33 large banks that were part of the test: 8.2% under a V-shaped recession, 10.3% under a U-shaped one, and 9.9% under a W-shaped recession. Those figures are all higher than the 6.8% loss rate during the global financial crisis. Importantly, however, the Fed’s analysis did not factor in any benefit from government support measures.

The bottom line: global banks are already facing $2 trillion in losses over 2 years. Should the pandemic make a triumphal return and force another round of shutdowns, countless banks – both in the US and across the world – will end up going out of business, as there is no amount of direct or indirect Fed funding that can offset another $2 trillion in losses in the coming years.

via ZeroHedge News https://ift.tt/2ZS9sKX Tyler Durden