The Dual Mandate Of The Fed “Appears To Be The S&P 500 And Nasdaq”

Tyler Durden

Sat, 08/01/2020 – 13:00

Authored by Sven Henrich via NorthmanTrader.com,

With a furious rally in the last hour (when else?) markets closed the month of July slightly above the June highs bringing the S&P 500 to green on the year. This following GDP prints of -5% and – 32.9% for Q1 and Q2 respectively. Bears may be rightfully asked:

If you can’t get anything but a momentary decline in markets with historically disastrous readings such as this then what will it take?

After all markets rose in 2019 on flat earnings growth and are rising in 2020 with negative earnings growth. Are markets destined to rise forever and are bear markets simply a thing of the past as the overlords of markets, the central bankers, are simply too powerful and determined to never let the consequences of recessions, slowing growth and ever expanding valuations matter?

The dual mandate of the Federal Reserve says Guy Adami appear to be the S&P 500 and the Nasdaq, consequences be damned.

Yet the price action this week in particular again highlighted the distortions in markets that keep building with ominous red flags screaming danger as the rally continues to crawl higher emboldened by stunning earnings reports by some of the tech monopolies. $AAPL added $170B in market cap just on Friday. Gold continues to rally vertically while yields continue to sink to historic lows and the US dollar saw its biggest monthly drop in years while again the broader market is showing weakening underneath with overall market valuations continuing to soar. GDP has been dropping and a few tech stocks are producing overall market cap to GDP extensions we have never seen before far beyond even the tech bubble of 2000:

The classic definition of an asset bubble.

And make no mistake, the internal picture of this market is atrocious.

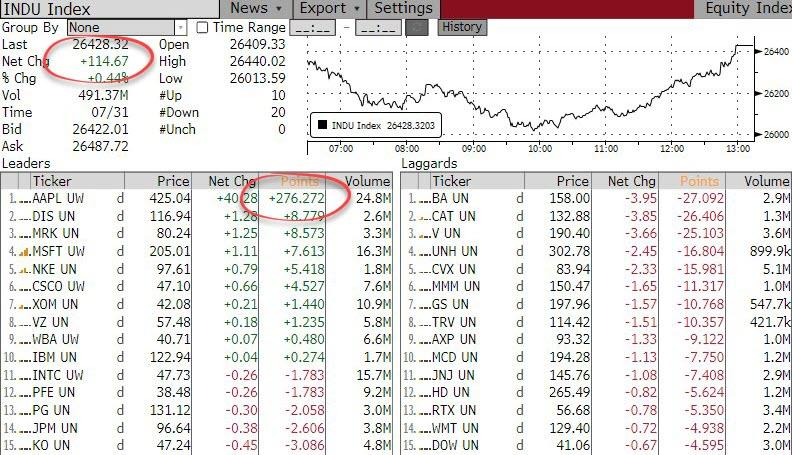

Take just Friday’s action as an example:

While the $DJIA manage to eek out a gain by the end of the day the principle price driver was one stock:

Broad based market rally. pic.twitter.com/Pi6YjCFnON

— Sven Henrich (@NorthmanTrader) July 31, 2020

And $SPX went positive on Friday as $NYAD advance/decline was sitting in the -1400 range:

And even the furious rally into close couldn’t get internals to positive. Improved yes, but not positive.

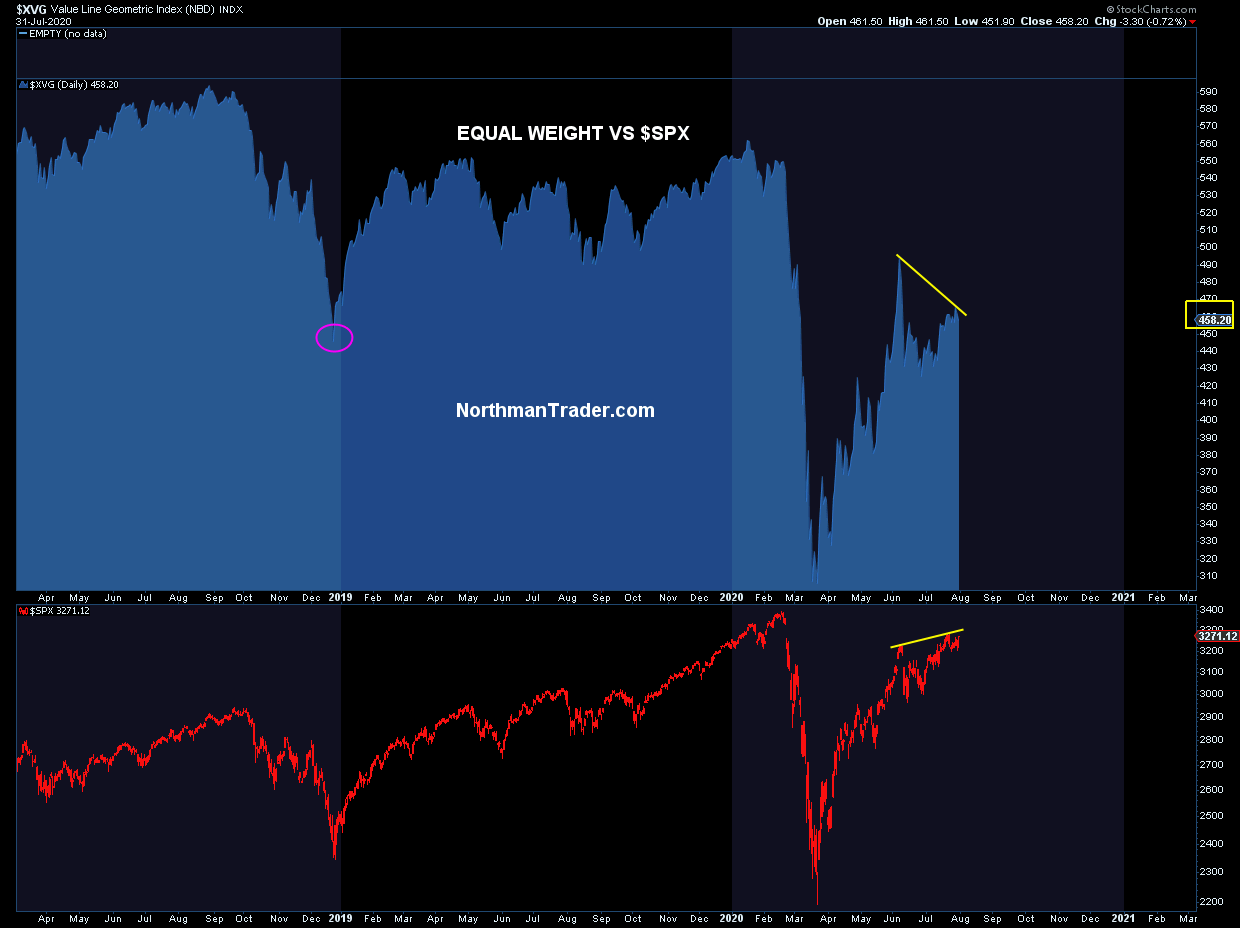

Which speaks to equal weight showing a marked weaker reading versus the June highs:

What’s the next for these markets? The prospect of yet another stimulus package as debt levels have already soared to a historic 136% debt to GDP?

And yes, debt has consequences as Fitch downgraded the outlook for the United States to negative from stable, warning of high debt and deficits made worse by the coronavirus downturn. But for now markets continue to thrive on stimulus headlines at a time when market valuations are the highest they’ve ever been relative to the economy, but the dangers of a meaningful reversal keep mounting especially as the US dollar just hit key technical trend line support on Friday:

Could the dollar be reversing in August and bring about a long awaited correction or will the forces of intervention continue to succeed in expanding this historic asset bubble? And let there be no doubt for that’s exactly what we are witnessing here:

Don’t kid yourself.

This is exactly the retail speculative nonsense we saw in 2000. Everybody trying to make a quick buck bidding up crap that will never grow into any of the valuations they are bidding on.

Works until it doesn’t.

Don’t confuse it with investing. It’s gambling. pic.twitter.com/sFhsXGaIEF— Sven Henrich (@NorthmanTrader) July 31, 2020

We’re discussing all these issues in our Straight Talk program and as always we’re trying to keep it real:

* * *

Note: I’ll also be posting a separate Market Video focusing on the latest technical implications this weekend (For those not already signed up for these videos please see link to sign up).

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

via ZeroHedge News https://ift.tt/33g7IhD Tyler Durden