Democratic Sweep Will Unleash New $7 Trillion Fiscal Stimulus

Tyler Durden

Wed, 09/30/2020 – 14:38

Earlier today, former Goldman CEO Lloyd Blankfein sent out a snarky tweet in which the Democrat and prominent Hillary Clinton supporter mused on the reasons behind today’s market ramp (which as recently as 11pm last night was a sharp drop, because as Bloomberg reported just before midnight, “S&P Futures Slip as Biden Election Odds Firm” which begs the question: are Trump’s election odds rising now alongside stocks) saying “so far the stock market doesn’t seem too upset at the prospect of Biden winning, despite Trump’s more market friendly policies. Perhaps folks think their stocks and 401(k)s will do better with higher taxes and increased regulation than with nastiness and scorched earth.”

So far the stock market doesn’t seem too upset at the prospect of Biden winning, despite Trump’s more market friendly policies. Perhaps folks think their stocks and 401(k)s will do better with higher taxes and increased regulation than with nastiness and scorched earth.

— Lloyd Blankfein (@lloydblankfein) September 30, 2020

Blankfein’s trolling aside, what the ex-Goldman CEO forgot to mention is that just yesterday his former bank Goldman Sachs published a report in which it completely reversed itself on its warnings of a Biden victory which as early as a few months ago it said was market negative, and now claims that “a Democratic sweep could have a modestly positive net impact on the trajectory of S&P 500 profits.”

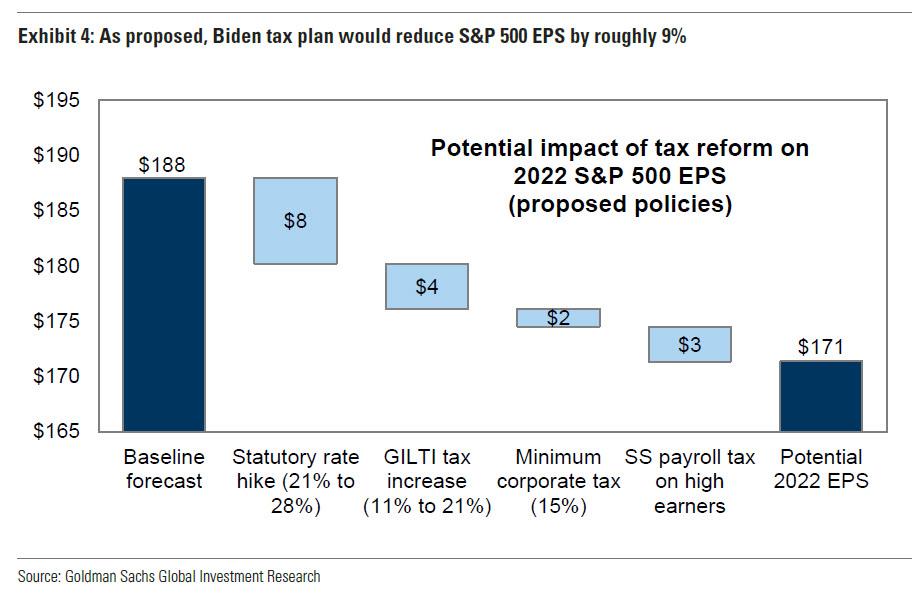

As a reminder, Biden has proposed lifting the domestic corporate statutory tax rate to 28% from 21%, reversing half of the Trump cuts, as well as implementing a number of other tax changes including an increased tax on global, low-tax, intangible (“GILTI”) income.

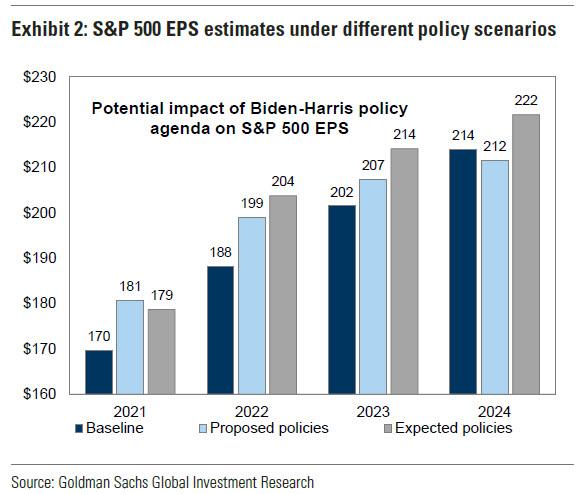

As Goldman’s David Kostin elaborates, “our earnings forecast depends on the specific sequencing and size assumptions made regarding corporate tax reform and fiscal stimulus. By 2024, we model just a 4% difference between our baseline EPS forecast ($214), which assumes no change in policy, and the potential earnings outlook under policies expected to be enacted in the event of a Democratic sweep ($222). In contrast, most market participants believe a blue wave election would have major downward ramifications for earnings.”

Kostin also claims that “the immediate impact of the election outcome on equity valuation multiples will depend on both the reaction of the interest rate market and investor risk sentiment.” It gets better: so desperate is Goldman to spin a Biden victory in a market-positive that it claims the mere fact the election is over should be bullish in itsef, to wit:

“To some extent, regardless of the outcome, the resolution of a highly uncertain election should help reduce the equity risk premium and support equity valuations.“

As with every other self-serving Goldman reco, most of the above is pablum. Even Kostin admits that the Biden corporate tax plan would arithmetically reduce S&P 500 earnings by roughly 9%, “excluding any potential second-order impact from economic growth, business confidence, or other factors.” This compares with a 10% boost to S&P 500 EPS following the TCJA.

Needless to say, the hit to after tax net income would be tremendous, impairing both EPS and multiples, so for Goldman to claim that a Biden sweep would have only a modest impact, all else equal, is naive. Yet Goldman repeats its mid-2021 price target of 3800 which using the bank’s baseline 2022 EPS of $171, means a PE multiple more than 22x. Or, as Kostin would probably call it “cheap.”

We are, of course, joking and many immediately took Goldman to task for its latest forecast, which was basically goalseeked to convince traders that no matter who wins – Trump or Biden – stocks will still go up. As the Bear Traps report wrote this morning, “We disagree… Higher corporate taxes, regulation add-ons, China supply chain shift does not stop with Biden, etc…”

And yet, there is one scenario where Goldman’s projections could make some sense: that would be if the Biden tax hikes were accompanied by a new fiscal stimulus wave, one not prompted by another global cataclysm such as a covid pandemic.

It is this massive fiscal stimulus bombshell that Goldman assumes. As Kostin writes, “our political economists outline roughly $7 trillion in gross fiscal expansion spread out over several years that Biden has proposed, including roughly $2 trillion of front-loaded COVID-related stimulus as well as spending on infrastructure, healthcare, and other policies.“

It is only when this stimulus supernova, which will send US debt soaring even more, is factored in that Goldman’s forecast of a market rise under Biden makes sense:

Our economists use the Fed’s FRB/US model to simulate the economic impact of both the policies proposed by the Biden campaign and the more modest set of policies they believe would be implemented by a potential Biden administration. FRB/US translates these expansionary polices into a large increase in the output gap, defined as actual minus potential GDP. This potential boost would add to their already above-consensus outlook for the US economy as it recovers from the pandemic recession.

What follows next is a convoluted goalseeking of how and why this fiscal stimulus flood would push stocks higher:

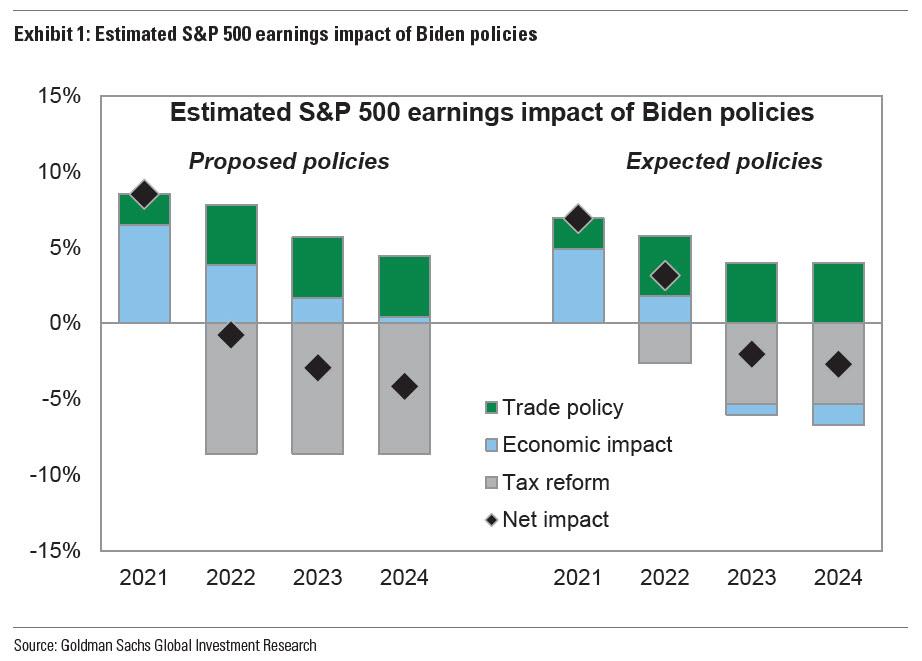

Although government spending would rise by more than tax revenue, from an earnings perspective the impact of tax reform would likely outweigh the impact of fiscal expansion. Taxes are deducted from profits, while fiscal spending and economic activity boost revenues. Based on our top-down S&P 500 macro earnings model, the economic effects of the Biden policy agenda would likely add a few percentage points to S&P 500 earnings growth in 2021 and 2022, depending on the magnitude of policies implemented.

And the punchline: the $7 trillion fiscal boost to markets is exhausted some time in 2023 at which point even more will be needed to keep stocks rising.

In 2023, however, the impulse becomes negative as the economy grows more slowly than would be the case absent the additional economic acceleration in the first half of the Biden administration.

And considering that toal US debt is now just under $27 trillion, and that every $1 in deficit monetization equates to about $1.50 in new debt, by 2023 total US debt should be around $40 trillion, while US GDP – thanks to the covid pandemic – will barely be above the 2019 levels.

In short, Goldman may be right, and a Biden sweep could be good for markets for the next 2 years – even with a 7% increase in corporate tax rates – but some time in 2023 the wheel on the US fiscal bus will really fall off at which point the US becomes fully Japanified, and only full-blown helicopter money coupled with direct “digital dollar” deposits by the Fed into US household accounts, would allow the US to reach the end of the Biden administration in 2024 without total collapse in the process.

via ZeroHedge News https://ift.tt/3jgzUWU Tyler Durden