Shocktober: Stocks Suffer Worst Pre-Election Plunge In History

Tyler Durden

Fri, 10/30/2020 – 16:00

The Hunt for a Red October is over… must be the Russians…

Global stocks suffered their worst week since March as it appears the constant liquidity pukage is losing its impact…

Source: Bloomberg

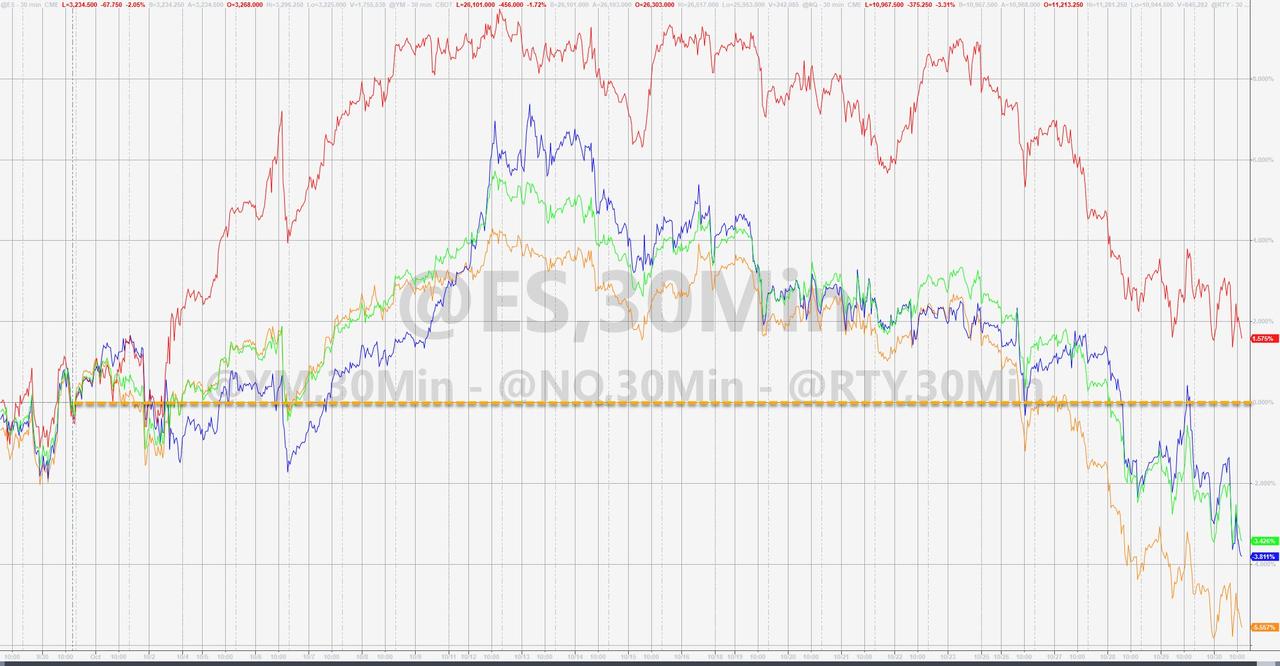

And US stocks (down 6-7% across the board) also saw their biggest weekly drawdowns in 7 months…

In fact, as Bloomberg notes, the second half of October – essentially since earnings reports began to flood in – the S&P 500 is down 5%. That is the worst performance for the final two weeks of the month of October since 1987’s 10.9% plunge – a year that certainly had other extenuating circumstances to account for such a disastrous performance in the back-half of the month. While it bears little resemblance to this year’s market context, know that in 1987 equities did not bounce back by the end of that year.

Source: Bloomberg

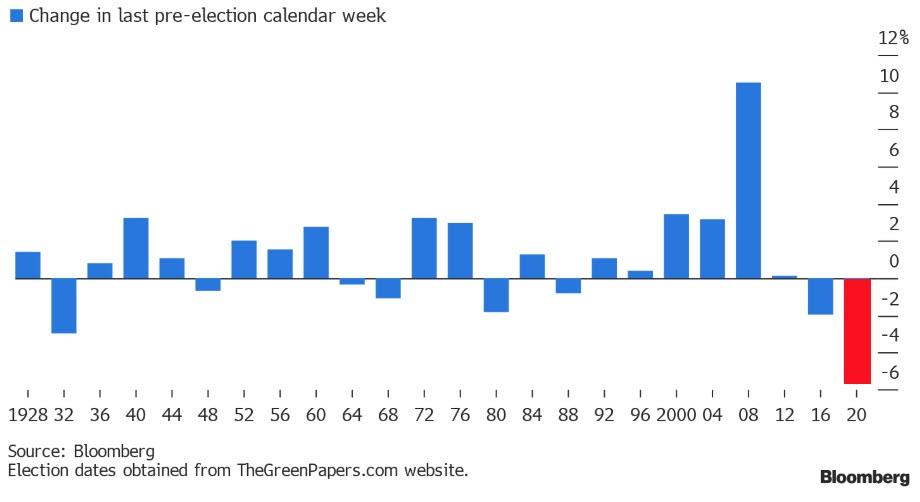

Additionally, the S&P just suffered its biggest-ever loss in the week before a US presidential election…

Source: Bloomberg

But we note that the S&P was down 9 straight days into 2016 election… will the pattern repeat this time?

Source: Bloomberg

This was also the worst week for any balanced portfolio as aggregate stock and bond returns were the worst since March…

Source: Bloomberg

Stocks were also down for the 2nd straight month (Dow was the laggard with it’s worst month since March) leaving the S&P barely holding green YTD. Small Caps bucked the trend with a modest 1.5% gain on the month…

Source: Bloomberg

The Dow and the Nasdaq are both in correction, down 10% or more from their recent highs.

All the US majors are at critical technical levels (Dow at 200DMA, S&P and Nasdaq < 100DMA, Russell ~100DMA)

Russell 2000 dramatically outperformed Nasdaq for the second straight month…

Source: Bloomberg

European markets bloodbath’d even more this week (worst since March also) and worst month since March (closing at lowest since May)…

Source: Bloomberg

It seem Einhorn was right – the launch of the SPAC ETF marked the top…

Source: Bloomberg

Back in the US, FANG Stocks ended down for the second month in a row…

Source: Bloomberg

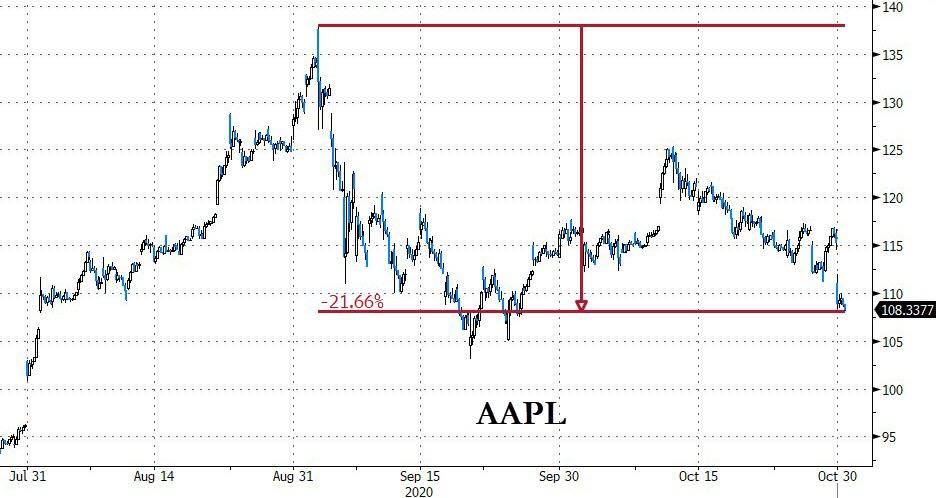

AAPL has slumped into a bear market from its early September highs…

Source: Bloomberg

Rough day for Jack Dorsey’s net worth…

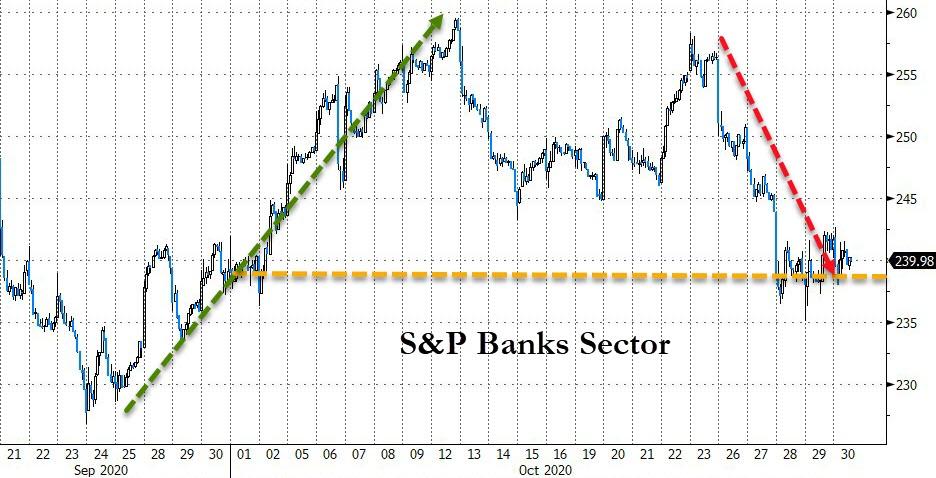

Bank stocks ended unch on the month…

Source: Bloomberg

VIX jumped almost 6 vols on the week – its biggest rise in vol since March…

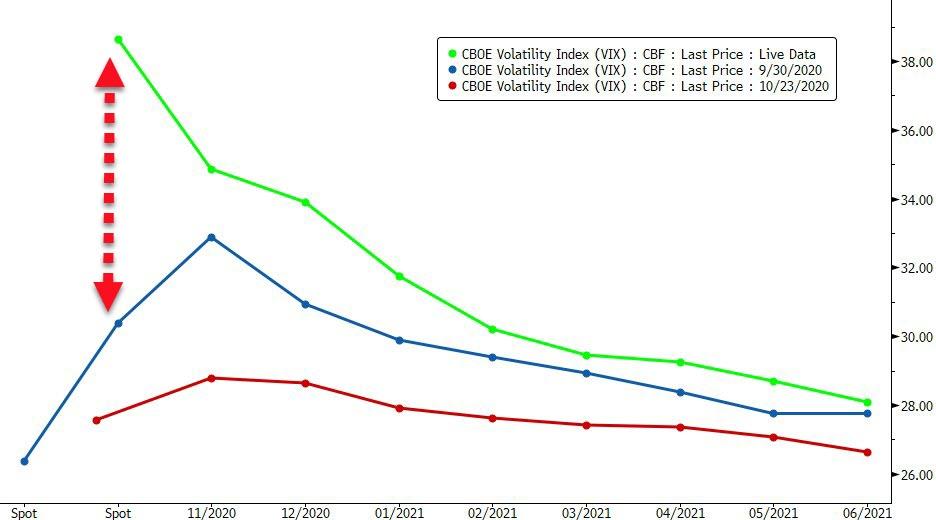

And the VIX curve is now in full backwardation (with the forward curve similar to how it was a month ago but the spike in front-month vol must have crushed any vol carry traders)…

Source: Bloomberg

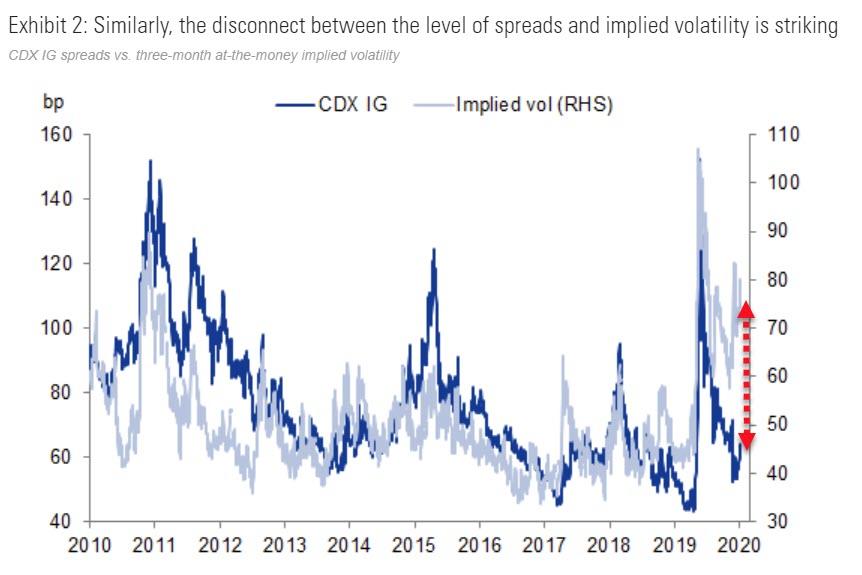

And while credit spreads have started to crack wider, compared to equity risk, there is a long way to go…

Source: Goldman

On the week, Treasury yields were practically unch – ramping higher after gains early on as liquidations appeared widespread…

Source: Bloomberg

On the month, yields were notably higher (30Y +18bps) and the curve steeper…

Source: Bloomberg

Not exactly a ‘rout’ in bonds…

Source: Bloomberg

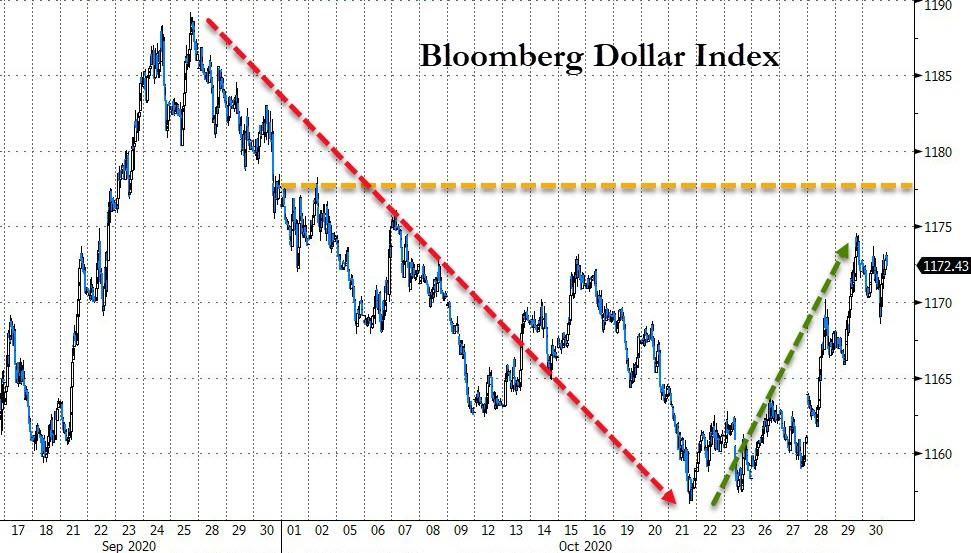

Despite gains this week, the Dollar was lower on the month (after September’s big surge) for the 6th month lower in the last 7…

Source: Bloomberg

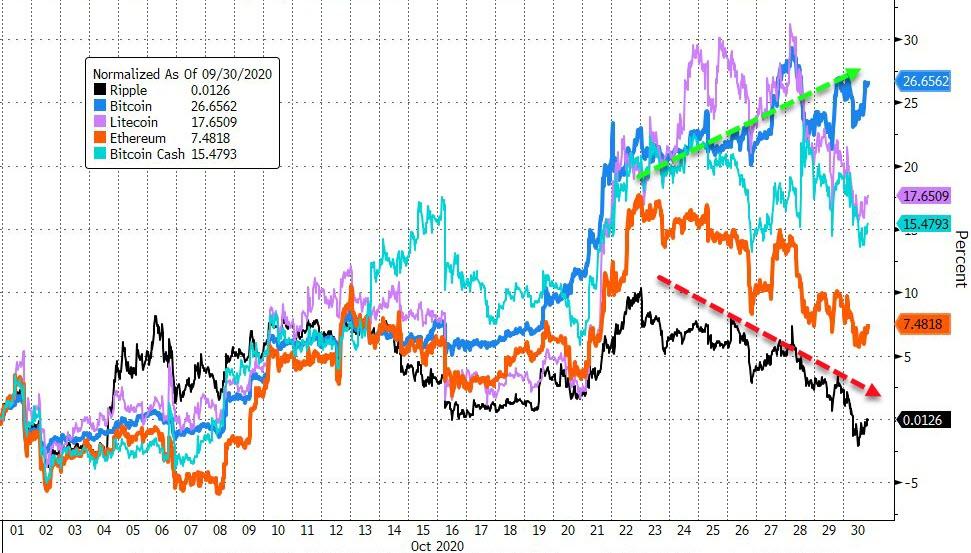

Cryptos were very mixed this week with a major rotation apparent as altcoins were offered and Bitcoin bid…

Source: Bloomberg

On the month, Bitcoin led the way, with Ripple lagging…

Source: Bloomberg

This was Bitcoin’s best month since April, closing above $13500…

Source: Bloomberg

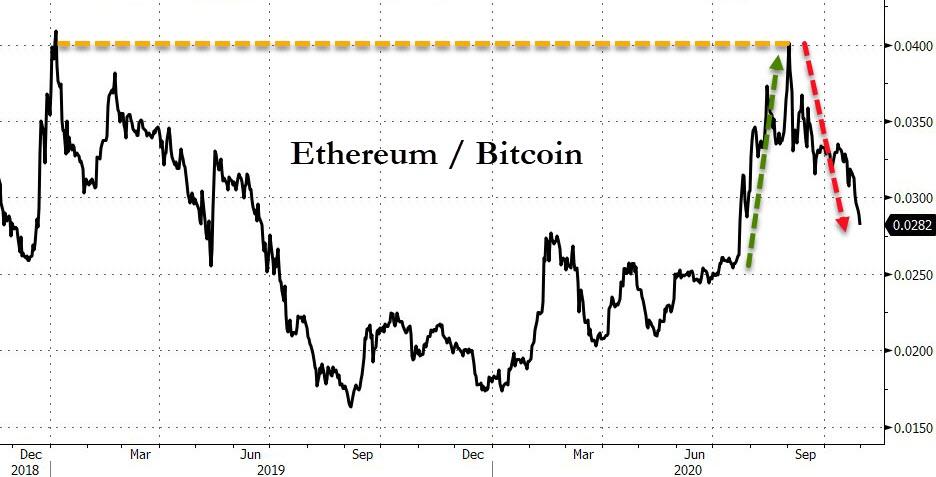

Ethereum notably underperformed after a solid DeFi-driven surge in July/August…

Source: Bloomberg

Crude was clubbed like a baby seal this week (PMs also slipped lower), and also on the month (but PMs managed to hold)…

Source: Bloomberg

WTI traded down to a $34 handle this week – its lowest level since May…

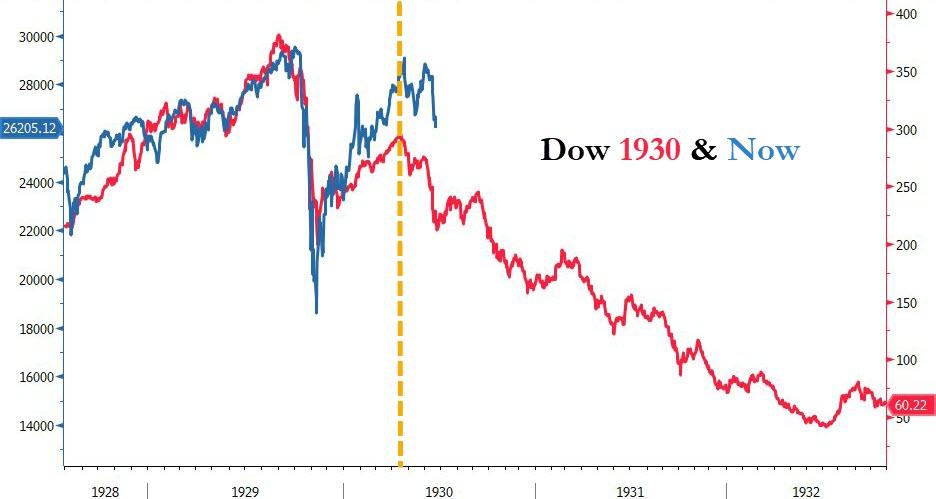

Finally, just on thing to think… “mother’s milk” appears to have left the building

Source: Bloomberg

This could never happen again, right?

Source: Bloomberg

Oh, and don’t panic!! The “Casedemic” will be over soon…

Source: Bloomberg

via ZeroHedge News https://ift.tt/37WYiKg Tyler Durden