Central Banks Sell Gold For The First Time In 10 Years Due To Just Two Countries

Tyler Durden

Fri, 10/30/2020 – 20:00

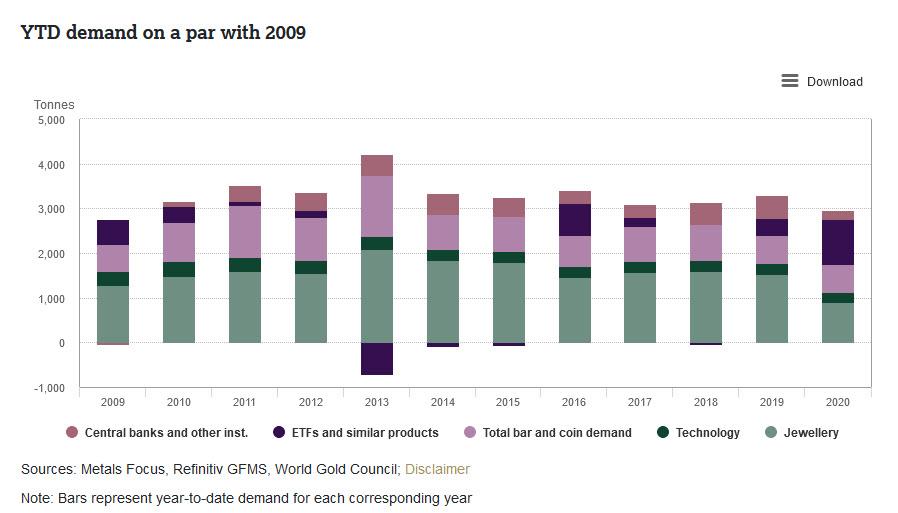

Following continuous quarterly net purchases since the start of 2011, in the third quarter of 2020 central banks switched to being modest net sellers for the first time in a decade, reducing global gold reserves by 12.1 tonnes in Q3 compared with purchases of 141.9 tons a year earlier, according to the latest Gold Demand Trends report by the World Gold Counsel.

And while that selling in itself would be notable, there are two very big caveats: not only have central banks remained net purchasers on a YTD, basis, with demand for the first three quarters totalling 220.6 tonnes, the selling was the results of just two reserve-strapped nations which rushed to convert gold into dollars: Turkey and Uzbekistan.

A few observations on Q3 activity which reflected two trends: a slowdown in purchases as the year has progressed combined with higher sales, which increased during the last quarter.

First, the WGC notes that there was more buying from familiar faces. Despite the quarterly net sales, six central banks increased their reserves in Q3 by a tonne or more, although total gross purchases were a modest 33t largely due to the continued economic hardship sparked by COVID-19. This has pre-occupied central banks and governments around the world, which have been forced to find USD-denominated liquidity. Indeed, as the WGC notes, “uncertainty has been elevated by the pandemic, motivating many investors – including central banks – to seek assets that will diversify and protect the value of their portfolios in times of crisis.” Central banks have been particularly hard hit by the low and negative interest rates on sovereign bonds, which make up the largest proportion of reserve assets for many. United Arab Emirates (7.4t), India (6.8t), Qatar (6.2t), Kyrgyz Republic (5t), Kazakhstan (4.9t), and Cambodia (1t) were notable, and familiar, buyers during the quarter.

Which brings us to the sellers… which were sizable but extremely concentrated. Reported gross sales jumped to 78.9t in Q3, with the rise mainly attributable to just two central banks: Turkey and Uzbekistan.

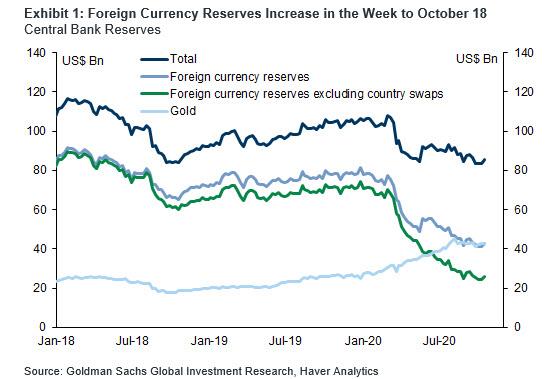

- Turkey, which is undergoing an unprecedented current and capital account crisis which has drained the central bank’s reserves to almost nothing as the Turkish lira has disintegrated, reduced gold reserves by 22.3 tonnes during the quarter, the first quarterly decline since Q4 2018, as it is well on its way to becoming the next Venezuela – a country which liquidates its gold to keep the lights on. As the chart below from Goldman shows, while Turkey hasn’t engaged in full-blown liquidation yet, it may do so sooner rather than later with its FX reserves (excl swaps) at all time lows.

Although the story is a bit more complex: higher domestic gold demand in August and September led to heightened gold trading activity between commercial banks and the central bank, resulting in this decline. But on a YTD basis, the country remains the biggest gold buyer, adding 148.7 tonnes, although the inflection point seems to coincide around the point in time when the lira suddenly collapse. Turkey’s official gold holdings now amount to 561 tonnes and 47% of total reserves. In August, Hasan Yucel, the head of Turkey’s Gold Miners Association, indicated that national gold production was expected to increase by 44% this year. He also stated that since 2017 the central bank has been the sole buyer of all domestic output and that will likely continue this year. - Uzbekistan reduced its gold reserves by 34.9t during Q3, bringing YTD net sales to 28.6t. Despite the sizable sale in Q3, gold reserves of 307t still account for 56% of total reserves. The country has seen a rise in gold exports this year as it looks to utilize its gold reserves, taking advantage of higher prices to combat the economic impact of the pandemic. Tajikistan (9.2t), Philippines (7.8t), Mongolia (2.4t), and Russia (1.2t) were the other notable but small sellers during the quarter.

“It’s not surprising that in the circumstances banks might look to their gold reserves,” said WGC analyst Louise Street. “Virtually all of the selling is from banks who buy from domestic sources taking advantage of the high gold price at a time when they are fiscally stretched.”

Central bank selling aside, total bullion demand fell 19% year-on-year to the lowest since 2009 in Q3, largely thanks to continued weakness in jewelry buying as a result of record high prices and the lockdown-induced economic slowdown. Indian jewelry demand fell by half, while Chinese jewelry consumption was also down. Overall jewelry demand fell to 333 tonnes, 29% below an already relatively anaemic Q3 2019.

By contrast, bar and coin demand strengthened, gaining 49% Y/Y to 222.1 tonnes as investors scrambled to buy paper gold. Much of the growth was also in official coins, due to continued strong safe-haven demand in Western markets and Turkey, where coins are the more prevalent form of gold investment. Q3 also saw continued inflows into gold-backed ETFs, which saw an eighth consecutive quarter of inflows. Q3 inflows of 272.5 tonnes pushed YTD flows to a record 1,003.3t and total global holdings of gold-backed ETFs to a new record of 3,880 tonnes.

Meanwhile, on the all important supply side, things are getting more ominous as total gold supply declined 3% year-on-year as mine production remained depressed, even after Covid-19 restrictions were lifted in producers like South Africa. A quarterly uptick in recycling softened the decline according to Bloomberg, with consumers cashing in on high prices.

via ZeroHedge News https://ift.tt/2TGXRM4 Tyler Durden