Puerto Rico Tax Incentives:

Ultimate Guide & My Personal Experience

With Act 20 & Act 22

-

AUTHOR

Daniel -

LAST UPDATED

December 1, 2020

When I wake up and see the ocean in front of me, I have to pinch myself.

Here I am, living in a beautiful place that’s part of the United States… yet I pay ZERO US federal income tax, only a 4% corporate tax for my businesses and ZERO capital gains and dividends tax.

I’m still a US citizen, and this is all perfectly legal.

I’m simply using the existing rules to live a comfortable lifestyle in paradise.

You too can have this type of lifestyle and tax advantages– especially if you are one of the many people now working from home and realizing, you can work from anywhere.

In this In-Depth Article

Impossible! How could these tax incentives be true?

I’ll be upfront. Sure, Puerto Rico has its share of challenges.

As COVID hit in March 2020, Puerto Rico issued one of the first, and one of the strictest, lockdowns in the US. And milder forms of draconian COVID measures have continued to harm the tourism and hospitality industries ever since.

And this isn’t Puerto Rico’s first rodeo.

As you probably recall, Hurricane Maria pummeled Puerto Rico in September 2017. It took a big toll on the island’s infrastructure, tourism industry, and caused about 130,000 people – nearly 4% of the population – to leave.

But Puerto Rico’s problems started well before Maria arrived.

The island has some serious economic issues. Puerto Rico has $74 billion in bond debt and another $49 billion in unfunded pension liabilities. Back in 2010, the unemployment rate was nearly 17%. And the unemployment rate didn’t drop below double-digits until 2018.

To deal with these kinds of issues, other governments would probably follow the usual playbook, starting with oppressive tax hikes. They would try to squeeze the remaining residents for more revenue.

But not Puerto Rico. They got creative.

The view from my balcony…

Smart, local leaders have responded to these challenges in a unique, promising way: They’ve created these amazing tax incentives to lure productive individuals and their successful businesses to the island.

Puerto Rico is a commonwealth of the US. That means that most things here fall under US federal law, like immigration and customs and border enforcement.

But Puerto Rico’s tax system is independent from the US. Puerto Rico has its own tax agency, like the IRS. That’s what makes Puerto Rico unique. It’s a part of the US, but tax-wise, it’s not. And that’s a big advantage…

The US is one of only two countries in the world – the other being the tiny east African country of Eritrea – that taxes its citizens on their worldwide income even if they do not live in the United States.

But Puerto Rico, with its independent tax system, grants you an exception.

If Puerto Rico is the only source of your income, the US government effectively says, “Okay. We won’t touch any income in Puerto Rico. We won’t even look at it.”

And since the island has extended these generous tax incentives, business owners, self-employed individuals, independent contractors, traders and investors who relocate to Puerto Rico have the opportunity of a lifetime.

If you’re a regular employee, don’t be discouraged. If you can work anywhere – which is practically everyone since COVID shut down offices – see if you can switch to be a contractor for your company. You’ll be able to enjoy the same tax privileges.

When successful businessmen and women, wealthy hedge fund managers, investors, etc. are running like mad to Puerto Rico, you know the government here is doing something right.

Let me share specifically what Puerto Rico is doing to attract these productive people.

But first let’s talk about…

What’s new in 2020?

In late June 2019, Puerto Rico completed a massive overhaul of their tax incentives, enacting the Incentives Code.

The new law does NOT eliminate the existing incentives. It systematizes dozens of incentive acts – Acts 20 and 22 are just the most famous ones – that Puerto Rico has enacted over the years.

The law came into effect on January 1, 2020 and altered previous legislation.

Act 22 is now part of Act 60, Chapter 2, Incentives for Individual Investors.

Unfortunately, it became more costly to comply with.

The mandatory annual donation to Puerto Rican charity increased from $5,000 to $10,000. And within the first two years of living there you now need to buy a home in Puerto Rico.

Then in April, the Governor signed new legislation which raised the annual filing fee for Act 22 from $300 to $5,000.

On the bright side, conditions for Act 20, known as the Export Services Act–now part of Chapter 3, Incentives for Export Services– remained largely the same.

Under the new rules, If your Act 20 company churns $3,000,000 (or more) of revenue a year, you will need to employ a full-time employee in Puerto Rico. And that single employee can be you actively managing your business.

The Acts themselves are not even called Acts anymore: For example, Act 20 became Chapter 3 of Act 60 of the Incentives Code – Exportation of Goods and Services. And Act 22 is now Chapter 2 of Act 60 the Incentives Code.

In this article, we outline the new requirements, but for easier understanding will keep calling them Act 20 and Act 22.

Puerto Rico’s Tax Incentives –

How to SLASH your taxes to just 4%…

Puerto Rico has introduced two pieces of legislations that allow you to reduce your corporate and investment income taxes…

But let’s start with…

Act 20

(Chapter 3 of Act 60, Incentives for Export Services):

How to slash your company’s tax rate to only 4%

The first is Puerto Rico’s Act 20, known as the Export Services Act, available to citizens of any country.

It allows you to slash your corporate tax rate to only 4%.

Dividends paid to you personally from your Act 20 company also won’t be taxed AT ALL— but only as long as you are a bona fide resident of Puerto Rico.

The Export Services Act is interesting, because of its extremely broad legislation. Here’s the idea behind it…

You incorporate a business in Puerto Rico that’s providing a service. And that service is being sold to people outside of Puerto Rico.

Your service could be research and development, advertising, any kind of consulting, project management, accounting, legal services, information technology services, telemedicine, and much more.

Regardless of your particular specialty, your businesses’ service – provided to clients anywhere in the world – is considered “qualifying activity” under Act 20. So, your business is eligible for a special corporate tax rate of just 4%.

The key to obtaining this 4% corporate tax rate is that you’re providing a service or services exported outside of Puerto Rico.

A clinic providing healthcare services to only Puerto Rican residents wouldn’t qualify. But if you’re providing telemedicine consultations to patients in the mainland US, Europe, or Asia, then your business meets the “qualifying activity” criteria.

Even if your primary business doesn’t fit within the “services” space, there’s a way to qualify for the 4% corporate tax rate.

I know people here, for example, who sell products online through Fulfillment by Amazon (FBA), where Amazon’s customer service centers pack and ship their inventory.

Since marketing is a service, they set up a Puerto Rico Act 20 company to provide that marketing service. Their Puerto Rican Act 20 company exports its marketing services to their FBA business.

The marketing company in Puerto Rico only pays a 4% corporate tax rate, and their FBA business can write off these marketing expenses.

Other people I know have a manufacturing business incorporated overseas, and they also use these Act 20 companies to reduce their taxes.

Some of them use their Act 20 company to provide management services in Puerto Rico, or ‘shared services’ like payroll, accounting, etc. to their manufacturing business overseas.

These management and shared service fees are completely legitimate services to provide.

And the setup is similar to the previous marketing services example. The Puerto Rican management company pays a 4% corporate tax, and the manufacturing business writes off the management expenses.

And remember, if you follow the proper rules, your Puerto Rican company won’t pay any US tax. So instead of a 21% corporate tax in the mainland US, plus another 20% dividend tax, all you’ll be paying in Puerto Rico is a measly 4% corporate tax. And zero in dividend tax.

This is an absolutely incredible deal.

The Act 20 legislation is very broad. Again, regular employees cannot benefit, but if you can arrange to work remotely (which should be easier than ever with COVID shutting down most offices), then you can transition to being an independent contractor operating out of Puerto Rico.

And as an independent contractor, you’ll now be exporting your services – whatever they may be.

If you have a skill where you can work anywhere – copywriting, digital marketing, telemedicine, investment management, consulting, design, coding, paralegal work, medical transcription, accounting, recruiting, etc. – then you owe it to yourself to check out Puerto Rico’s Act 20.

Note that the new Incentives Code introduced an employment requirement to Act 20 in 2020.

If your Act 20 company churns $3,000,000 (or more) of revenue a year, you will need to employ a full-time employee – a resident of Puerto Rico – working a normal 8-hour day. That single employee can be you, the business owner actively managing your business.

If your company earns less than that, there is no employment requirement at all, as before.

Keep reading to see how much it costs to set up and maintain an Act 20 company.

Act 22

(Chapter 2 of Act 60, Incentives for Individual Investors):

How to reduce your capital gains tax to ZERO

The second piece of legislation is Act 22, the Individual Investor Act.

If you’re an investor based in the US, you’re paying a top 20% tax on dividends and capital gains, potentially the 3.8% Obamacare surcharge tax (for those married filing jointly with over $250,000 in annual income) and a host of state and local taxes.

But if you pack up and move down to sunny and beautiful Puerto Rico, then all your future capital gains on stocks and bonds… become tax free. And the new Incentives Code explicitly includes gains on crypto too.

Additionally, any dividends, interest, and royalties you may receive from Puerto Rican sources will also be tax-free.

That’s right. The IRS won’t touch any of your investment income.

If you’re expecting big capital gains in the future, you need to seriously consider Act 22. Gains on stocks, bonds, crypto… you will have after your move to the territory, will be tax-free.

And if you are sitting on significant gains already, Puerto Rico may still help you. If you spend more than ten years as a resident there, your tax obligation on the portion of capital gain you accrued while still living in the US will also go down… to 5%.

That’s an incredible deal.

Please note that the new Incentives Code made Act 22 more expensive in 2020.

First, in order to qualify for Act 22, you need to make an annual donation to official charities in Puerto Rico, and in 2020, the donation amount increased from $5,000 to $10,000.

And under the new rules, within two years of obtaining your Act 22 decree, you will need to buy a property in Puerto Rico and use it as your primary residence (you can’t rent it out). You will need to keep it throughout the validity of your Act 22 decree.

(There is no minimum purchase price requirement.)

The annual filing fee also increased from $300 to $5,000.

Traveling or moving to Puerto Rico is very easy…

Traveling to Puerto Rico is just like traveling from state to state. Let’s say you get on a plane in Miami and fly to Puerto Rico’s capital of San Juan. When you arrive, you don’t have to go through immigration or customs. You just get off the plane and go on your way… because technically, you never left the US.

The same goes for moving.

Moving to Puerto Rico is just like moving from California to Texas or from New York to Florida. You arrange the movers and off you go. No customs or border patrol to deal with. No hassles or headaches like when you move from country to country.

Puerto Ricans also enjoy the same travel and moving benefits as Americans. Again, that’s because they ARE Americans.

How did you like this article?

Click one of the stars to add your vote…

Other readers gave this article an average rating of stars.

Taxation examples in different scenarios…

Here are a few examples of how much tax you would pay in different scenarios.

If you are living in the US while operating your Act 20 company in Puerto Rico…

You’ll pay a 4% corporate tax to the Puerto Rican government and a GILTI tax of up to 21% to the US government. (Can be lowered to 10.5% in certain cases.)

GILTI is a new tax that came into existence with Trump’s Tax Reform of 2018 and the IRS considers Puerto Rico a foreign country for GILTI tax purposes.

Since you are not a bona fide resident of Puerto Rico you also can’t take advantage of the dividend tax exemption.

So, if you pay out dividends they will likely be considered qualified dividends by the IRS and taxed according to your tax bracket. That can be up to 20%, plus the 3.8% Obamacare surcharge tax and a host of state and local taxes.

Because of the GILTI tax our opinion is that, for most people, an Act 20 company only makes sense if they actually become Puerto Rican bona fide residents.

If you are a bona fide resident of Puerto Rico while operating an Act 20 company…

On the corporate side, you’ll pay a 4% corporate tax to the Puerto Rican government and you will escape the GILTI taxation by the IRS for your Act 20 company. Dividends will also be tax-free.

On the individual side, you’ll pay yourself a small salary that’s taxable at normal Puerto Rican tax rates, comparable to mainland US tax rates.

Don’t think that you can pay yourself $1 per year. Your salary has to be reasonable.

But you don’t have to pay yourself mainland US wages, either. You’ll find that wages in Puerto Rico are much lower than the US mainland, so you can pay yourself a commensurate regular salary. We advise you to check with your accountant on this rate.

And you can take the rest of your compensation as a qualified dividend, taxed at… 0%. Yes, imagine that. You can take all this money that you earned and put in your pocket tax-free.

But you’ll continue to pay the usual US taxes on investment income.

You can learn more about how to become a bona fide resident of Puerto Rico in the Act 22 section.

And if you also take advantage of Act 22…

You’ll pay the same taxes on your Act 20 company’s profits and dividends as in the previous scenario.

But you’ll also pay ZERO on your future capital gains on stocks, bonds and crypto.

Any dividends, interest, and royalties you may receive from Puerto Rican sources will also be tax-free.

How to qualify for Puerto Rico’s tax incentives

In this section you’ll learn…

Why you need to apply for Acts 20 & 22 NOW

I cannot emphasize this enough…

YOU SHOULD STRONGLY CONSIDER ACTS 20 AND 22 TODAY.

That’s because I don’t expect Puerto Rico’s incentives to last for much longer. The Bolsheviks that may come to power soon in Washington, DC hate win/win scenarios. They want “the rich” to lose, even if Puerto Rico loses too.

The good news is that Act 20 and Act 22 are essentially a contract with the Puerto Rican government that lasts 15 years.

So even if they shut down the programs to new applicants, people who already have their tax incentives established will be grandfathered under the old rules.

That should be a pretty strong motivator to get down here and at least check it out.

And if more Bolsheviks continue rolling into power, you can count on much higher taxes in the Land of the Free… which makes Puerto Rico even more compelling.

And even if you’re not ready to move to Puerto Rico right now, if you think there’s a chance that you might move there some time in the next few years to take advantage of these tax incentives, you can still set up an Act 20 company today.

The company can’t be completely dormant. But as long as it has some basic commercial activity, you can lock in today’s incentives, and then move down in a few years’ time to really boost your tax benefits.

One thing to keep in mind – The IRS considers Puerto Rico a foreign country for GILTI tax purposes.

The tax came into existence with Trump’s Tax Reform of 2018. If you stay in the US while operating your Act 20 company in Puerto Rico, you will need to pay GILTI tax on your company’s income.

How to set up an Act 20 company

I’ve already covered that your Act 20 company must be a service-based business that exports some type of service to global customers…

Obviously, your first step is to have a business that meets this requirement.

If you don’t have an existing business that meets the criteria, remember, you still have options to qualify under Act 20. For example, you can structure a marketing or management company that provides these services.

Then, you must apply for a decree. You do it by submitting an application at the Single Business Portal of the Office of Industrial Tax Exemption (OITE) of Puerto Rico to obtain a tax exemption decree, which will provide full details of tax rates and conditions.

All-in, it takes the Puerto Rican government at least four to five months (in normal, non-COVID times) to approve your tax exemption (which they’ll retroactively date to when you applied).

Alternatively, you can use an attorney to help navigate Puerto Rican bureaucracy.

Expect the attorney fees to start at around $8,000, which includes incorporation and the Act 20 tax exemption filing. I paid around $15,000 for mine, using one of Puerto Rico’s top firms.

And if you go with one of the official promoters of the Act 20 program, then you will essentially pay only the government-related fees of around $2,000. The promoters later get a small cut from the 4% corporate tax you will be paying to the government.

So if you are moving a simple business to Puerto Rico (and not some complicated international structure) then the cheapest way to open an Act 20 company would be through such an official promoter.

You can either set up an LLC or a corporation. I personally set up an LLC. But for tax purposes, it needs to be a corporation, so I elected my LLC to be treated as a corporation. To do this, you simply need to check the box on IRS Form 8832.

Additionally, you’ll pay a few hundred dollars per year to maintain the company, between accounting fees and renewal costs.

Looking for a reliable service provider in Puerto Rico?

If you are a member of our flagship international diversification service, Sovereign Man: Confidential, we can give you a reference for both an experienced attorney and a reliable, official promoter we have worked with.

Just get in touch with us through the member site.

And please keep in mind that we take absolutely no commissions, kickbacks or anything of the sort from the providers we refer our members to.

It’s a huge part of my personal moral code, and I just think it’s the right way to do it.

While this is extremely rare in the financial industry where commissions and kickbacks are the norm… I would never put myself in a position where my interests and the interests of our members are not 100% aligned.

Additionally, we always do our best to pass the commissions our referred providers ordinarily pay to promoters as additional discounts to our members.

For example, one of the service providers we have a relationship with usually charges $1,500 to file an Act 22 application, but our members get a $500 discount on that.

How to file for Act 22’s tax incentive

In 2020, the conditions to apply for Act 22 have become more stringent.

In order to qualify for Act 22, you need to make an annual donation to official charities in Puerto Rico. And in 2020, the donation amount increased from $5,000 to $10,000.

And now it will be split into two parts: The first $5,000 will go to one of the charities specifically approved by the government, and the second $5,000 will still go to the charity of your choice in Puerto Rico (as before).

And under the new rules, within two years of obtaining your Act 22 decree, you will need to buy a property in Puerto Rico and use it as your primary residence (you can’t rent it out). You will need to keep it throughout the validity of your Act 22 decree.

On the bright side, there is no minimum purchase price.

And as noted before another significant cost was added in April 2020 when new legislation raised the cost of the filing fee for Act 22 to $5,000 (previously just $300).

To get started, you can hire an attorney to file the paperwork for Act 22, or, you can file yourself through Puerto Rico’s Single Business Portal.

I’m well-versed in legal matters, but I still used an attorney.

Expect to pay about $1,500 to $5,000 in legal fees (or just $995 if you are a member of our flagship international diversification service, Sovereign Man: Confidential, and use one of our trusted service providers).

It should take Puerto Rico at least three months to process your application, but it could take up to ten months, especially with COVID disrupting normal work. When approved, they’ll retroactively date your residency so you get the tax benefit from when you applied.

After you are approved you have one year to enter Puerto Rico, otherwise, you will lose the decree and will have to reapply.

And to be exempt from US federal income taxes you have to become a bona fide Puerto Rican tax resident.

The three tests to become a bona fide Puerto Rican tax resident

The Internal Revenue Code has specific guidelines for what qualifies individuals as bona fide residents of a US possession.

And as a resident, you’re eligible for the Act 22 exemption and you will escape the GILTI taxation by the IRS for your Act 20 company.

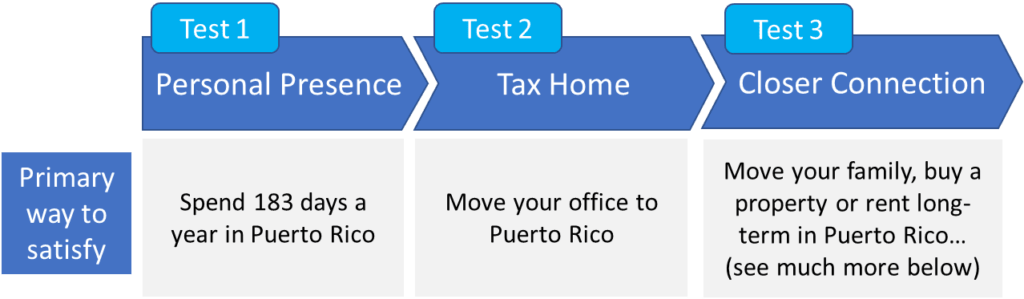

In Puerto Rico, the US says you have to check the box in three categories. Or, in other words, you must pass three tests:

1. Personal presence test

To satisfy the first test, you must meet any one of the following five conditions:

1) Be present in Puerto Rico for at least 183 days during the tax year.

These 183 days don’t need to be consecutive, you can make multiple trips to the US or elsewhere during the year. (To be on the safe side, we recommend you spend at least a few days more than 183 in Puerto Rico.)

2) Be present in Puerto Rico for at least 549 days (aggregate) during a 3-year period. And during each year of the 3-years, you need to be present in Puerto Rico for at least 60 days.

For the math to work, you will still need to spend at least 183 days during your first two years in Puerto Rico. However, this method potentially allows you to spend as little as 60 days in Puerto Rico in the 3rd year.

3) Be present in the United States for 90 days or less during the tax year.

At first, this condition seems easy to meet, but remember that you still must meet two other tests – tax home and closer connection (we explain both further down).

4) Earn less than $3,000 in wages, salaries, or professional fees in the United States, AND spend more time in Puerto Rico than on the mainland during the tax year. This option may not work for you if you will be traveling to the United States to meet clients, perform some work… meaning that you will have US-based wages or professional fees.

5) Have no significant connection to the United States during the tax year.

The IRS considers that you have a significant connection to the United States if you:

- Have a permanent home in the US (rental property is OK), or

- Are registered to vote in the US, or

- Have a spouse or a child under the age of 18 whose main home is in the US (unless the child is in school in the US or has legally divorced parents).

2. Tax home test

This one, too, is relatively straight forward.

To pass the tax home test, your tax and business activities need to be located in Puerto Rico. If your primary business activities are located anywhere else in the world, you won’t pass this test.

Now, the IRS defines ‘tax home’ as your regular place of business or employment.

So by setting up an Act 20 company, you go a long way in proving that your primary business activity is in Puerto Rico.

You can still travel to the United States, or elsewhere, to attend conferences, meet your clients, etc. As long as your main business (or consulting) activity happens in Puerto Rico, then you should be fine.

3. Closer connection test

The final test is more qualitative, and it’s similar to the ‘significant connection’ criterion I mentioned with the physical presence test.

Remember, you’re proving to the IRS that you’re not liable for US federal taxes on your qualified income.

So, consider these questions:

-

Is your family with you in Puerto Rico or back home in the mainland US? -

Are you renting an Airbnb in Puerto Rico or do you have an apartment or house? -

Are your personal belongings (car, furniture, jewelry) in Puerto Rico? -

Do you participate in social, political, cultural, charitable organizations in Puerto Rico? -

Where do you bank? -

Do you have a Puerto Rican driver’s license? -

Are you registered to vote in Puerto Rico?

You don’t have to do everything we outline in the table above, but you should do as much as you reasonably can. If the IRS runs an audit on you, they need to leave convinced that you treat Puerto Rico as your primary home.

When I fill out an IRS Form 8898, all these things I’ve done count for the closer connection test. I can check those boxes on the form and say, “Yes, IRS. I’m living in Puerto Rico and it’s my legitimate home base.”

If all this sounds too good to be true…

It’s not.

I’ll admit that a few years ago when my friend and fund manager Peter Schiff mentioned Puerto Rico’s tax incentives, I initially had my hesitations.

Hesitation #1: What if the government breaks its promises?

My primary concern was what would happen if the Puerto Rican government breaks its promises.

You, too, might have this concern. After all, we are talking about a promise made by a bankrupt government.

But I assure you not to worry about the Puerto Rican government breaking its promise. For one, the government needs productive people – and their tax revenue – more than productive people need Puerto Rico. So, there’s an advantage there for individuals.

And second, Puerto Rico issues a binding contract between the government and individuals who qualify for the incentives. The government is contractually obligated to honor its commitments well out into the future.

There’s also a growing case law that prevents the Puerto Rican government from breaking contracts.

For example, over the last few years, there was a famous case involving Walmart in Puerto Rico. Puerto Rico had extended a special tax incentive. But the government felt like Walmart wasn’t keeping up its end of the bargain. So, the government sued Walmart for additional tax revenue that wasn’t part of the contract.

The case went to court here in Puerto Rico. And the government lost. The Puerto Rican judge who ruled against the government said the government must honor the signed contract.

And if in the future, the Bolsheviks in Washington will press Puerto Rico to end the incentives altogether, all current participants will be grandfathered under the old rules according to the contracts signed.

So, with that hesitation answered, let’s move on to the next one…

Hesitation #2: I’m not a multi-millionaire. Can I still qualify?

YES.

There are plenty of wealthy people here. But I also know people in Puerto Rico who make $60,000 per year and are doing well.

Also, there are expensive areas around the capital of San Juan. But there are also pockets of San Juan perfectly suited for middle class people.

And if you get out to the west and southern coasts or to the island’s interior, your tax savings and a lower cost of living means a nice life here.

Hesitation #3: Is it worth it?

There’s no better risk-adjusted return than saving money on taxes.

Otherwise, to achieve an extra 30% return on investment, you’ll have to take some serious risk. Or break the law.

But saving on taxes means no investment risk. Instead of handing over that money earmarked for Uncle Sam, it’s now earmarked for your pocket.

And if you compound tax savings over years and decades, that’s a life-changing amount of money. For example, after several years, just your tax savings would be enough to buy a house.

And Puerto Rico’s tax incentives are not just helping the Act 20 and 22 individuals get wealthier…

You can help boost the Puerto Rican economy

All this capital injection is also doing wonders for the island’s economy and for fellow Puerto Rican residents.

For starters, Puerto Rico is able to recapitalize its banks. The surge in deposits allows banks to make additional loans for long-term projects. And this translates into more economic activity and job creation.

Puerto Rico is also generating economic activity from its newcomers’ spending.

For example, a new arrival needs a car, which means a sales commission for the car salesman. And this salesman celebrates by going to dinner with his or her spouse. They may leave a big tip for the waiter or waitress, and so on down the line…

I saw a study that each individual who moved to Puerto Rico has created eight jobs.

I’m incredibly proud to be a part of Puerto Rico’s turnaround story. It’s a win-win. I get to keep the money I earned through hard work, and I can invest in Puerto Rico or spend as I wish.

And that’s the power of just my tax savings. Multiplied by the number of newcomers, we’ve got the opportunity to really make an impact here in Puerto Rico.

Puerto Rico is not the only way to save on Taxes for Americans

Consider this incredible incentive too…

If you are sitting on unrealized capital gains – stocks, real estate, art, crypto… – Opportunity Zones may offer amazing tax benefits.

It’s a brand-new program that was buried inside President Trump’s 2018 tax reform legislation.

Through the program, you can sell your appreciated assets, defer capital gains tax, and invest the proceeds into one of 9,000 designated distressed communities across America.

Most of Detroit and Baltimore is an Opportunity Zone… and even parts of Manhattan.

Your investment in real estate, an existing business, a new business, etc. located in an Opportunity Zone can grow completely tax-free for decades.

The program is still new, but it is already a huge success with billions of dollars pouring into America’s distressed communities.

You can learn more about Opportunity Zones and my personal experience with it in this in-depth article.

Frequently Asked Questions

If you don’t have time to read the full article, here are the most frequently asked questions we get…

What’s new in 2020 for Puerto Rico’s Tax Incentives?

In late June 2019, Puerto Rico completed a massive overhaul of their tax incentives, enacting the Incentives Code.

The new law does NOT eliminate the existing incentives. It systematizes dozens of incentive acts – Acts 20 and 22 are just the most famous ones – that Puerto Rico has enacted over the years.

The law came into effect on January 1, 2020 and altered previous legislation.

Act 22 became more costly to comply with. The mandatory annual donation to Puerto Rican charity increased from $5,000 to $10,000. And within the first two years of living there you now need to buy a home in Puerto Rico.

The annual filing fee (just for Act 22) also increased from $300 to $5,000.

On the bright side, conditions for Act 20 remained largely the same. Under the new rules, If your Act 20 company churns $3,000,000 (or more) of revenue a year, you will need to employ a full-time employee in Puerto Rico. And that single employee can be you actively managing your business.

The Acts themselves are not even called Acts anymore: For example, Act 20 became Chapter 3 of Act 60 of the Incentives Code – Exportation of Goods and Services. And Act 22 is now part of Act 60, Chapter 2 – Individuals.

What is Puerto Rico’s Act 20?

Act 20 is known as the Export Services Act, now Chapter 3 of Act 60 of the Incentives Code.

It allows you to slash your corporate tax rate to only 4% and dividends paid to you personally from your Act 20 company to ZERO.

The key to obtaining this 4% corporate tax rate is that you’re providing a service or services exported outside of Puerto Rico.

The Export Services Act is interesting, because of its extremely broad legislation. So, even if your primary business doesn’t fit within the “services” space, there’s a way to qualify for the 4% corporate tax rate.

What is Puerto Rico’s Act 22?

Act 22 is the Individual Investor Act, now Chapter 2 of Act 60 of the Incentives Code.

If you’re an investor based in the US, you’re paying a top 20% tax on dividends and capital gains, potentially the 3.8% Obamacare surcharge tax (for those married filing jointly with over $250,000 in annual income) and a host of state and local taxes.

But if you pack up and move down to sunny and beautiful Puerto Rico, then all your future capital gains on stocks, bonds and crypto… become tax free.

Additionally, any dividends, interest, and royalties you may receive from Puerto Rican sources will also be tax-free.

That’s right. The IRS won’t touch any of your investment income.

I’m not a multi-millionaire. Do Puerto Rico’s tax incentives still make sense for me?

Yes. There’s no better risk-adjusted return than saving money on taxes.

Otherwise, to achieve an extra 30% return on investment, you’ll have to take some serious risk.

But saving on taxes means no investment risk. Instead of handing over that money earmarked for Uncle Sam, it’s now earmarked for your pocket.

And if you compound tax savings over years and decades, that’s a life-changing amount of money. For example, after several years, just your tax savings would be enough to buy a house.

There are plenty of wealthy people here. But I also know people in Puerto Rico who make $60,000 per year and are doing well.

Also, there are expensive areas around the capital of San Juan. But there are also pockets of San Juan perfectly suited for middle class people. And if you get out to the west and southern coasts or to the island’s interior, your tax savings and a lower cost of living means a nice life here.

Conclusion

Here’s what I encourage you to consider…

Book a flight and get down here as soon as possible. Puerto Rico is only a short flight from cities on the US east coast. So, you can even take a weekend trip. (Although, if you can, I recommend spending several weeks on the ground before you move down.)

And something you can do immediately is sign up for our free Notes From the Field daily dispatch.

I frequently travel around the world to find exciting business opportunities, discover risks in our financial system and economies, and offer solutions, like Puerto Rico, that make sense no matter what happens next.

Puerto Rico is now my official home base, so I usually check in from Bahia Beach – just east of San Juan – and from time to time, I also write about what’s developing here.

I’m really optimistic about Puerto Rico’s future. And I’m excited that I can legally maximize my tax savings in such a beautiful place.

Think what we’re doing makes sense?

Get to know us more…

Join over 100,000 subscribers who receive our free Notes From the Field newsletter, where you’ll get real boots-on-the-ground intelligence as we travel the world and seek out the best opportunities for our readers.

It’s free, it’s packed with information, and best of all, it’s short… there’s no verbose pontification here – we both have better things to do with our time.

And while I appreciate all the visitors who stop by our website, I provide special bonuses to our email subscribers… including free premium intelligence reports and other valuable content that I only share with them.

It’s definitely worth your while to sign-up, and if you don’t like it, you can unsubscribe at any time with just one click.

How did you like this article?

Click one of the stars to add your vote…

Other readers gave this article an average rating of stars.

from Sovereign Man https://ift.tt/2HW5wDZ

via IFTTT