Poor Demand For 7Y Treasury In Ugly, Final Auction Of 2020

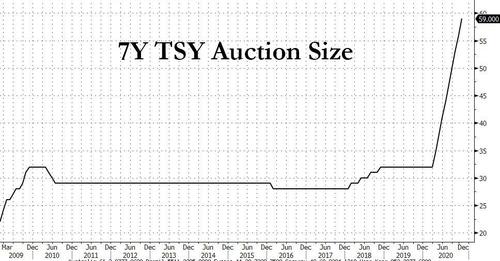

After two mediocre Treasury coupon auctions priced on Monday in the crammed first day of the holiday shortened week, moments ago the US Treasury held its final auction for the year which was a doozy: coming in at $59 billion, it was not only the biggest 7Y auction on record some $3 billion bigger than November, but was roughly double the average auction size for much of the past decade.

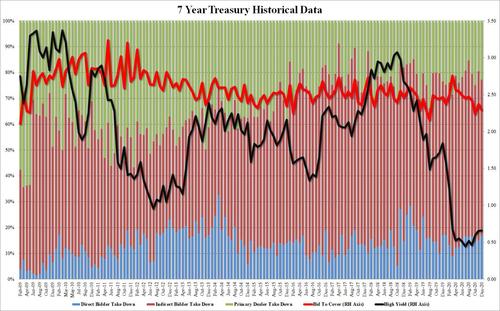

Just like the week’s past two coupon auctions, this one was hardly pretty, stopping at 0.662% which was a 0.2bps tail to the 0.660% When Issued and printing above November’s 0.653%, it was the highest yield since March.

The Bid to Cover also deteriorated, dropping from 2.374 last month to 2.315, below the 2.41 six auction average.

Internals were also ugly with Indirects dropping from 65.4% to 60.3%, the lowest since January, and below the 64.0% recent average. And while Directs rose modestly in keeping with their tick up in the 2Y and 5Y auctions, from 15.12% in Nov to 16.98%, Dealers also ended up holding to more of the auction, or 22.7% vs 19.5% last month.

Overall, an ugly auction to conclude the week’s trifecta of coupon sales, and a fitting tribute to the debt sales of 2021 where the only thing that is certain is that the amount of debt that Uncle Sam has to sell each and every month will continue to grow in perpetuity.

Tyler Durden

Tue, 12/29/2020 – 13:19

via ZeroHedge News https://ift.tt/3hra1DA Tyler Durden