ARK’s Innovation ETF Posts $137 Million Outflow On Tuesday, Its Largest On Record

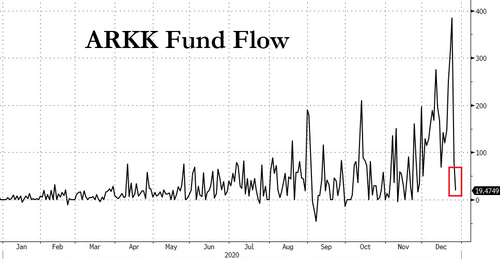

One day after we speculated the top in ARK Funds could be in, based on what appeared to be a technical trend in inflows breaking down, ARK’s Innovation ETF posted its largest outflow on record.

The ETF saw $137 million in outflows on Tuesday of this week, according to Bloomberg, marking a stark break from the trend of inflows that the fund has seen over the last 18 months. Prior to Tuesday, the fund had not had a daily withdrawal dating back to November. It also hadn’t seen a weekly withdrawal dating back to February, the report says.

Todd Rosenbluth, director of ETF research for CFRA Research told Bloomberg: “Given the strong demand in the fourth quarter for ARKK and its hard-to-duplicate returns in 2020, it was inevitable that some investors would want to take profits.”

The fund sunk 4.2% on Tuesday, but as of this writing is up about 2.4% on Wednesday.

Recall, on Tuesday of this week we wrote that the most recent data on ARKK fund flows heading into the last few trading days of 2020 appeared to show a meaningful reversal in flows. ARKK inflows made a lower low on Monday, we pointed out:

This suggested the obvious to us: that we may have witnessed a blowoff top of cash pouring into the ETF this month.

Tuesday’s data seems to confirm our suspicions and could be a bellwether for a less-than-stellar start to 2021 for ARKK holders.

Recall, last week we published a report highlighting Bloomberg’s ETF expert Eric Balchunas’ take on how ARK Funds could wind up becoming victims of their own success.

Many of Balchunas’ assumptions pointed out sustained massive inflows into the ARK family of ETFs – notably its ARKK ETF – which we noted last week was seeing inflows of about $400 million per day. In fact, ARK’s haul has been so massive that Balchunas noted that it has a chance of taking in more cash than Blackrock in December. The funds are on pace to bring in $11 billion, he said last week.

“This one ETF has more in assets than the other 240 actively managed equity ETFs combined,” he pointed out.

Tyler Durden

Wed, 12/30/2020 – 16:40

via ZeroHedge News https://ift.tt/38TMEz0 Tyler Durden